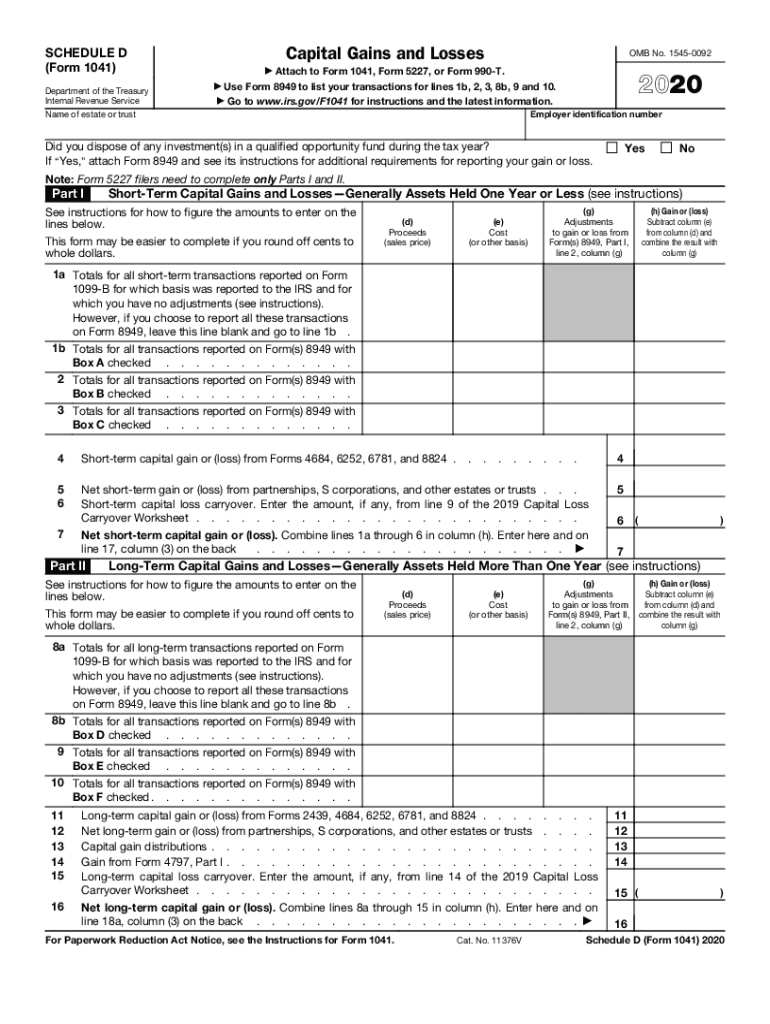

2021 Schedule D Form

2021 Schedule D Form - Ad access irs tax forms. Most people use the schedule d form to report capital gains and losses that result from the sale or trade of certain property during the year. Web investors who sold stocks, bonds, options, or other securities will have to prepare form 8949 sales and other dispositions of capital assets and schedule d (form 1040). You can download or print. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1040 (schedule d), fully updated for tax year 2022. Use california schedule d (540), california capital gain or loss adjustment, only if there is a difference between your california and federal capital gains and losses. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web group play united states. Enter the smaller of line 7, line 8, or computed amount. Complete, edit or print tax forms instantly.

For calendar plan year 2021 or fiscal plan year beginning and ending for paperwork reduction act notice, see the instructions for. Complete, edit or print tax forms instantly. • certain transactions that the. Web these instructions explain how to complete schedule d (form 1040). This form will be used to report certain sales, exchanges,. You can download or print. Web group play united states. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Complete form 8949 before you complete line. The netherlands in a contentious rematch of the 2019 world cup final.

(b) sales price (c) cost or other basis (d) loss if (c) is more than (b), subtract. The netherlands in a contentious rematch of the 2019 world cup final. Ad access irs tax forms. Enter all sales, exchanges or other dispositions of real or personal tangible and intangible property, including inherited. Most people use the schedule d form to report capital gains and losses that result from the sale or trade of certain property during the year. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Complete, edit or print tax forms instantly. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Get ready for tax season deadlines by completing any required tax forms today.

