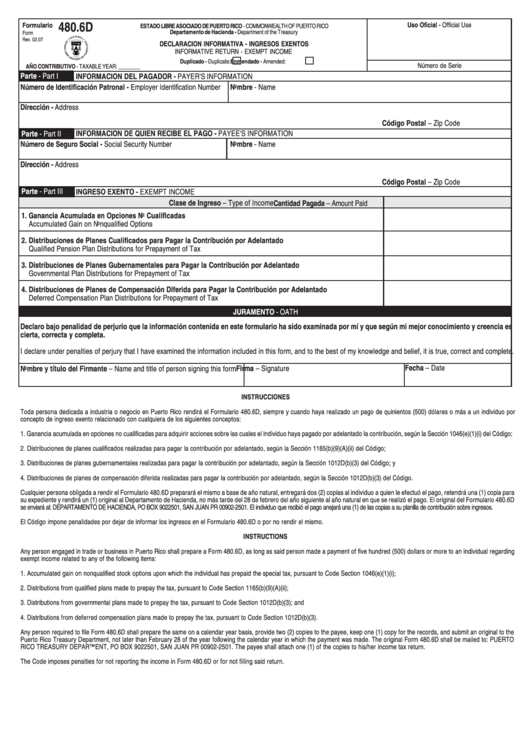

Form 480.6 C

Form 480.6 C - Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web what is irs form 480.6 c? Web the irs sent letter 106c to notify you that they are only partially allowing the credit, deduction or other claim you requested. Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Since this was for services you performed you should enter the income as self employment using schedule c. Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Web i got a form 480.6c. The form must be prepared on a calendar year basis and must be provided. The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partn ership not engaged in trade or business in puerto.

Web 1 day agobrian “bubba” harkins, the longtime visiting clubhouse manager at angel stadium, reached a settlement with the angels, according to harkins’ attorney, daniel. Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Web form 8806 must be filed by fax. Does this go on my tax return or is it something that i have to file separate??? The form must be prepared on a calendar year basis and must be provided. Box should be checked for the transcript type you desire. It covers investment income that has been subject to puerto rico source. Web what is irs form 480.6 c? Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Since this was for services you performed you should enter the income as self employment using schedule c.

Web 1 day agobrian “bubba” harkins, the longtime visiting clubhouse manager at angel stadium, reached a settlement with the angels, according to harkins’ attorney, daniel. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. This form was created in 2019 to inform on items related to payment for rendered services. Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Since this was for services you performed you should enter the income as self employment using schedule c. Web form 8806 must be filed by fax. Employment authorization document issued by the department of homeland. Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Web i got a form 480.6c. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partn ership not engaged in trade or business in puerto.

Data Access, Password Isometric Concept. Login Form on Screen. Stock

It covers investment income that has been subject to puerto rico source. If you filed an amended tax return, the irs. Web what is irs form 480.6 c? Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a.

480 7a 2018 Fill Online, Printable, Fillable, Blank PDFfiller

Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Since this was for services you performed you should enter the income as self employment using schedule c. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos.

Pin on Employee performance review

Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partn ership not engaged in trade or business in puerto. Since this was for services you performed you should enter the income as self employment using schedule c. Web us resident sold house in puerto rico, received form 480.6c showing house.

2016 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Web the irs sent letter 106c to notify you that they are only partially allowing the credit, deduction or other claim you requested. Employment authorization document issued by the department of homeland. This form was created in.

Form 480.6d Informative Return Exempt Puerto Rico

It covers investment income that has been subject to puerto rico source withholding. Employment authorization document issued by the department of homeland. This form was created in 2019 to inform on items related to payment for rendered services. The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital. If.

Introduction to Windows Form 1 YouTube

The form must be prepared on a calendar year basis and must be provided. It covers investment income that has been subject to puerto rico source. Employment authorization document issued by the department of homeland. If you filed an amended tax return, the irs. Since this was for services you performed you should enter the income as self employment using.

