12C Tax Form

12C Tax Form - (if you checked the box on line 1, see the line 31 instructions). It will explain the changes we made and why you owe money on your taxes. Web advance child tax credit letters. Download right horizons form 12c & more fillable forms, register and subscribe now! 12c [see rule 26b] form for sending particulars of income under section 192(2b) for the year ending 31st march, 19 name and address of the employee. It could help you navigate your way through the irs. Web what to do if you get a 12c letter about the premium tax credit. Web form 12c back to glossary what is form 12c? Easily sign the form 12c download with your finger. Edit, sign and save right horizons 12c form.

Web what you need to do. Download right horizons form 12c & more fillable forms, register and subscribe now! It will explain the changes we made and why you owe money on your taxes. Form 1040nr, line 13) and on. It is a form given to the employer by the employee to reveal the income from sources other than salary. Estates and trusts, enter on. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is. It could help you navigate your way through the irs. Edit, sign and save right horizons 12c form. Send filled & signed form 12c form.

Web irs letter 12c (officially labeled ltr0012c) is a notice that the irs needs more information before it can process your return. (if you checked the box on line 1, see the line 31 instructions). Web information about schedule 8812 (form 1040), additional child tax credit, including recent updates, related forms, and instructions on how to file. Form 1040nr, line 13) and on. Web advance child tax credit letters. It is a form given to the employer by the employee to reveal the income from sources other than salary. It could help you navigate your way through the irs. Easily sign the form 12c download with your finger. Audit report under section 33ab(2) form no. It was considered an income.

Irs Name Change Letter Sample / Request to Link to Website Letter

Web irs letter 12c (officially labeled ltr0012c) is a notice that the irs needs more information before it can process your return. 3ac [see rule 5ac] audit report under section 33ab(2) part i audit report under section. Web solved•by turbotax•4077•updated january 13, 2023. It is a form given to the employer by the employee to reveal the income from sources.

Form 12C PDF Tax Capital Gains Tax

If you agree with the changes we. It will explain the changes we made and why you owe money on your taxes. Web the income tax department provided a document called form 12c. Open the sample filled form 12c income tax and follow the instructions. The american rescue plan, signed into law on march 11, 2021,includes a provision that eliminates.

Form 12c Pdf Fill and Sign Printable Template Online US Legal Forms

Some taxpayers will be receiving an irs letter about the premium tax credit. Download right horizons form 12c & more fillable forms, register and subscribe now! Form 12c was a working paper for the income tax rebate for mortgage loans. Get details on letters about the 2021 advance child tax credit payments: Edit, sign and save right horizons 12c form.

Download New form 12BB to claim tax deduction on LTA and HRA

Edit, sign and save right horizons 12c form. The most common reason is a. It is a form given to the employer by the employee to reveal the income from sources other than salary. Download right horizons form 12c & more fillable forms, register and subscribe now! Estates and trusts, enter on.