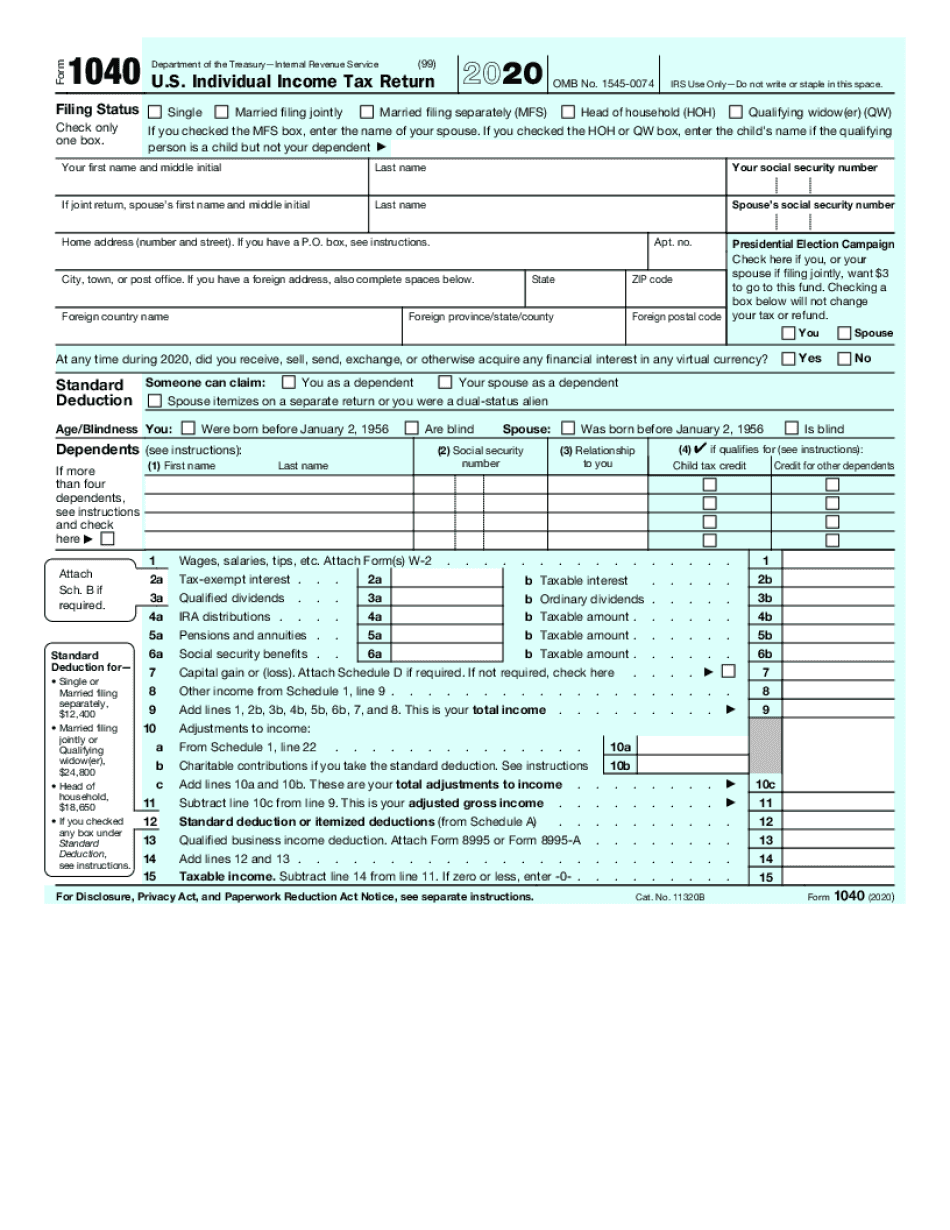

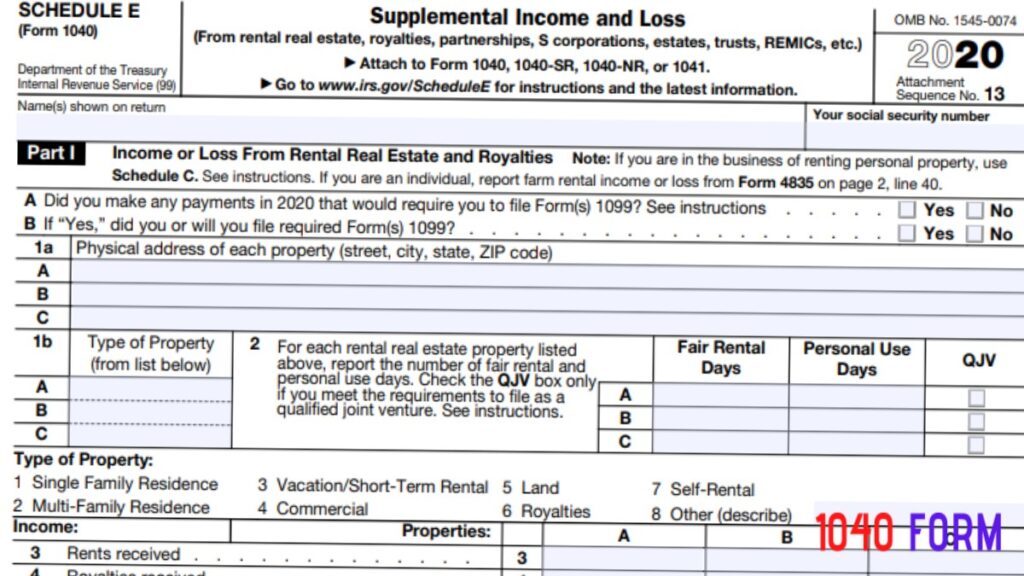

Form 1040 2020 2021 Fill Online Printable Fillable Printable Form 2021

This form is used in conjunction with form 1040. Web sale on their separate pa schedule d. You can download or print. • certain transactions that the. Web group play united states.