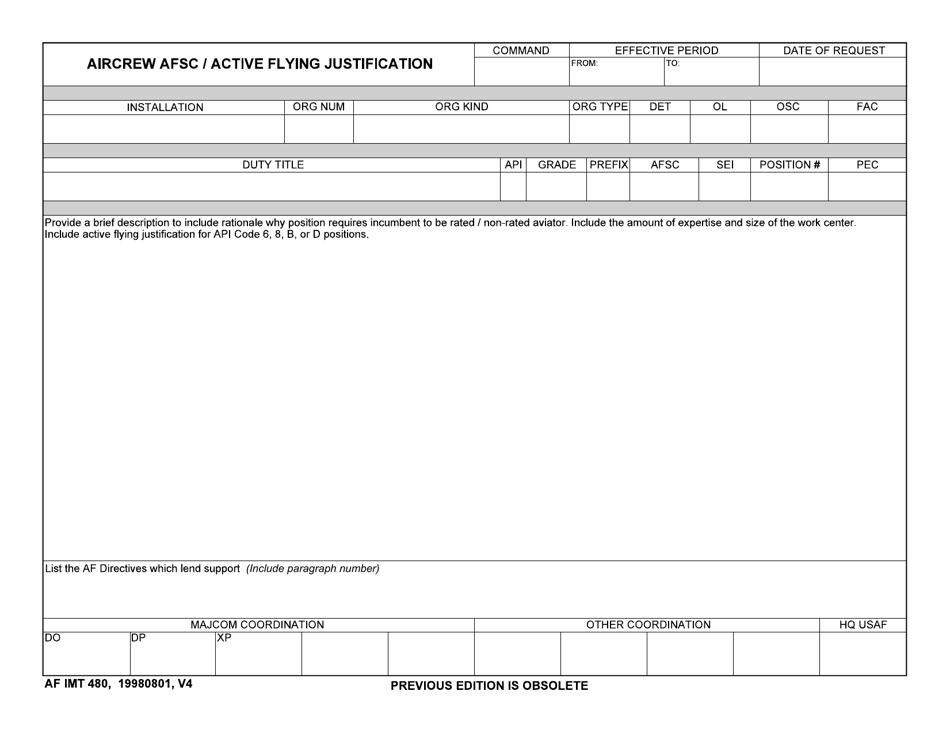

AF IMT Form 480 Download Fillable PDF or Fill Online Aircrew AFSC

It covers investment income that has been subject to puerto rico source. It covers investment income that has been subject to puerto rico source. Web i got a form 480.6c. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. If you filed an amended tax return, the irs.

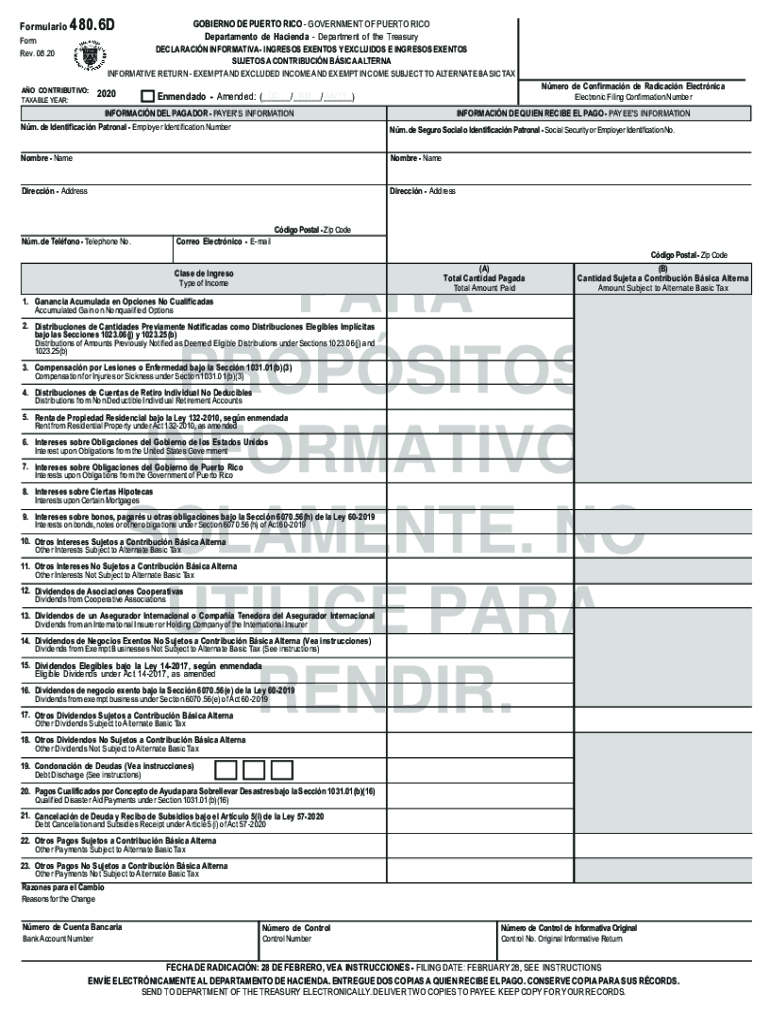

Form 480 6D Fill Out and Sign Printable PDF Template signNow

Web what is irs form 480.6 c? It covers investment income that has been subject to puerto rico source. It covers investment income that has been subject to puerto rico source. The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital. Ives request for transcript of tax return.

