2022 Form M1 Instructions

2022 Form M1 Instructions - This form is for income earned in tax year 2022, with tax. Find them using find a form. Department of the treasury internal revenue service. Web minnesota department of revenue | minnesota department of revenue 9995 2022 schedule m1ref instructions these credits may allow you to receive a refund even if you do not have a. Ira, pensions, and annuities c. In such a case, the administrator will have an additional 60 days to file a completed form. Web you must file yearly by april 15. Web from the table or schedules in the form m1 instructions. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue.

Web you must file yearly by april 15. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Sign it in a few clicks draw your. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. Web minnesota department of revenue | minnesota department of revenue Find them using find a form. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. The following draft forms and instructions are for. For calendar year 2022 or tax year beginning, 2022, ending.

The following draft forms and instructions are for. Web this package contains the following form and related instructions: Web 12 you must include this schedule with your form m1. Sign it in a few clicks draw your. In general, mewas are arrangements that offer health. Web from the table or schedules in the form m1 instructions. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Ira, pensions, and annuities c. Find them using find a form. Department of the treasury internal revenue service.

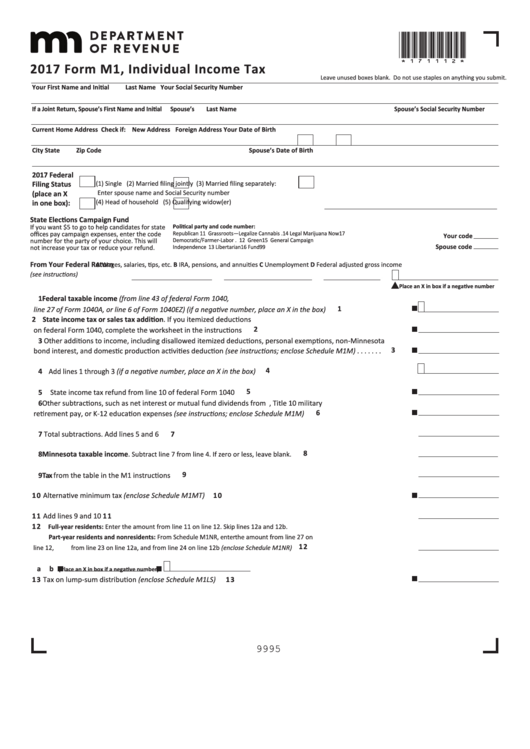

Form M1 Individual Tax 2017 printable pdf download

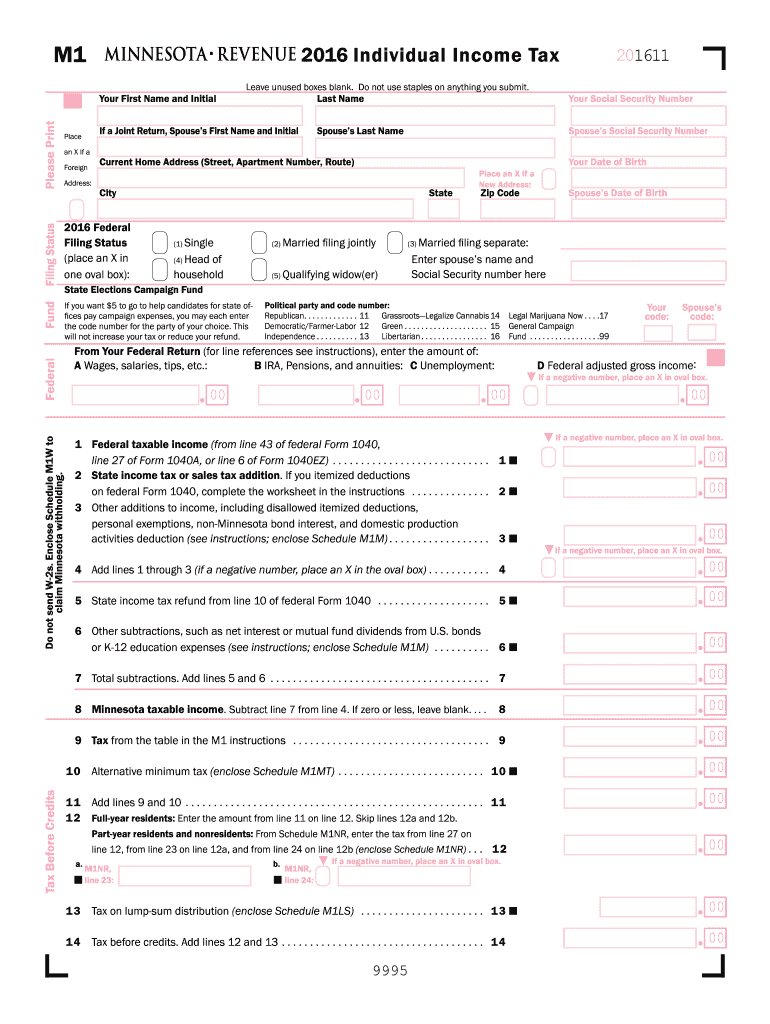

This form is for income earned in tax year 2022, with tax. Edit your mn tax forms 2016 printable online type text, add images, blackout confidential details, add comments, highlights and more. The following draft forms and instructions are for. Find them using find a form. Sign it in a few clicks draw your.