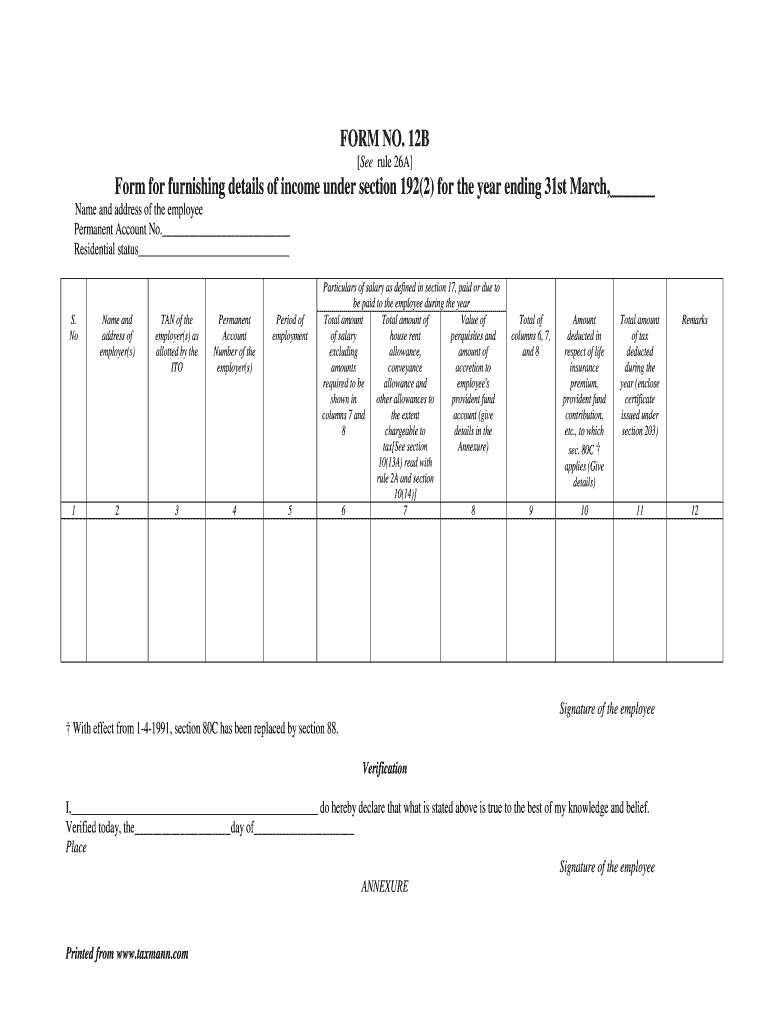

How To Fill Form 12b Fill Online, Printable, Fillable, Blank pdfFiller

12c [see rule 26b] form for sending particulars of income under section 192(2b) for the year ending 31st march, 19 name and address of the employee. Web form 1040, line 12, (or. 3ac [see rule 5ac] audit report under section 33ab(2) part i audit report under section. Web if your letter 12c indicates that form 8962, premium tax credit was.

Contributions

Web solved•by turbotax•4077•updated january 13, 2023. Open the sample filled form 12c income tax and follow the instructions. It was considered an income. Web if your letter 12c indicates that form 8962, premium tax credit was missing and not attached to your return, you will need to send the completed form 8962 to the irs. Download right horizons form 12c.

FORM NO. 12C (See Rule 26B) Form For Sending Particulars of

Web what to do if you get a 12c letter about the premium tax credit. Web advance child tax credit letters. Web irs letter 12c (officially labeled ltr0012c) is a notice that the irs needs more information before it can process your return. Web letter 12c were errors found on return view our interactive tax map to see where you.

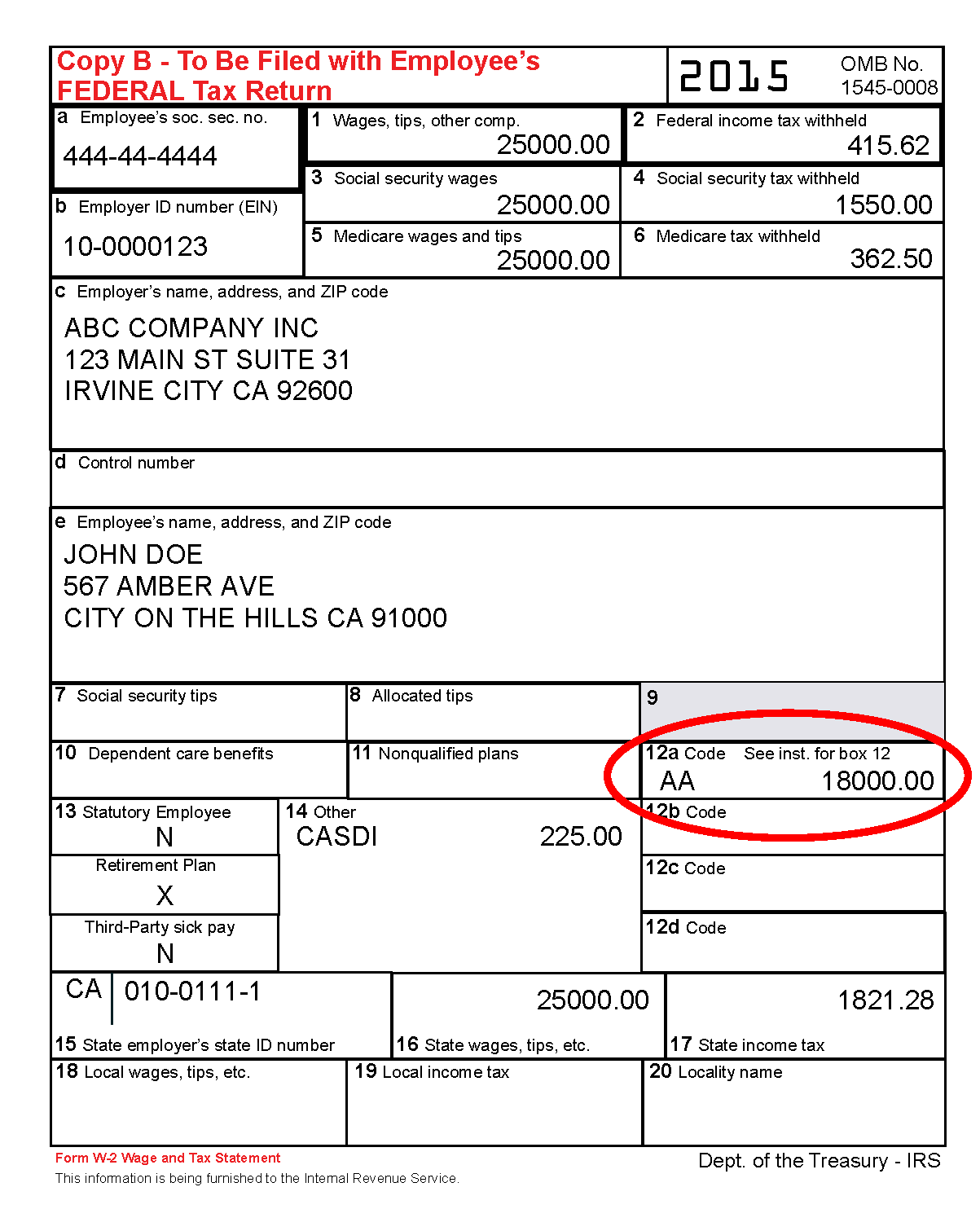

Understanding Tax Season Form W2 Remote Financial Planner

(if you checked the box on line 1, see the line 31 instructions). Web the income tax department provided a document called form 12c. Web form 12c back to glossary what is form 12c? It was considered an income. Download right horizons form 12c & more fillable forms, register and subscribe now!

