501-Llc Form California

501-Llc Form California - Web 501 (c) (1): Web for tax years beginning on or after january 1, 2021, and before january 1, 2024, llcs that organize, register, or file with the secretary of state to do business in california are not subject to the annual tax of $800 for their first tax year. Get started on any device! The misleading solicitation can be identified from the following characteristics as shown in the sample (pdf) : California secretary of state 1500 11th street sacramento, california 95814 office: The llc has articles of organization accepted by the california secretary of state (sos). An llc should use this voucher if any of the following apply: Web form 1024, application for recognition of exemption under section 501 (a). Exemption application (form 3500) download the form; Ad make your free legal documents.

I give my permission for any necessary verification. The llc has articles of organization accepted by the california secretary of state (sos). Any corporation that is organized under an act of congress that is exempt from federal income tax. Get started on any device! Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Ensure campaign deadlines are met. An llc should use this voucher if any of the following apply: File the form 501 before. Web www.fppc.ca.gov candidate intention statement california 501 form who files: Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online.

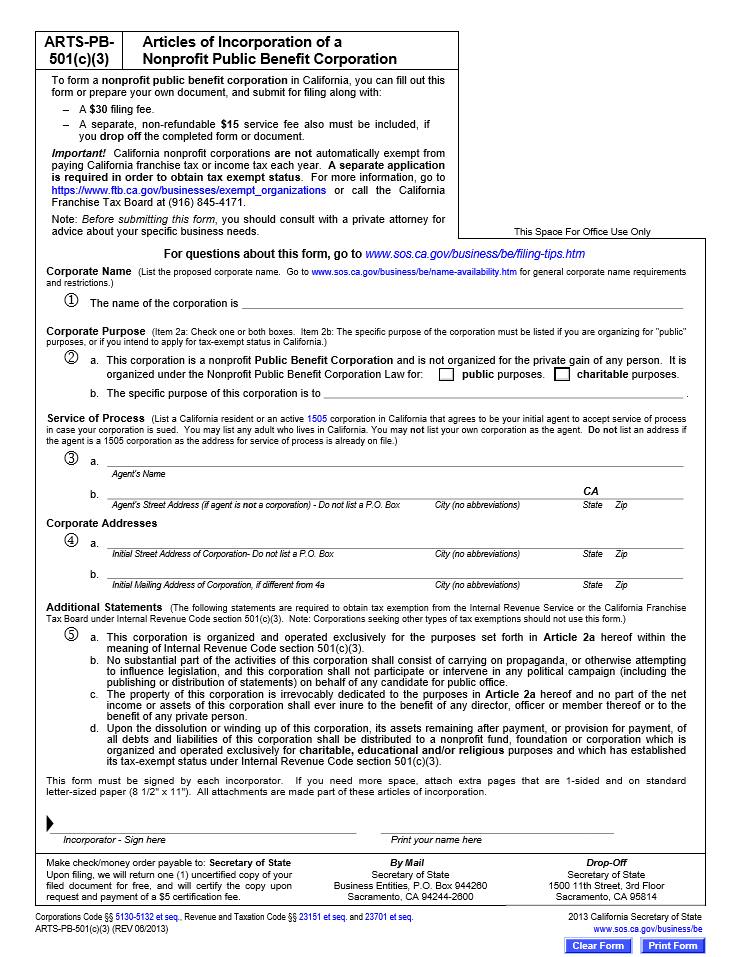

Web secretary of state (sos) filing requirements who must file use the tables to determine your organization's filing requirement for the following forms: Go to www.fppc.ca.gov for most campaign disclosure filing schedules or check with your. Here are the steps to create a nonprofit in california. Corporations that hold a title of property for exempt organizations. This form is considered filed the date it is postmarked or hand delivered. Web the purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the california revised uniform limited liability company act. Choose the initial directors for your corporation. Web click to edit settings and logout. Determine your exemption type, complete, print, and mail your application; A candidate for state or local office must file this form for each election, including reelection to the same office.

