1120S Extension Form

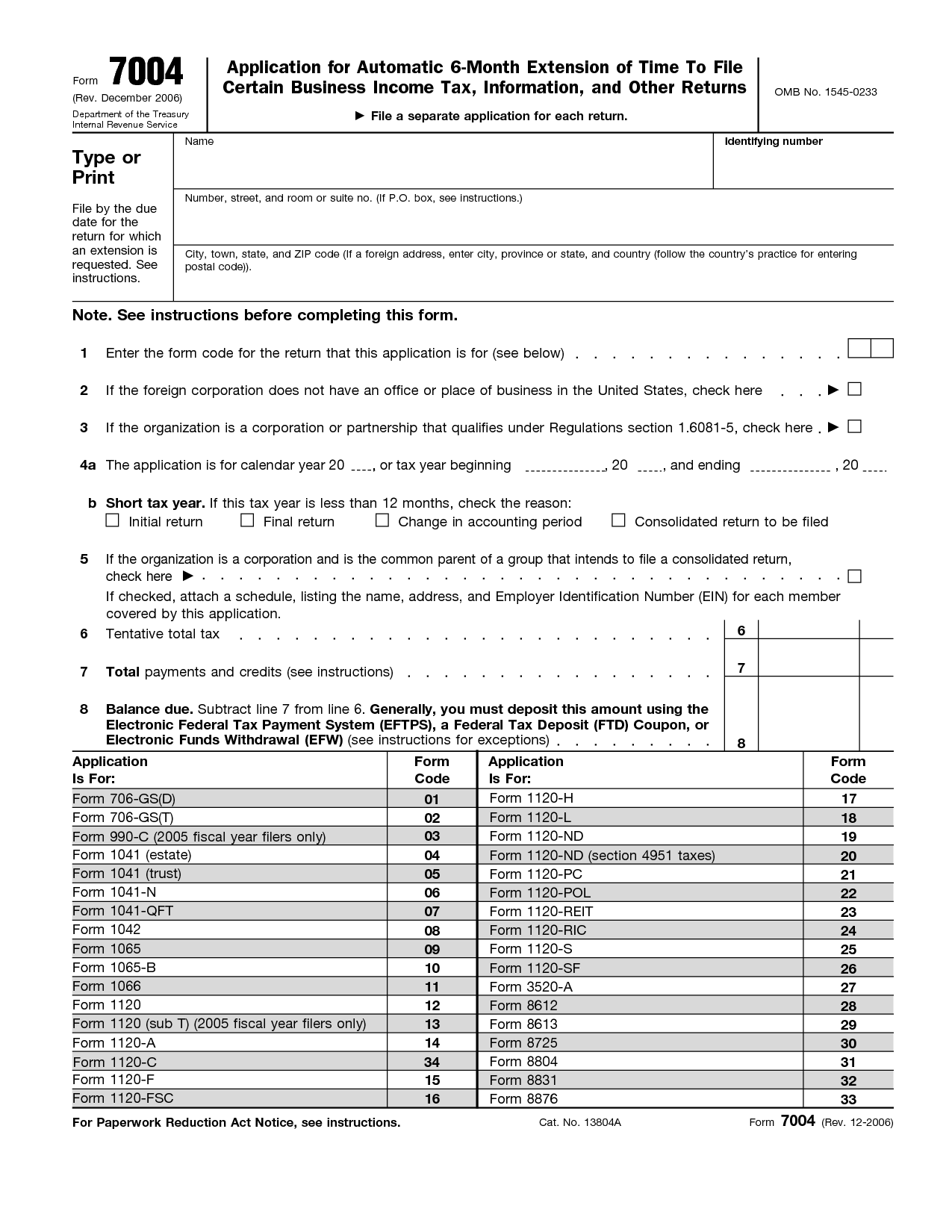

1120S Extension Form - Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Part i automatic extension for certain business income tax, information, and other returns. Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. Use the following irs center address: Alternatively, businesses can file on the next business day. Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. If you are an individual, the deadline is the 15th day of the third month after the tax year ends. Web what is the extended due date for the 1120s form? Your payment on mydorway automatically extends your time to file. This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid.

