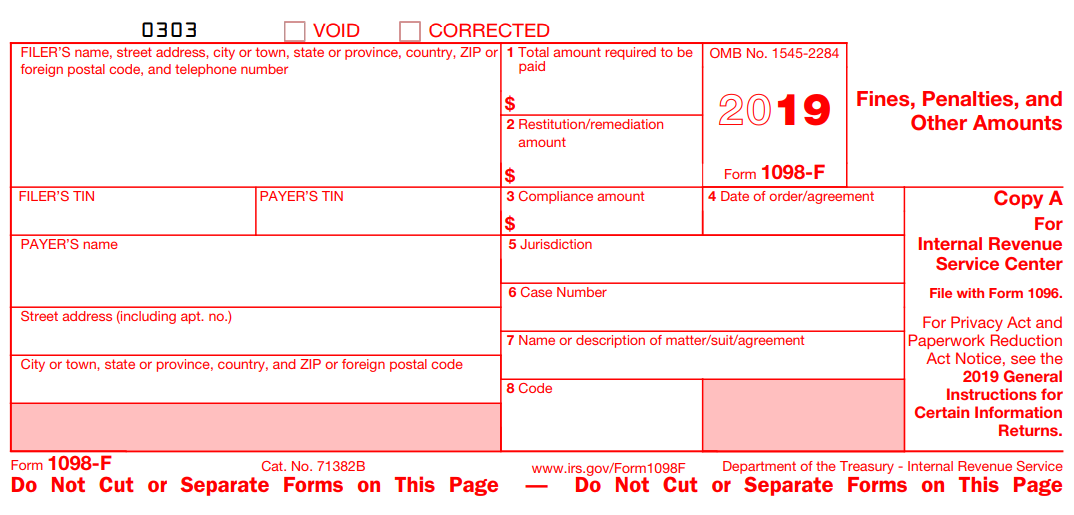

1098-F Form

1098-F Form - Complete, edit or print tax forms instantly. Find the document you require in our library of legal templates. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties. Try it for free now! Ad upload, modify or create forms. Complete, edit or print tax forms instantly. Contract reimb./refund this is important. Insurers file this form for each individual to whom they. Ad complete irs tax forms online or print government tax documents.

