8027 Form 2022

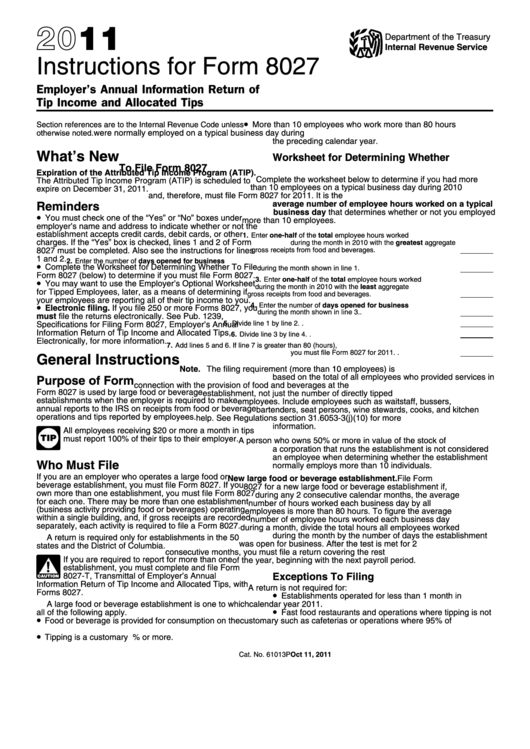

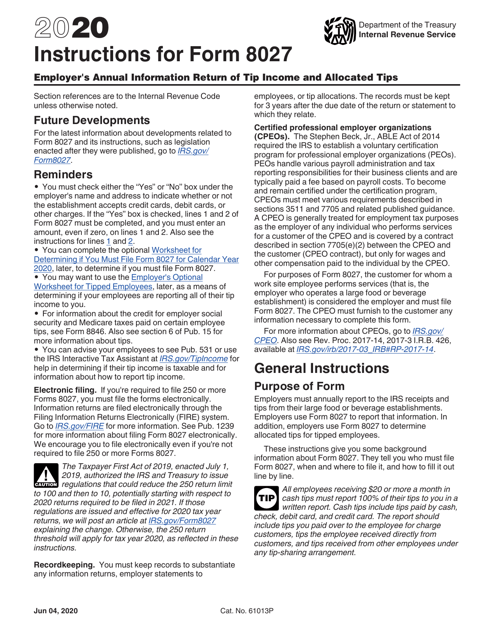

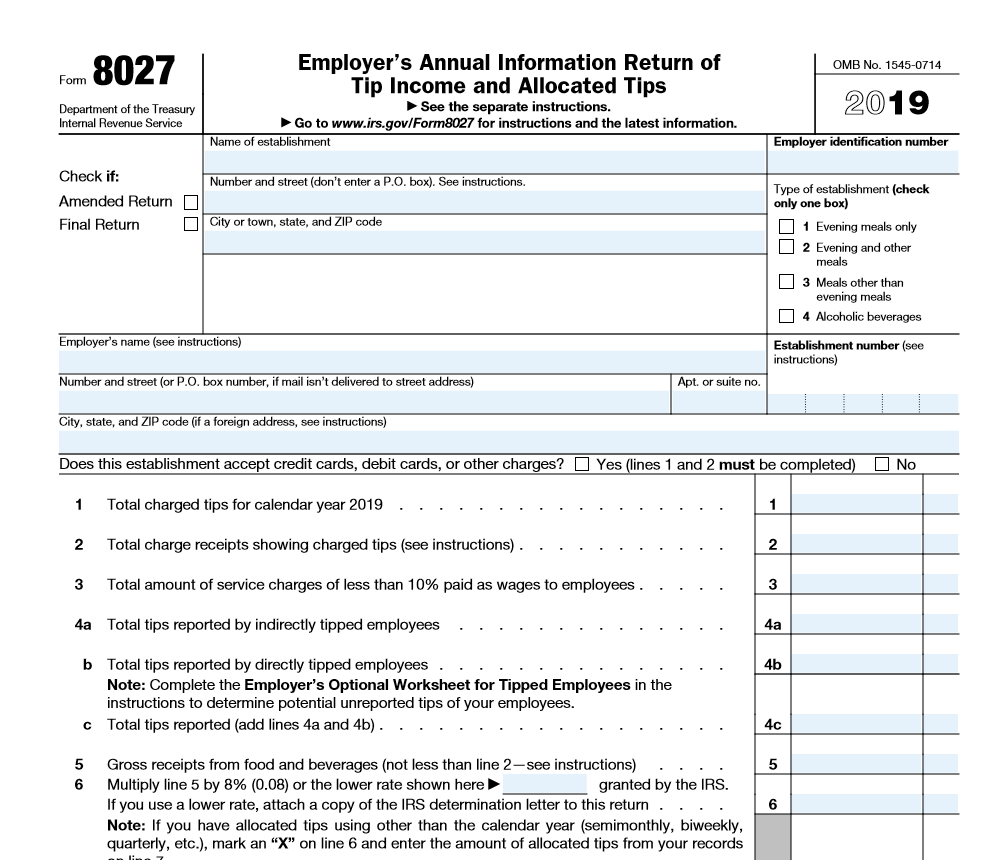

8027 Form 2022 - Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Web worksheet for determining if you must file form 8027 for calendar year 2022; Web what is form 8027? Extension of time to file. Edit, sign and save irs tip income tax return form. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Irs form 8027, or the employer’s annual information return of tip income and allocated tips, is used to report annual tip income. Web what is form 8027? Web we last updated federal form 8027 from the internal revenue service in december 2022. Web the form 8027, employer's annual information report of tip income and allocated tips is an information return that is required by law to be filed annually by certain large food and.

Complete, edit or print tax forms instantly. The form did not contain substantive. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated federal form 8027 from the internal revenue service in december 2022. Show sources > about the corporate income tax the irs and most states require. 27 by the internal revenue service. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web what is form 8027? Sign it in a few clicks draw your signature, type it,. Ad complete irs tax forms online or print government tax documents.

27 by the internal revenue service. How to file 8027 instructions for easy reporting 8027 online. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Get ready for tax season deadlines by completing any required tax forms today. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Form 8027 is an annual report that is filed to the irs containing the receipts and tips from large food or beverage establishments. Tip income and allocated tips. Box number, if mail isn’t delivered to street address) apt. Web form 8027 is an irs document certain food service businesses use to report their employees' tips to the irs each year. Number of accompanying forms 8027 city or town, state, and.

Do you need to File Form 8027? Stub Creator

Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Number of accompanying forms 8027 city or town, state, and. Web what is form 8027? Sign it in a few clicks draw your signature, type it,. Get ready for tax season deadlines by completing any required tax forms today.

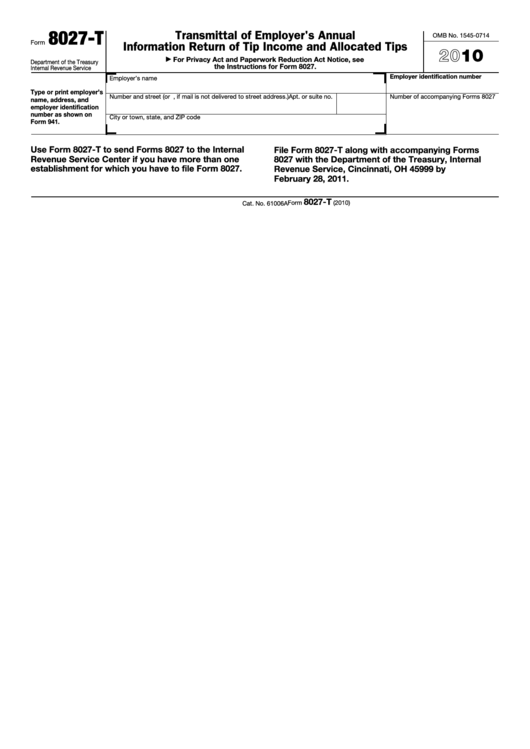

Fillable Form 8027T Transmittal Of Employer'S Annual Information

The form did not contain substantive. Web form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see the separate instructions. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web form 8027 is an irs document certain food service businesses use to report their employees' tips to.

W4 Form 2023 Instructions

Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web what is form 8027? Sign it in a few clicks draw your signature, type it,. Employer's annual information return of.

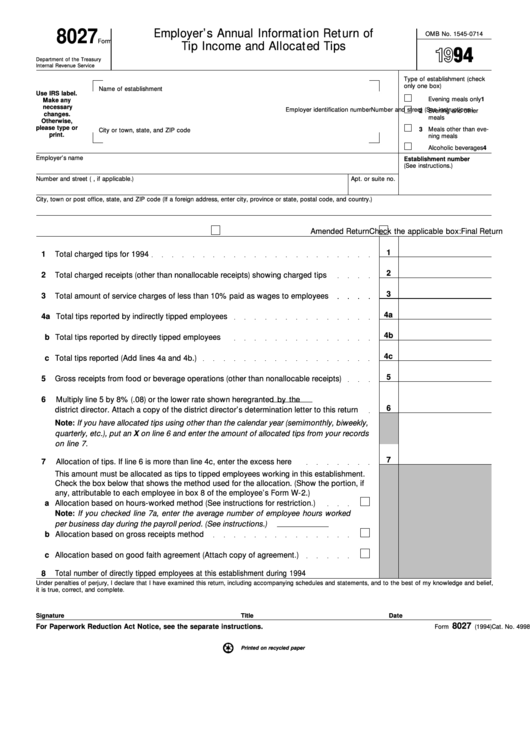

Form 8027 Employer'S Annual Information Return Of Tip And

Box number, if mail isn’t delivered to street address) apt. Show sources > about the corporate income tax the irs and most states require. Web form 8027 is an irs document certain food service businesses use to report their employees' tips to the irs each year. Ad access irs tax forms. Web form 8027 department of the treasury internal revenue.

