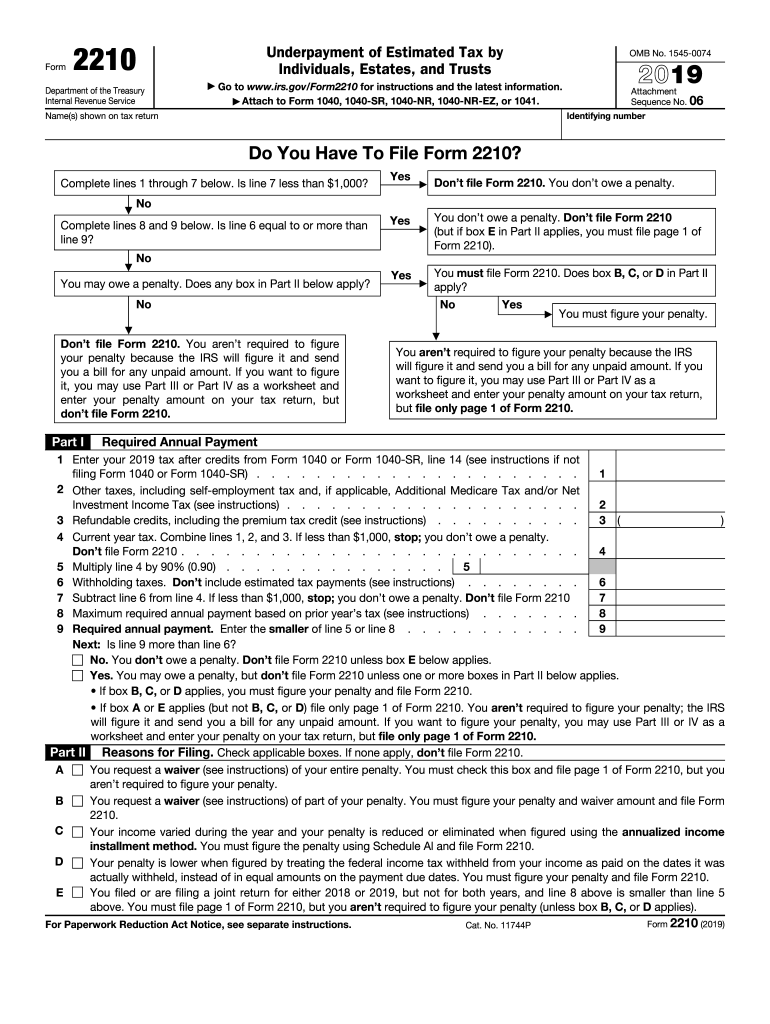

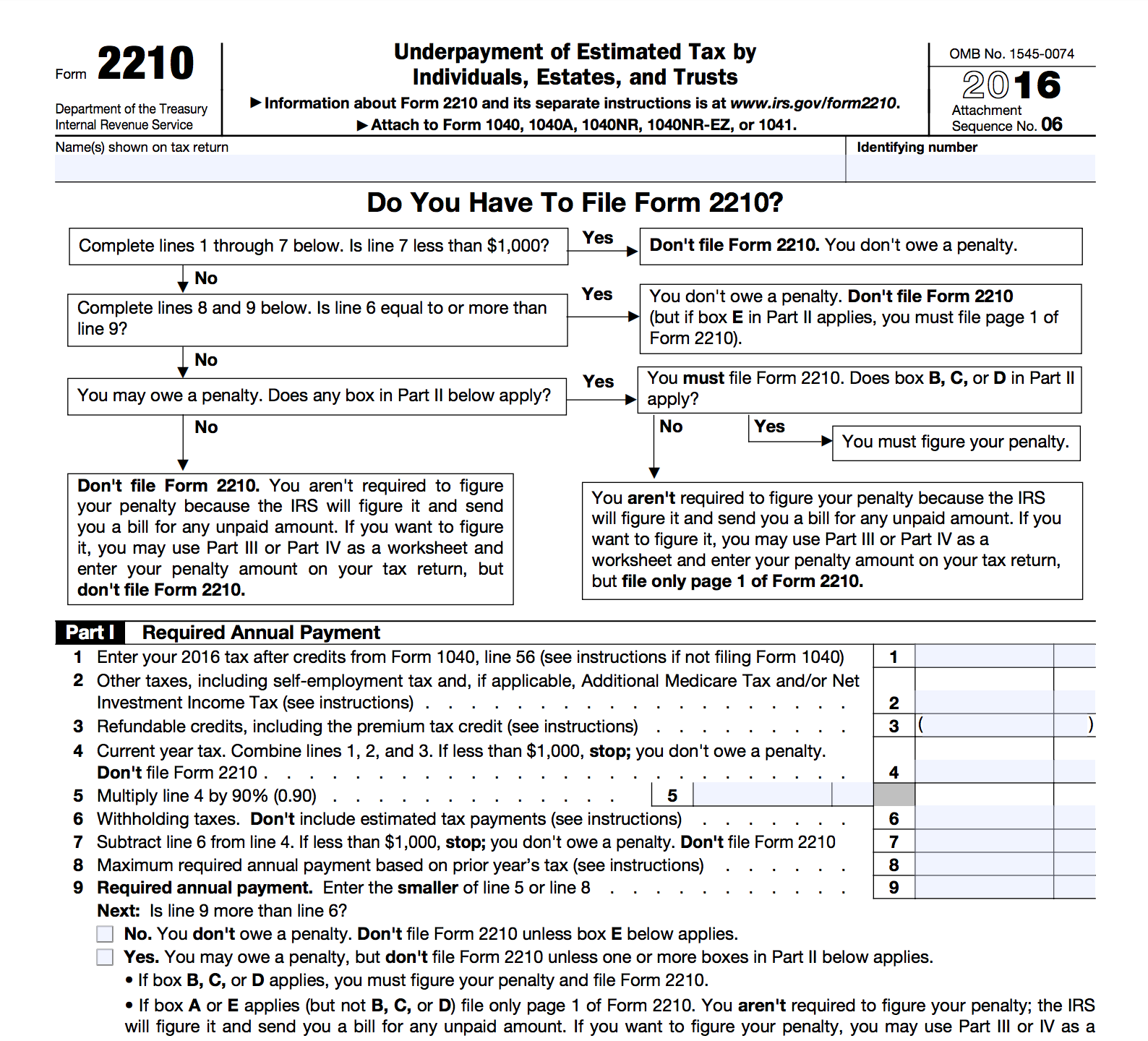

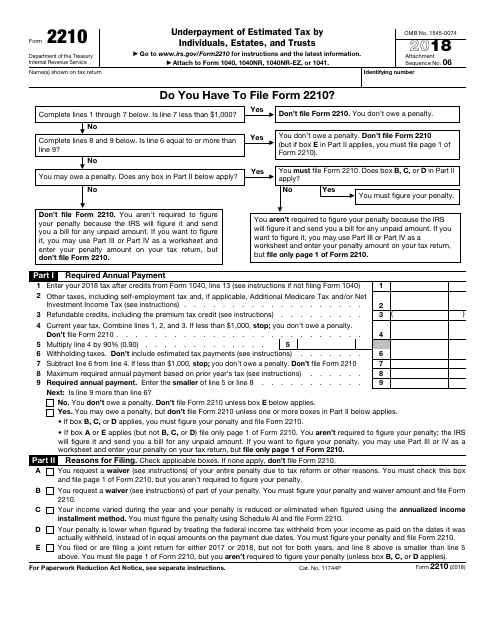

2021 Form 2210

2021 Form 2210 - Web if you don't meet test 1, use form 2210. Web tt 2021 desktop form 2210 wrong calculations. In my copy of turbotax desktop 2021, turbotax is calculating a penalty for late payment, on form 2210 part iii. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Different percentages are used for farmers and fishermen, and certain. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming. We'll automatically generate a form 2210 if your return needs it. Special rules for certain individuals. Web form 2210me instructions purpose of form. Complete, edit or print tax forms instantly.