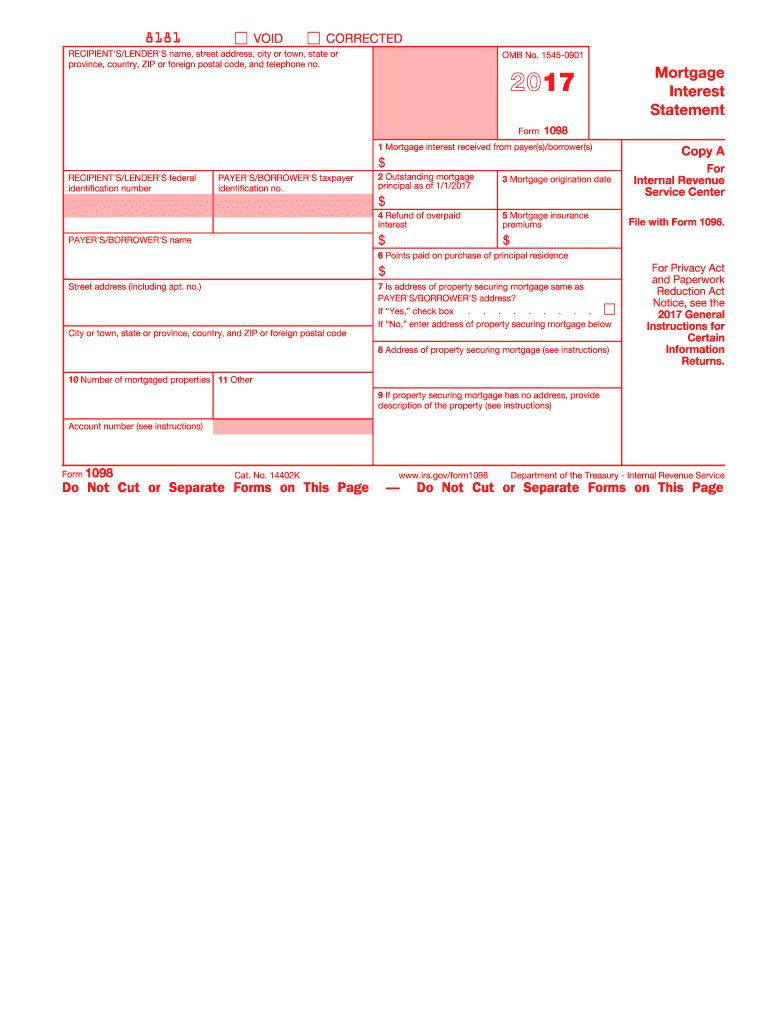

Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Complete, edit or print tax forms instantly. Try it for free now! Complete, edit or print tax forms instantly. Ad upload, modify or create forms. Find the document you require in our library of legal templates. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties. Insurers file this form for each individual to whom they. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by.

Ad upload, modify or create forms. Ad complete irs tax forms online or print government tax documents. Open the document in our online. Try it for free now! Complete, edit or print tax forms instantly. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Contract reimb./refund this is important.

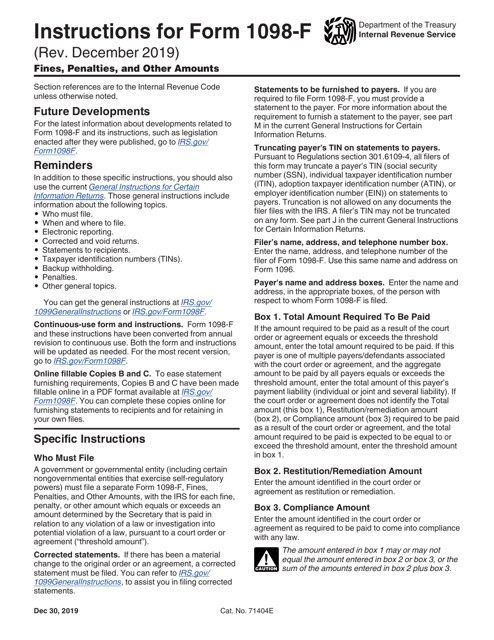

Download Instructions for IRS Form 1098F Fines, Penalties, and Other

Insurers file this form for each individual to whom they. Complete, edit or print tax forms instantly. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Find the document you require in our library of legal templates. This document contains proposed regulations that.

