1099 Form For Rent Paid

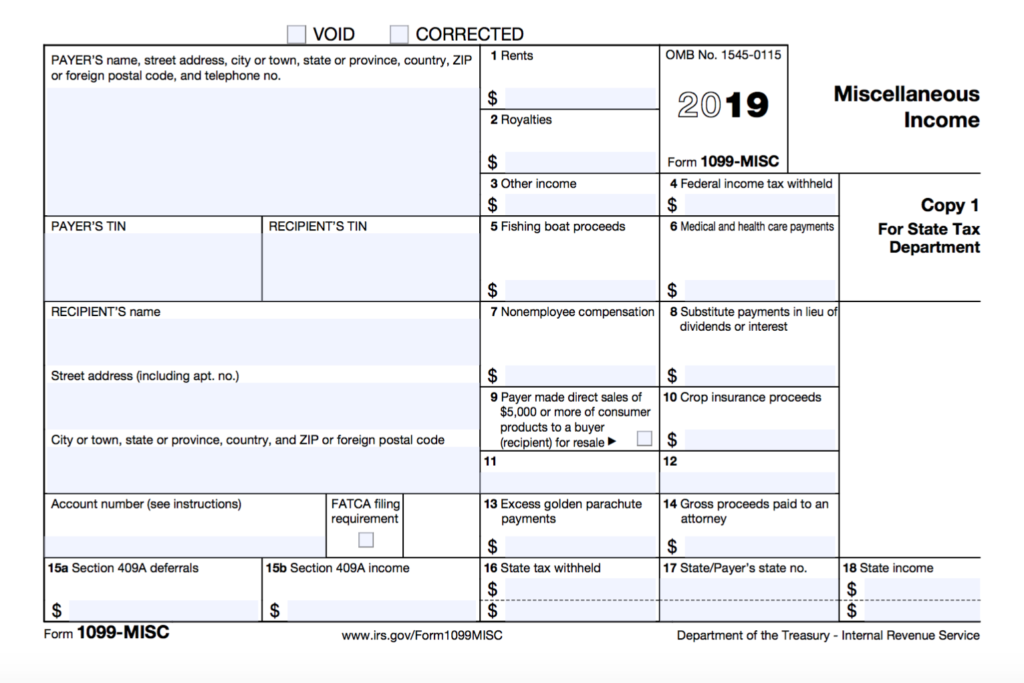

1099 Form For Rent Paid - Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. Web how to fill out form 1099 for rent paid. Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income. Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care services (box 6) Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year.

Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care services (box 6) Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Additionally, you will need the landlord's social security number or federal employer id number (ein). Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income. Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. Medical and health care payments. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord.

Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Web how to fill out form 1099 for rent paid. If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income. Medical and health care payments. Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord. There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year.

Accounts Payable Software for Small Business Accurate Tracking

The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Web the 1099 form is a tax form that documents income from a source that isn’t an employer. Medical and health care payments. Web in the real estate industry, these documents become necessary when.

Prepare for the Extended Tax Season With Your Rental Property These

Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Additionally, you will need the landlord's social security number or federal employer id number (ein). There are 20 different.

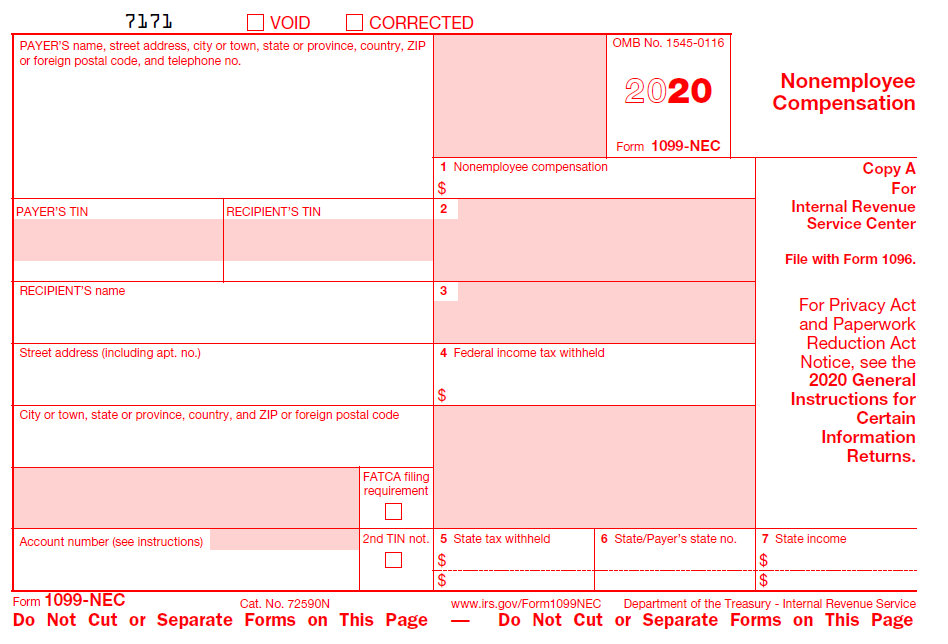

Now is the Time to Start Preparing for Vendor 1099 Forms Innovative

Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care.