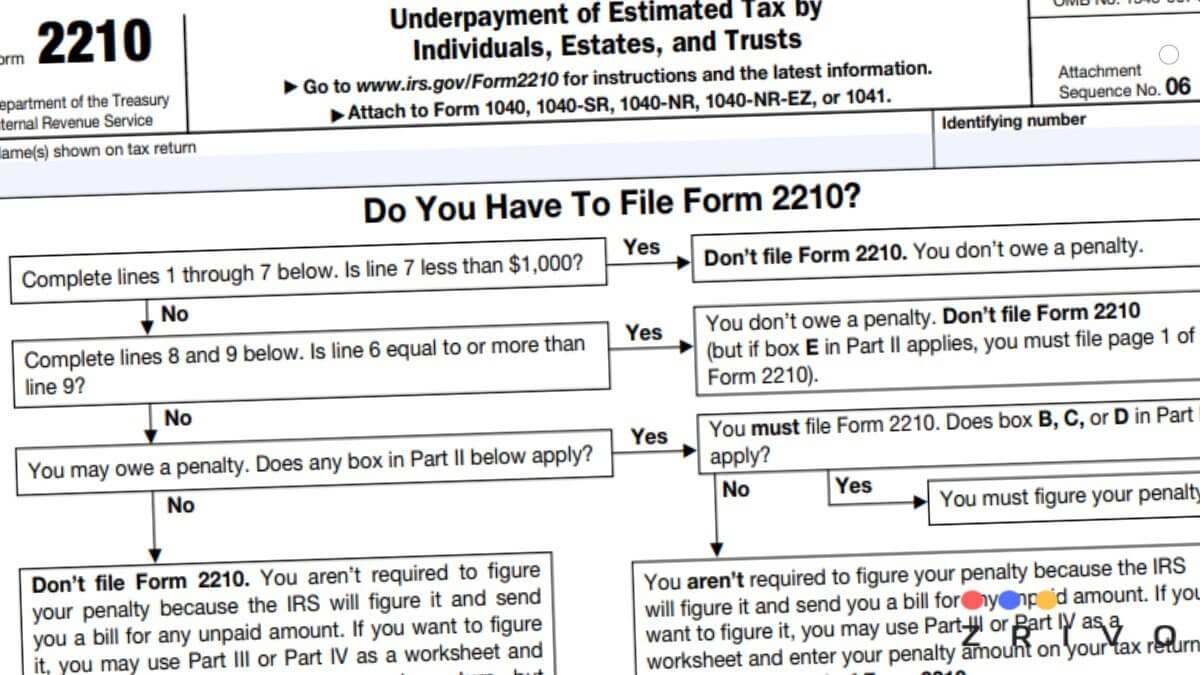

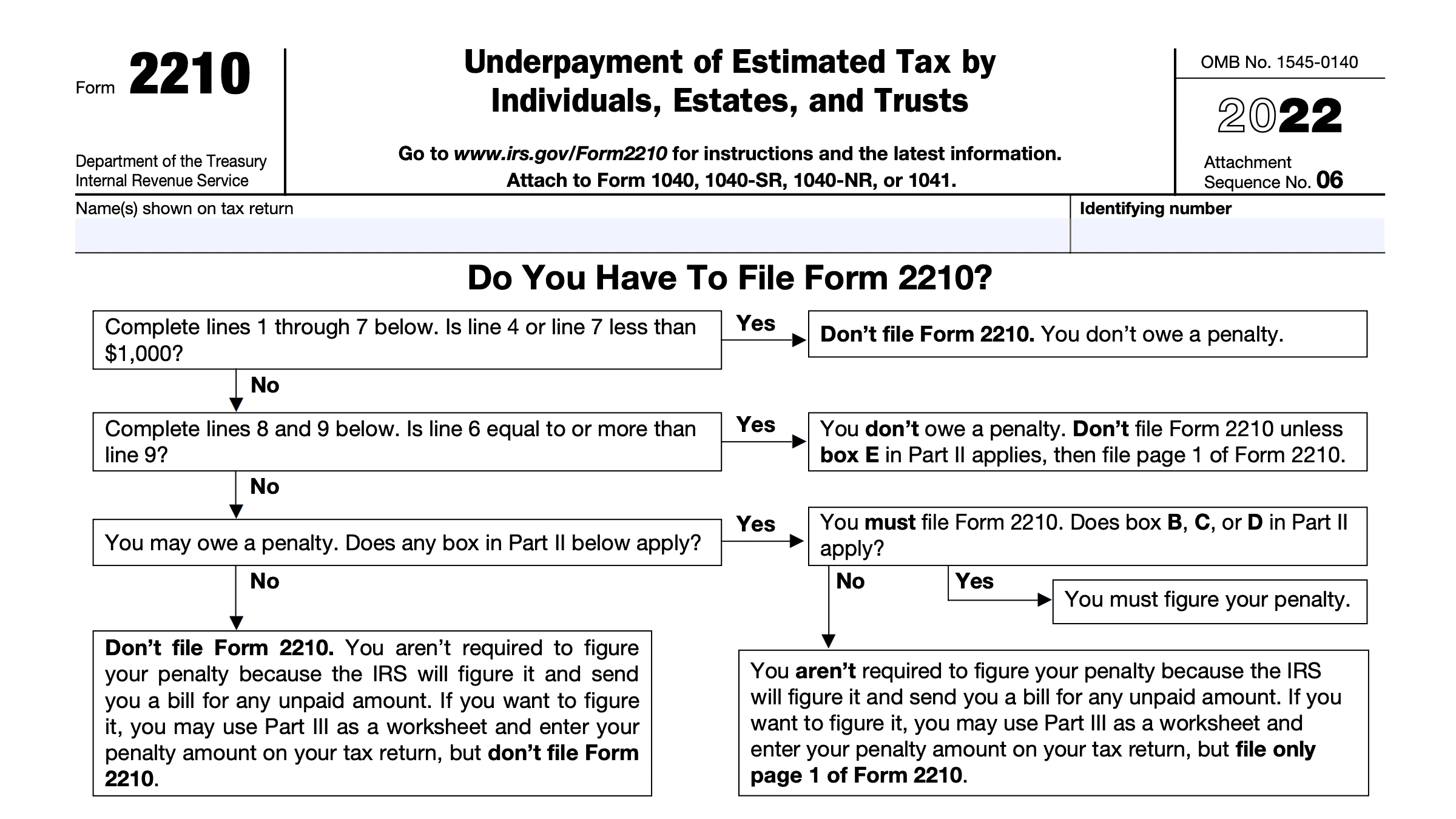

You don’t owe a penalty. The form doesn't always have to be. Department of the treasury internal revenue service. Eyou filed or are filing a joint return for either 2021 2022, but not both years, and line 8 above is smaller than 5 above. We'll automatically generate a form 2210 if your return needs it. A recent kiplinger tax letter reported. Complete, edit or print tax forms instantly. Complete lines 1 through 7 below. Web do you have to file form 2210? Waiver of penalty if you have an underpayment, all or part of the penalty for that underpayment will be waived if the irs determines that:

The form doesn't always have to be. Web form 2210me instructions purpose of form. February 26, 2021 share on social what is irs form 2210? If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Is line 4 or line 7 less than $1,000? In my copy of turbotax desktop 2021, turbotax is calculating a penalty for late payment, on form 2210 part iii. Web tt 2021 desktop form 2210 wrong calculations. We'll automatically generate a form 2210 if your return needs it. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming. Different percentages are used for farmers and fishermen, and certain.

