2021 Eic Form

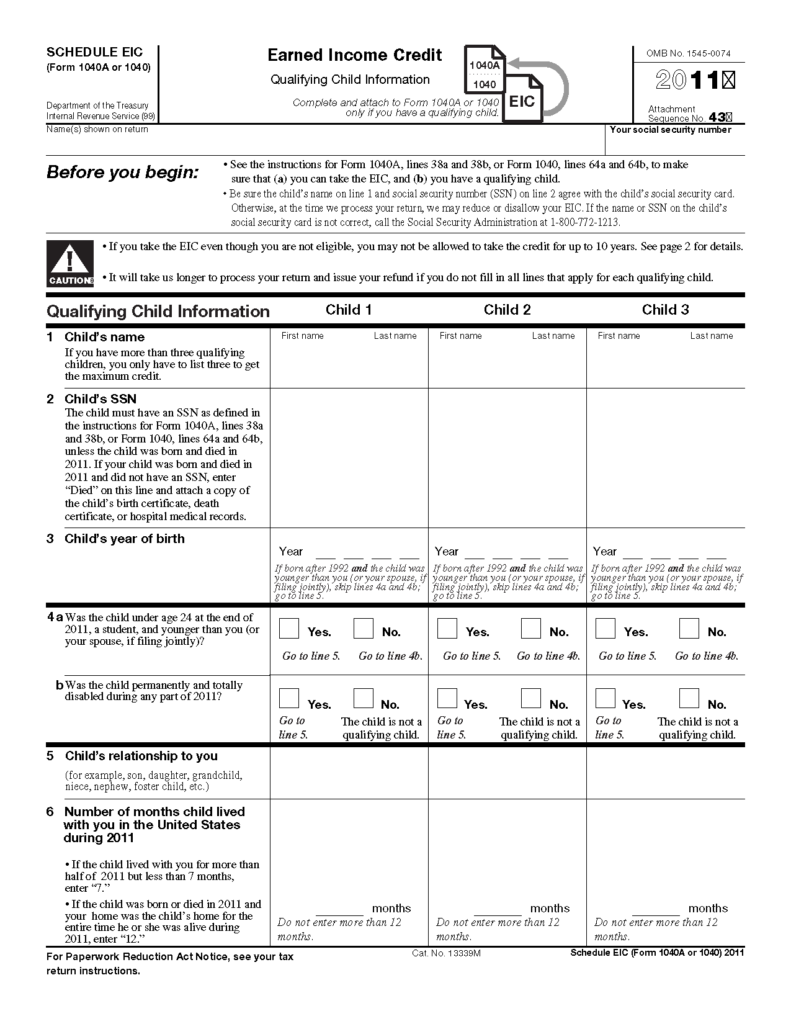

2021 Eic Form - The online ein application ( irs.gov/ein ) helps you get an employer identification number (ein) at no cost. The purpose of the eic is to reduce the tax burden and to supplement the wages of working families whose earnings are less than the maximums for their filing status. To figure the amount of your credit or to have the irs figure it for you, see the instructions for form 1040, lines 27a, 27b, and 27c. Web the schedule eic form is generally updated in december of each year by the irs. Refer to your notice cp09 for information on the document upload tool. Web the earned income tax credit assistant (irs.gov/eitcassistant) determines if you’re eligible for the earned income credit (eic). Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). Special rule for separated spouses. Web most of the forms are available in both english and spanish. Find out what to do.

The purpose of the eic is to reduce the tax burden and to supplement the wages of working families whose earnings are less than the maximums for their filing status. Eic line item instructions follow later as part of the form 1040 general instructions booklet. Web most of the forms are available in both english and spanish. Find out what to do. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). See the instructions for form 1040, line 27, for information on who may be a qualifying child. To figure the amount of your credit or to have the irs figure it for you, see the instructions for form 1040, lines 27a, 27b, and 27c. If updated, the 2022 tax year pdf file will display, the prior tax year 2021 if not. Did you receive a letter from the irs about the eitc? Refer to your notice cp09 for information on the document upload tool.

