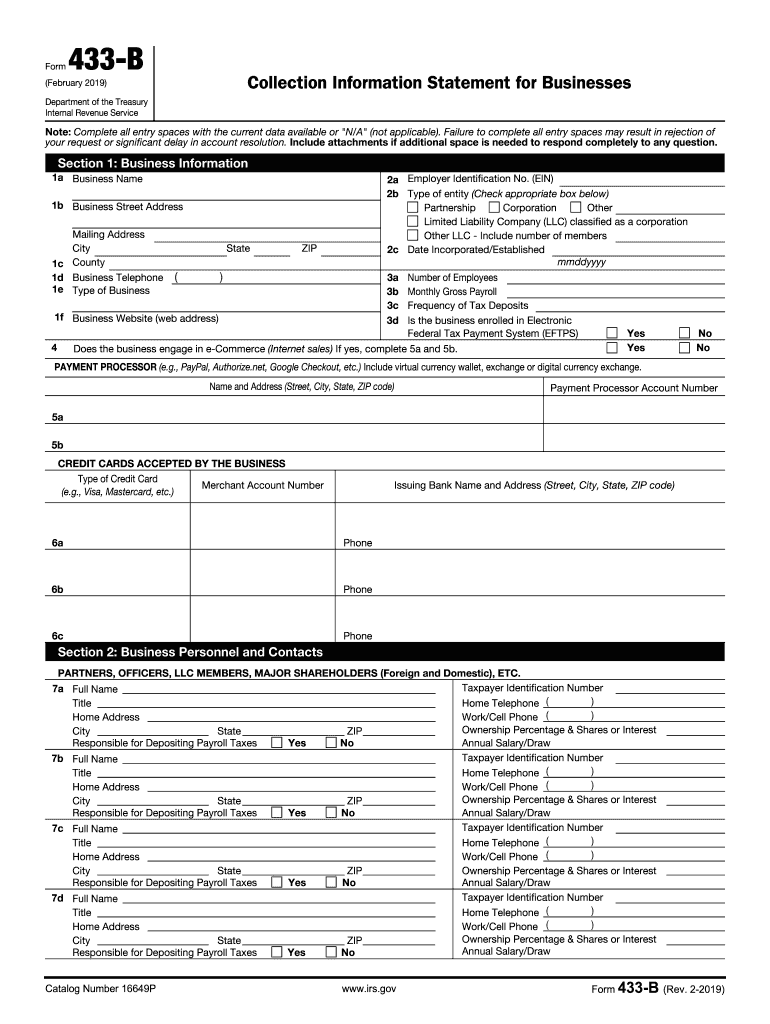

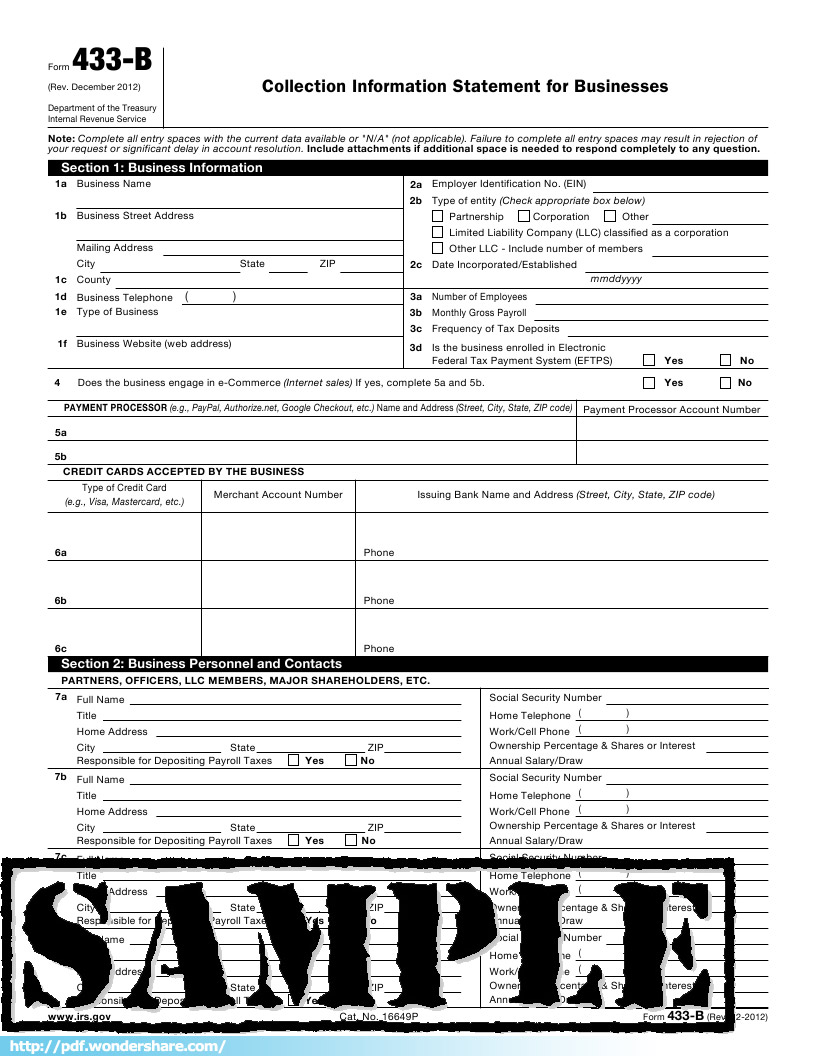

433B Irs Form

433B Irs Form - If your business is a sole proprietorship do not use this form. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Web requesting non collectible status due to financial hardship, which delays your tax obligation. The form should be completed as accurately as possible. Answer all questions or write n/a if the question is not. Use this form if you are an individual who owes income tax on a form 1040, u.s. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Complete all entry spaces with the current data available or n/a (not applicable). The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. • partnerships • corporations • exempt organizations

Web requesting non collectible status due to financial hardship, which delays your tax obligation. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. • partnerships • corporations • exempt organizations If your business is a sole proprietorship do not use this form. Use this form if you are an individual who owes income tax on a form 1040, u.s. Both forms are six pages long, but the sections. The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. The form should be completed as accurately as possible. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Complete all entry spaces with the current data available or n/a (not applicable).

If your business is a sole proprietorship do not use this form. • partnerships • corporations • exempt organizations Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Answer all questions or write n/a if the question is not. The form should be completed as accurately as possible. Both forms are six pages long, but the sections. Complete all entry spaces with the current data available or n/a (not applicable). Use this form if you are an individual who owes income tax on a form 1040, u.s. Web requesting non collectible status due to financial hardship, which delays your tax obligation. The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed.