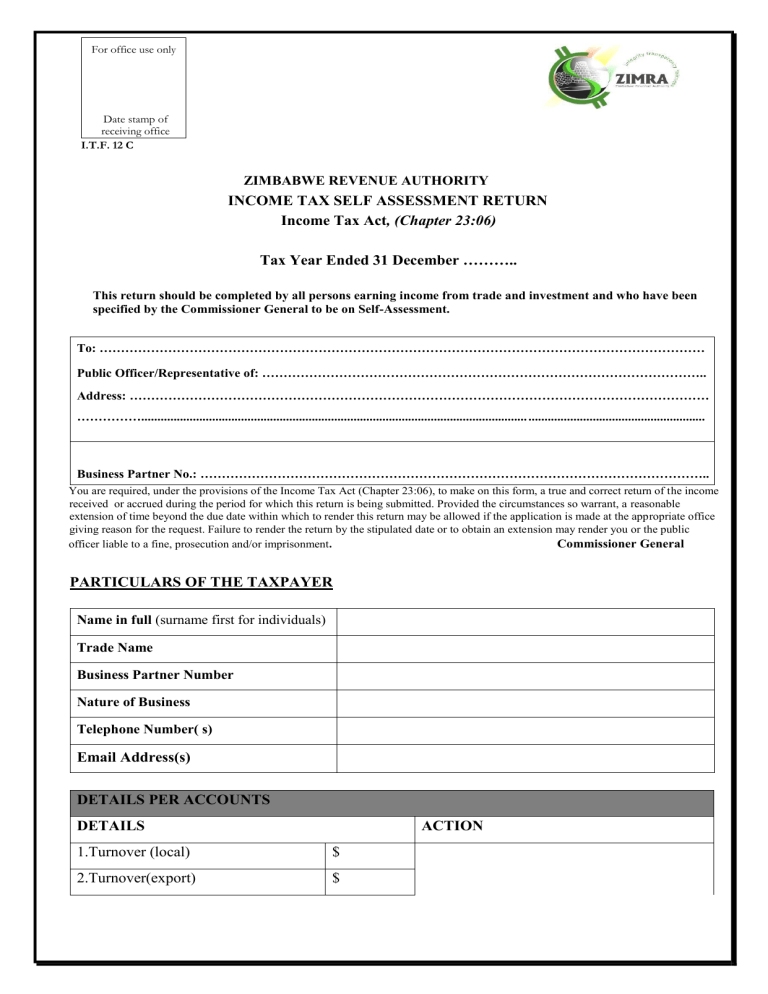

ITF 12C Tax Self Assessment Return

It was considered an income. Be sure to read your letter carefully. Easily sign the form 12c download with your finger. If you agree with the changes we. Web irs letter 12c (officially labeled ltr0012c) is a notice that the irs needs more information before it can process your return.

3.12.179 Individual Master File (IMF), Payer Master File (PMF

Web form 1040, line 12, (or. Audit report under section 33ab(2) form no. Get details on letters about the 2021 advance child tax credit payments: Web if your letter 12c indicates that form 8962, premium tax credit was missing and not attached to your return, you will need to send the completed form 8962 to the irs. Web letter 12c.

Get Details On Letters About The 2021 Advance Child Tax Credit Payments:

Form 12c was a working paper for the income tax rebate for mortgage loans. The american rescue plan, signed into law on march 11, 2021,includes a provision that eliminates the. It is a form given to the employer by the employee to reveal the income from sources other than salary. Web information about schedule 8812 (form 1040), additional child tax credit, including recent updates, related forms, and instructions on how to file.

Be Sure To Read Your Letter Carefully.

12c [see rule 26b] form for sending particulars of income under section 192(2b) for the year ending 31st march, 19 name and address of the employee. Web advance child tax credit letters. 3ac [see rule 5ac] audit report under section 33ab(2) part i audit report under section. Send filled & signed form 12c form.

Web If Your Letter 12C Indicates That Form 8962, Premium Tax Credit Was Missing And Not Attached To Your Return, You Will Need To Send The Completed Form 8962 To The Irs.

Web the income tax department provided a document called form 12c. It was considered an income. Web solved•by turbotax•4077•updated january 13, 2023. Form 1040nr, line 13) and on.

Edit, Sign And Save Right Horizons 12C Form.

Some taxpayers will be receiving an irs letter about the premium tax credit. Web form 12c back to glossary what is form 12c? Web irs letter 12c (officially labeled ltr0012c) is a notice that the irs needs more information before it can process your return. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is.