1099 Form Due Date 2023

1099 Form Due Date 2023 - Tax payers submit payments in box eight or box 10 of the tax form; Web failing to file your tax return by the due date can result in penalties and extra charges. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web the irs filing season 2023 deadlines for tax year 2022 are as follows: 2023 deadlines (ty2022) irs paper file deadline. Import your 1099 form and file for your max refund today. Ad get a jumpstart on your taxes. Have confidence filing 1099 forms w/ america's leader in taxes. The form 1099 misc recipient copy deadline is january 31, 2023. If you need an extension, submit form 4868 by this date.

Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Web go to irs.gov/orderforms to order current forms, instructions, and publications; The irs will process your order for. Copy a & copy b should be filed by january 31. Web when is form 1099 misc due? Furnishing due date for information returns payers must. Web failing to file your tax return by the due date can result in penalties and extra charges. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. If you are reporting payments in box 8 or 10, the due date. Web 1099 due dates for 2022:

Web go to irs.gov/orderforms to order current forms, instructions, and publications; Get rid of the guesswork. Web a new irs online portal allowing users to create and file 1099 forms, known as the information return intake system, is scheduled to be available by jan. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. If you need an extension, submit form 4868 by this date. Ad get a jumpstart on your taxes. If you are reporting payments in box 8 or 10, the due date. Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Web when is form 1099 misc due? 2023 deadlines (ty2022) irs paper file deadline.

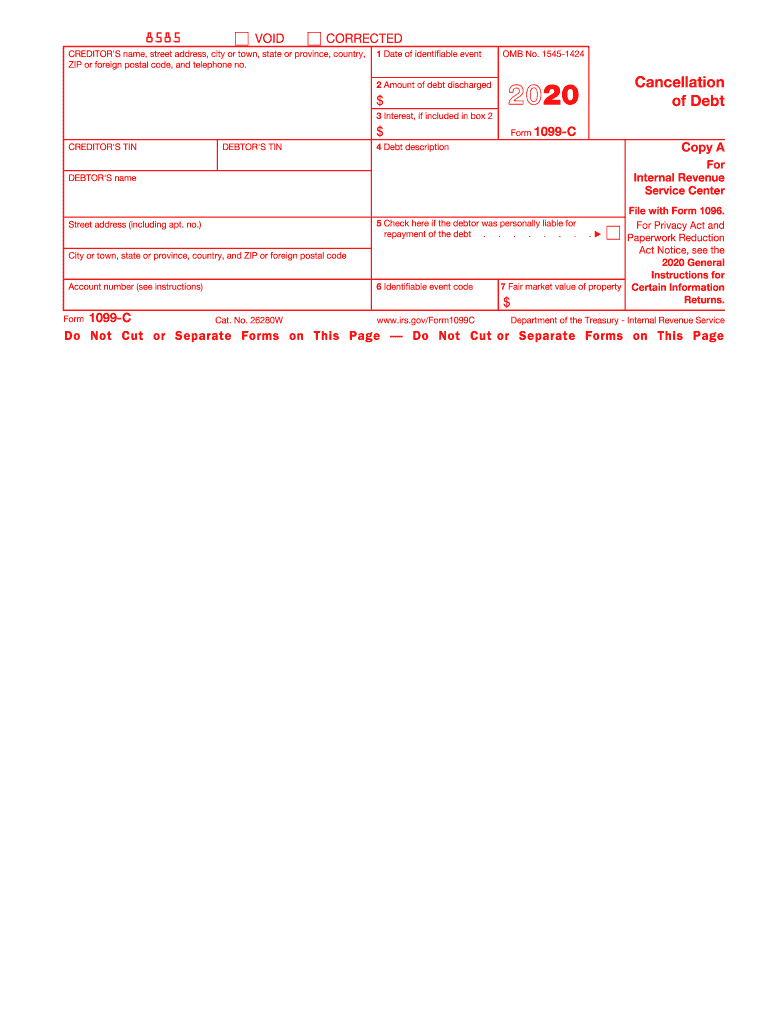

Form 1099 C Cancellation of Debt Form Fill Out and Sign Printable PDF

If you are reporting payments in box 8 or 10, the due date. Web go to irs.gov/orderforms to order current forms, instructions, and publications; Web simple steps to efile form 1099 misc & others start filing now Tax payers submit payments in box eight or box 10 of the tax form; Ap leaders rely on iofm’s expertise to keep them.

