1099 S Form 2021

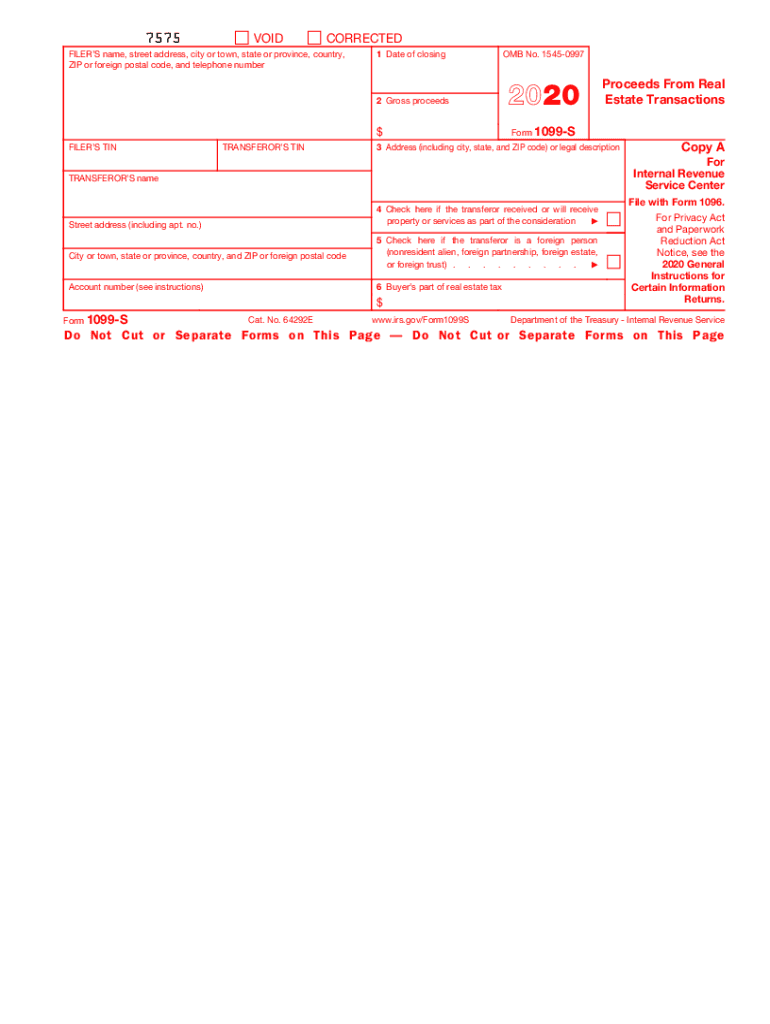

1099 S Form 2021 - This is important tax information and is being furnished to the irs. Proceeds from real estate transactions. Web instructions for recipient recipient’s taxpayer identification number (tin). For 2020 taxes this would be february 1st 2021. Follow the steps below to report real estate for personal, investment, or business use. A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. This could include land, permanent structures, apartments or condominiums, and more. File this form to report the sale or exchange of real estate. Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).

This could include land, permanent structures, apartments or condominiums, and more. Follow the steps below to report real estate for personal, investment, or business use. How the property is used (personal, investment, business) will determine where the information is reported. This is important tax information and is being furnished to the irs. For 2020 taxes this would be february 1st 2021. Web instructions for recipient recipient’s taxpayer identification number (tin). A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web what is a 1099 s? File this form to report the sale or exchange of real estate.

The due date for irs paper filing march 15th 2021. It must be used whenever you make a real estate transaction in the tax year. This is important tax information and is being furnished to the irs. How the property is used (personal, investment, business) will determine where the information is reported. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. Web instructions for recipient recipient’s taxpayer identification number (tin). File this form to report the sale or exchange of real estate. A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. For 2020 taxes this would be february 1st 2021. Proceeds from real estate transactions.