This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid. Web what is the extended due date for the 1120s form? Your payment on mydorway automatically extends your time to file. Form 7004 is used to request an automatic extension to file the certain returns. See instructions before completing this form. The penalty, although seemingly minimal, can accumulate quickly, significantly increasing your overall tax liability. The irs has extended the due date of form 1120s by six months. Alternatively, businesses can file on the next business day. And the total assets at the end of the tax year are: Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file.

This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid. See instructions before completing this form. Corporations have to file their returns by that date. Web file request for extension by the due date of the return. Part i automatic extension for certain business income tax, information, and other returns. Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. Use the following irs center address: Select business income tax payment to get started. 5/3/22) dor.sc.gov 3096 request a filing extension using our free tax portal, mydorway, at dor.sc.gov/pay. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file.

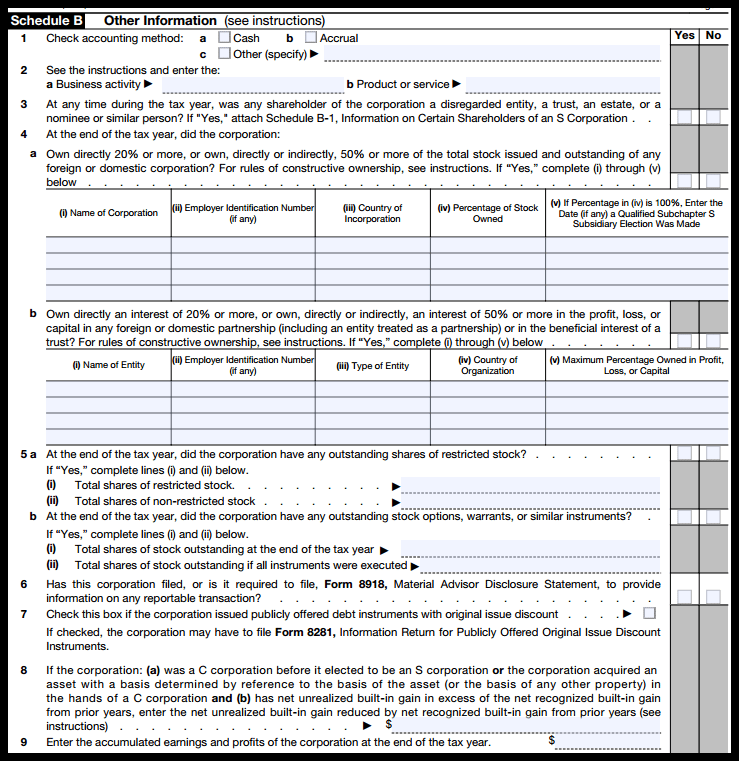

IRS Borang 1120S Definisi, Muat Turun, & Arahan 1120S Perakaunan 2020

Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. And the total assets at the end of the tax year are: Alternatively, businesses can file on the next.

How to Complete Form 1120S Tax Return for an S Corp

Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. Form 7004 is used to request an automatic extension to file the certain returns. Web file request for extension by the due date of the return. And the total assets at the end of the tax year are: Connecticut,.