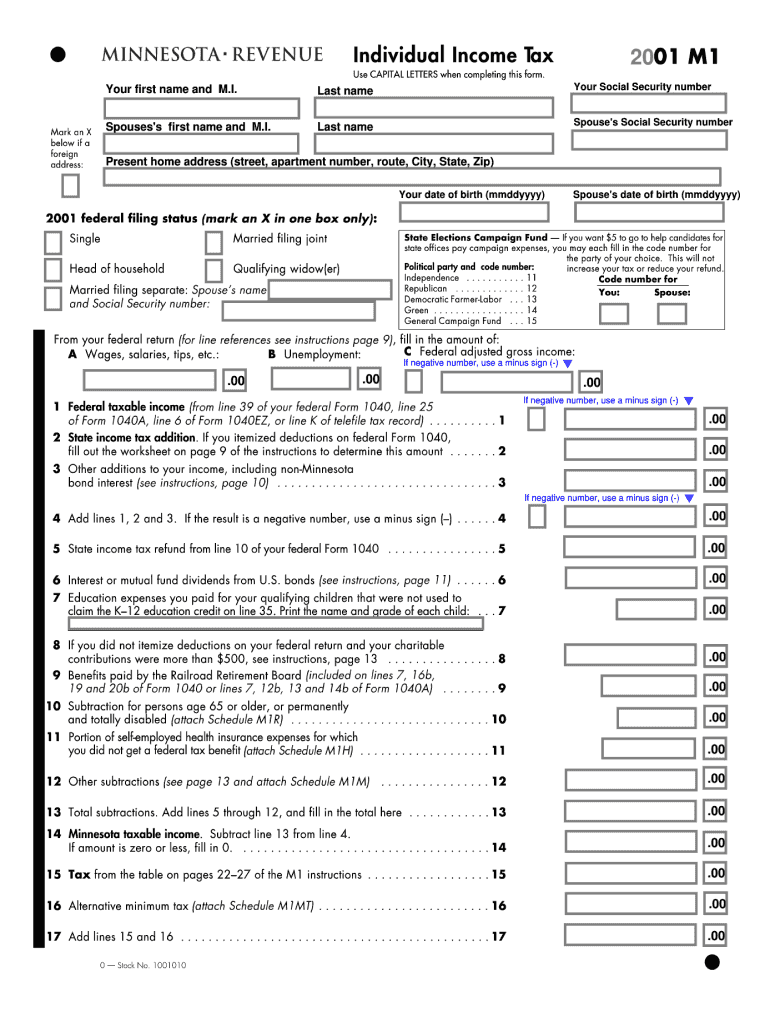

M1 Tax Documents Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax. Department of the treasury internal revenue service. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Find them using find a form. In such a case, the administrator will have an additional 60 days to file a completed form.

Minnesota State Tax Table M1

Sign it in a few clicks draw your. Web this package contains the following form and related instructions: Edit your mn tax forms 2016 printable online type text, add images, blackout confidential details, add comments, highlights and more. The following draft forms and instructions are for. We last updated the individual income tax return in december 2022, so this is.

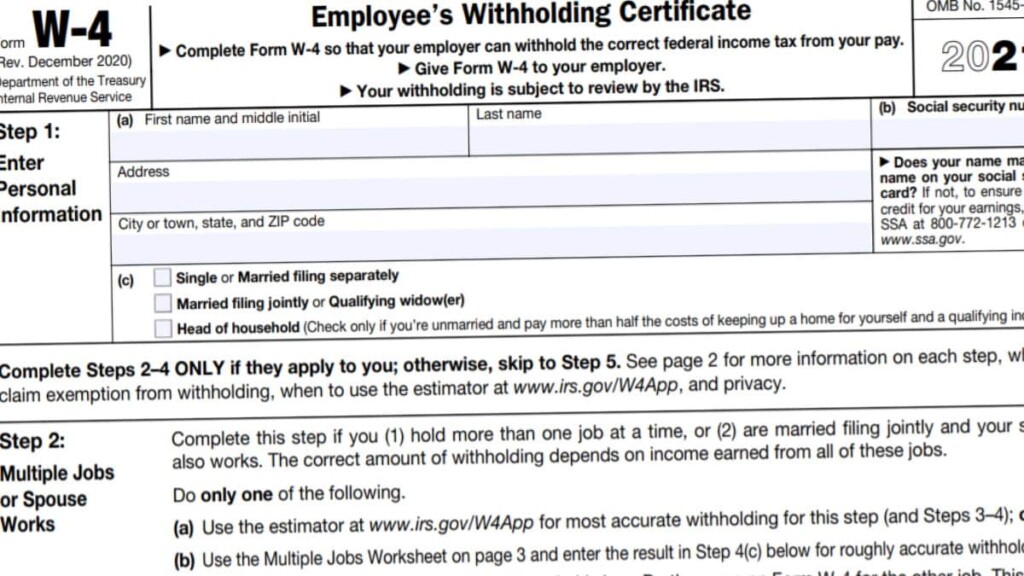

Printable W4 Forms 2022 April Calendar Printable 2022

Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. Ira, pensions, and annuities c. We last updated the individual income tax return in december 2022, so this is.

minnesota tax forms Fill out & sign online DocHub

Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. Ira, pensions, and annuities c. Web minnesota department of revenue | minnesota department of revenue Web you must file yearly by april 15.

