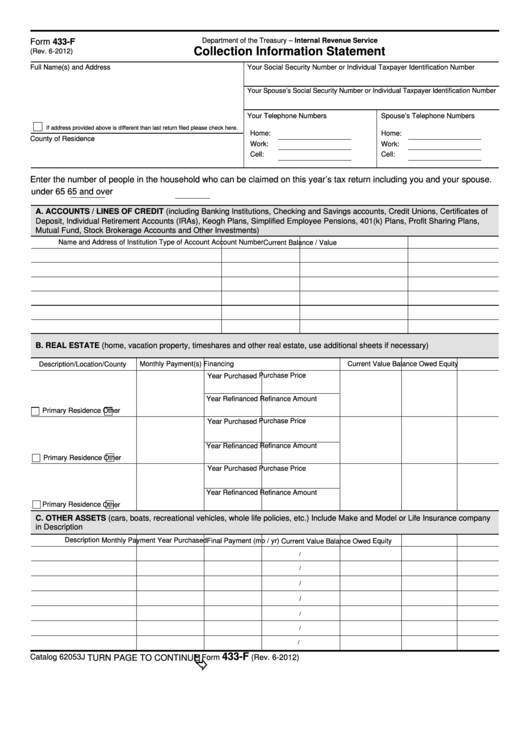

433-F Form

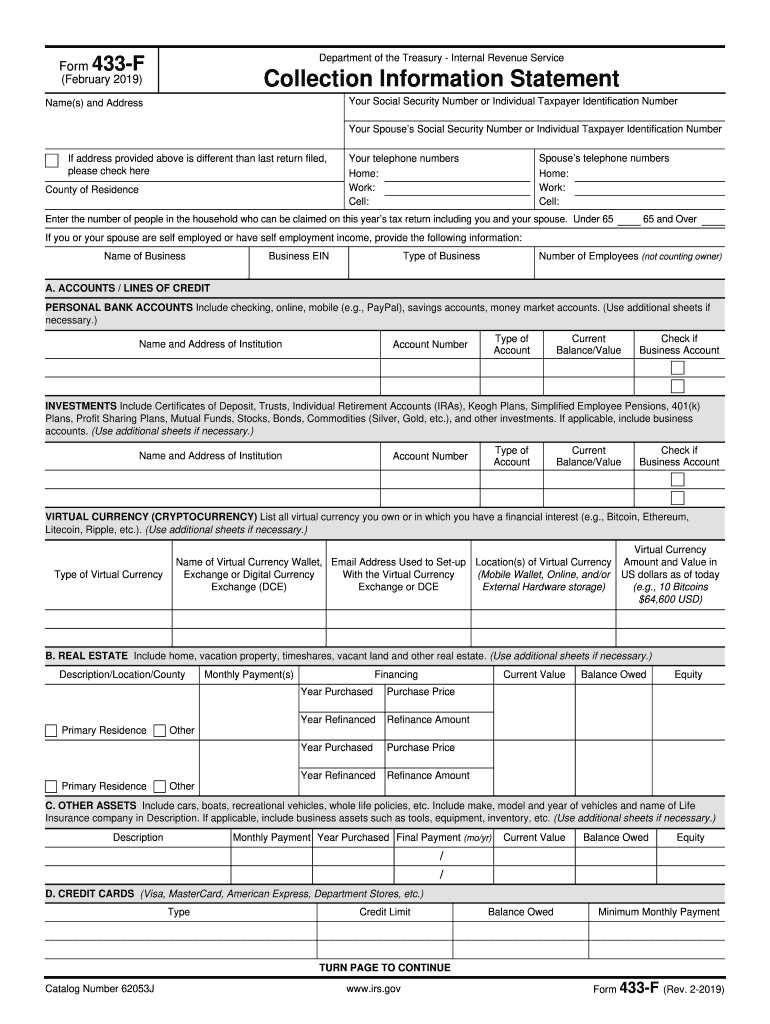

433-F Form - Requests for copy of tax. Refer to form 8821, tax information authorization. Answer all questions or write n/a if the question is not. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the. County of residence your social security number or individual taxpayer identification number Table of contents what is irs form 433 f? It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. You may be able to establish an online payment agreement on the. If you want to make payments on a tax liability over $50,000.

Refer to form 8821, tax information authorization. Requests for copy of tax. The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. If you want to make payments on a tax liability over $50,000. Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the. It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years). Table of contents what is irs form 433 f? You may be able to establish an online payment agreement on the. Answer all questions or write n/a if the question is not.

You may be able to establish an online payment agreement on the. It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Requests for copy of tax. Answer all questions or write n/a if the question is not. It shows the irs the taxpayer's ability to pay (monthly cash flow). Table of contents what is irs form 433 f? If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years). Refer to form 8821, tax information authorization. Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the.

Stephen B. Jordan, EA Form 433A / Form 433F

It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. Table of contents what is irs form 433 f? Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Answer all questions or write n/a if the question is not. County of residence your social security number.

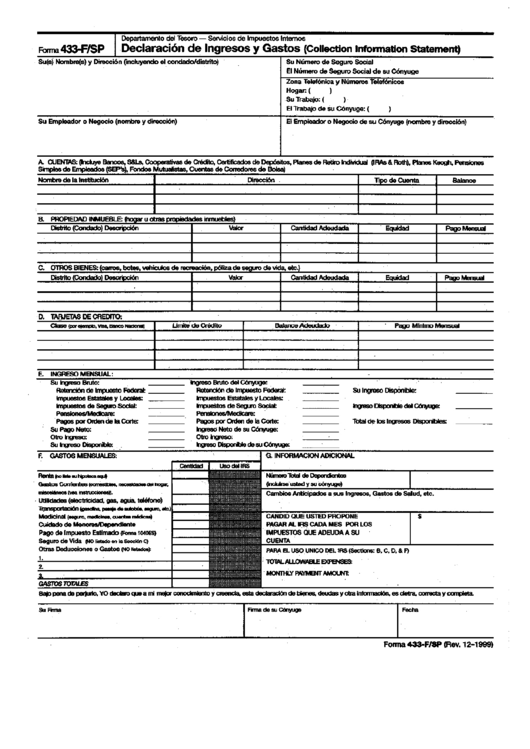

Forma 433F/sp Declaracion De Ingresos Y Gastos (Collection

Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. County of residence your social security number or individual taxpayer identification number The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. It shows the irs the taxpayer's ability to pay (monthly cash flow)..

Where To File Form 433f Charles Leal's Template

Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the. The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. Answer all questions or write n/a if the question is not. It shows the irs the taxpayer's ability to pay (monthly.

Irs Form 433 F Instructions Form Resume Examples qlkmd3rOaj

It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. Requests for copy of tax. Refer to form 8821, tax information authorization. If your proposed monthly payment isn’t enough to pay.

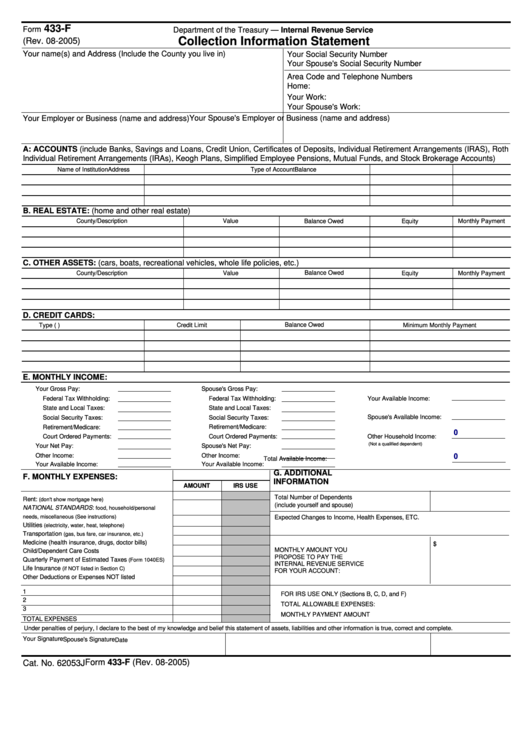

Fillable Form 433F Collection Information Statement 2005 printable

Requests for copy of tax. It shows the irs the taxpayer's ability to pay (monthly cash flow). It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. Answer all questions or.

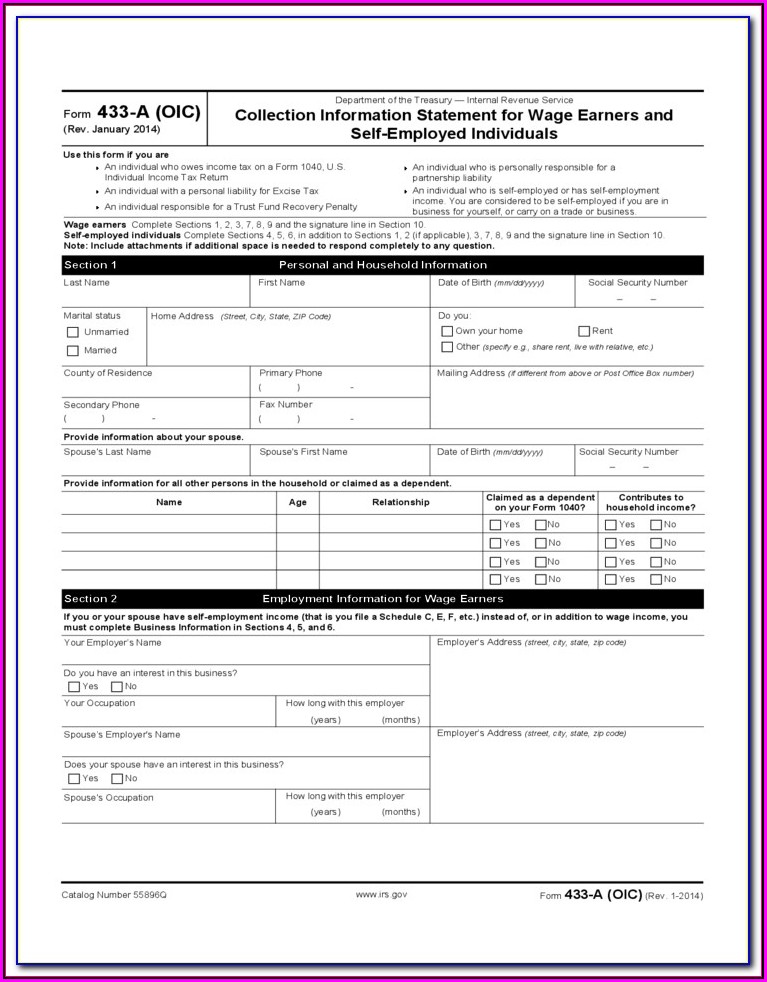

Irs Form 433 A Instructions Form Resume Examples emVKeel9rX

It shows the irs the taxpayer's ability to pay (monthly cash flow). Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the. If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years). The irs uses the information on this form to determine eligibility for.

Form 433A & 433F How the IRS Decides Your Ability to Pay

Requests for copy of tax. It shows the irs the taxpayer's ability to pay (monthly cash flow). Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the. If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years). It is often used to determine eligibility.

F Financial Necessary Latest Fill Out and Sign Printable PDF Template

Refer to form 8821, tax information authorization. Table of contents what is irs form 433 f? It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years). It shows the irs the taxpayer's ability to.

Form 433F Collection Information Statement (2013) Free Download

Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the. If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years). Requests for copy of tax. Refer to form 8821, tax information authorization. It is often used to determine eligibility for certain types of installment.

32 433 Forms And Templates free to download in PDF

It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. You may be able to establish an online payment agreement on the. It shows the irs the taxpayer's ability to pay (monthly cash flow). Table of contents what is irs form 433 f? The irs uses the information on this form to.

Table Of Contents What Is Irs Form 433 F?

It is often used to determine eligibility for certain types of installment agreements or currently not collectible status. Answer all questions or write n/a if the question is not. If your proposed monthly payment isn’t enough to pay off the tax liability in 72 months (six years). If you want to make payments on a tax liability over $50,000.

The Irs Uses The Information On This Form To Determine Eligibility For Payment Plans And Uncollectible Status , Among Other Resolutions.

Refer to form 8821, tax information authorization. County of residence your social security number or individual taxpayer identification number It shows the irs the taxpayer's ability to pay (monthly cash flow). Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4.

Requests For Copy Of Tax.

You may be able to establish an online payment agreement on the. Delinquent taxes are any form of tax debt owed to the irs—the debt is considered delinquent once the.