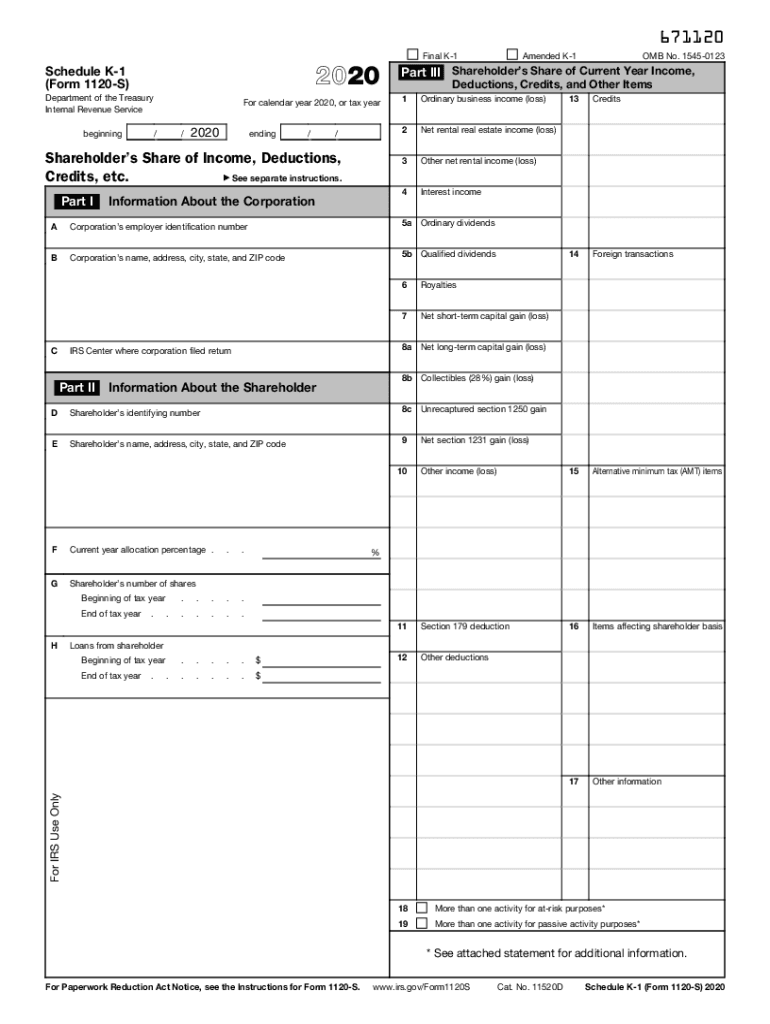

IRS 1120S Schedule K1 2020 Fill out Tax Template Online US Legal

Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. Use the following irs center address: The penalty, although seemingly minimal, can accumulate quickly, significantly increasing your overall tax liability. Select business income tax payment to get started. Web file request for extension by the due date of the return.

