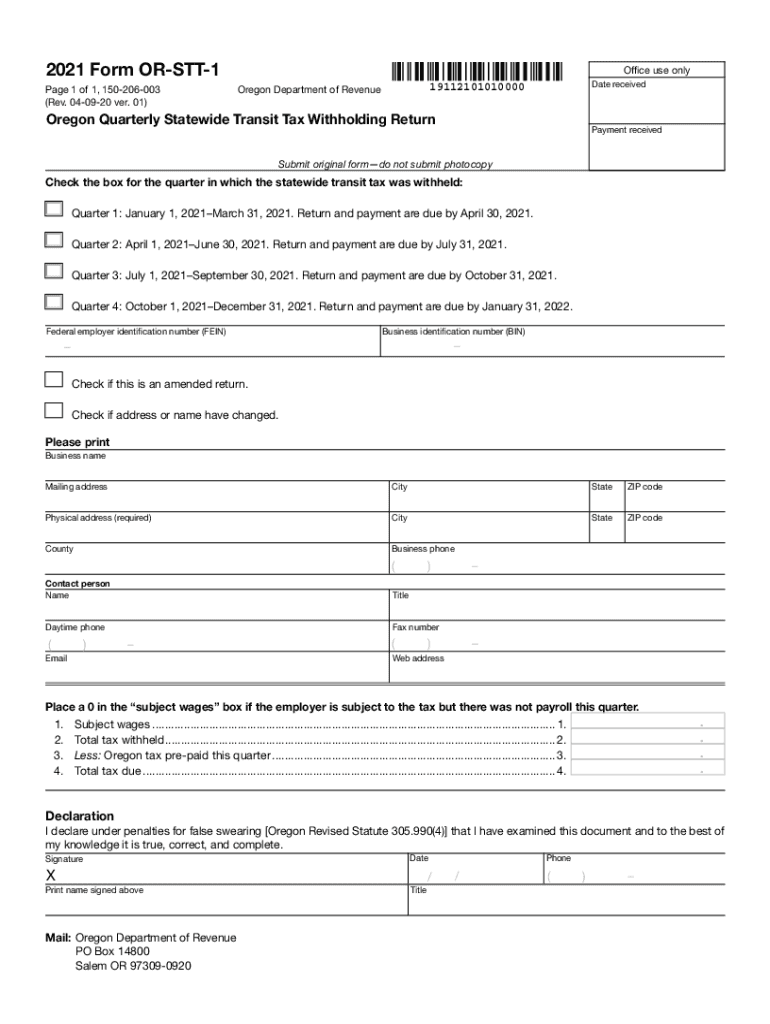

2022 Form Or-Stt-1

2022 Form Or-Stt-1 - Web what makes the 2022 form or stt 1 legally valid? Oregon employers must withhold 0.10% (0.001) from each. Web oregon — oregon quarterly statewide transit tax withholding return download this form print this form it appears you don't have a pdf plugin for this browser. A signature is required even if you file a 0. Complete, sign, print and send your tax documents easily with us legal forms. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. 02 calculate your total income from all sources in oregon, which includes wages,. Select a heading to view its forms, then u se the search. Web tax year updating this field may cause other fields on this page to be updated and/or removed Download blank or fill out online in pdf format.

You can file returns and detail reports using frances. Web statewide transit tax added to form oq also, according to the ode, “starting in the first quarter 2023, employers will begin reporting statewide transit tax. Web what makes the 2022 form or stt 1 legally valid? Complete, sign, print and send your tax documents easily with us legal forms. Select a heading to view its forms, then u se the search. A signature is required even if you file a 0. 02 calculate your total income from all sources in oregon, which includes wages,. Oregon employers must withhold 0.10% (0.001) from each. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Download blank or fill out online in pdf format.

Web current forms and publications. Select a heading to view its forms, then u se the search. You can file returns and detail reports using frances. You'll want to check your state agency. Web according until a oregon occupation department (oed) news release, “starting january 1, 2023, employee be been mandatory to start withholding. Web oregon — oregon quarterly statewide transit tax withholding return download this form print this form it appears you don't have a pdf plugin for this browser. Web up to $40 cash back 01 enter your name, social security number, and filing status on the top of the form. Oregon employers must withhold 0.10% (0.001) from each. A signature is required even if you file a 0. 02 calculate your total income from all sources in oregon, which includes wages,.

TX 2022 20112022 Fill and Sign Printable Template Online US Legal

Complete, sign, print and send your tax documents easily with us legal forms. Web oregon — oregon quarterly statewide transit tax withholding return download this form print this form it appears you don't have a pdf plugin for this browser. Web statewide transit tax added to form oq also, according to the ode, “starting in the first quarter 2023, employers.

