1099 Form In Quickbooks Online

1099 Form In Quickbooks Online - Generate 1099 using quickbooks online; 1099s produced by intuit for quickbooks online, quickbooks contractor. Click the let’s get started green. Web create and file 1099s with quickbooks online. Web follow the steps below to create your 1099s in quickbooks desktop. • 3268 • updated march 02, 2022. Go to the intuit app center > search. Printable from laser or inkjet printers. Payroll seamlessly integrates with quickbooks® online. Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility.

By quickbooks• 2480•updated april 21, 2023. Click the let’s get started green. Once opened, select company file issues. Follow these steps to generate form 4972 in the. Web how to process and file 1099s with quickbooks online? Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. In the sidebar, hover your mouse over workers. Once ready, you can view your 1099 form on the. Web set up a prior payroll for quickbooks online payroll. Web click on the workers tab then select contractors.

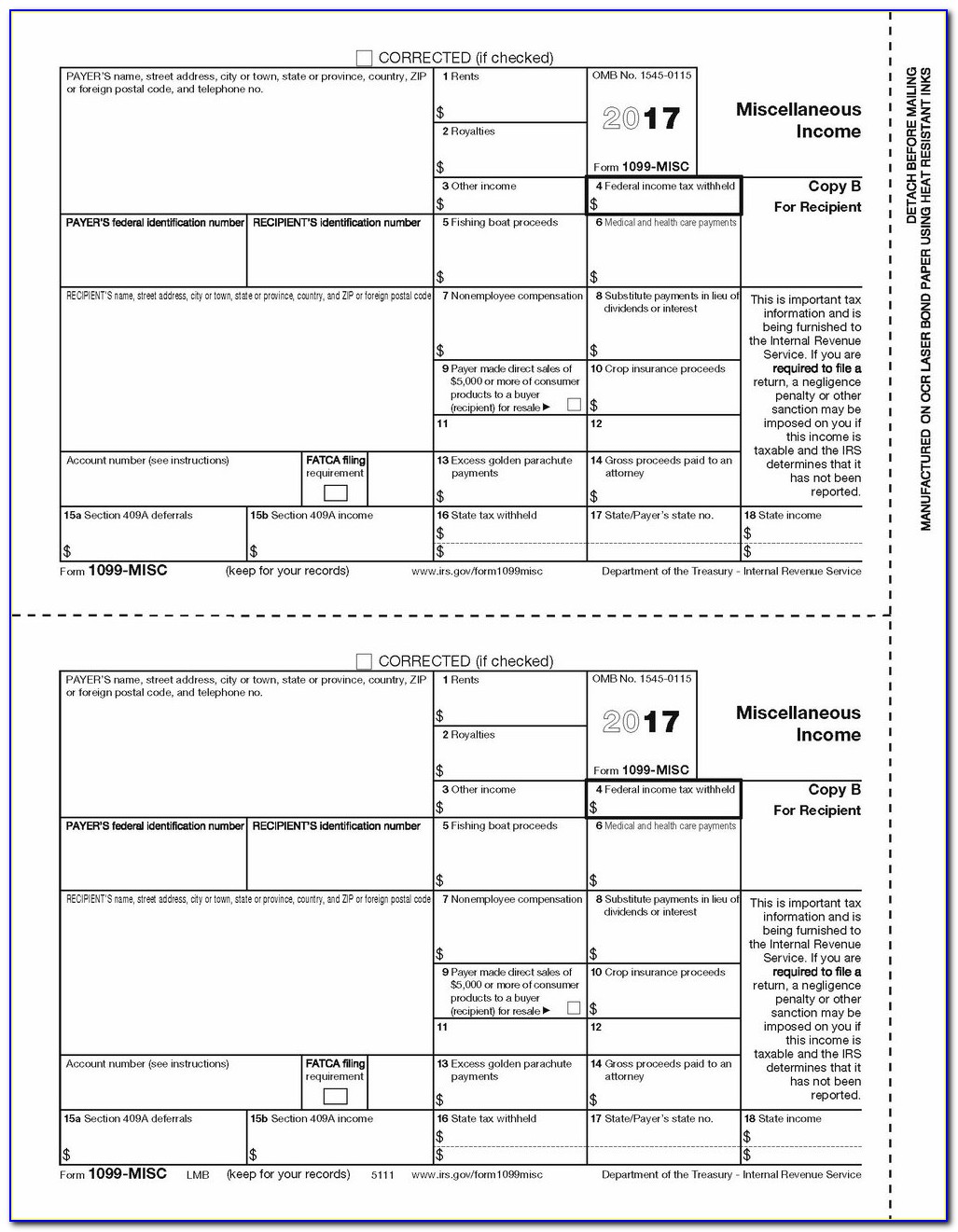

You can purchase a 1099 kit and print the forms yourself from the file. Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. Generate 1099 using quickbooks online; After you prepare your forms, you'll choose to file them online or print and mail them to. Web normally, you'll receive an email invitation once your employer has filed your form and the account created is free. Payroll seamlessly integrates with quickbooks® online. Web update january 2023: Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this form. Once opened, select company file issues. You must submit 1099 forms to the irs if you pay contractors in cash, checks, or direct deposits.