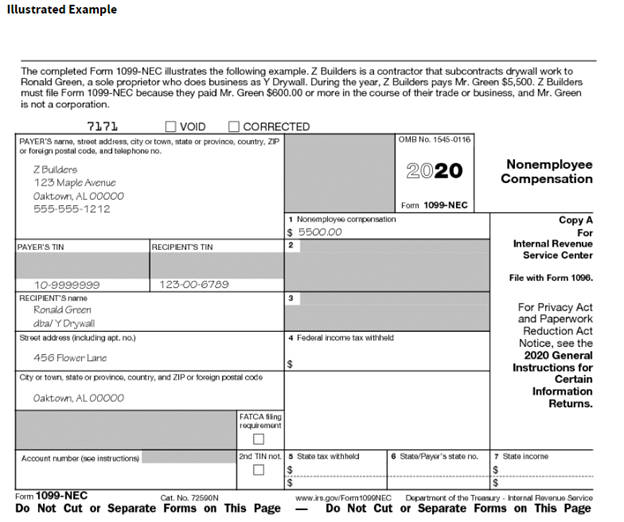

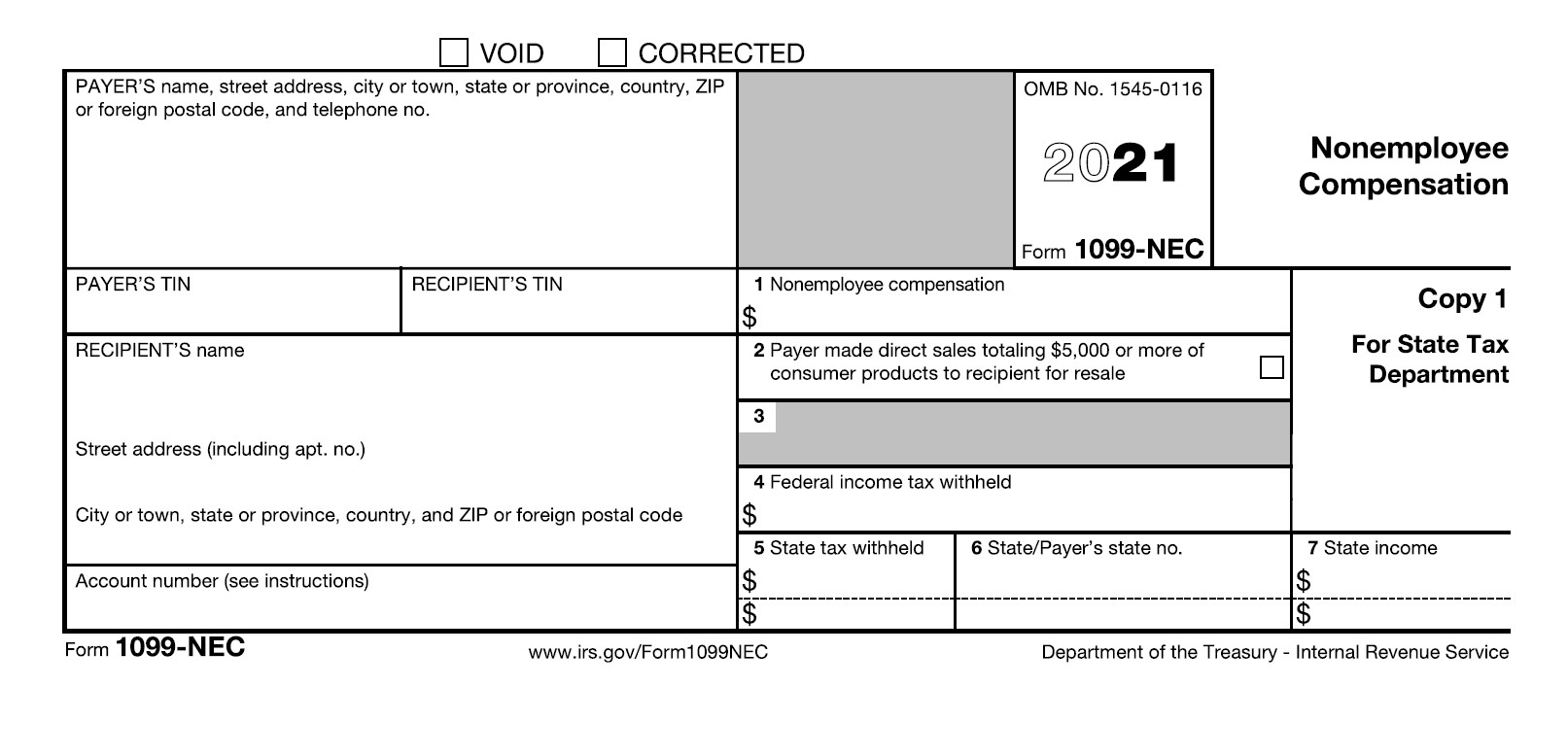

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future Web instructions for recipient recipient’s taxpayer identification number (tin). Web what is a 1099 s? How the property is used (personal, investment, business) will determine where.

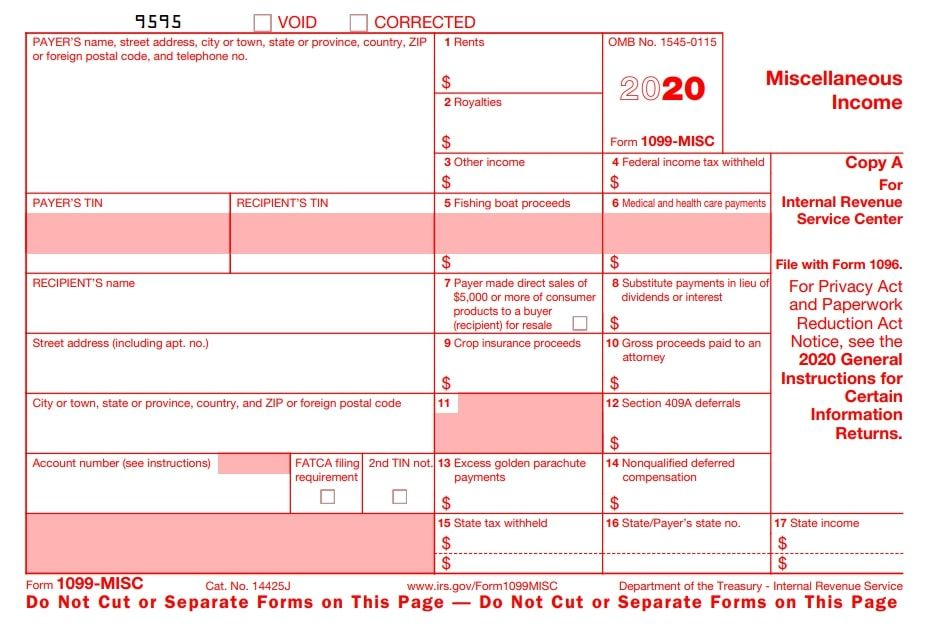

Printable 1099s 2021 Form Printable Form 2022

The due date for irs paper filing march 15th 2021. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption.

1099 Form 2019 Fill and Sign Printable Template Online US Legal Forms

The due date for irs paper filing march 15th 2021. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. Web instructions for recipient recipient’s taxpayer identification number (tin). For 2020 taxes this would be february 1st 2021. Web what is a 1099 s?

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. This is important tax information and is being furnished to the irs. For 2020 taxes this would be february 1st 2021. It must be used whenever you make a real estate transaction in the.

25 ++ sample completed 1099 misc form 2020 325140How to fill in 1099

Proceeds from real estate transactions. A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. Follow the steps below to report real estate for personal, investment, or business use. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number.

Irs Printable 1099 Form Printable Form 2022

Follow the steps below to report real estate for personal, investment, or business use. File this form to report the sale or exchange of real estate. It must be used whenever you make a real estate transaction in the tax year. For your protection, this form may show only the last four digits of your social security number (ssn), individual.