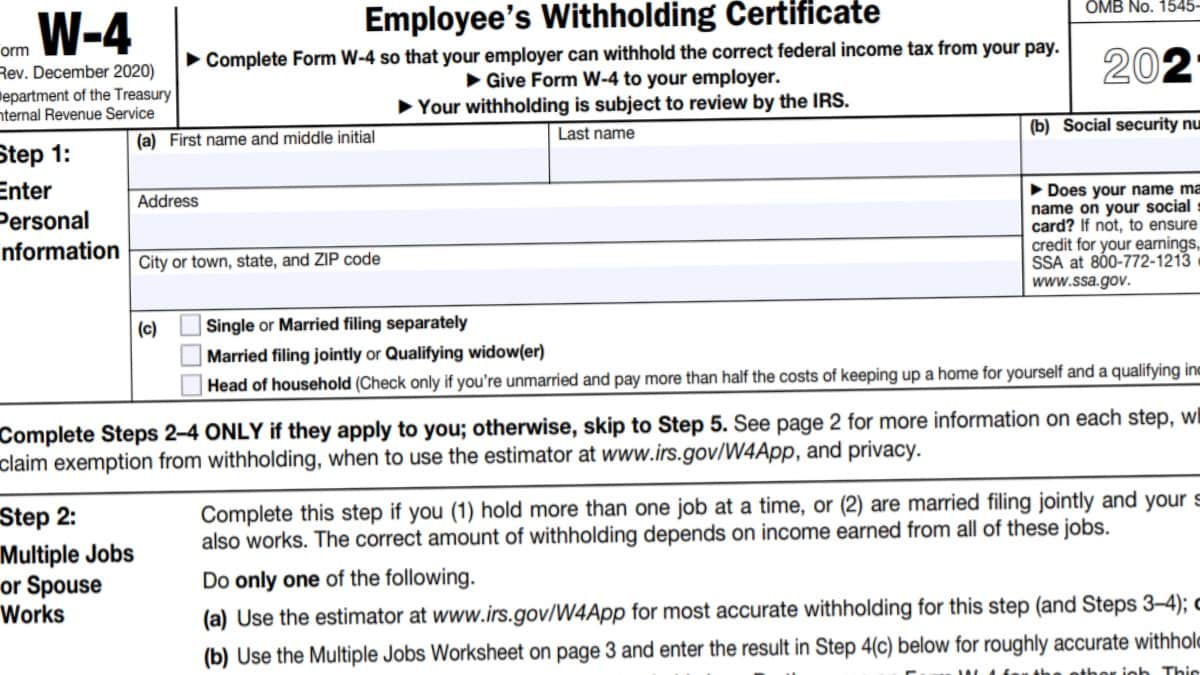

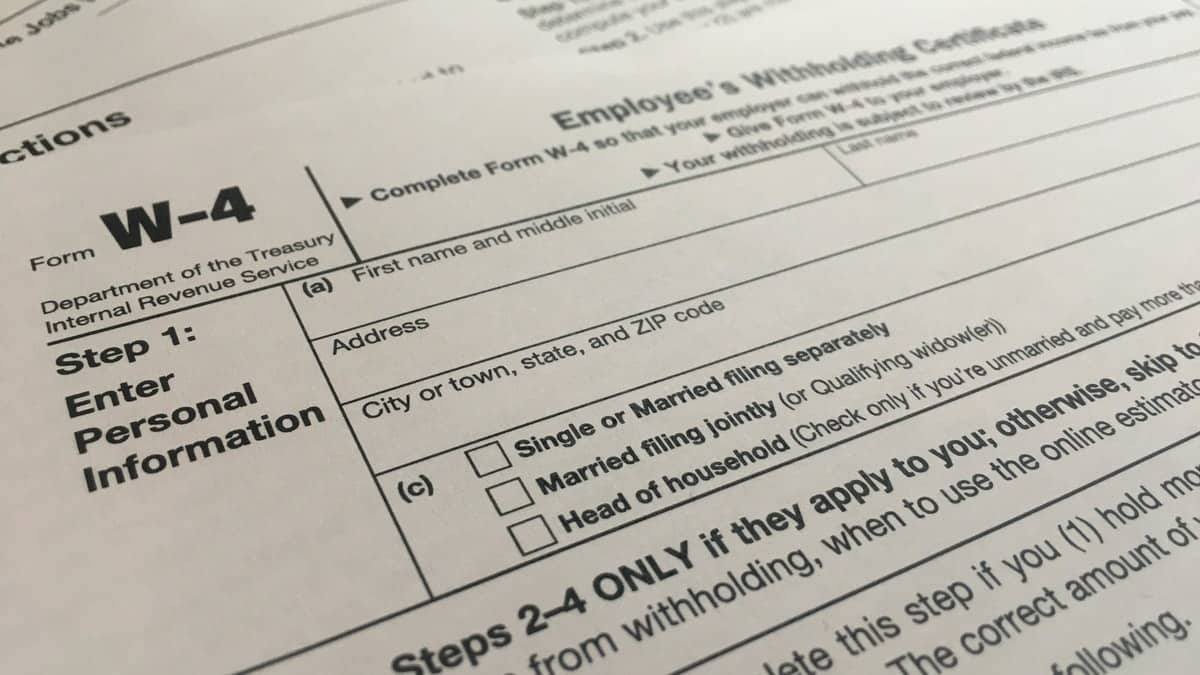

W4 Form 2022 Instructions W4 Forms TaxUni

Download blank or fill out online in pdf format. Web tax year updating this field may cause other fields on this page to be updated and/or removed Web according until a oregon occupation department (oed) news release, “starting january 1, 2023, employee be been mandatory to start withholding. You'll want to check your state agency. View all of the current.

Oregon form wr 2019 Fill out & sign online DocHub

Select a heading to view its forms, then u se the search. Because the world ditches office working conditions, the execution of paperwork more and more happens electronically. View all of the current year's forms and publications by popularity or program area. Web up to $40 cash back 01 enter your name, social security number, and filing status on the.

W4 Form 2022 Fillable PDF

Web tax year updating this field may cause other fields on this page to be updated and/or removed Web statewide transit tax added to form oq also, according to the ode, “starting in the first quarter 2023, employers will begin reporting statewide transit tax. Web current forms and publications. Web according until a oregon occupation department (oed) news release, “starting.

Calendar2022 form horizontal and vertical

Web starting with first quarter 2023 and forward, the statewide transit tax must be filed on the form oq if you are a quarterly filer. A signature is required even if you file a 0. Web what makes the 2022 form or stt 1 legally valid? Web tax year updating this field may cause other fields on this page to.