FORM M1.doc Google Drive

Web 12 you must include this schedule with your form m1. Ira, pensions, and annuities c. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web you must file yearly by april 15. Department of the treasury internal revenue service.

Minnesota tax forms Fill out & sign online DocHub

Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. In general, mewas are arrangements that offer health. Web.

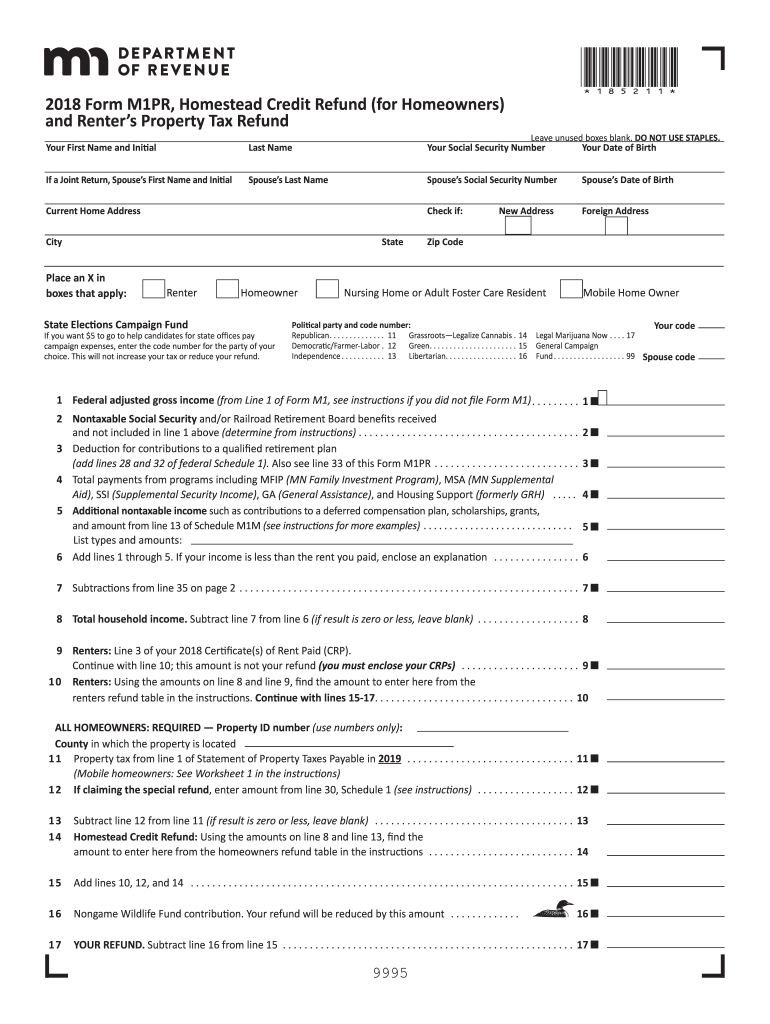

MN DoR M1PR 2018 Fill out Tax Template Online US Legal Forms

Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. This form is for income earned in tax year 2022, with tax. In such a case, the administrator.

Form M1 Individual Tax Printable YouTube

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. The following draft forms and instructions are for. Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. We last updated the individual income tax return in december.

2020 Form MN DoR M1PRX Fill Online, Printable, Fillable, Blank pdfFiller

Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web 12 you must include this schedule with your form m1. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax.

We Last Updated The Individual Income Tax Return In December 2022, So This Is The Latest Version Of Form M1, Fully Updated For Tax Year 2022.

Web minnesota department of revenue | minnesota department of revenue For calendar year 2022 or tax year beginning, 2022, ending. Sign it in a few clicks draw your. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use.

Web We Last Updated Minnesota Form M1 Instructions In February 2023 From The Minnesota Department Of Revenue.

In general, mewas are arrangements that offer health. Web from the table or schedules in the form m1 instructions. In such a case, the administrator will have an additional 60 days to file a completed form. Ira, pensions, and annuities c.

Corporation Income Tax Return, To Report The Income, Gains, Losses, Deductions, Credits, And To Figure The Income.

Web 12 you must include this schedule with your form m1. Web you must file yearly by april 15. The following draft forms and instructions are for. Department of the treasury internal revenue service.

9995 2022 Schedule M1Ref Instructions These Credits May Allow You To Receive A Refund Even If You Do Not Have A.

Web before starting your minnesota income tax return (form m1, individual income tax), you must complete federal form 1040 to determine your federal taxable income. Web this package contains the following form and related instructions: Find them using find a form. Edit your mn tax forms 2016 printable online type text, add images, blackout confidential details, add comments, highlights and more.