Understanding the 1099 5 Straightforward Tips to File

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. This could include land, permanent structures, apartments or condominiums, and more. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin),.

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

How the property is used (personal, investment, business) will determine where the information is reported. This could include land, permanent structures, apartments or condominiums, and more. File this form to report the sale or exchange of real estate. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item.

1099 vs W2 Calculator (To Estimate Your Tax Difference)

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future.

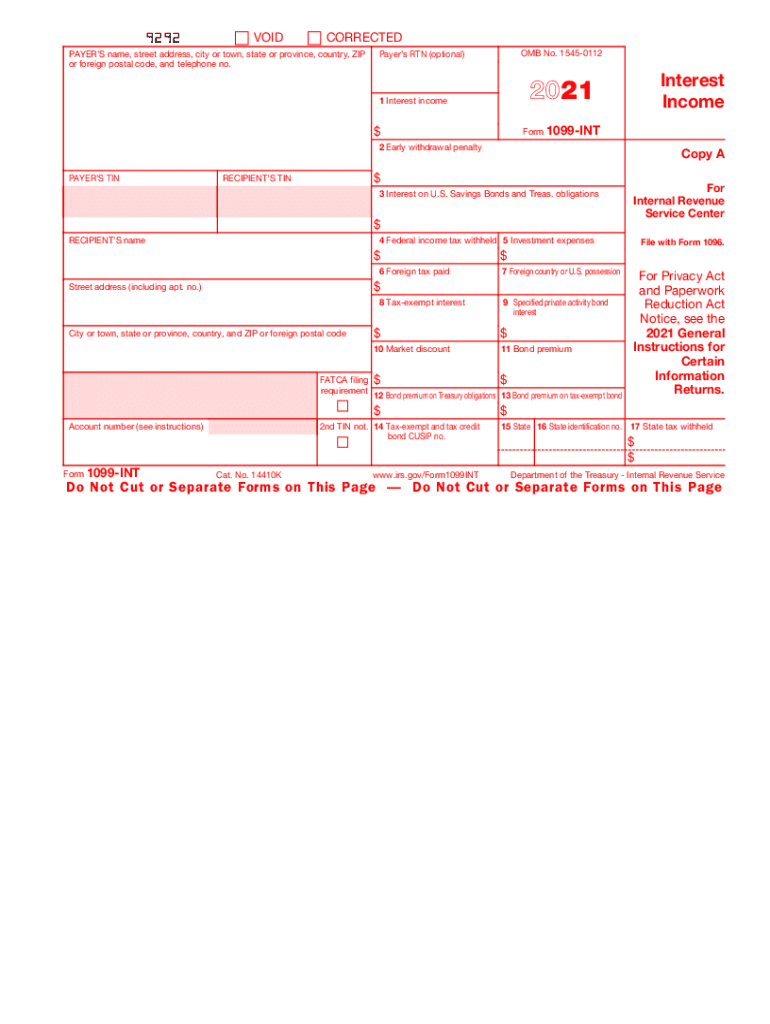

2021 Form IRS 1099INT Fill Online, Printable, Fillable, Blank pdfFiller

Follow the steps below to report real estate for personal, investment, or business use. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. It must be used whenever you make a real estate transaction in the tax year. How the property is used.

For 2020 Taxes This Would Be February 1St 2021.

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. Web what is a 1099 s? For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Proceeds from real estate transactions.

File This Form To Report The Sale Or Exchange Of Real Estate.

The due date for irs paper filing march 15th 2021. It must be used whenever you make a real estate transaction in the tax year. Follow the steps below to report real estate for personal, investment, or business use. How the property is used (personal, investment, business) will determine where the information is reported.

A Sale Of Real Estate Under Threat Or Imminence Of Seizure, Requisition, Or Condemnation Is Generally A Reportable Transaction.

This is important tax information and is being furnished to the irs. Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future Web instructions for recipient recipient’s taxpayer identification number (tin). This could include land, permanent structures, apartments or condominiums, and more.