Irs.gov Where To File Form 3531

Irs.gov Where To File Form 3531 - Web hi thank you for helping me. Web how to submit form 3531 request for signature or missing information to complete return. ( for a copy of a form, instruction or publication) address to mail form to irs: Web english charities & nonprofits tax pros file pay refunds credits & deductions forms & instructions search form 3531, page 1this represents the front page of form 3531, request for signature or missing information to complete return, with an example of how to fill out the form for correspondence. Shown is a form 3531 and a partially obscured form 1040. Internal revenue service submission processing center address for form 3531. Is internal revenue service, submission processing center, austin, tx 73301 a valid address for form 3531 request for signature or missing information to. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Box 6 on form 3531 says: Request for transcript of tax return.

I tried a search in the irs web site putting form 3531 on the search bar but it resulted on no such items. Web instructions for form 1040. 1 , 2 , 3 , 4 , 5 , 7 , 8 , 9 Your original signature is required. Web english charities & nonprofits tax pros file pay refunds credits & deductions forms & instructions search form 3531, page 1this represents the front page of form 3531, request for signature or missing information to complete return, with an example of how to fill out the form for correspondence. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Don't understand what this is all about as i followed all the indications turbo tax gave me and all was supposed to have been in order. Shown is a form 3531 and a partially obscured form 1040. Get help preparing your taxes by volunteers; Web usually form 3531 has an address in the upper left corner to send the form.

I tried a search in the irs web site putting form 3531 on the search bar but it resulted on no such items. Find forms that begin with numbers: Don't understand what this is all about as i followed all the indications turbo tax gave me and all was supposed to have been in order. Web usually form 3531 has an address in the upper left corner to send the form. Web english charities & nonprofits tax pros file pay refunds credits & deductions forms & instructions search form 3531, page 1this represents the front page of form 3531, request for signature or missing information to complete return, with an example of how to fill out the form for correspondence. ( for a copy of a form, instruction or publication) address to mail form to irs: Get help preparing your taxes by volunteers; Web level 1 just received same form 3531 with copy of my 2019 taxes i filed online. Box 6 on form 3531 says: Request for transcript of tax return.

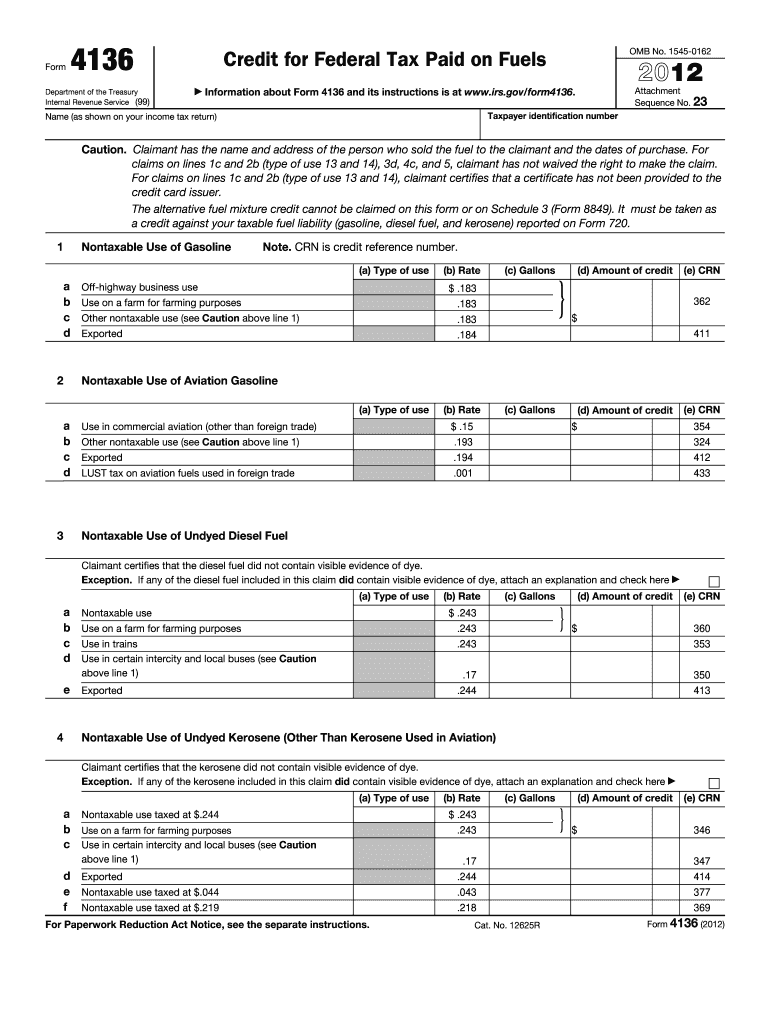

Credit For Federal Tax Paid On Fuels IRS gov Fill Out and Sign

Request for taxpayer identification number (tin) and certification. Box 6 on form 3531 says: Find out where to file your return; I tried a search in the irs web site putting form 3531 on the search bar but it resulted on no such items. Web to find form 3520, annual return to report transactions with foreign trusts and receipt of.

IRS FORM 8281 PDF

Get help preparing your taxes by volunteers; Web to find form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, choose the number 3; Form 3115 application for change in accounting method. Request for transcript of tax return. Shown is a form 3531 and a partially obscured form 1040.

Irs.gov Form W 2 Instructions Universal Network

Box 6 on form 3531 says: Web to find form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, choose the number 3; You must resubmit the original completed form along with all applicable schedules, forms and attachments. Web level 1 just received same form 3531 with copy of my 2019 taxes i filed.