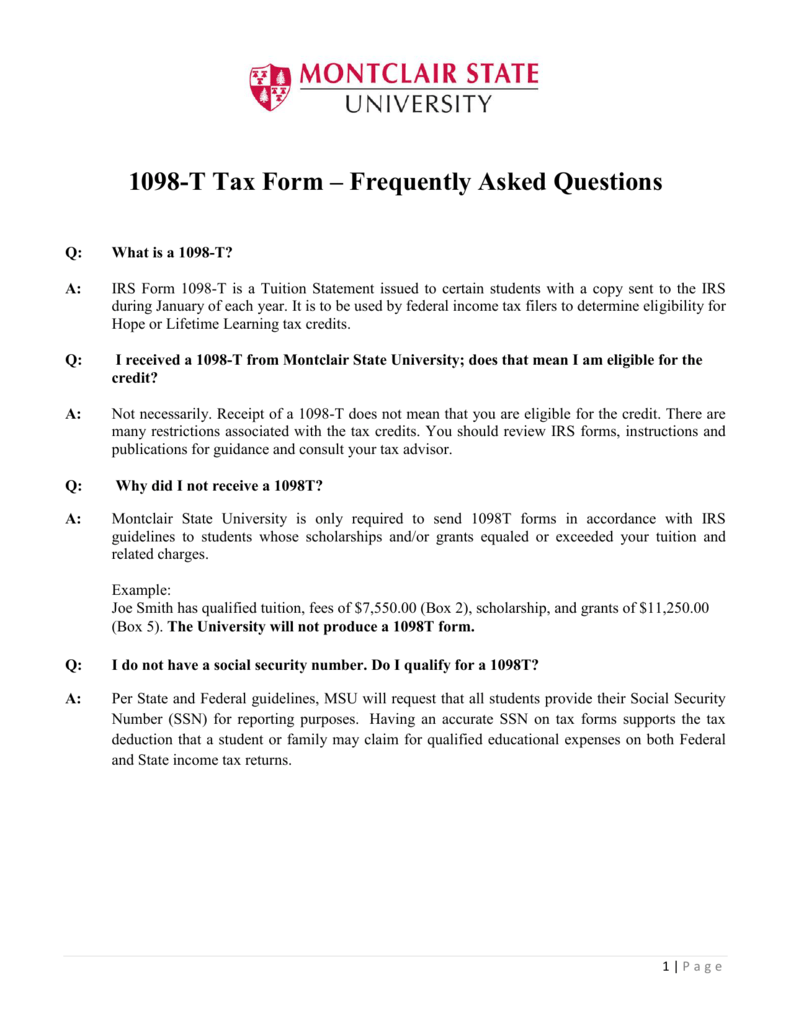

1098T Tax Form Frequently Asked Questions

Ad complete irs tax forms online or print government tax documents. Ad upload, modify or create forms. Open the document in our online. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Contract reimb./refund this is important.

1098 Software Printing Electronic Reporting EFile TIN Matching

This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year.

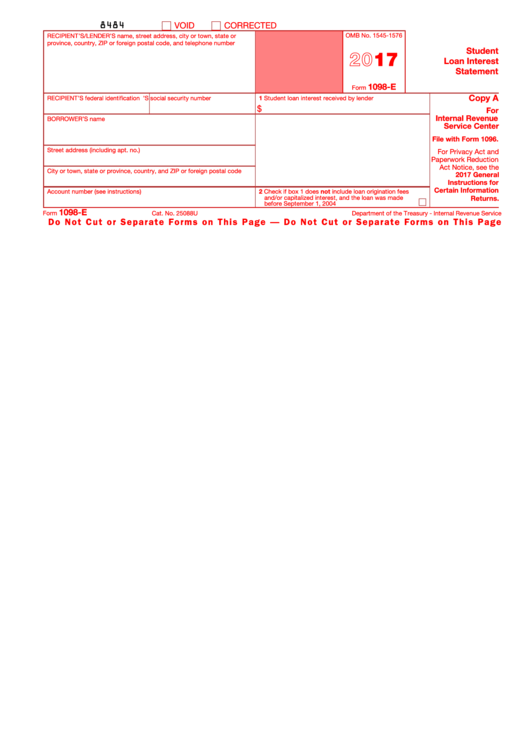

Form 1098E Student Loan Interest Statement 2017 printable pdf download

Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Complete, edit or print tax forms instantly. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties. Find the document you require in our library of legal templates. Contract reimb./refund.