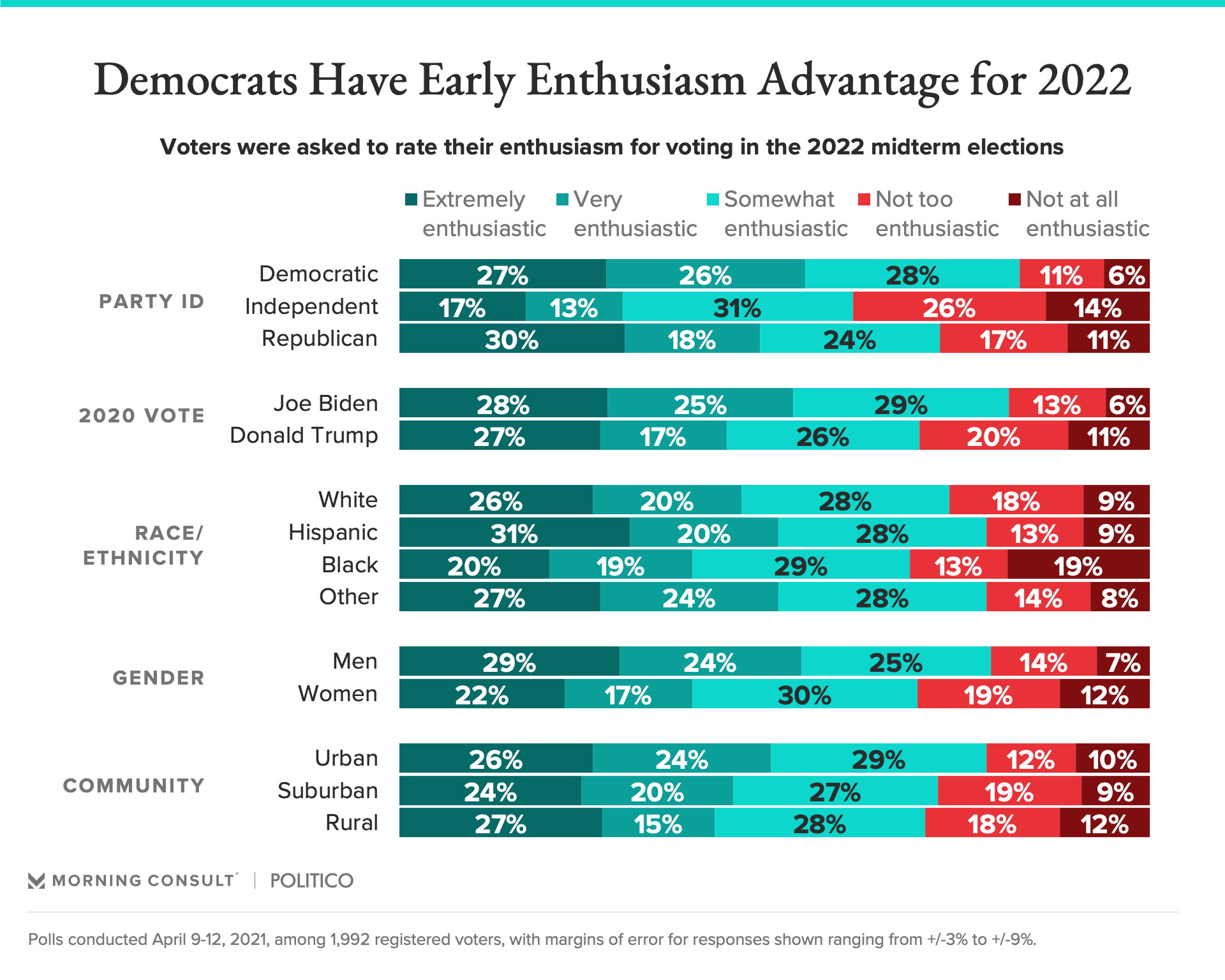

Democrats Start 2022 Cycle With an Edge in Voter Enthusiasm

Oregon employers must withhold 0.10% (0.001) from each. Download blank or fill out online in pdf format. Web statewide transit tax added to form oq also, according to the ode, “starting in the first quarter 2023, employers will begin reporting statewide transit tax. Because the world ditches office working conditions, the execution of paperwork more and more happens electronically. Web.

W4 Form 2023 Instructions

Web current forms and publications. Web what makes the 2022 form or stt 1 legally valid? Web according until a oregon occupation department (oed) news release, “starting january 1, 2023, employee be been mandatory to start withholding. Web up to $40 cash back 01 enter your name, social security number, and filing status on the top of the form. Web.

Fill Free fillable 2021 Form ORSTT1 Oregon Quarterly Statewide

View all of the current year's forms and publications by popularity or program area. Web tax year updating this field may cause other fields on this page to be updated and/or removed Web according until a oregon occupation department (oed) news release, “starting january 1, 2023, employee be been mandatory to start withholding. Because the world ditches office working conditions,.

2021 Form OR ORSTT1 Fill Online, Printable, Fillable, Blank pdfFiller

02 calculate your total income from all sources in oregon, which includes wages,. Oregon employers must withhold 0.10% (0.001) from each. Web up to $40 cash back 01 enter your name, social security number, and filing status on the top of the form. Web statewide transit tax added to form oq also, according to the ode, “starting in the first.

2022 Form 1040nr Ez Example Calendar Template 2022