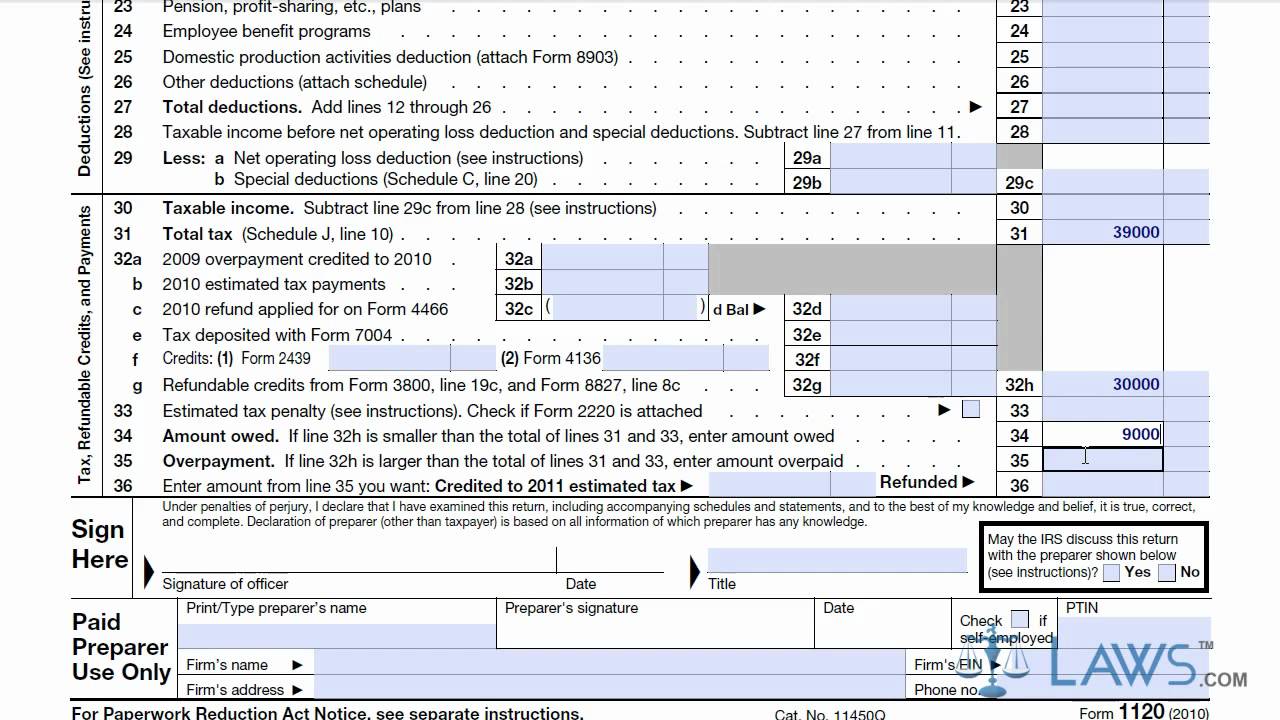

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

The irs has extended the due date of form 1120s by six months. Part i automatic extension for certain business income tax, information, and other returns. Web file request for extension by the due date of the return. Corporations have to file their returns by that date. If you are an individual, the deadline is the 15th day of the.

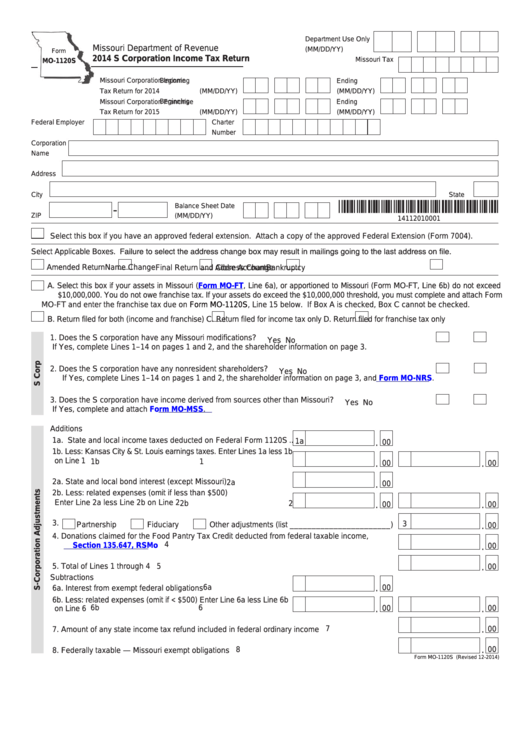

Fillable Form Mo1120s S Corporation Tax Return 2014

Web what is the extended due date for the 1120s form? This form is used to report the gains, deductions, income, and losses of the business during the current tax year. 5/3/22) dor.sc.gov 3096 request a filing extension using our free tax portal, mydorway, at dor.sc.gov/pay. Corporations have to file their returns by that date. See instructions before completing this.

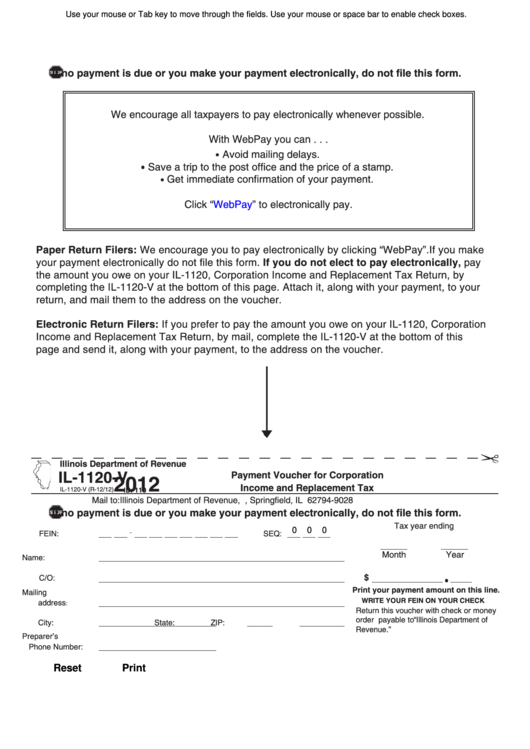

Fillable Form Il1120V Payment Voucher For Corporation And

Web file request for extension by the due date of the return. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Corporations have to file their returns by that date. Part i automatic extension for certain business.