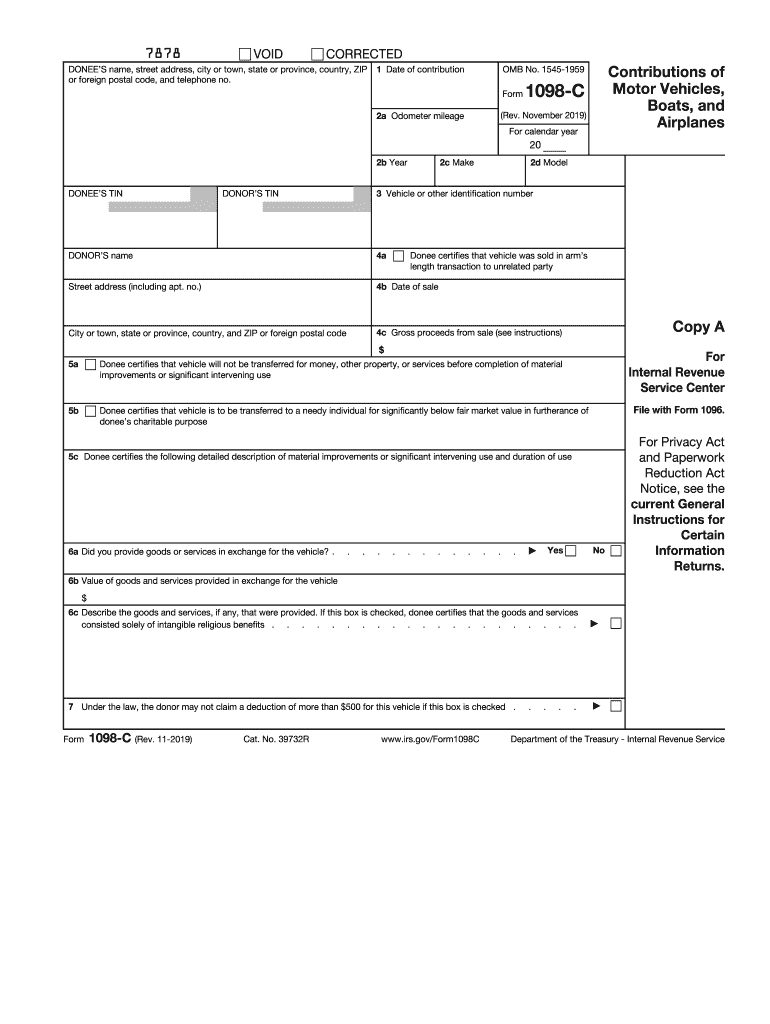

IRS 1098C 20192021 Fill and Sign Printable Template Online US

Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Ad complete irs tax forms online or print government tax documents. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his.

How to Print and File Tax Form 1098F, Fines, Penalties, and Other Amounts

Ad upload, modify or create forms. Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Try it for free now!

1098 Explained

Contract reimb./refund this is important. Find the document you require in our library of legal templates. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Open the document in our online.

2017 Form IRS 1098 Fill Online, Printable, Fillable, Blank pdfFiller

Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Irs requires that all income and deductible expenses are reported by businesses and individuals or penalties..

Form 1FP1098 Download Fillable PDF or Fill Online Order/Notice to

Find the document you require in our library of legal templates. Insurers file this form for each individual to whom they. Web form 1098, mortgage interest statement, is an internal revenue service (irs) form used by taxpayers to report the amount of interest and related expenses paid. Open the document in our online. Try it for free now!

Instructions for IRS Form 1098f Fines, Penalties, and Other Amounts

Find the document you require in our library of legal templates. Contract reimb./refund this is important. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Web form 1098, mortgage interest statement, is an internal revenue service.

Irs Requires That All Income And Deductible Expenses Are Reported By Businesses And Individuals Or Penalties.

Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in. Contract reimb./refund this is important. Complete, edit or print tax forms instantly. Try it for free now!

Web Form 1098, Mortgage Interest Statement, Is An Internal Revenue Service (Irs) Form Used By Taxpayers To Report The Amount Of Interest And Related Expenses Paid.

Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. Open the document in our online. Insurers file this form for each individual to whom they.

Web Each Borrower Is Entitled To Deduct Only The Amount He Or She Paid And Points Paid By The Seller That Represent His Or Her Share Of The Amount Allowable As A Deduction.

Find the document you require in our library of legal templates. This document contains proposed regulations that provide guidance on section 162 (f) of the internal revenue code (code), as amended by. Ad upload, modify or create forms.