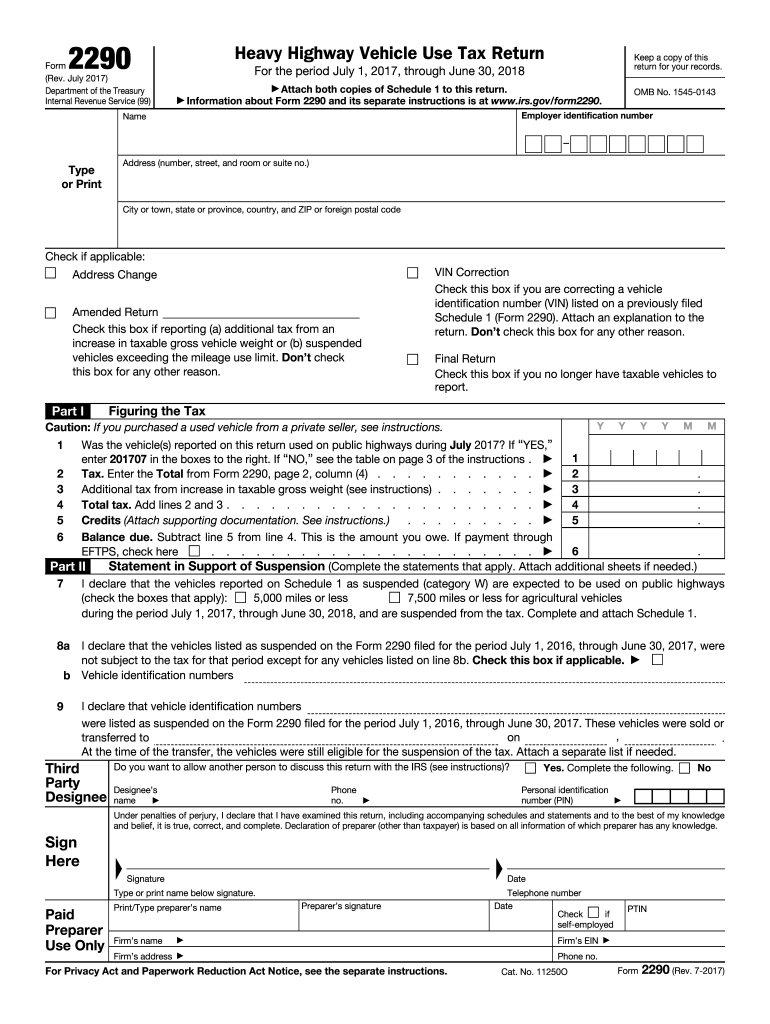

IRS Gov Efile IRS Form 2290

Find out where to file your return; Box 6 on form 3531 says: Don't understand what this is all about as i followed all the indications turbo tax gave me and all was supposed to have been in order. ( for a copy of a form, instruction or publication) address to mail form to irs: Is internal revenue service, submission.

2290 Fill Out and Sign Printable PDF Template signNow

Hope this answers your question. Request for transcript of tax return. Your original signature is required. Web usually form 3531 has an address in the upper left corner to send the form. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Www Uscis Gov Citizenship Form N 400 Form Resume Examples BpV5ZG521Z

File your tax return online; You must resubmit the original completed form along with all applicable schedules, forms and attachments. Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts..

Using Free File Fillable Forms from IRS dot gov HubPages

Web how to submit form 3531 request for signature or missing information to complete return. 1 , 2 , 3 , 4 , 5 , 7 , 8 , 9 You must resubmit the original completed form along with all applicable schedules, forms and attachments. Box 6 on form 3531 says: Web level 1 just received same form 3531 with.

Websites We Love IRS.GOV Salute to Spouses

Web usually form 3531 has an address in the upper left corner to send the form. ( for a copy of a form, instruction or publication) address to mail form to irs: Box 6 on form 3531 says: Request for transcript of tax return. 1 , 2 , 3 , 4 , 5 , 7 , 8 , 9

IRS Form 941 Mistakes What Happens If You Mess Up?

Request for transcript of tax return. Web instructions for form 1040. Web how to submit form 3531 request for signature or missing information to complete return. Is internal revenue service, submission processing center, austin, tx 73301 a valid address for form 3531 request for signature or missing information to. Don't understand what this is all about as i followed all.

Irs Form 3531 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web instructions for form 1040. Form 3115 application for change in accounting method. Hope this answers your question. File your tax return online;

Web Hi Thank You For Helping Me.

Hope this answers your question. Web how to submit form 3531 request for signature or missing information to complete return. Form 3115 application for change in accounting method. Your original signature is required.

Box 6 On Form 3531 Says:

Web to find form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, choose the number 3; Request for transcript of tax return. Web level 1 just received same form 3531 with copy of my 2019 taxes i filed online. Find out where to file your return;

Web Instructions For Form 1040.

Get help preparing your taxes by volunteers; Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. Is internal revenue service, submission processing center, austin, tx 73301 a valid address for form 3531 request for signature or missing information to. Web english charities & nonprofits tax pros file pay refunds credits & deductions forms & instructions search form 3531, page 1this represents the front page of form 3531, request for signature or missing information to complete return, with an example of how to fill out the form for correspondence.

( For A Copy Of A Form, Instruction Or Publication) Address To Mail Form To Irs:

Shown is a form 3531 and a partially obscured form 1040. Your form 1040/a/ez/sr is blank, illegible, missing or damaged and we can't process it. You must resubmit the original completed form along with all applicable schedules, forms and attachments. Don't understand what this is all about as i followed all the indications turbo tax gave me and all was supposed to have been in order.