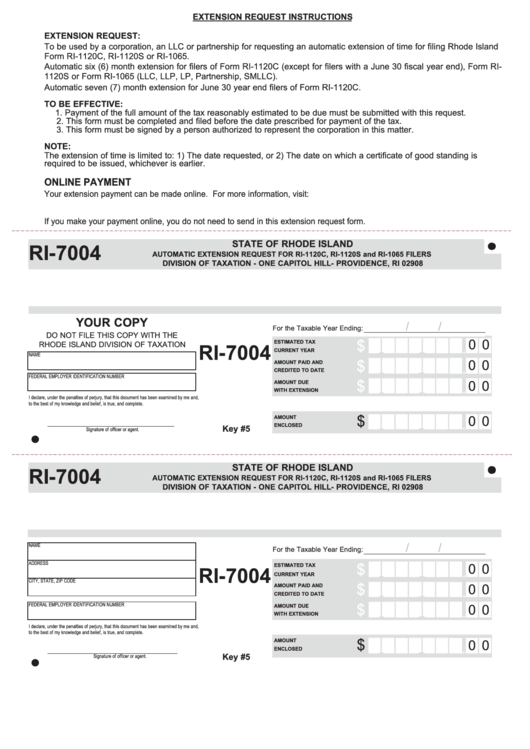

Fillable Form Ri7004 Automatic Extension Request For Ri1120c, Ri

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. And the total assets at the end of the tax year are: Web file request for extension by the due date of the return. If you are an.

How to File an Extension for Your SubChapter S Corporation

Use the following irs center address: And the total assets at the end of the tax year are: Web file request for extension by the due date of the return. Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty. Alternatively, businesses can file on the next business day.

U.S. TREAS Form treasirs1120sschedulek11995

Your payment on mydorway automatically extends your time to file. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york,. Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. Corporations have to file their returns by that date. Web in.

Form Mo1120S 2015 SCorporation Tax Return Edit, Fill, Sign

Enter the form code for the return listed below that this application is for. The irs has extended the due date of form 1120s by six months. And the total assets at the end of the tax year are: Form 7004 is used to request an automatic extension to file the certain returns. Your payment on mydorway automatically extends your.

Connecticut, Delaware, District Of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York,.

If you are an individual, the deadline is the 15th day of the third month after the tax year ends. This equates to 0.5% of your tax liability, and this fee accrues each month until the taxes are fully paid. And the total assets at the end of the tax year are: 5/3/22) dor.sc.gov 3096 request a filing extension using our free tax portal, mydorway, at dor.sc.gov/pay.

Web What Is The Extended Due Date For The 1120S Form?

See instructions before completing this form. Form 7004 is used to request an automatic extension to file the certain returns. Web file request for extension by the due date of the return. This form is used to report the gains, deductions, income, and losses of the business during the current tax year.

Part I Automatic Extension For Certain Business Income Tax, Information, And Other Returns.

Enter the form code for the return listed below that this application is for. Select business income tax payment to get started. The penalty, although seemingly minimal, can accumulate quickly, significantly increasing your overall tax liability. Web in the event that you file your federal taxes late, the irs is authorized to impose a late payment penalty.

The Irs Has Extended The Due Date Of Form 1120S By Six Months.

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web application for automatic extension of time to file corporation, partnership, and exempt organization returns | arizona department of revenue. Your payment on mydorway automatically extends your time to file. Use the following irs center address: