2022 Instructions For Form 5695

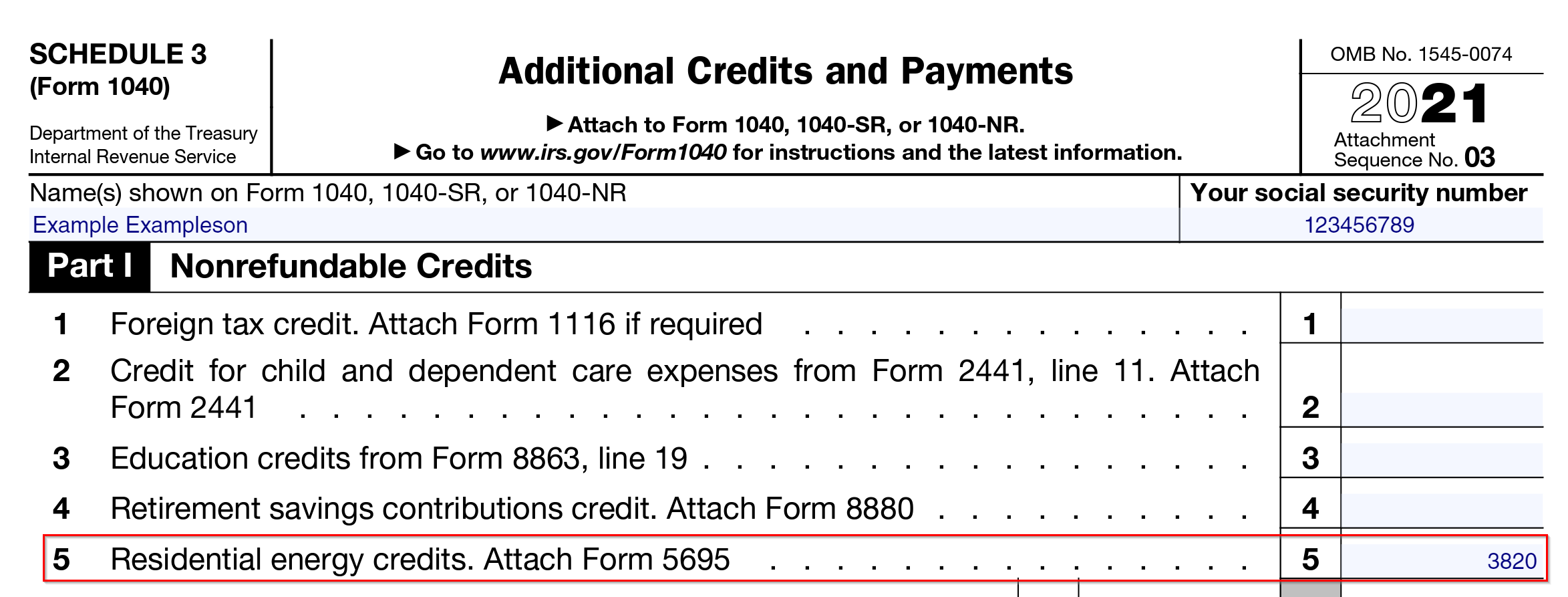

2022 Instructions For Form 5695 - Web residential clean energy credit (part l) it you made energy saving improvements to more than one home that you used as a residence during 2022, enter the total ot those costs. Web per irs instructions for form 5695, page 1: Web per the form 5695 instructions for line 22a: Extends the residential energy efficient property credit to qualified biomass fuel property costs on. Purpose of form use form 5695 to figure and take your residential energy credits. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. The instructions give taxpayers additional information regarding eligibility for the credit. A stove that uses the burning of biomass fuel to heat your home or heat water for your home that has a thermal. Enter the amount, if any, from your 2022 form 5695, line 16. This is not intended as tax advice.

Web service through december 31, 2022. Web what is the irs form 5695? • the residential energy efficient property credit, and. For paperwork reduction act notice, see your tax. Use form 5695 to figure and take. Press f6to bring up open forms. Solved • by turbotax • 4482 • updated january 13, 2023 form 5695 (residential energy credits) is used to calculate. Web credit carryforward from 2022. This is not intended as tax advice. Web per irs instructions for form 5695, page 1:

Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Purpose of form use form 5695 to figure and take your residential energy credits. This form is for income earned in tax year 2022, with tax returns due in april. Solved • by turbotax • 4482 • updated january 13, 2023 form 5695 (residential energy credits) is used to calculate. Web residential clean energy credit (part l) it you made energy saving improvements to more than one home that you used as a residence during 2022, enter the total ot those costs. Web per irs instructions for form 5695, page 1: Web per the form 5695 instructions for line 22a: This is not intended as tax advice. Web generating the 5695 in proseries: Use form 5695 to figure and take.

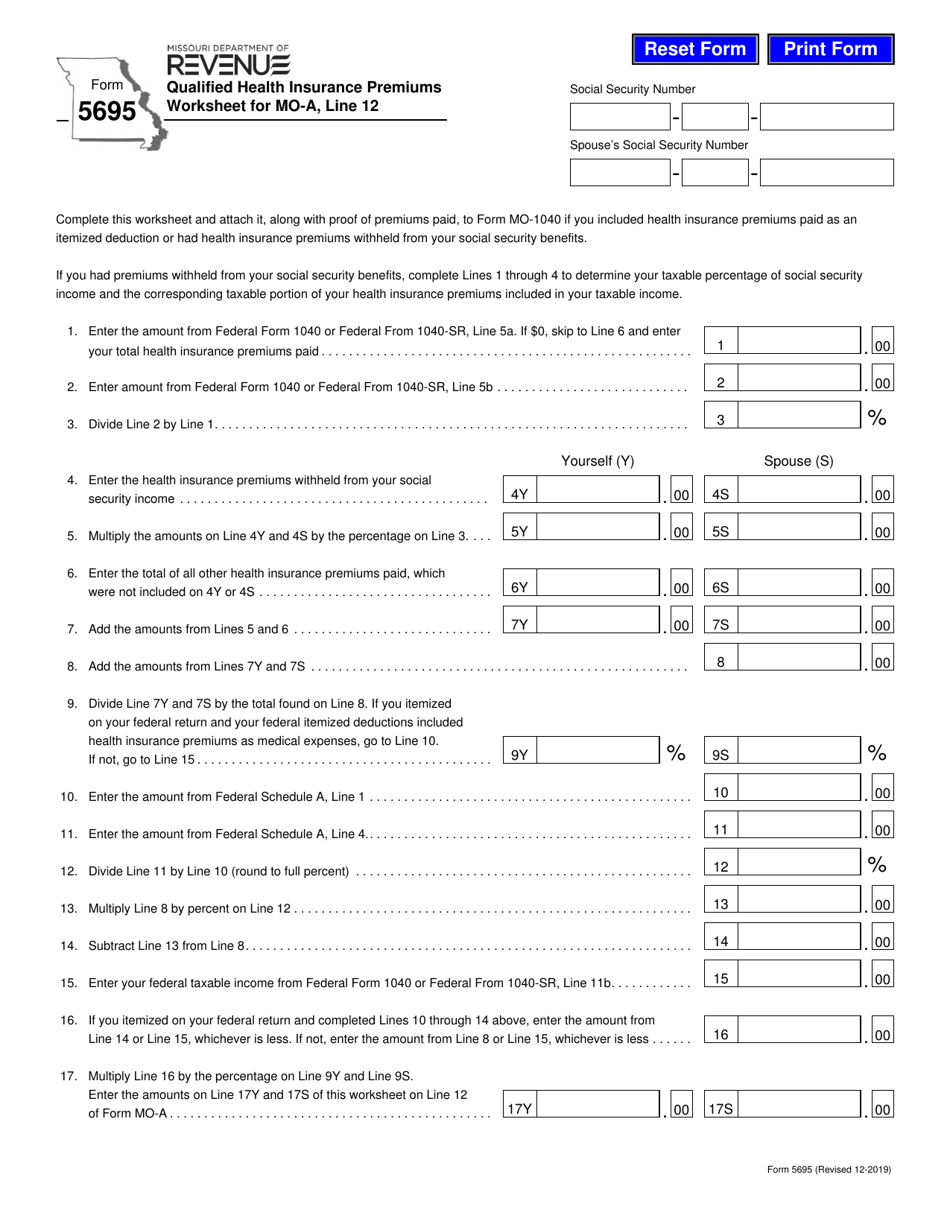

Form 5695 Download Fillable PDF or Fill Online Qualified Health

Use form 5695 to figure and take. Purpose of form use form 5695 to figure and take your residential energy credits. Web we last updated federal form 5695 in december 2022 from the federal internal revenue service. Web residential clean energy credit (part l) it you made energy saving improvements to more than one home that you used as a.

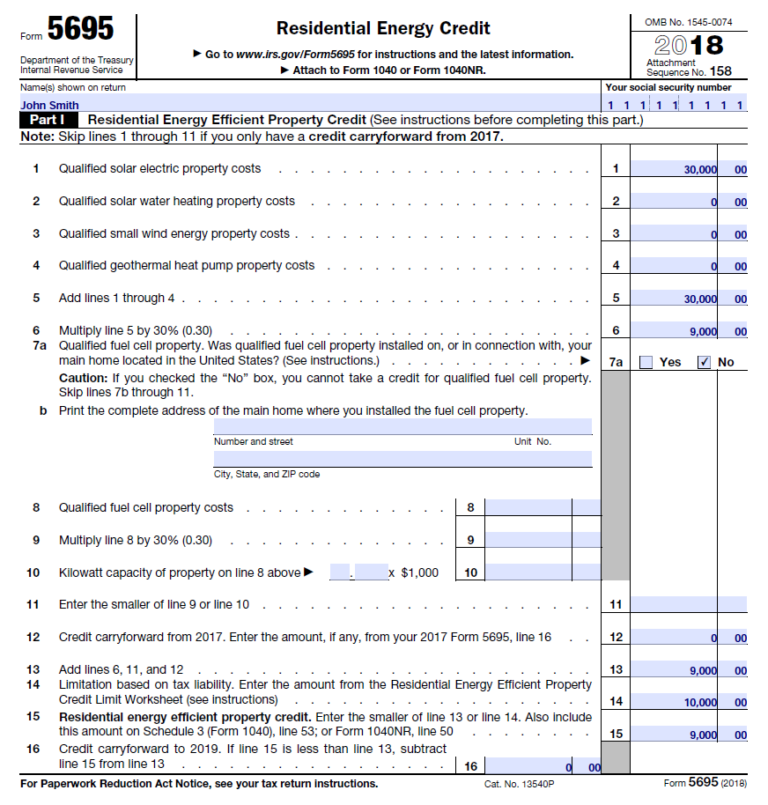

Form 5695 2021 2022 IRS Forms TaxUni

This is not intended as tax advice. Web how to complete irsform 5695 in 2022: A stove that uses the burning of biomass fuel to heat your home or heat water for your home that has a thermal. Web purpose of form use form 5695 to figure and take your residential energy credits. This credit is available for certain energy.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Department of the treasury internal revenue service. Web what is the irs form 5695? Press f6to bring up open forms. Web per the form 5695 instructions for line 22a: Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information.