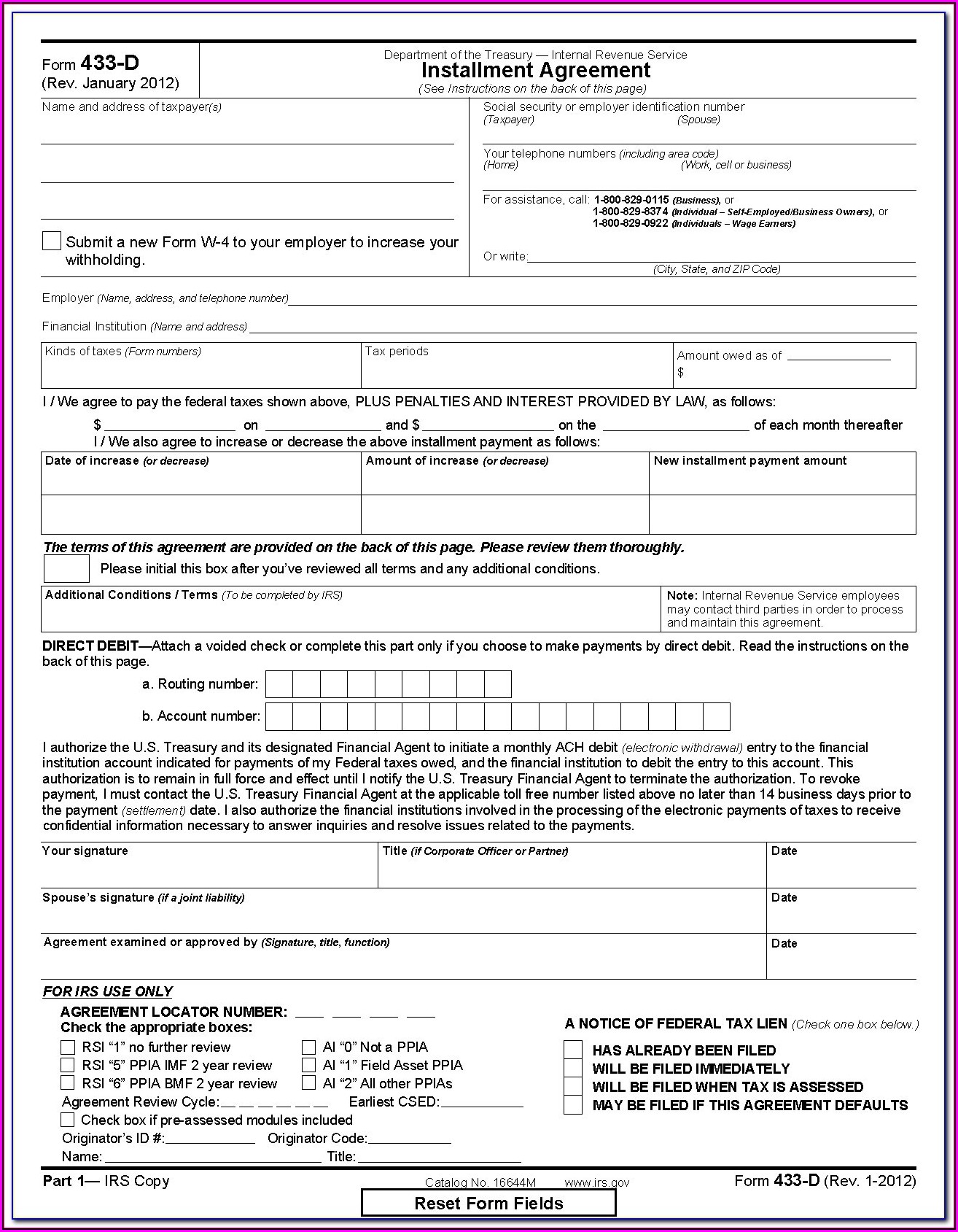

Steps & Forms To Prepare An Installment Agreement

The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed. The form should be completed as accurately as possible. If your business is a sole proprietorship do not use this form. This form is often used during a situation in which a business owes federal tax payments but cannot.

20192022 Form IRS 433B Fill Online, Printable, Fillable, Blank

• partnerships • corporations • exempt organizations This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. Answer all questions or write n/a if the question is not. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. If your business.

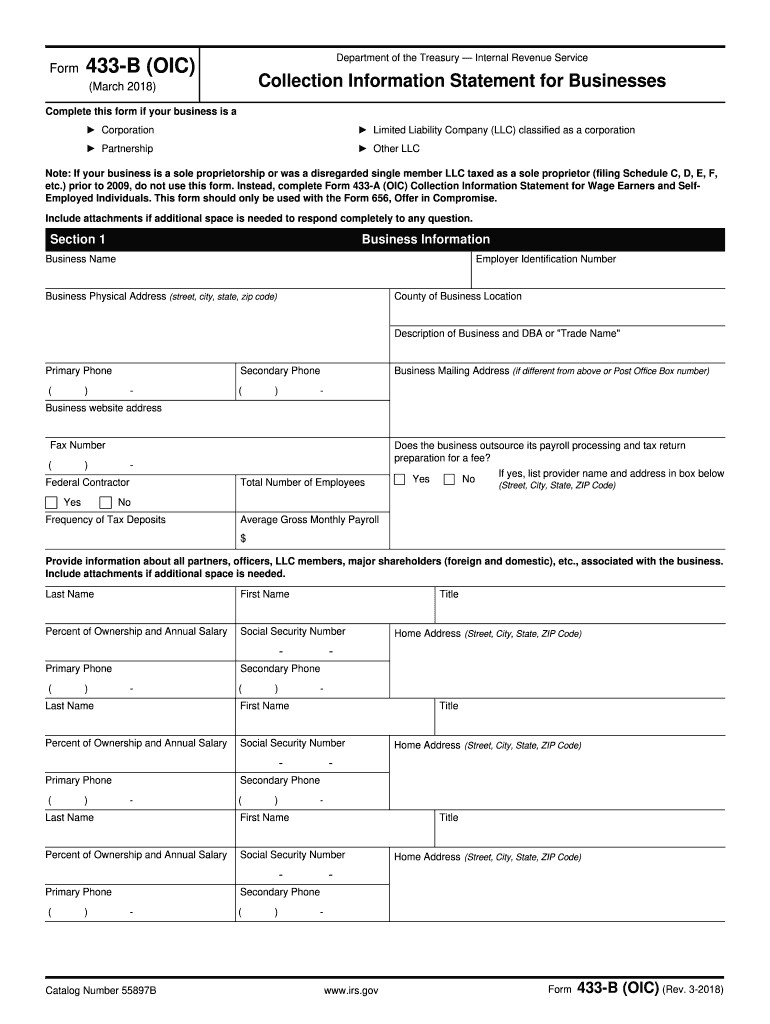

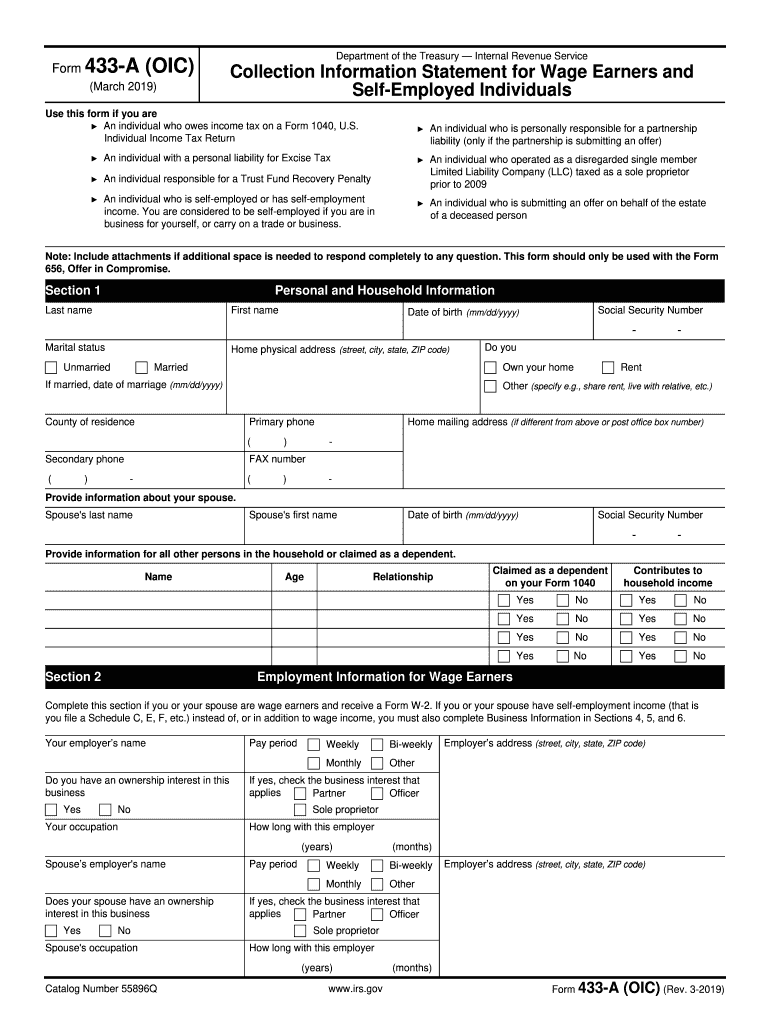

2018 Form IRS 433B (OIC) Fill Online, Printable, Fillable, Blank

The form should be completed as accurately as possible. Both forms are six pages long, but the sections. Web requesting non collectible status due to financial hardship, which delays your tax obligation. Complete all entry spaces with the current data available or n/a (not applicable). Use this form if you are an individual who owes income tax on a form.

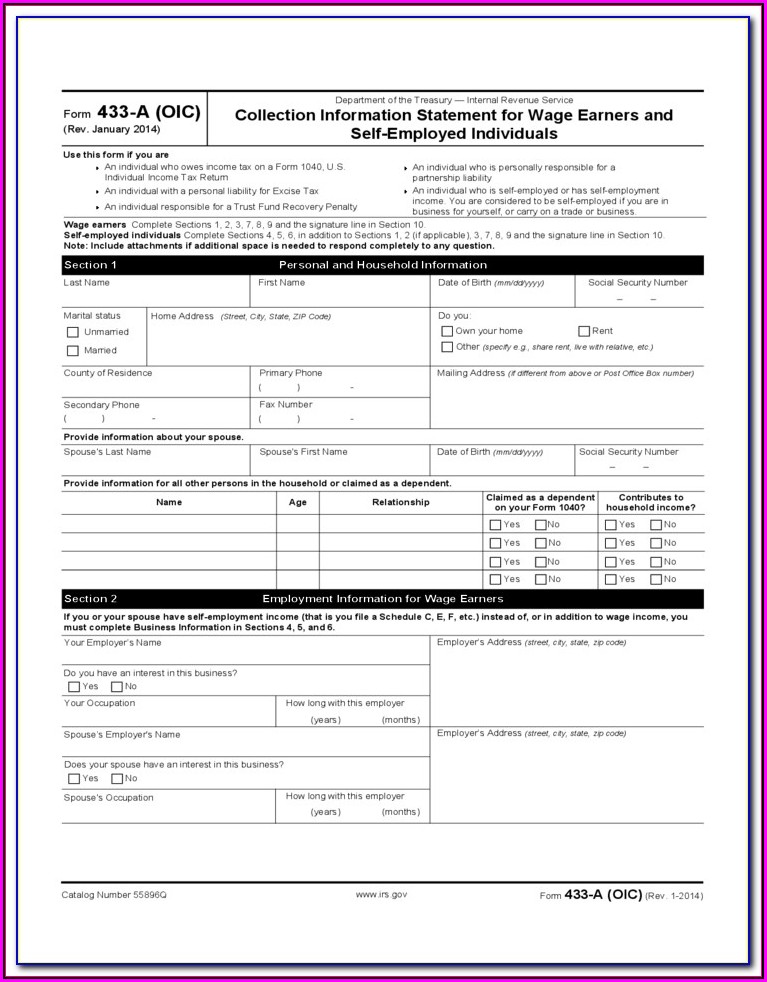

Irs Form 433 A Instructions Form Resume Examples emVKeel9rX

Both forms are six pages long, but the sections. If your business is a sole proprietorship do not use this form. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Use this form if you are an individual who owes income tax on a form 1040, u.s. Web requesting non collectible status due to.

IRS Form 433B (OIC) Download Fillable PDF or Fill Online Collection

Complete all entry spaces with the current data available or n/a (not applicable). The form should be completed as accurately as possible. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. Answer all questions or write n/a if the question is not. • partnerships •.

2019 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

Complete all entry spaces with the current data available or n/a (not applicable). The form should be completed as accurately as possible. • partnerships • corporations • exempt organizations Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. Failure to complete all entry spaces may result in rejection of your request or significant delay.

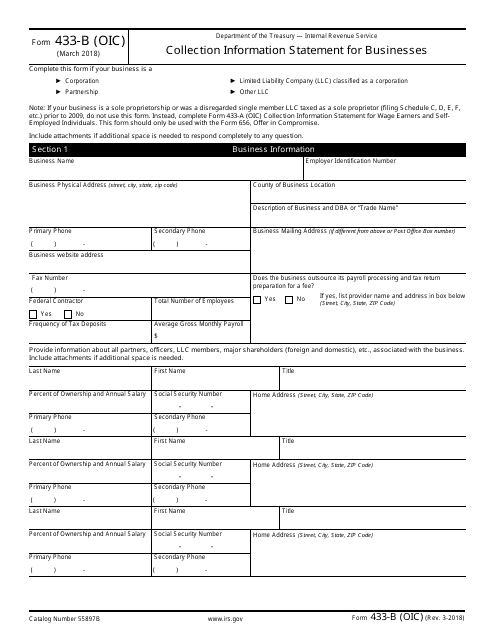

IRS Form 433B Free Download, Create, Edit, Fill and Print

Web requesting non collectible status due to financial hardship, which delays your tax obligation. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Complete all entry spaces with the current data available or n/a (not applicable). This form is often used during a situation in which a business owes federal.

Irs Form 433 D Fillable Form Resume Examples YL5zejyDzV

Complete all entry spaces with the current data available or n/a (not applicable). Use this form if you are an individual who owes income tax on a form 1040, u.s. The form should be completed as accurately as possible. Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. • partnerships • corporations • exempt.

Irs Form 433 D Fillable Form Resume Examples n49m1169Zz

Both forms are six pages long, but the sections. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. If your business is a sole proprietorship do not use this form. The amount of the installment payments varies according to the business’s income and expenses, and.

Fill Free fillable IRS Form 433B Collection Information Statement

Complete sections 1, 2, 3, 4, and 5 including the signature line on page 4. • partnerships • corporations • exempt organizations Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. The form should be completed as accurately as possible. The amount of the installment payments varies according to the.

Complete All Entry Spaces With The Current Data Available Or N/A (Not Applicable).

Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. If your business is a sole proprietorship do not use this form. This form is often used during a situation in which a business owes federal tax payments but cannot afford to pay the total debt. • partnerships • corporations • exempt organizations

Complete Sections 1, 2, 3, 4, And 5 Including The Signature Line On Page 4.

Use this form if you are an individual who owes income tax on a form 1040, u.s. Both forms are six pages long, but the sections. The form should be completed as accurately as possible. The amount of the installment payments varies according to the business’s income and expenses, and the amount of the taxes owed.

Web Requesting Non Collectible Status Due To Financial Hardship, Which Delays Your Tax Obligation.

Answer all questions or write n/a if the question is not.