All That You Need To Know About Filing Form 1099MISC Inman

The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. If you rent out your property for $1,000/month and earn $12,000 by the end of the year, the remaining amount after deductions is taxable income. Medical and health care payments. Property managers must do.

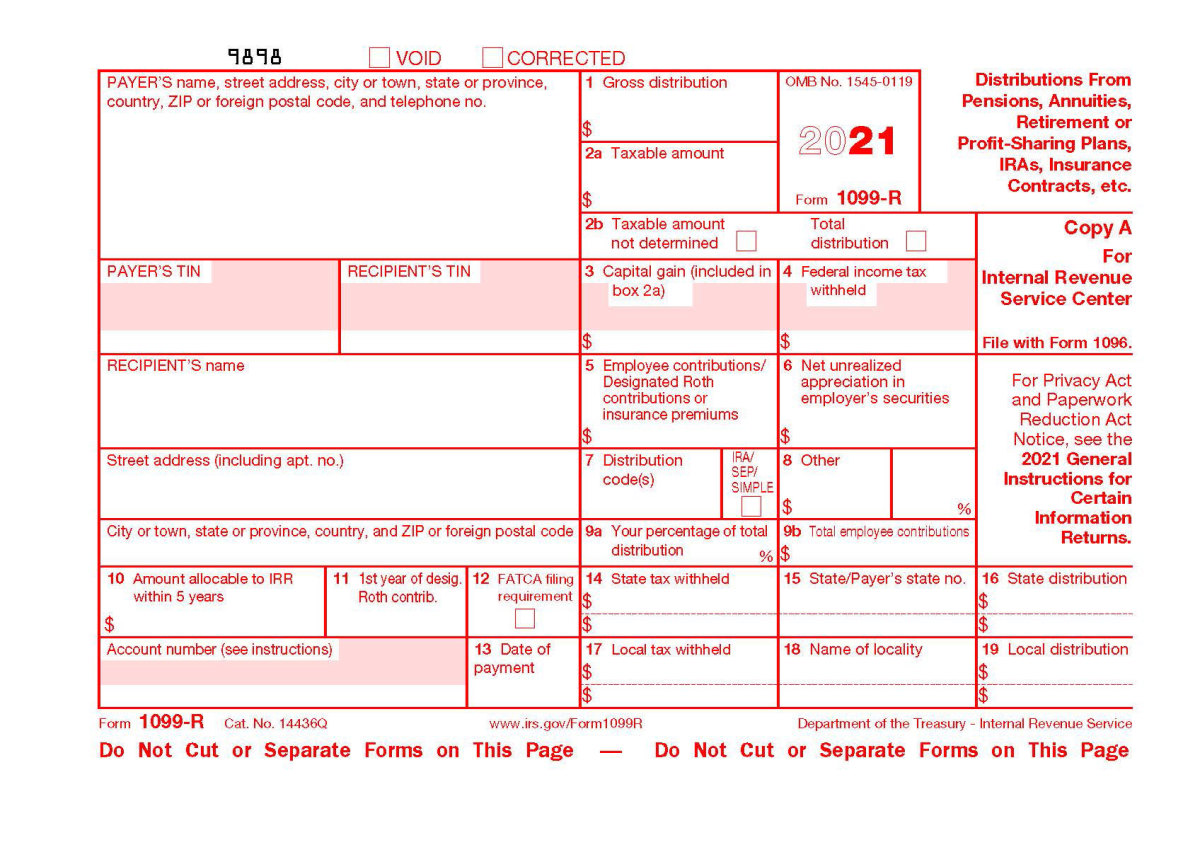

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Medical and health care payments. There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes.

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Examples include.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Web the 1099 form is a tax form that documents.

How to Calculate Taxable Amount on a 1099R for Life Insurance

Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. The irs defines rental property as any single home, mobile home, vacation home, apartment, condominium, or similar dwelling rented out more than 15 days a year. Web rental income taxes explained according to the irs, a taxpayer must report all.

Form 1099K Wikipedia

Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. There are 20 different variations of the 1099 form, but only a few are relevant to landlords. Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding.

Form 1099 Misc Fillable Universal Network

Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few.

The Irs Defines Rental Property As Any Single Home, Mobile Home, Vacation Home, Apartment, Condominium, Or Similar Dwelling Rented Out More Than 15 Days A Year.

Additionally, you will need the landlord's social security number or federal employer id number (ein). Examples include rental income, earnings made as an independent contractor, and a tax refund from the state or local level. Web rental income taxes explained according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Web how to fill out form 1099 for rent paid.

Web The 1099 Form Is A Tax Form That Documents Income From A Source That Isn’t An Employer.

Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. Medical and health care payments. Rents (box 1) royalties (box 2) other income (box 3), including prizes and awards federal income tax withheld (box 4), including backup withholding fishing boat proceeds (box 5) medical and health care services (box 6) Tenants in commercial leases may need to include additional information when filing taxes, depending on the tax status of the landlord.

If You Rent Out Your Property For $1,000/Month And Earn $12,000 By The End Of The Year, The Remaining Amount After Deductions Is Taxable Income.

Web any contractor making over $600 will also need to receive a 1099 for landlord duties performed. Web in the real estate industry, these documents become necessary when a landlord receives more than $600 in rent annually. There are 20 different variations of the 1099 form, but only a few are relevant to landlords.