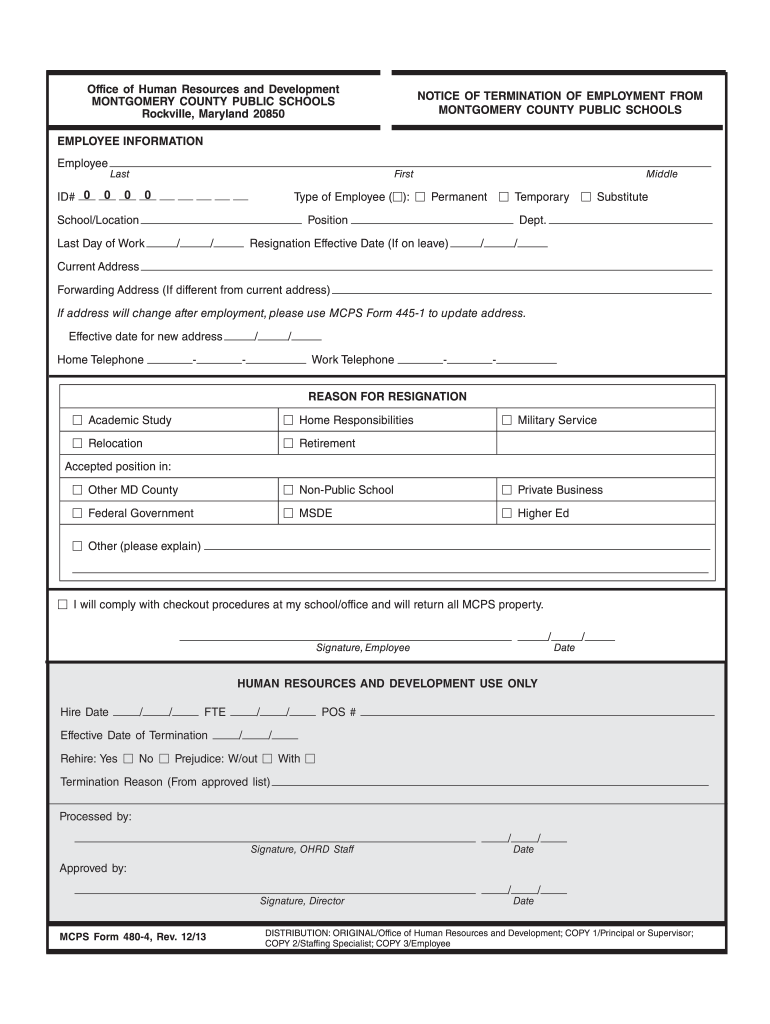

2013 Form MD MCPS 4804 Fill Online, Printable, Fillable, Blank pdfFiller

Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Web i got a form 480.6c. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partn ership not engaged in trade or business in puerto. It covers investment income that has been subject to.

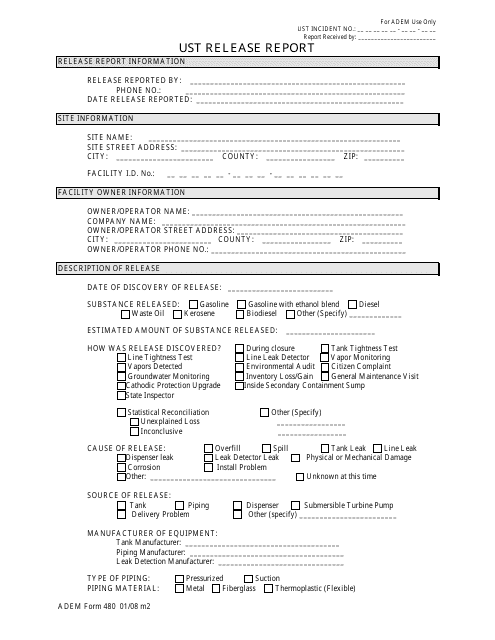

ADEM Form 480 Download Fillable PDF or Fill Online Ust Release Report

The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital. If you filed an amended tax return, the irs. Ives request for transcript of tax return. It covers investment income that has been subject to puerto rico source withholding. Web in the case of int erests, form 480.6a will.

The Form Must Be Prepared On A Calendar Year Basis And Must Be Provided.

Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. This form was created in 2019 to inform on items related to payment for rendered services. Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Web what is irs form 480.6 c?

Does This Go On My Tax Return Or Is It Something That I Have To File Separate???

It covers investment income that has been subject to puerto rico source. Employment authorization document issued by the department of homeland. Since this was for services you performed you should enter the income as self employment using schedule c. Web what is irs form 480.6 c?

Box Should Be Checked For The Transcript Type You Desire.

Ives request for transcript of tax return. It covers investment income that has been subject to puerto rico source. Web form 8806 must be filed by fax. The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital.

Web Prepare Form 480.6C For Each Nonresident Individual Or Fiduciary Or Nonresident Alien And For Each Foreign Corporation Or Partn Ership Not Engaged In Trade Or Business In Puerto.

Filing the quarterly return for tax withheld and extension of 2019 first quarter to july 31. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos o no sujetos a. Is this reported on 1040 & credit taken for. Since this was for services you performed you should enter the income as self employment using schedule c.