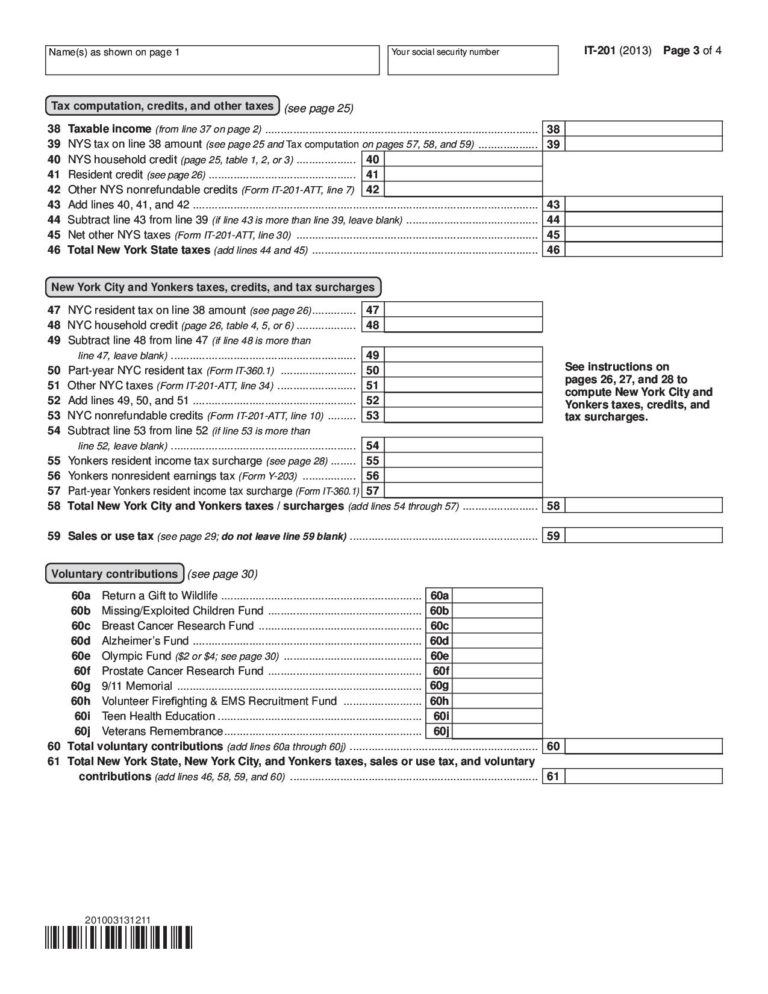

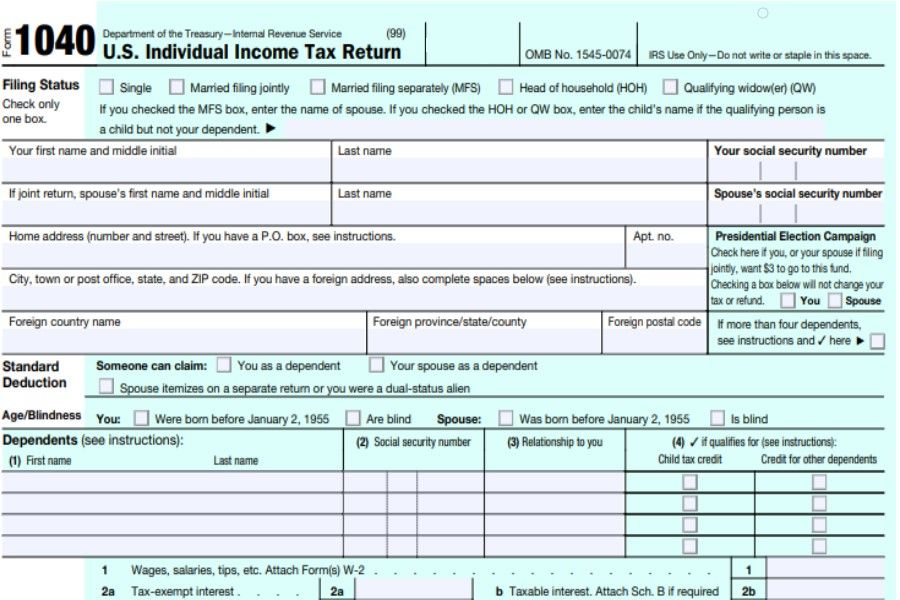

1040 U S Individual Tax Return With Schedule D 2021 Tax Forms

Web these instructions explain how to complete schedule d (form 1040). Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1040 (schedule d), fully updated for tax year 2022. Complete form 8949 before you complete line. Get ready for tax season deadlines by completing any required tax forms today. Complete,.

2021 Federal Tax Forms Printable 2022 W4 Form

Enter all sales, exchanges or other dispositions of real or personal tangible and intangible property, including inherited. This form is used in conjunction with form 1040. • the overall capital gains and losses from transactions reported on form 8949. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1040 (schedule.