Web most of the forms are available in both english and spanish. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Web the schedule eic form is generally updated in december of each year by the irs. The purpose of the eic is to reduce the tax burden and to supplement the wages of working families whose earnings are less than the maximums for their filing status. Special rule for separated spouses. Refer to your notice cp09 for information on the document upload tool. Eic line item instructions follow later as part of the form 1040 general instructions booklet. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). See the instructions for form 1040, line 27, for information on who may be a qualifying child. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren).

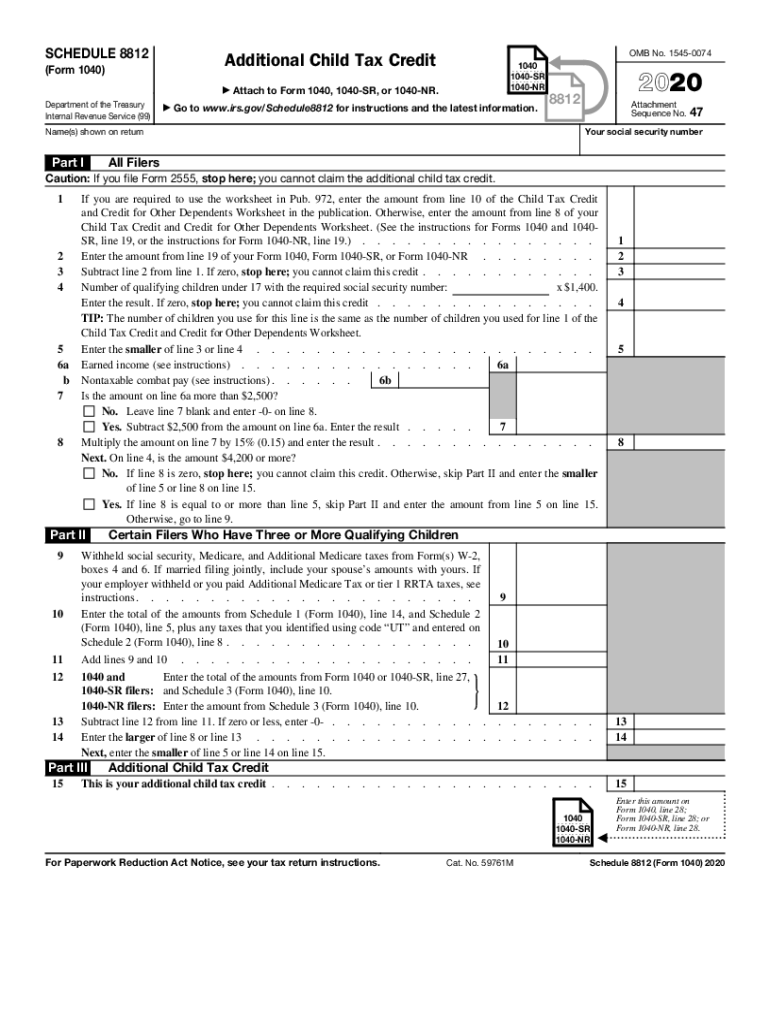

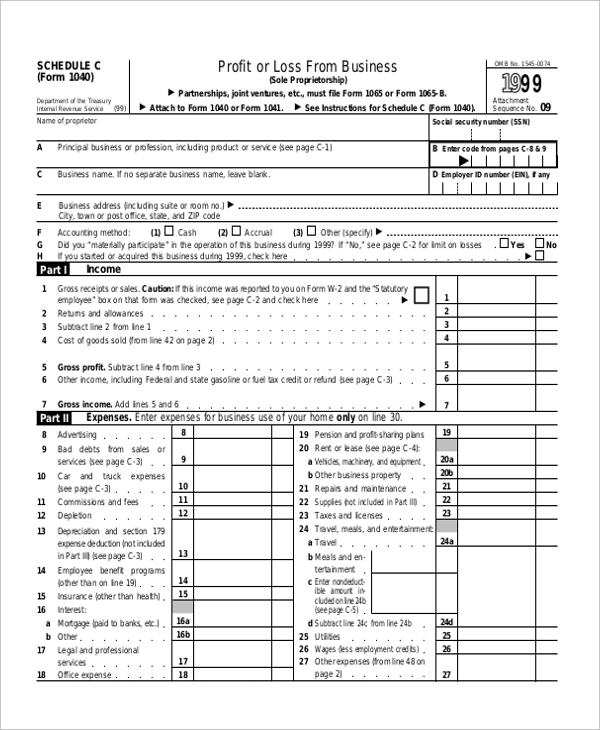

Irs 1040 Form 2020 Pdf 1040ez Form Fill Out And Sign Printable Pdf

Special rule for separated spouses. Web most of the forms are available in both english and spanish. Web the schedule eic form is generally updated in december of each year by the irs. Find out what to do. The purpose of the eic is to reduce the tax burden and to supplement the wages of working families whose earnings are.

