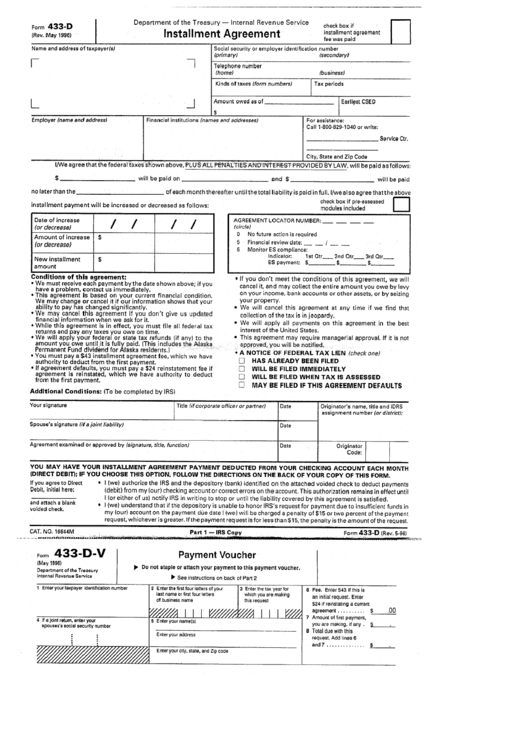

433D Tax Form

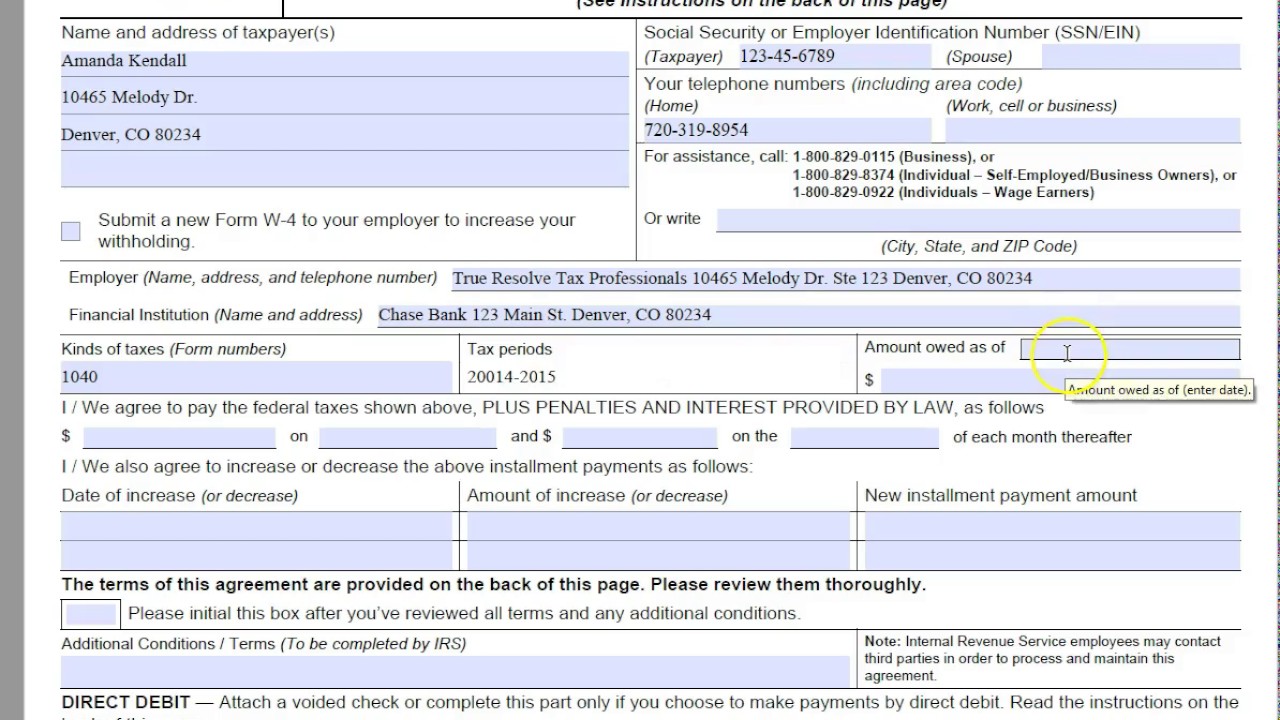

433D Tax Form - Web irs form 433d installment agreement for individuals and businesses. Edit, download & esign pdf online. Then you should send your irs payment plan forms and payments to the following address: Web part 1 — irs copy $ on and $ on the i / we also agree to increase or decrease the above installment payments as follows: Complete, edit or print tax forms instantly. Date of increase (or decrease) amount of increase (or. Complete, edit or print tax forms instantly. We charge the penalty for each. Web tax at the beginning of each penalty month following the payment due date for that tax. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement.

Table of contents what is irs form 433. This penalty applies even if you filed the return on time. Er identification number (ssn/ein)(taxpayer)(spouse)your telephone numbers (including area. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. Complete, edit or print tax forms instantly. Download blank or fill out online in pdf format. Date of increase (or decrease) amount of increase (or. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Web part 1 — irs copy $ on and $ on the i / we also agree to increase or decrease the above installment payments as follows: Complete, edit or print tax forms instantly.

Download blank or fill out online in pdf format. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. This penalty applies even if you filed the return on time. Date of increase (or decrease) amount of increase (or. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Web tax at the beginning of each penalty month following the payment due date for that tax. We charge the penalty for each. You can download or print current or past. Web part 1 — irs copy $ on and $ on the i / we also agree to increase or decrease the above installment payments as follows: Complete, sign, print and send your tax documents easily with us legal forms.

8. Form 433D if you can't pay your tax bill mediafeed

Ad access irs tax forms. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Then you should send your irs payment plan forms and payments to the following address: Date of increase (or decrease) amount of increase (or. Form 433d installment agreement is used to finalize an irs installment agreement and.

20182020 Form IRS 433D Fill Online, Printable, Fillable, Blank

Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. Er identification number (ssn/ein)(taxpayer)(spouse)your telephone numbers (including area. Complete, edit or print tax forms instantly. Web part 1 — irs copy $ on and $ on the i / we also agree to increase or decrease the above installment payments as follows: Web.

Form 433D Installment Agreement Internal Revenue Service printable

Ad access irs tax forms. Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. Web irs form 433d installment agreement for individuals and businesses. Then you should send your irs payment plan forms and payments to the following address: Form 433d installment agreement is used to finalize an irs installment agreement and.

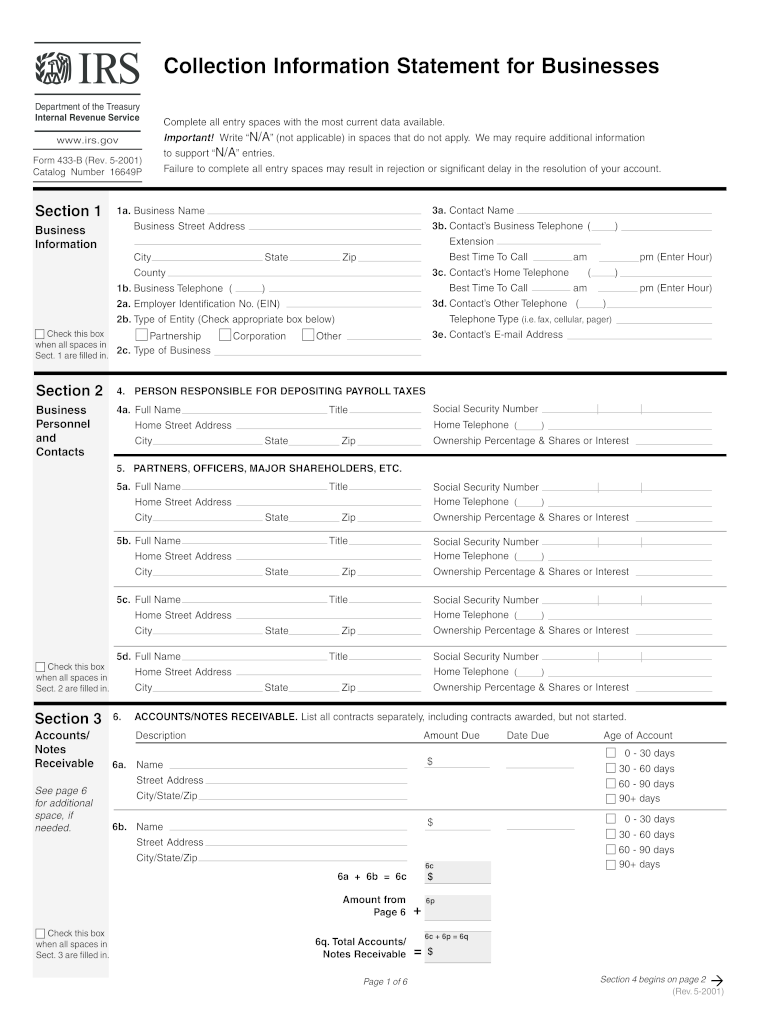

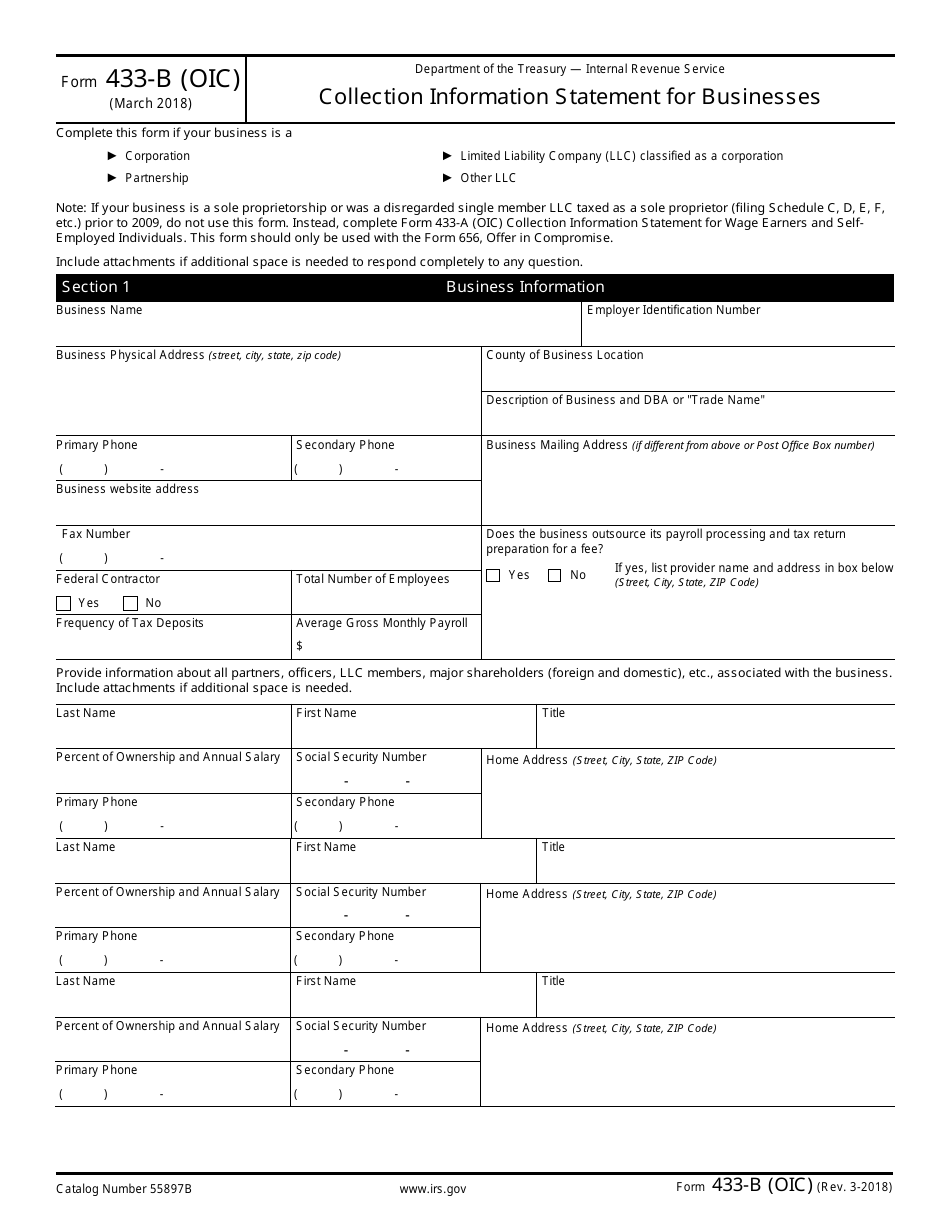

2001 Form IRS 433B Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web tax at the beginning of each penalty month following the payment due date for that tax. Table of contents what is irs form 433. Web irs form 433d installment agreement for individuals and businesses. Download blank or fill out online in pdf format.

IRS Form 433B Fill it Right the First Time

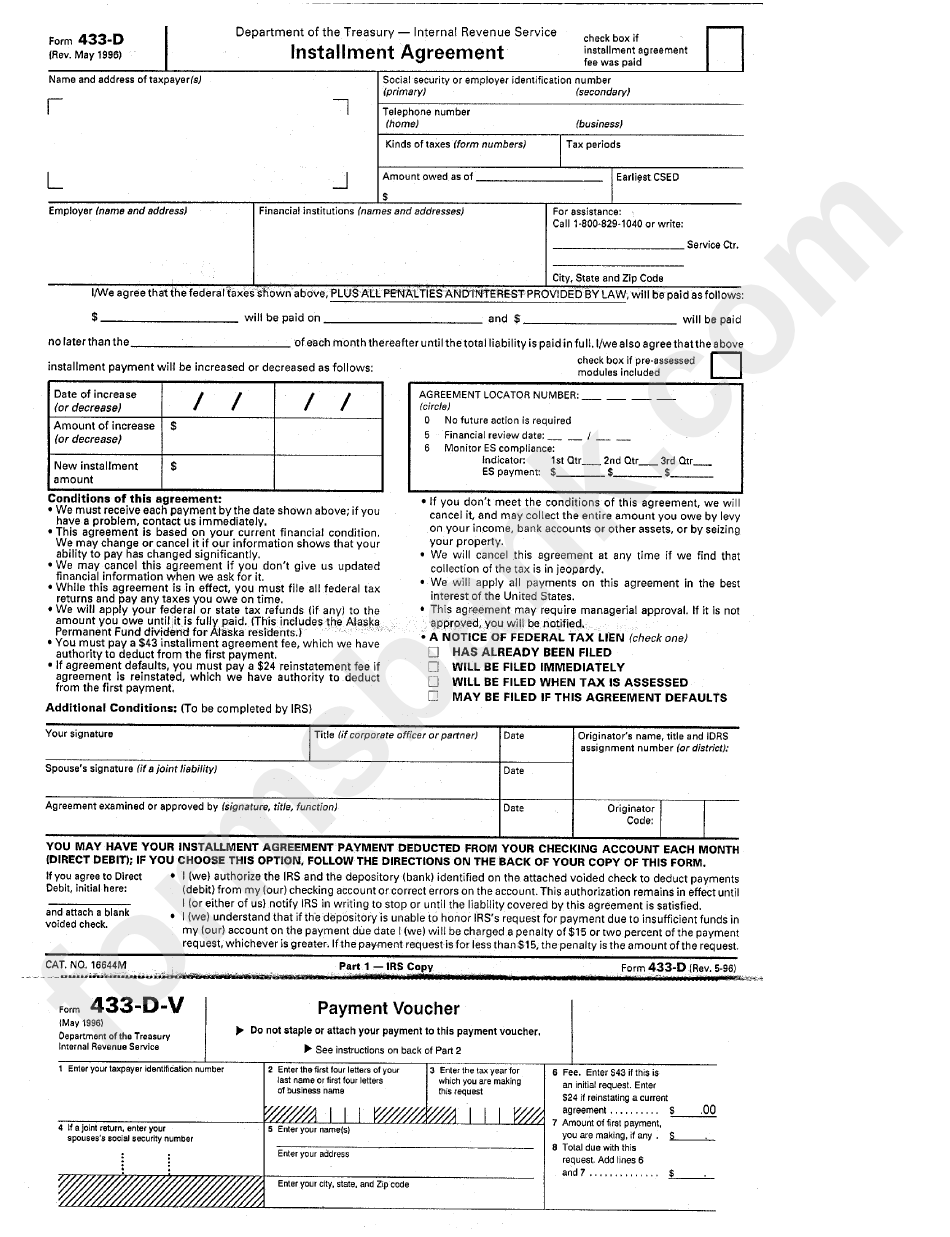

Form 433d installment agreement is used to finalize an irs installment agreement and irs. Web part 1 — irs copy $ on and $ on the i / we also agree to increase or decrease the above installment payments as follows: Download blank or fill out online in pdf format. This penalty applies even if you filed the return on.

Form 433D Installment Agreement Internal Revenue Service printable

Then you should send your irs payment plan forms and payments to the following address: Web irs form 433d installment agreement for individuals and businesses. Table of contents what is irs form 433. Download blank or fill out online in pdf format. This penalty applies even if you filed the return on time.

Fillable Form 433D Installment Agreement printable pdf download

Download blank or fill out online in pdf format. Form 433d installment agreement is used to finalize an irs installment agreement and irs. You can download or print current or past. Complete, edit or print tax forms instantly. Web tax at the beginning of each penalty month following the payment due date for that tax.

Where To File Form 433f Charles Leal's Template

Web tax at the beginning of each penalty month following the payment due date for that tax. We charge the penalty for each. Date of increase (or decrease) amount of increase (or. Table of contents what is irs form 433. Web part 1 — irs copy $ on and $ on the i / we also agree to increase or.

Steps & Forms To Prepare An Installment Agreement

Web the form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. This penalty applies even if you filed the return on time. Form 433d installment agreement is used to finalize an irs installment agreement and irs. Er identification number (ssn/ein)(taxpayer)(spouse)your telephone numbers (including area. Web part 1 — irs copy $ on and $.

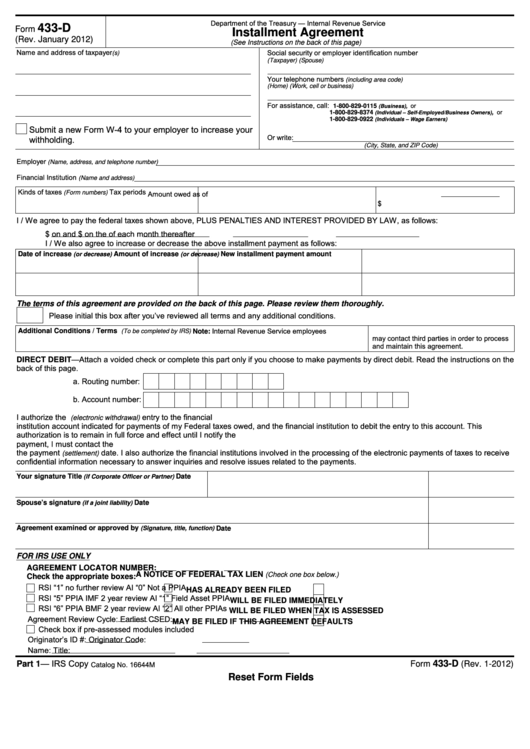

IRS Form 433B (OIC) Download Fillable PDF or Fill Online Collection

Edit, download & esign pdf online. Complete, edit or print tax forms instantly. Web irs form 433d installment agreement for individuals and businesses. Then you should send your irs payment plan forms and payments to the following address: Download blank or fill out online in pdf format.

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

Form 433d installment agreement is used to finalize an irs installment agreement and irs. You can download or print current or past. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Download blank or fill out online in pdf format.

Web The Form 9465 Is Used Mainly By Taxpayers To Request And Authorize A Streamlined Installment Agreement.

Er identification number (ssn/ein)(taxpayer)(spouse)your telephone numbers (including area. Web tax at the beginning of each penalty month following the payment due date for that tax. Ad access irs tax forms. We charge the penalty for each.

Edit, Download & Esign Pdf Online.

Complete, edit or print tax forms instantly. This penalty applies even if you filed the return on time. Complete, edit or print tax forms instantly. Web irs form 433d installment agreement for individuals and businesses.

Date Of Increase (Or Decrease) Amount Of Increase (Or.

Web part 1 — irs copy $ on and $ on the i / we also agree to increase or decrease the above installment payments as follows: Then you should send your irs payment plan forms and payments to the following address: Table of contents what is irs form 433.