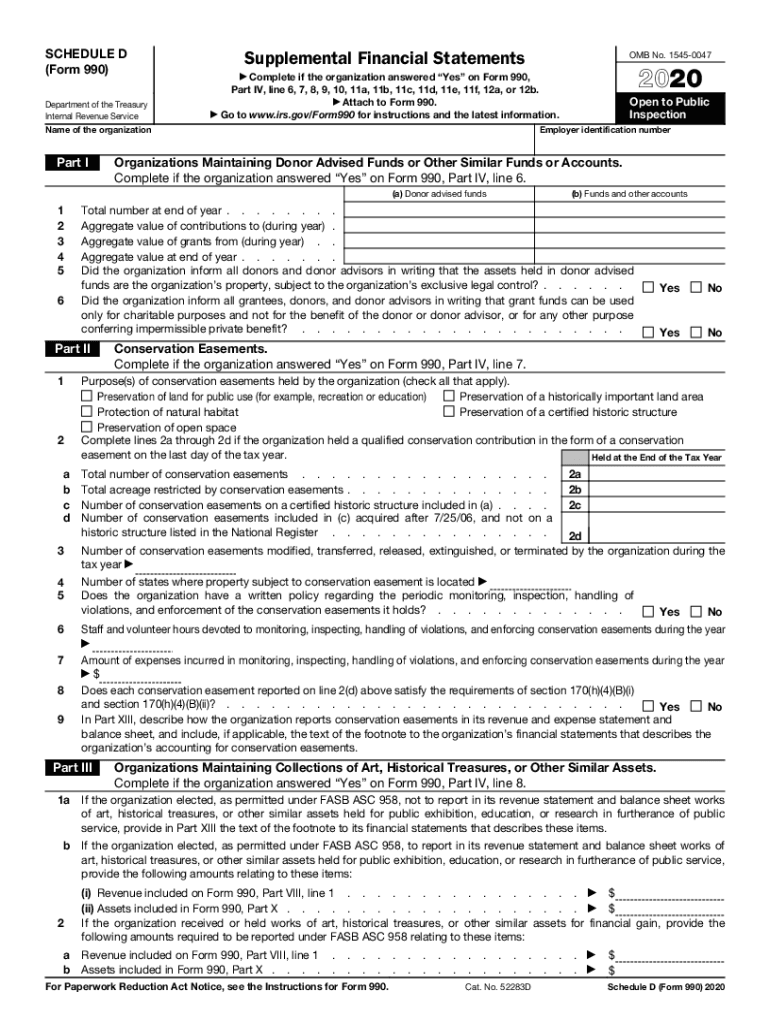

Schedule D Form 990 Supplemental Financial Statements Fill Out and

Complete, edit or print tax forms instantly. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. This form will be used to report certain sales, exchanges,. (b) sales price (c) cost or other basis (d) loss if (c) is more than (b), subtract. 100 shares of “z” co.

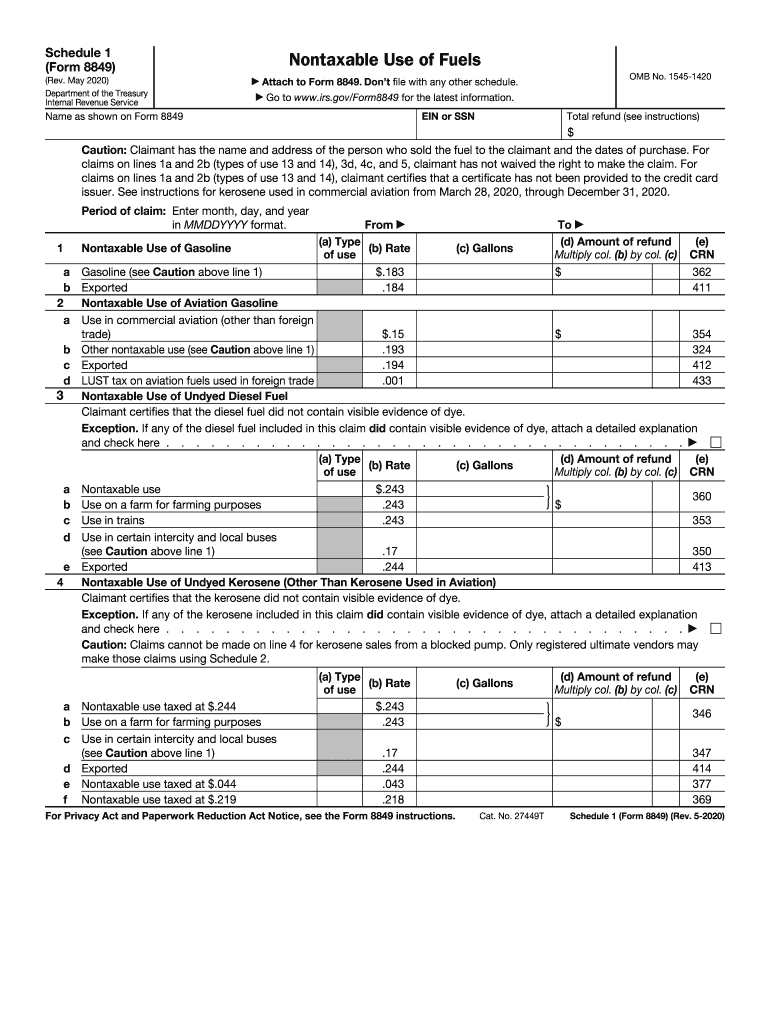

IRS 8849 Schedule 1 20202021 Fill and Sign Printable Template Online

Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1040 (schedule d), fully updated for tax year 2022. Web schedule d (540) taxable year 2021 (a) description of property example: You can download or print. Web 2022 instructions for schedule d capital gains and losses these instructions explain how to.