1099s Due February 1st, 2021 Guidelines RTW Xxact

If you are reporting payments in box 8 or 10, the due date. Tax payers submit payments in box eight or box 10 of the tax form; Get rid of the guesswork. Web failing to file your tax return by the due date can result in penalties and extra charges. Copy a & copy b should be filed by january.

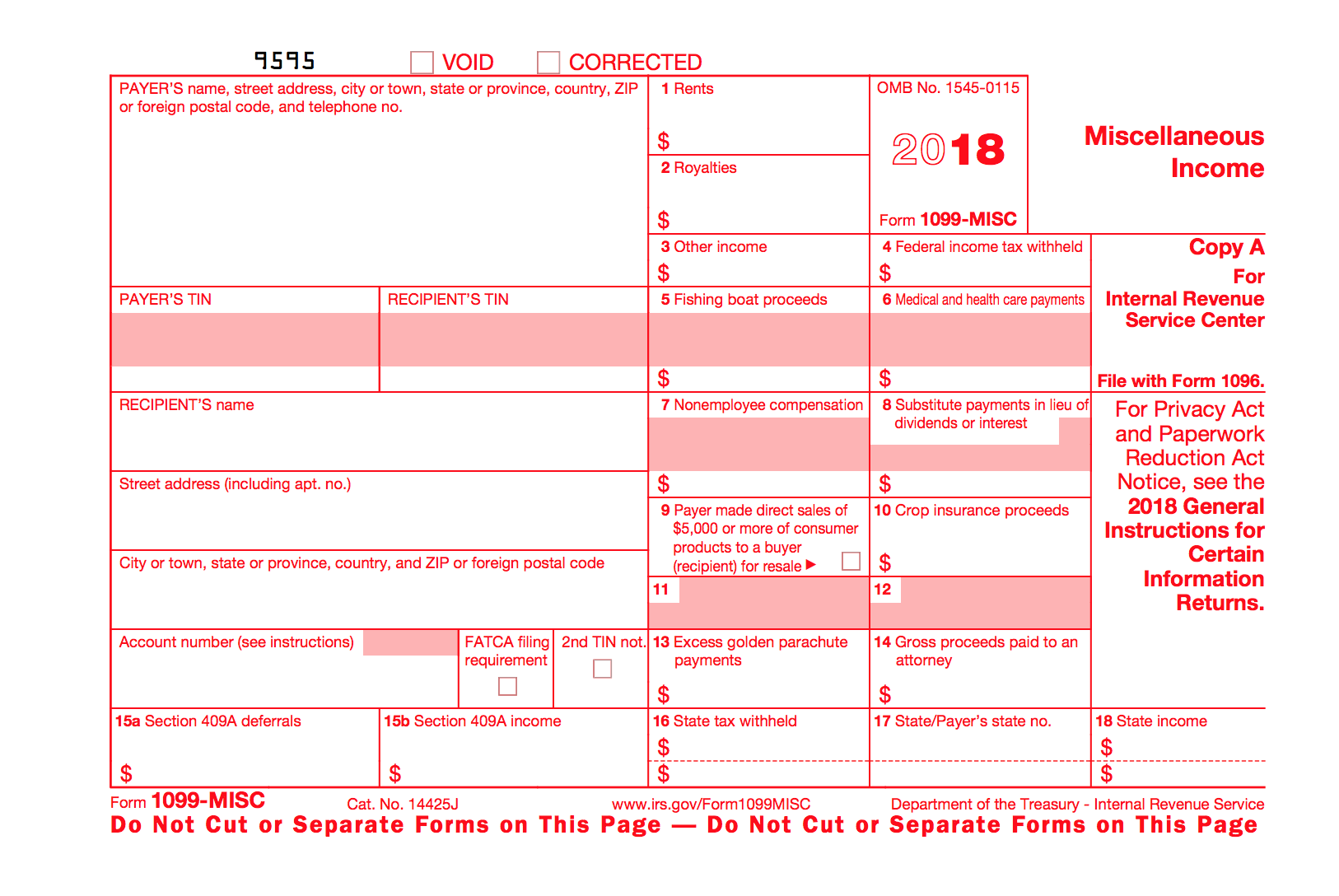

2018 Forms 1099MISC Due January 31, 2019 Miami CPA Bay, PLLC

Web simple steps to efile form 1099 misc & others start filing now Web go to irs.gov/orderforms to order current forms, instructions, and publications; Web failing to file your tax return by the due date can result in penalties and extra charges. Copy a & copy b should be filed by january 31. The irs will process your order for.

Efile 2022 Form 1099R Report the Distributions from Pensions

Get rid of the guesswork. Web when is form 1099 misc due? Web there are different due dates for different types of 1099 forms. The irs will process your order for. The form 1099 misc recipient copy deadline is january 31, 2023.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Furnishing due date for information returns payers must. If you are reporting payments in box 8 or 10, the due date. The irs will process your order for. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

1099 MISC Form 2022 1099 Forms TaxUni

Web failing to file your tax return by the due date can result in penalties and extra charges. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The form 1099 misc recipient copy deadline is january 31, 2023. Web when is form 1099 misc due? Web a new irs online portal allowing users.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web a new irs online portal allowing users to create and file 1099 forms, known as the information return intake system, is scheduled to be available by jan. Tax payers submit payments in box eight or box 10 of the tax form; Furnishing due date for information returns payers must. Have confidence filing 1099 forms w/ america's leader in taxes..

