7203 Tax Form

7203 Tax Form - Use this address if you are not enclosing a payment use this. Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. Web form 7203 is generated for a 1040 return when: Employers engaged in a trade or business who. Employers engaged in a trade or business who. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. ( for a copy of a form, instruction, or publication) address to mail form to irs: Web addresses for forms beginning with the number 7.

Use this address if you are not enclosing a payment use this. To enter basis limitation info in the. Employee's withholding certificate form 941; Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Web form 7203 contains a detailed accounting of the shareholder’s basis in the corporation and replaces the requirement that the shareholder/taxpayer attach a basis. S corporation shareholders use form 7203 to figure the potential. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web irs issues guidance for s corporation shareholders. Web up to 10% cash back the draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Web form 7203 is generated for a 1040 return when:

Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Please note, the form 7203 is not required to. Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation. Web what is form 7203? Employee's withholding certificate form 941; Employers engaged in a trade or business who. Web up to 10% cash back the draft form 7203 for tax year 2022 makes only two changes to the 2021 form:

National Association of Tax Professionals Blog

The draft form includes a new item d. Use this address if you are not enclosing a payment use this. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. S corporation shareholders use form 7203 to figure the potential. Web addresses for.

Peerless Turbotax Profit And Loss Statement Cvp

December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Employee's withholding certificate form 941; To enter basis limitation info in the. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

The irs recently issued a new draft form 7203, s corporation shareholder stock and debt. Web form 7203 is generated for a 1040 return when: Web about form 7203, s corporation shareholder stock and debt basis limitations. S corporation shareholders use form 7203 to figure the potential. A taxpayer will need to.

National Association of Tax Professionals Blog

Employers engaged in a trade or business who. Employee's withholding certificate form 941; ( for a copy of a form, instruction, or publication) address to mail form to irs: Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Employers engaged in a.

IRS Issues New Form 7203 for Farmers and Fishermen

How do i clear ef messages 5486 and 5851? Web addresses for forms beginning with the number 7. Web irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web starting with the 2021 tax.

More Basis Disclosures This Year for S corporation Shareholders Need

December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web irs form 7203 is a tax form used to report the basis of your shares.

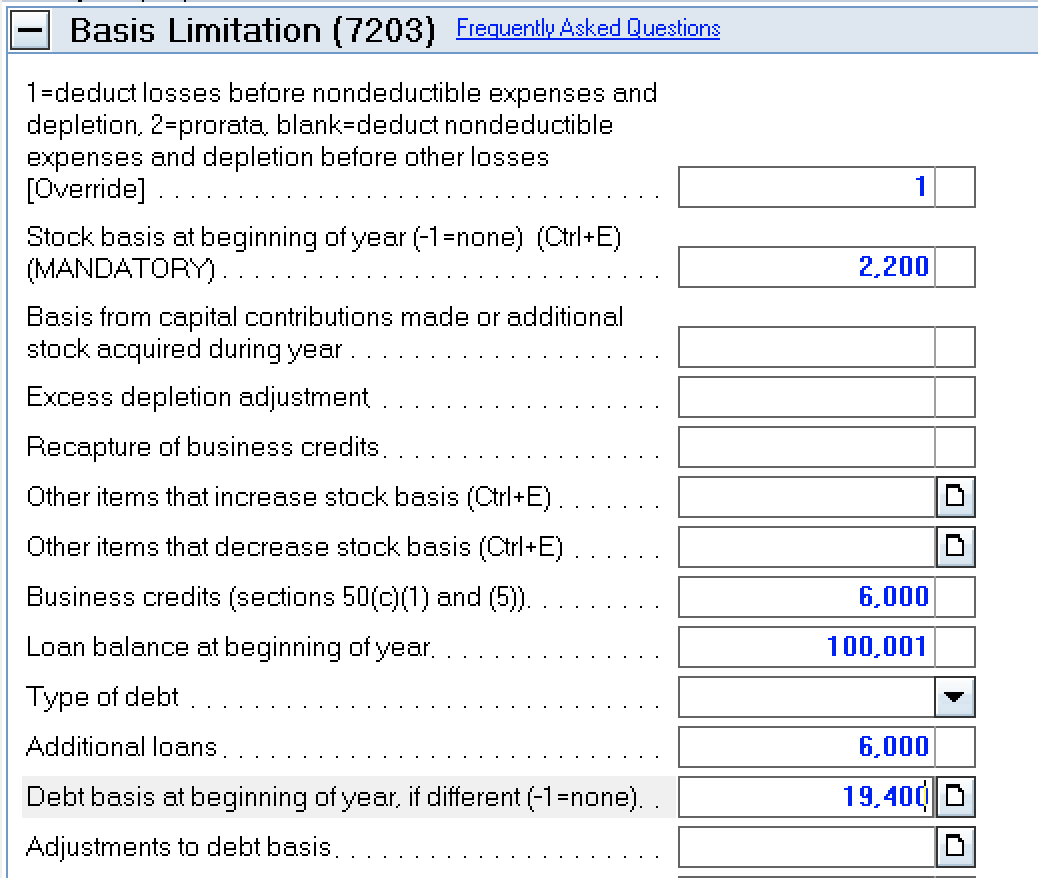

How to complete Form 7203 in Lacerte

Employers engaged in a trade or business who. Use this address if you are not enclosing a payment use this. To enter basis limitation info in the. How do i clear ef messages 5486 and 5851? Web what is form 7203?

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web about form 7203, s corporation shareholder stock and debt basis limitations. Web addresses for forms beginning with the number 7. Employers engaged in a trade or business who. This form helps you calculate the adjusted basis of your stock and debt. A taxpayer will need to.

SCorporation Shareholders May Need to File Form 7203

Web up to 10% cash back the draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Web irs issues guidance for s corporation shareholders. Press f6 to bring up open forms. This form helps you calculate the adjusted basis of your stock and debt. S corporation shareholders use form 7203 to figure the potential.

IRS Proposes New Form 7203 for S Corporation Shareholders to Report

Employee's withholding certificate form 941; Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. S corporation shareholders use form.

Employee's Withholding Certificate Form 941;

The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Use this address if you are not enclosing a payment use this. S corporation shareholders use form 7203 to figure the potential. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt.

Web Irs Issues Guidance For S Corporation Shareholders.

Web about form 7203, s corporation shareholder stock and debt basis limitations. How do i clear ef messages 5486 and 5851? ( for a copy of a form, instruction, or publication) address to mail form to irs: To enter basis limitation info in the.

Web Starting With The 2021 Tax Year, A New Form 7203 Replaces The Supplemental Worksheet For Figuring A Shareholder’s Stock And Debt Basis.

Web addresses for forms beginning with the number 7. Web up to 10% cash back the draft form 7203 for tax year 2022 makes only two changes to the 2021 form: Web form 7203 is generated for a 1040 return when: Web the form 7203 represents the irs’ official reporting form to be used to track a shareholder’s basis in an s corporation.

Employee's Withholding Certificate Form 941;

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web what is form 7203? Employers engaged in a trade or business who. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a.