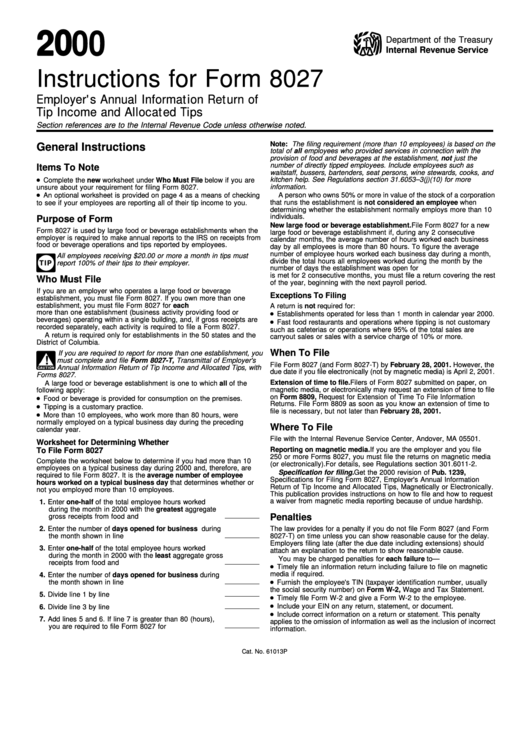

Instructions For Form 8027 printable pdf download

Get ready for tax season deadlines by completing any required tax forms today. Web we last updated federal form 8027 from the internal revenue service in december 2022. The form did not contain substantive. Ad complete irs tax forms online or print government tax documents. Form 8027 is an annual report that is filed to the irs containing the receipts.

Form 8027T Transmittal of Employer's Annual Information Return (2015

Ad complete irs tax forms online or print government tax documents. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web we last updated federal form 8027 from the internal revenue service in december 2022. Number of accompanying forms 8027 city or town, state, and. Show sources > about the corporate income tax.

Instructions For Form 8027 printable pdf download

Ad complete irs tax forms online or print government tax documents. Employer's annual information return of. Box number, if mail isn’t delivered to street address) apt. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Get ready for tax season deadlines by completing any required tax forms today.

Download Instructions for IRS Form 8027 Employer's Annual Information

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Form 8027 is an annual report that is filed to the irs containing the receipts and tips from large food or beverage establishments. Ad complete irs tax forms online or print government tax documents. Ad access irs tax forms. Web the internal revenue service (irs) uses.

Payroll Forms Employers Need

Web the form 8027, employer's annual information report of tip income and allocated tips is an information return that is required by law to be filed annually by certain large food and. Get ready for tax season deadlines by completing any required tax forms today. The form did not contain substantive. Number of accompanying forms 8027 city or town, state,.

3.11.180 Allocated Tips Internal Revenue Service

Web we last updated federal form 8027 from the internal revenue service in december 2022. Web the 2022 version of form 8027, which allows employers to report tips and receipts, was released oct. Sign it in a few clicks draw your signature, type it,. Web what is form 8027? Extension of time to file.

Web Worksheet For Determining If You Must File Form 8027 For Calendar Year 2022;

27 by the internal revenue service. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the. Tip income and allocated tips. Employer's annual information return of.

Web The 2022 Version Of Form 8027, Which Allows Employers To Report Tips And Receipts, Was Released Oct.

Ad complete irs tax forms online or print government tax documents. Uslegalforms allows users to edit, sign, fill & share all type of documents online. How to file 8027 instructions for easy reporting 8027 online. Complete, edit or print tax forms instantly.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Number of accompanying forms 8027 city or town, state, and. Box number, if mail isn’t delivered to street address) apt. Show sources > about the corporate income tax the irs and most states require. Get ready for tax season deadlines by completing any required tax forms today.

Sign It In A Few Clicks Draw Your Signature, Type It,.

The form did not contain substantive. Edit, sign and save irs tip income tax return form. Web we last updated federal form 8027 from the internal revenue service in december 2022. Ad access irs tax forms.