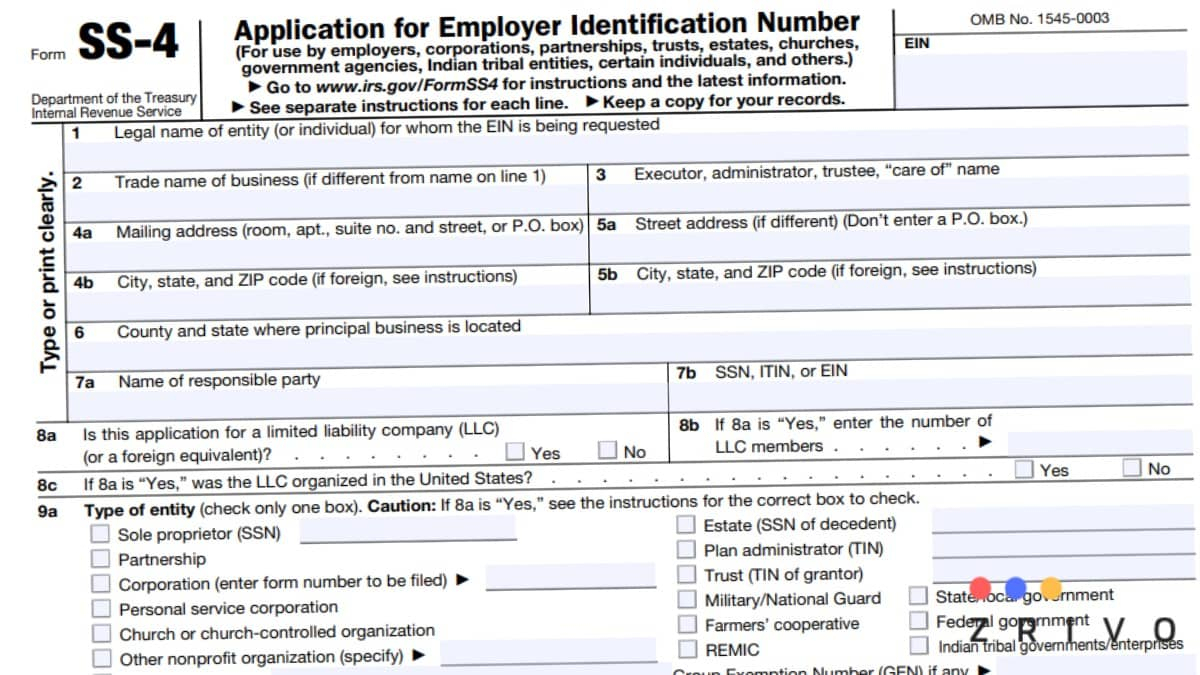

About Form 2210, Underpayment of Estimated Tax by Fill Out and Sign

Web form 2210me instructions purpose of form. February 26, 2021 share on social what is irs form 2210? Department of the treasury internal revenue service. A recent kiplinger tax letter reported. Underpayment of massachusetts estimated income.

2021 Printable Irs 1040Ez Forms Example Calendar Printable

Underpayment of massachusetts estimated income. Use this form to see if you must pay a penalty for underpaying your estimated tax or paying your estimated tax late. If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Different percentages are used for farmers and fishermen, and certain. February 26, 2021.

Solved Turbo Tax 2020 not adding Form 2210 for underpayme... Page 2

Web 100% of your 2021 tax. Underpayment of massachusetts estimated income. Department of the treasury internal revenue service. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming. You don’t owe a penalty.

Ssurvivor Form 2210 Instructions 2020

We'll automatically generate a form 2210 if your return needs it. Web form 2210me instructions purpose of form. You don’t owe a penalty. Web do you have to file form 2210? Web you must figure your penalty and file form 2210.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

Special rules for certain individuals. Web you must figure your penalty and file form 2210. Different percentages are used for farmers and fishermen, and certain. We'll automatically generate a form 2210 if your return needs it. Web tt 2021 desktop form 2210 wrong calculations.

Ssurvivor Form 2210 Instructions 2020

Underpayment of estimated tax by individuals, estates, and trusts. Underpayment of massachusetts estimated income. Web do you have to file form 2210? In my copy of turbotax desktop 2021, turbotax is calculating a penalty for late payment, on form 2210 part iii. Web 2021 form efo:

Ssurvivor Irs Form 2210 Instructions 2020

Department of the treasury internal revenue service. Waiver of penalty if you have an underpayment, all or part of the penalty for that underpayment will be waived if the irs determines that: Special rules for certain individuals. Web 2021 form efo: Different percentages are used for farmers and fishermen, and certain.