How to Complete a Schedule D Form (with Pictures) wikiHow

Web group play united states. You can download or print. Ad access irs tax forms. • certain transactions that the. Complete, edit or print tax forms instantly.

Irs 1040 Form 2020 Printable What Is IRS Form 1040? How It Works in

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web group play united states. You can download or print.

2020 2021 Form 1040 Individual Tax Return 1040 Form

It is used to help. Enter the smaller of line 7, line 8, or computed amount. Web open the document with our powerful pdf editor. Get ready for tax season deadlines by completing any required tax forms today. Web the schedule d is known as a capital gains and losses form.

2020 Form IRS 1041 Schedule D Fill Online, Printable, Fillable, Blank

Web these instructions explain how to complete schedule d (form 1040). Web 2022 instructions for schedule d capital gains and losses these instructions explain how to complete schedule d (form 1040). Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1040 (schedule d), fully updated for tax year 2022. The.

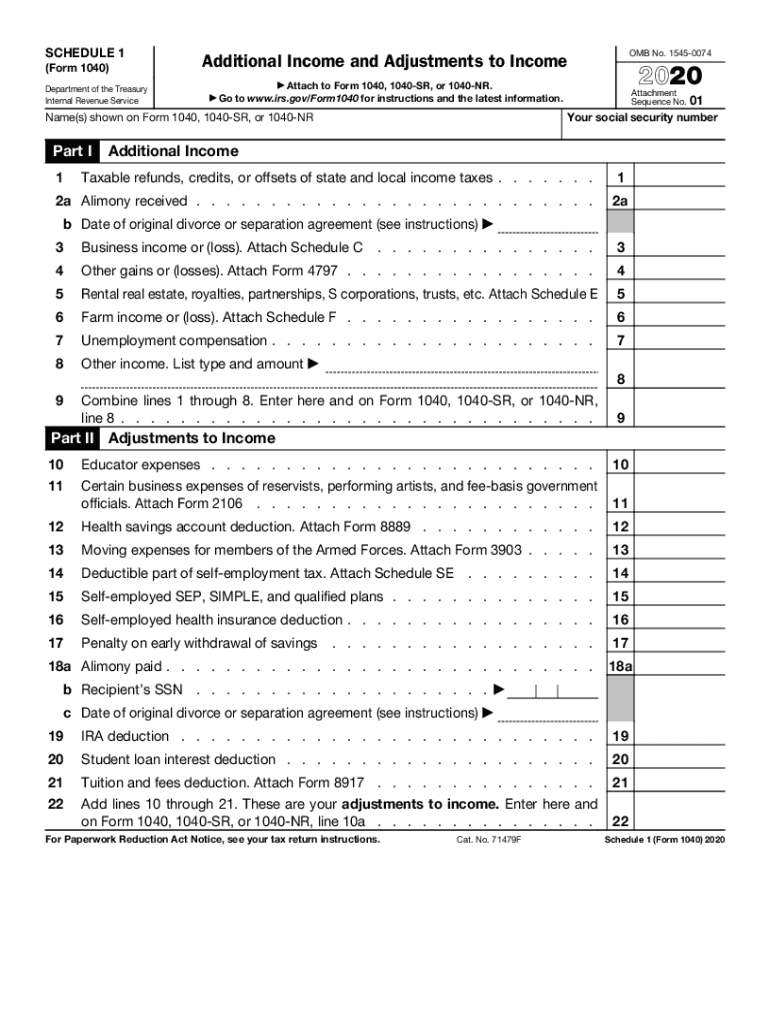

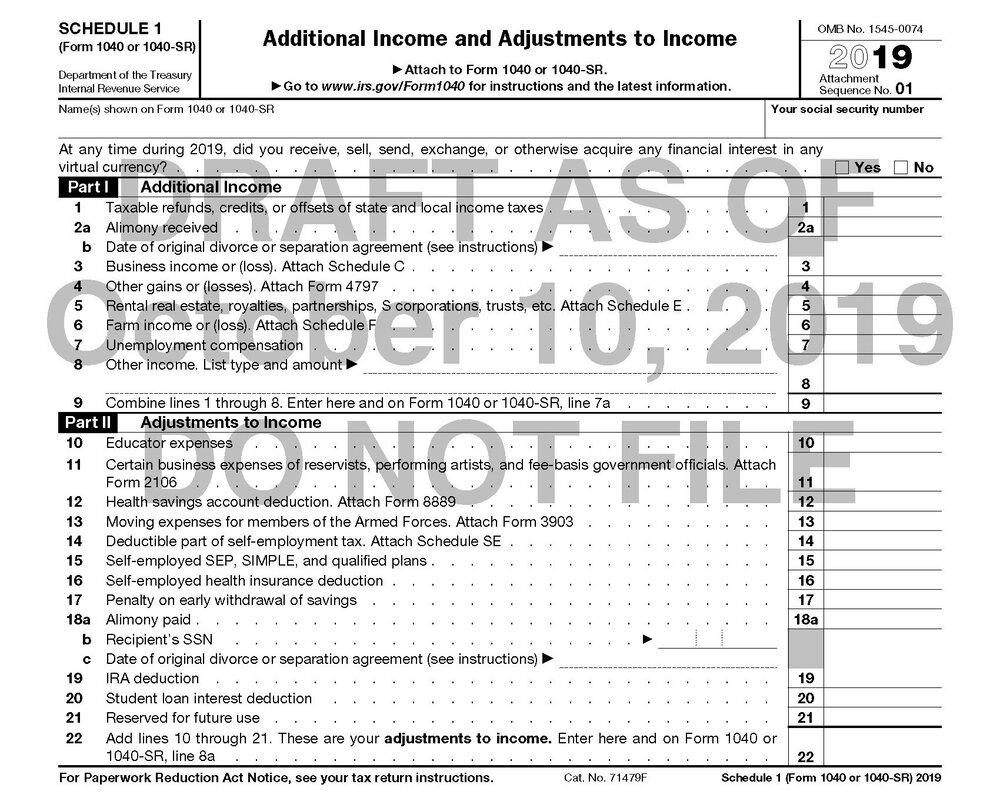

Schedule 1 Form 1040 2019 2021 Tax Forms 1040 Printable

This form will be used to report certain sales, exchanges,. Web schedule d (form 1040) is a tax schedule from the irs that attaches to the form 1040, u.s. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. This form is used in conjunction with form 1040. And irs.gov/schedulea for schedule a.