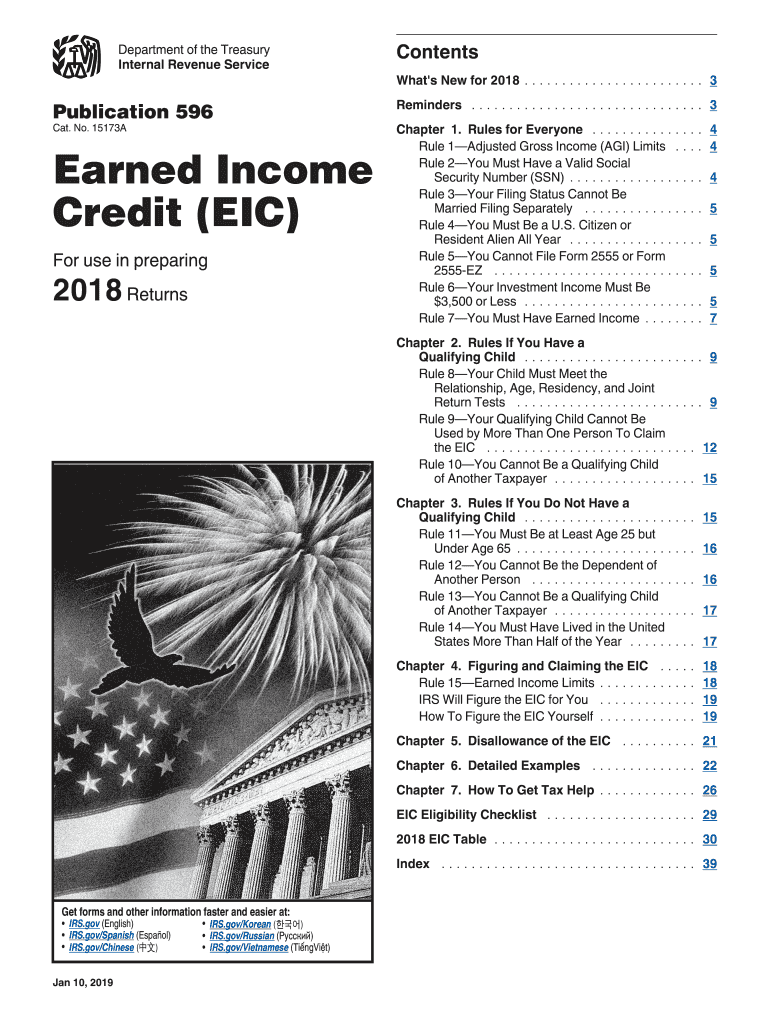

Earned Credit Table 2018 Chart Awesome Home

The purpose of the eic is to reduce the tax burden and to supplement the wages of working families whose earnings are less than the maximums for their filing status. Web most of the forms are available in both english and spanish. Refer to your notice cp09 for information on the document upload tool. The online ein application ( irs.gov/ein.

Child Tax Credit Worksheet 2020 Pdf IRS Form 1040 Schedule EIC

If updated, the 2022 tax year pdf file will display, the prior tax year 2021 if not. Did you receive a letter from the irs about the eitc? The online ein application ( irs.gov/ein ) helps you get an employer identification number (ein) at no cost. Web purpose of schedule after you have figured your earned income credit (eic), use.

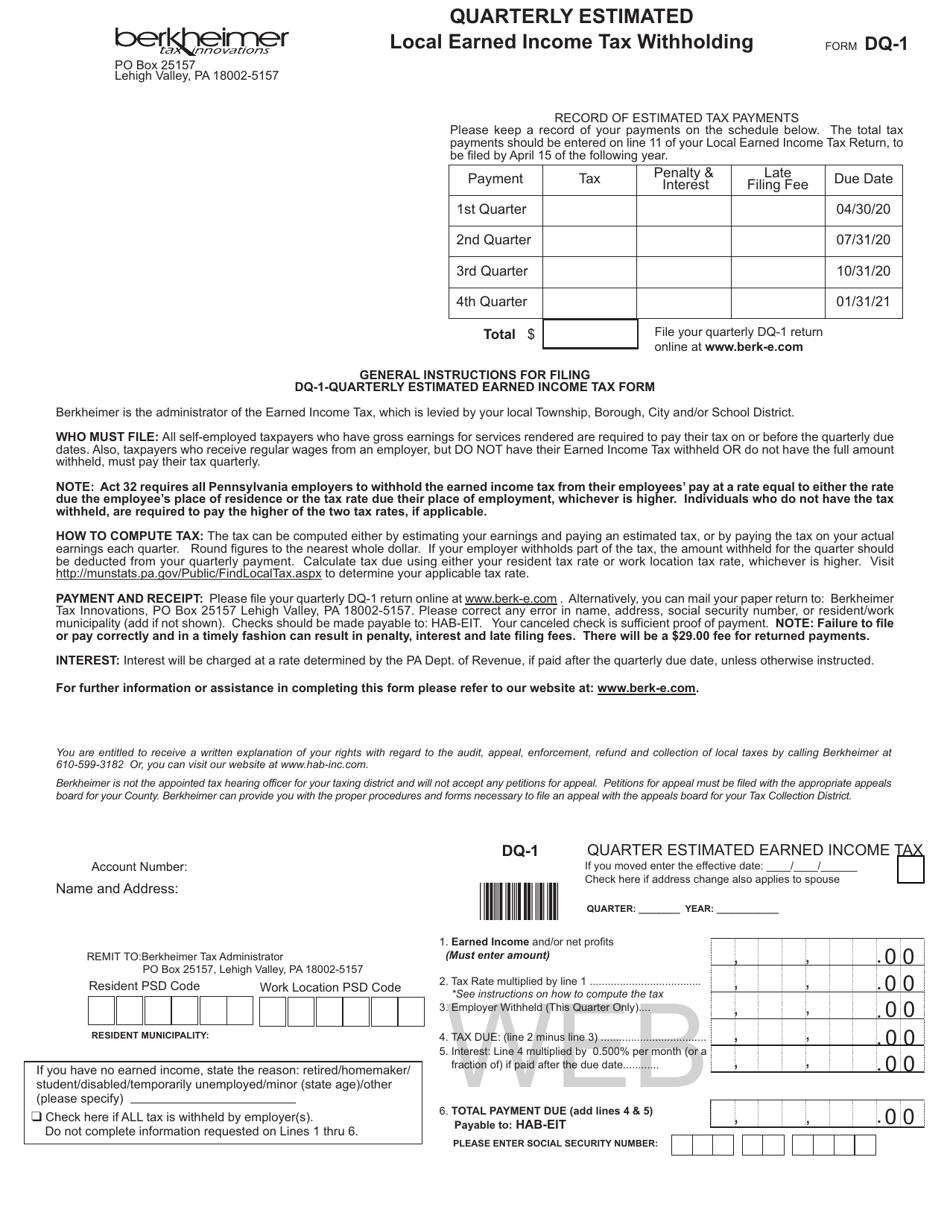

Worksheet A Eic Irs Form Triply

Web the schedule eic form is generally updated in december of each year by the irs. See the instructions for form 1040, line 27, for information on who may be a qualifying child. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). Web purpose.

2019 Eic Table Chart Fill Out and Sign Printable PDF Template signNow

Eic line item instructions follow later as part of the form 1040 general instructions booklet. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). Did you receive a letter from the irs about the eitc? To figure the amount of your credit or to.

Census 2021 Form Pdf

To figure the amount of your credit or to have the irs figure it for you, see the instructions for form 1040, lines 27a, 27b, and 27c. Web most of the forms are available in both english and spanish. If updated, the 2022 tax year pdf file will display, the prior tax year 2021 if not. Web the earned income.

8 Images Earned Credit Table 2018 And View Alqu Blog

Find out what to do. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). The purpose of the eic is to reduce the tax burden and to supplement the wages of working families whose earnings are less than the maximums for their filing status..