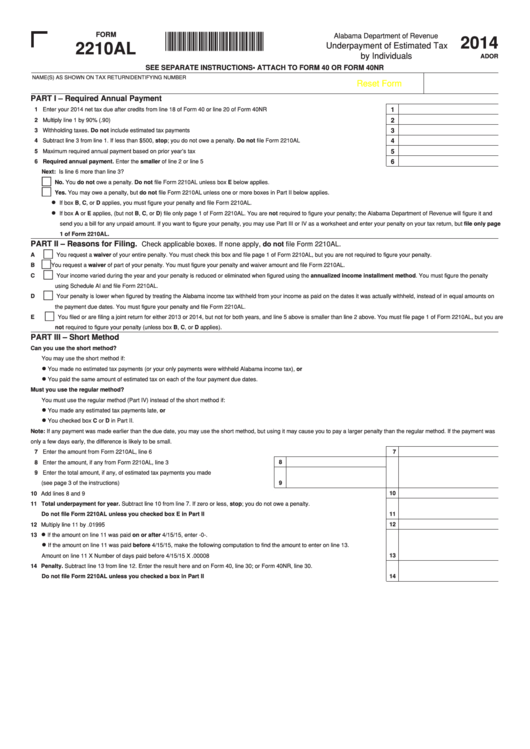

Fillable Form 2210al Alabama Underpayment Of Estimated Tax By

Complete, edit or print tax forms instantly. Special rules for certain individuals. Waiver of penalty if you have an underpayment, all or part of the penalty for that underpayment will be waived if the irs determines that: Underpayment of estimated tax by individuals, estates, and trusts. Eyou filed or are filing a joint return for either 2021 2022, but not.

2210 Form 2022 2023

If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Is line 4 or line 7 less than $1,000? Eyou filed or are filing a joint return for either 2021 2022, but not both years, and line 8 above is smaller than 5 above. We'll automatically generate a form 2210.

IRS Form 2210 Instructions Underpayment of Estimated Tax

Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. In my copy of turbotax desktop 2021, turbotax is calculating a penalty for late payment, on form 2210 part iii. Eyou filed or are filing a joint return for either 2021 2022, but.

The Form Doesn't Always Have To Be.

Underpayment of estimated tax by individuals, estates, and trusts. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming. Web if you don't meet test 1, use form 2210. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year.

A Recent Kiplinger Tax Letter Reported.

Complete, edit or print tax forms instantly. Web form 2210me instructions purpose of form. Different percentages are used for farmers and fishermen, and certain. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due.

We'll Automatically Generate A Form 2210 If Your Return Needs It.

Department of the treasury internal revenue service. Web tt 2021 desktop form 2210 wrong calculations. You don’t owe a penalty. Web you must figure your penalty and file form 2210.

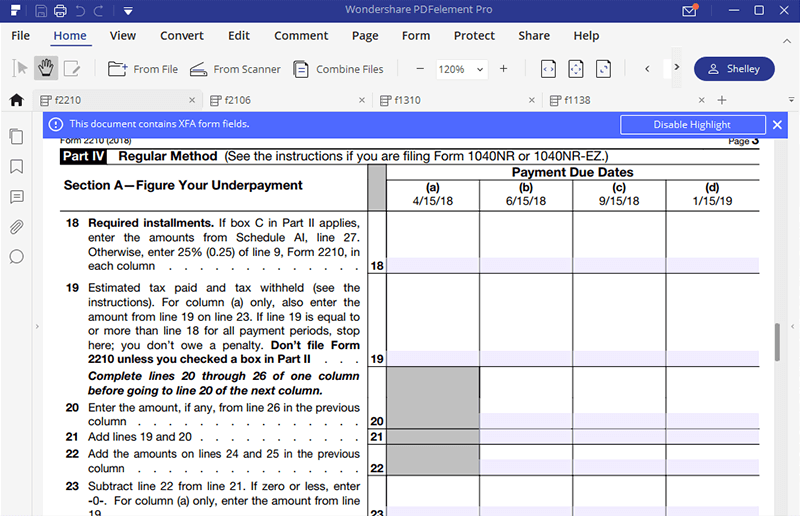

In My Copy Of Turbotax Desktop 2021, Turbotax Is Calculating A Penalty For Late Payment, On Form 2210 Part Iii.

Waiver of penalty if you have an underpayment, all or part of the penalty for that underpayment will be waived if the irs determines that: Complete lines 1 through 7 below. Underpayment of massachusetts estimated income. Web do you have to file form 2210?