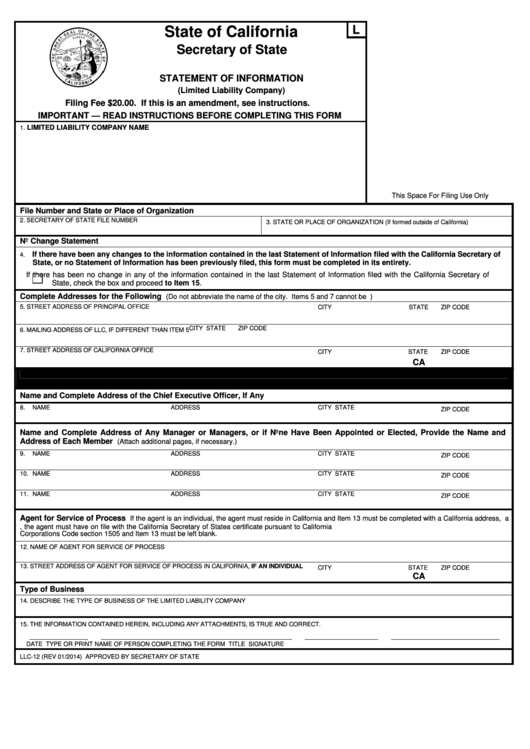

Fillable Form Llc12 Statement Of Information State Of California

© 2023 ca secretary of state Web www.fppc.ca.gov candidate intention statement california 501 form who files: This form is considered filed the date it is postmarked or hand delivered. Web in california, the statement of information (also known as a biennial report) is a regular filing that your llc must complete every two years to update your business information, including:.

Free California Articles of Incorporation of a Nonprofit Public Benefit

Names and addresses of llc members or managers Here are the steps to create a nonprofit in california. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. This form is considered filed the date it is postmarked or hand delivered. Web www.fppc.ca.gov candidate intention.

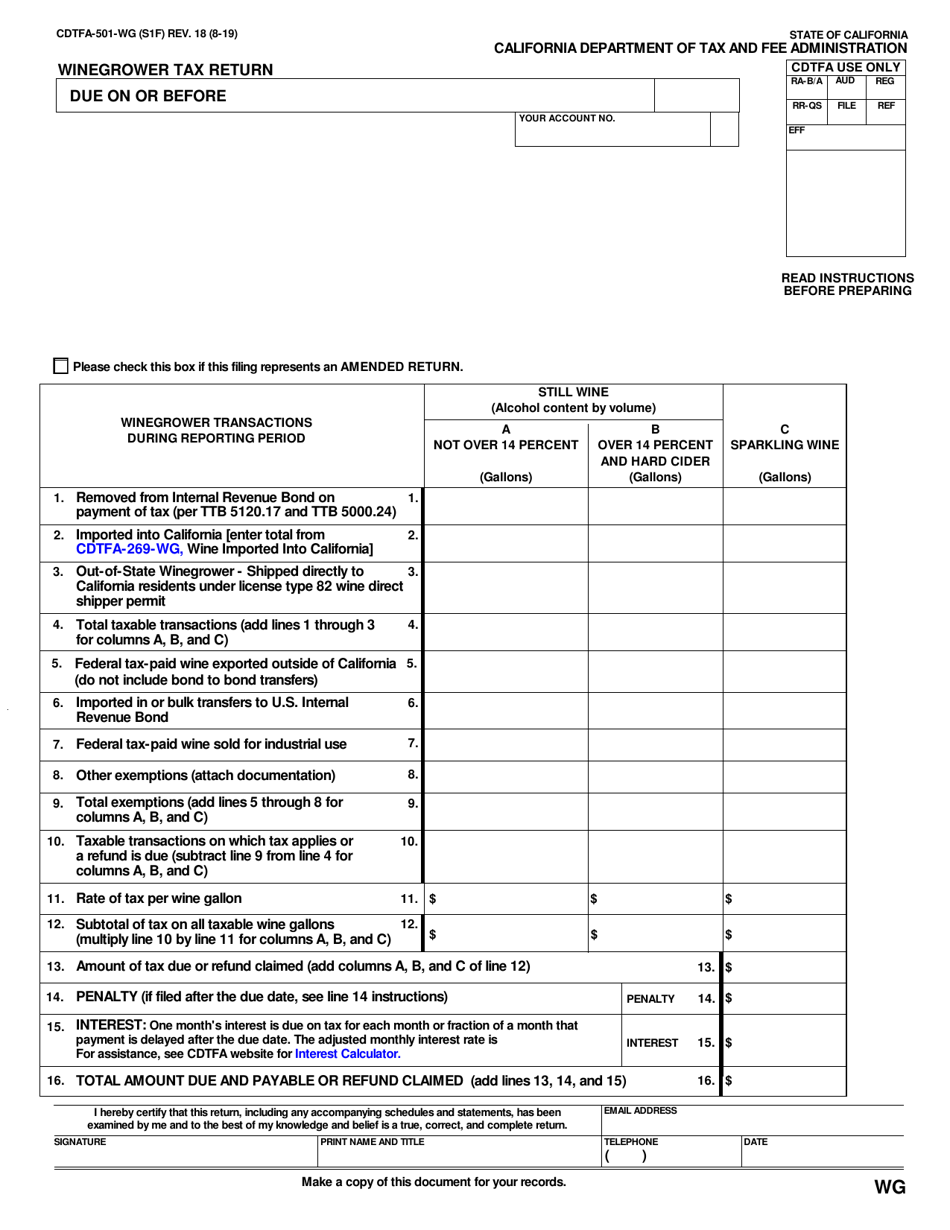

Form CDTFA501AU Download Fillable PDF or Fill Online User Use Fuel

Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Web form 1024, application for recognition of exemption under section 501 (a). Web in california, the statement of information (also known as a biennial report) is a regular filing that your llc must complete every.

501 Finding Ca Form Fill Online, Printable, Fillable, Blank pdfFiller

Get started on any device! Any corporation that is organized under an act of congress that is exempt from federal income tax. Web form 1024, application for recognition of exemption under section 501 (a). Ensure campaign deadlines are met. Choose the initial directors for your corporation.

501c3 Articles Of Incorporation Template Template 1 Resume Examples

I give my permission for any necessary verification. Candidates for county central committee that do not raise or spend $2,000 or more in a calendar year. Get started on any device! Exemption application (form 3500) download the form; Web the purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability.

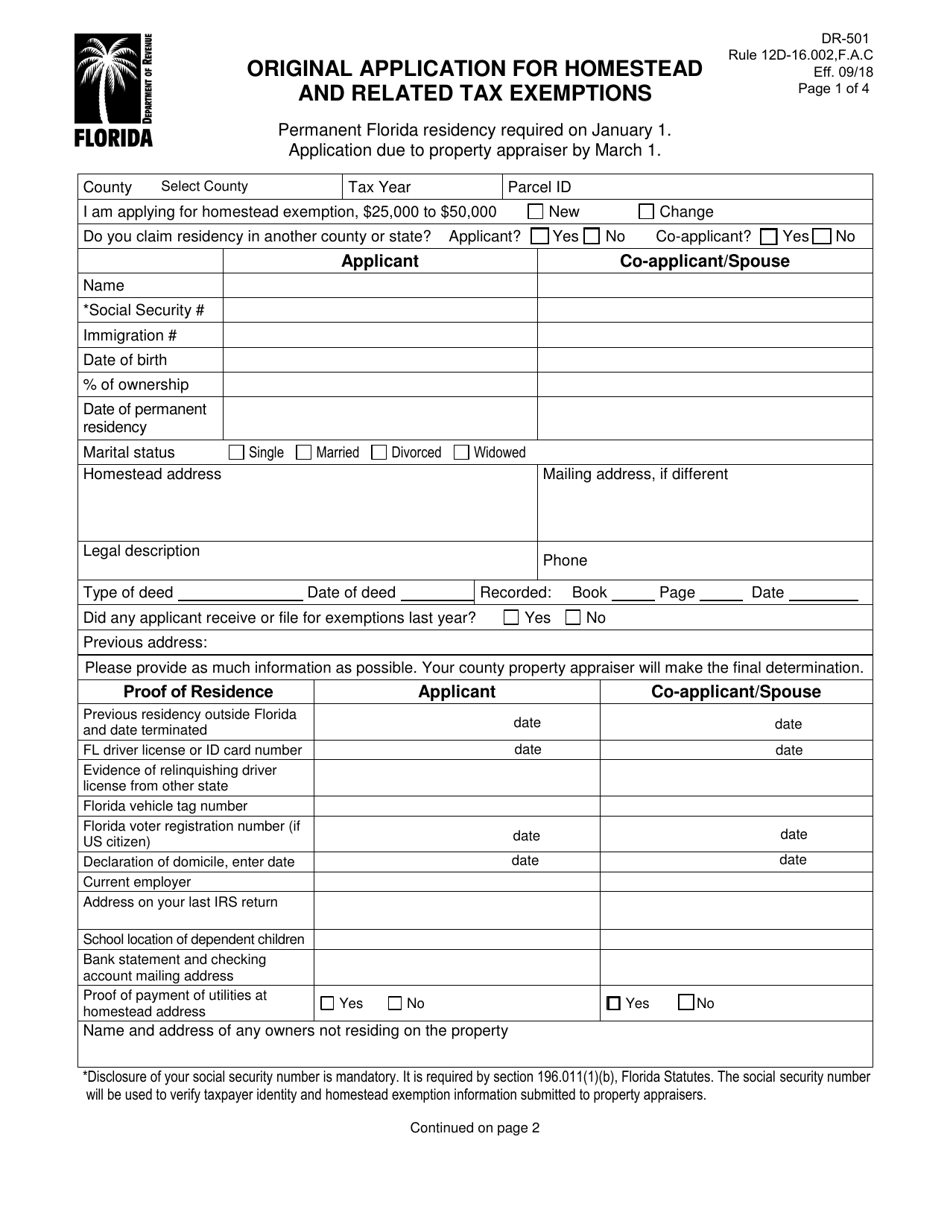

Form DR501 Download Fillable PDF or Fill Online Original Application

Web click to edit settings and logout. Exemption application (form 3500) download the form; This form is considered filed the date it is postmarked or hand delivered. Ensure campaign deadlines are met. Guidelines for access to public records;

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

Determine your exemption type, complete, print, and mail your application; Web 501 (c) (1): © 2023 ca secretary of state Web the purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the california revised uniform limited liability company act. Web general information use form.

Forming an LLC in California A StepbyStep Guide Gusto

Web secretary of state (sos) filing requirements who must file use the tables to determine your organization's filing requirement for the following forms: Web 501 (c) (1): Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Guidelines for access to public records; Names and.

Form CDTFA501WG Download Fillable PDF or Fill Online Winegrower Tax

Here are the steps to create a nonprofit in california. Ensure campaign deadlines are met. Corporations that hold a title of property for exempt organizations. Web secretary of state (sos) filing requirements who must file use the tables to determine your organization's filing requirement for the following forms: Web file the form 501 before you solicit or receive any contributions.

Form a California 501(c)(3) nonprofit corporation by following these

Ad make your free legal documents. Candidates for county central committee that do not raise or spend $2,000 or more in a calendar year. Web www.fppc.ca.gov candidate intention statement california 501 form who files: California secretary of state 1500 11th street sacramento, california 95814 office: The llc has articles of organization accepted by the california secretary of state (sos).

Ensure Campaign Deadlines Are Met.

Ad make your free legal documents. Names and addresses of llc members or managers Web the purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the california revised uniform limited liability company act. Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022.

Web In California, The Statement Of Information (Also Known As A Biennial Report) Is A Regular Filing That Your Llc Must Complete Every Two Years To Update Your Business Information, Including:

Candidates for county central committee that do not raise or spend $2,000 or more in a calendar year. Ensure campaign deadlines are met. Get started on any device! Corporations that hold a title of property for exempt organizations.

Web Click To Edit Settings And Logout.

Any corporation that is organized under an act of congress that is exempt from federal income tax. Exemption application (form 3500) download the form; Go to www.fppc.ca.gov for most campaign disclosure filing schedules or check with your. Guidelines for access to public records;

I Registered My Own Llc Early Last Year To.

Web form 1024, application for recognition of exemption under section 501 (a). Reading further, i saw a $243 processing fee, with deadlines, statutes, and penalties mentioned. This form is considered filed the date it is postmarked or hand delivered. Registered agent changes require a separate filing.