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Tax payers submit payments in box eight or box 10 of the tax form; 2023 deadlines (ty2022) irs paper file deadline. Web simple steps to efile form 1099 misc & others start filing now Have confidence filing 1099 forms w/ america's leader in taxes. Web go to irs.gov/orderforms to order current forms, instructions, and publications;

Form 1099 Misc Due Date Universal Network

Web there are different due dates for different types of 1099 forms. Tax payers submit payments in box eight or box 10 of the tax form; 2023 deadlines (ty2022) irs paper file deadline. Web now that tax year 2022 is coming to a close, employers will be expected to fulfill their irs requirements by the filing season 2023 deadlines for.

Irs 1099 Form Due Date 2015 Form Resume Examples

Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Copy a & copy b should be filed by january 31. Furnishing due date.

Tax Payers Submit Payments In Box Eight Or Box 10 Of The Tax Form;

Web go to irs.gov/orderforms to order current forms, instructions, and publications; If you are reporting payments in box 8 or 10, the due date. Web now that tax year 2022 is coming to a close, employers will be expected to fulfill their irs requirements by the filing season 2023 deadlines for form 1099, form w. Web a new irs online portal allowing users to create and file 1099 forms, known as the information return intake system, is scheduled to be available by jan.

The Irs Will Process Your Order For.

Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Ad get a jumpstart on your taxes. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. If you need an extension, submit form 4868 by this date.

Furnishing Due Date For Information Returns Payers Must.

Web failing to file your tax return by the due date can result in penalties and extra charges. The form 1099 misc recipient copy deadline is january 31, 2023. Web there are different due dates for different types of 1099 forms. Web the irs filing season 2023 deadlines for tax year 2022 are as follows:

Ap Leaders Rely On Iofm’s Expertise To Keep Them Up To Date On Changing Irs Regulations.

Get rid of the guesswork. Web simple steps to efile form 1099 misc & others start filing now Web 1099 due dates for 2022: Web when is form 1099 misc due?

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)