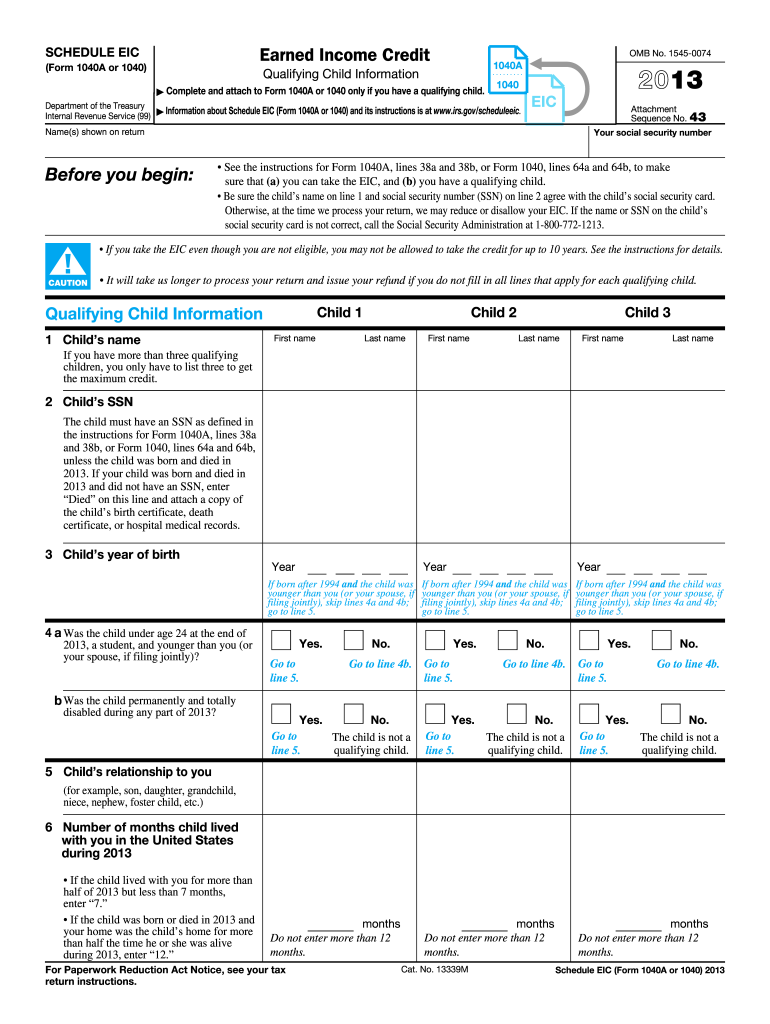

2013 Form IRS 1040 Schedule EIC Fill Online, Printable, Fillable

Did you receive a letter from the irs about the eitc? Refer to your notice cp09 for information on the document upload tool. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). See the instructions for form 1040, line 27, for information on who.

Form 1040 Schedule EIC Earned Credit 2021 Tax Forms 1040 Printable

Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Web purpose of schedule after you have figured your earned income credit (eic),.

What Is The Earned Credit Table

Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). If updated, the 2022 tax year pdf file will display, the prior tax year 2021 if not. See the instructions for form 1040, line 27, for information on who may be a qualifying child. Find.

Special Rule For Separated Spouses.

To figure the amount of your credit or to have the irs figure it for you, see the instructions for form 1040, lines 27a, 27b, and 27c. Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). Find out what to do. Refer to your notice cp09 for information on the document upload tool.

Web The Earned Income Tax Credit Assistant (Irs.gov/Eitcassistant) Determines If You’re Eligible For The Earned Income Credit (Eic).

Web most of the forms are available in both english and spanish. If updated, the 2022 tax year pdf file will display, the prior tax year 2021 if not. The purpose of the eic is to reduce the tax burden and to supplement the wages of working families whose earnings are less than the maximums for their filing status. See the instructions for form 1040, line 27, for information on who may be a qualifying child.

Eic Line Item Instructions Follow Later As Part Of The Form 1040 General Instructions Booklet.

Web purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your qualifying child(ren). The online ein application ( irs.gov/ein ) helps you get an employer identification number (ein) at no cost. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Web the schedule eic form is generally updated in december of each year by the irs.

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)