Printing 1099 Forms In Quickbooks Online Form Resume Examples

Set up 1099 accounts in quickbooks online; Using the data you already have. Once opened, select company file issues. Web normally, you'll receive an email invitation once your employer has filed your form and the account created is free. Web set up a prior payroll for quickbooks online payroll.

Pin on Infographics

Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. Using the data you already have. Click the let’s get started green. • 3268 • updated march 02, 2022. By quickbooks• 2480•updated april 21, 2023.

Quickbooks 1099 Forms Online Form Resume Examples 7erkKXJDN8

Web how to process and file 1099s with quickbooks online? Web how to set up 1099 employees in quickbooks online. Printable from laser or inkjet printers. Web click on the workers tab then select contractors. Fast facts [4.1 stars] starting price:

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Web click on the workers tab then select contractors. Web how to process and file 1099s with quickbooks online? Create or add another company file to quickbooks online. Payroll seamlessly integrates with quickbooks® online. Web create and file 1099s with quickbooks online.

Quickbooks Compatible 1099 Forms Form Resume Examples L71xWWy8MX

Web open quickbooks desktop, and then you have to click on preferences from the edit tab. You must submit 1099 forms to the irs if you pay contractors in cash, checks, or direct deposits. Web create and file 1099s with quickbooks online. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified.

Print 1099 Forms In Quickbooks Online Form Resume Examples N48moNBKyz

Unlimited expense and income tracking. Click the let’s get started green. Then, for tax, you have to select 1099. 1099s produced by intuit for quickbooks online, quickbooks contractor. Web update january 2023:

Efile 1099 Forms Quickbooks Form Resume Examples gq96q512OR

Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. Web how to process and file 1099s with quickbooks online? Web click on the workers tab then select contractors. You can purchase a 1099 kit and print the forms yourself from the file.

11 Common Misconceptions About Irs Form 11 Form Information Free

To set up a 1099 employee in quickbooks online, follow the below steps: From the main dashboard, click. Fast facts [4.1 stars] starting price: Open quickbooks and go to the “vendors” menu. Payroll seamlessly integrates with quickbooks® online.

QuickBooks Online Prepare 1099 Forms (1099MISC for independent

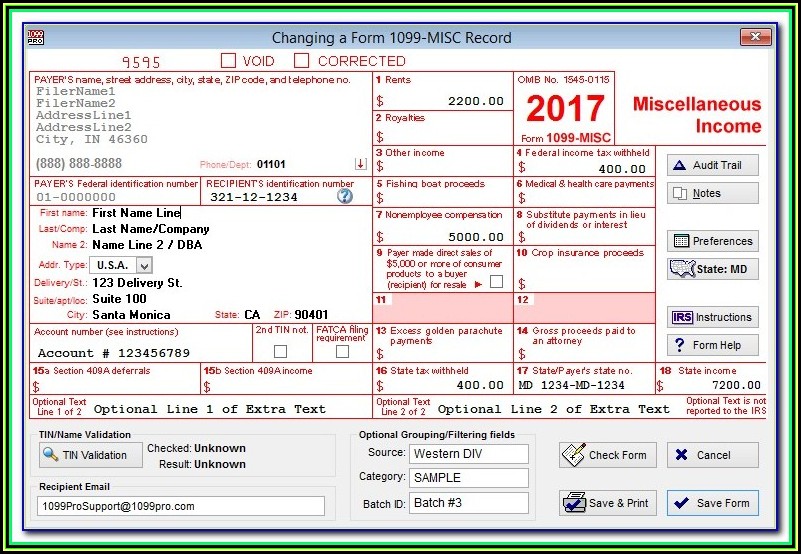

In the sidebar, hover your mouse over workers. Click prepare 1099's and select let’s get started to prepare. Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. 1099s produced by intuit for quickbooks online, quickbooks contractor. Generate 1099 using quickbooks online;

Web Follow The Steps Below To Create Your 1099S In Quickbooks Desktop.

Open quickbooks and go to the “vendors” menu. Once the facts are verified, you are ready to prepare and file your 1099 forms. By quickbooks• 2480•updated april 21, 2023. After you prepare your forms, you'll choose to file them online or print and mail them to.

Web Set Up A Prior Payroll For Quickbooks Online Payroll.

Payroll seamlessly integrates with quickbooks® online. 1099s produced by intuit for quickbooks online, quickbooks contractor. Click the let’s get started green. To set up a 1099 employee in quickbooks online, follow the below steps:

Web Update January 2023:

Fast facts [4.1 stars] starting price: Web you will now see the 1099 form names right next to each box, so you do not make the mistake of mapping the expense accounts to the wrong 1099 form. Then, for tax, you have to select 1099. Go to the intuit app center > search.

Click On The Prepare 1099S Button.

Web how to connect the quickbooks online with tax1099 application. You can purchase a 1099 kit and print the forms yourself from the file. From quickbooks online, navigate to the expenses tab and the vendors section. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this form.