Oregon employers must withhold 0.10% (0.001) from each. Download blank or fill out online in pdf format. You'll want to check your state agency. Select a heading to view its forms, then u se the search. Because the world ditches office working conditions, the execution of paperwork more and more happens electronically.

Web The Oregon Transit Tax Is A Statewide Payroll Tax That Employers Withhold From Employee Wages.

Web oregon — oregon quarterly statewide transit tax withholding return download this form print this form it appears you don't have a pdf plugin for this browser. Because the world ditches office working conditions, the execution of paperwork more and more happens electronically. Complete, sign, print and send your tax documents easily with us legal forms. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

Web Current Forms And Publications.

View all of the current year's forms and publications by popularity or program area. Download blank or fill out online in pdf format. 02 calculate your total income from all sources in oregon, which includes wages,. Oregon employers must withhold 0.10% (0.001) from each.

Web Up To $40 Cash Back 01 Enter Your Name, Social Security Number, And Filing Status On The Top Of The Form.

Web what makes the 2022 form or stt 1 legally valid? Web statewide transit tax added to form oq also, according to the ode, “starting in the first quarter 2023, employers will begin reporting statewide transit tax. Select a heading to view its forms, then u se the search. You can file returns and detail reports using frances.

A Signature Is Required Even If You File A 0.

Web starting with first quarter 2023 and forward, the statewide transit tax must be filed on the form oq if you are a quarterly filer. Web according until a oregon occupation department (oed) news release, “starting january 1, 2023, employee be been mandatory to start withholding. Web tax year updating this field may cause other fields on this page to be updated and/or removed You'll want to check your state agency.