Web 2021 This Form Is Open To Public Inspection.

Ad access irs tax forms. Complete form 8949 before you complete line. Web schedule d (540) taxable year 2021 (a) description of property example: Get ready for tax season deadlines by completing any required tax forms today.

This Form Will Be Used To Report Certain Sales, Exchanges,.

Ad access irs tax forms. Web updated june 16, 2023 reviewed by ebony howard if you have capital gains or losses during the tax year, you will need to report them to the internal revenue. Web open the document with our powerful pdf editor. Enter the smaller of line 7, line 8, or computed amount.

Web Investors Who Sold Stocks, Bonds, Options, Or Other Securities Will Have To Prepare Form 8949 Sales And Other Dispositions Of Capital Assets And Schedule D (Form 1040).

100 shares of “z” co. It is used to help. For calendar plan year 2021 or fiscal plan year beginning and ending for paperwork reduction act notice, see the instructions for. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1040 (schedule d), fully updated for tax year 2022.

Complete Form 8949 Before You Complete Line 1B, 2, 3, 8B, 9, Or 10 Of Schedule D.

• certain transactions that the. Web schedule d (form 1040) is a tax schedule from the irs that attaches to the form 1040, u.s. (b) sales price (c) cost or other basis (d) loss if (c) is more than (b), subtract. Most people use the schedule d form to report capital gains and losses that result from the sale or trade of certain property during the year.