Business Line Of Credit Stated 2022 Cuanmologi

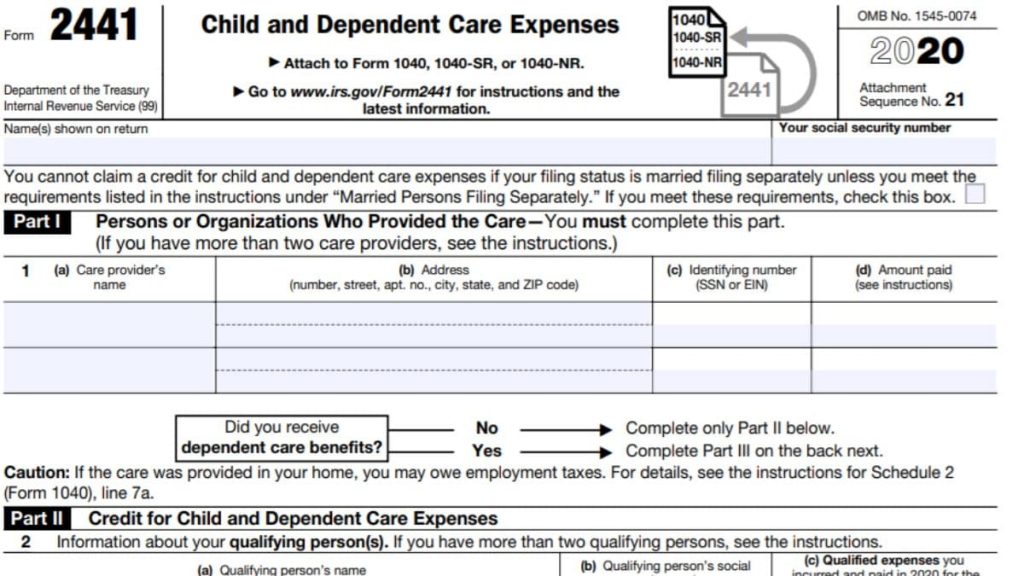

Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. This form is for income earned in tax year 2022, with tax returns due in april. For paperwork reduction act notice, see your tax return. Web the 3 steps to claiming the solar tax credit there are three main steps you’ll.

Tax Form 5695 by AscendWorks Issuu

Web how do i add or remove form 5695? This is a guide to entering residential energy credits into the taxslayer pro program. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Determine if you’re eligible complete irs. The residential energy credits are:

Completed Form 5695 Residential Energy Credit Capital City Solar

This is not intended as tax advice. Web per the form 5695 instructions for line 22a: Press f6to bring up open forms. Web go to www.irs.gov/form5695 for instructions and the latest information. For paperwork reduction act notice, see your tax return.

Form 5695 2021 2022 IRS Forms TaxUni

Web how to complete irsform 5695 in 2022: Purpose of form use form 5695 to figure and take your residential energy credits. Web per irs instructions for form 5695: Press f6to bring up open forms. The consolidated appropriations act, 2021:

How to Complete IRSForm 5695 in 2022 Instructions, Tip...

A stove that uses the burning of biomass fuel to heat your home or heat water for your home that has a thermal. Purpose of form use form 5695 to figure and take your residential energy credits. The section 25c credit is claimed on form 5695. • the residential energy efficient property credit, and. This is a guide to entering.

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Determine if you’re eligible complete irs. Press f6to bring up open forms. Web per the form 5695 instructions for line 22a: Web per irs instructions for form 5695: This credit is available for certain energy.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

The section 25c credit is claimed on form 5695. This is not intended as tax advice. Web how to complete irsform 5695 in 2022: The consolidated appropriations act, 2021: Web purpose of form use form 5695 to figure and take your residential energy credits.

The Residential Energy Credits Are:

The instructions give taxpayers additional information regarding eligibility for the credit. The consolidated appropriations act, 2021: Web how do i add or remove form 5695? • the residential energy efficient property credit, and.

Solved • By Turbotax • 4482 • Updated January 13, 2023 Form 5695 (Residential Energy Credits) Is Used To Calculate.

A stove that uses the burning of biomass fuel to heat your home or heat water for your home that has a thermal. Web residential clean energy credit (part l) it you made energy saving improvements to more than one home that you used as a residence during 2022, enter the total ot those costs. Web service through december 31, 2022. For paperwork reduction act notice, see your tax return.

Purpose Of Form Use Form 5695 To Figure And Take Your Residential Energy Credits.

The residential energy credits are: This is a guide to entering residential energy credits into the taxslayer pro program. Web residential energy credit form 5695; Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.

Web What Is The Irs Form 5695?

Web how to complete irsform 5695 in 2022: Web the 3 steps to claiming the solar tax credit there are three main steps you’ll need to take in order to benefit from the itc: Web per irs instructions for form 5695, page 1: Press f6to bring up open forms.