8233 Tax Form

8233 Tax Form - Therefore, we must obtain irs form 8233 and attachment for. Web the form you are looking for begins on the next page of this file. You must complete a form 8233 for each tax year. ( for a copy of a form, instruction, or publication) address to mail form to irs: As a result, you owe. Web employer's quarterly federal tax return. How does a tax treaty work? Web 314 rows form 8233 is valid for only one (1) year. (if you have applied for, or will apply for, an itin through the payroll office leave blank) line 3. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty.

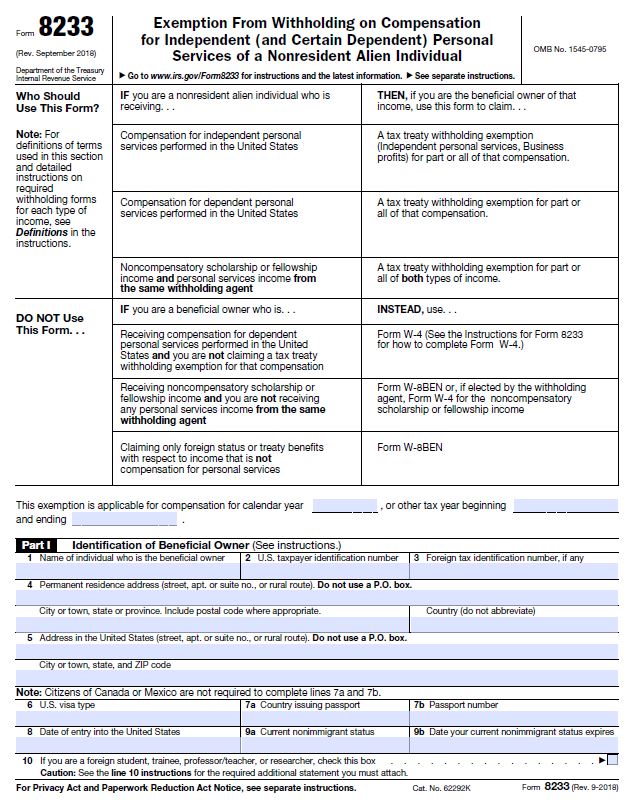

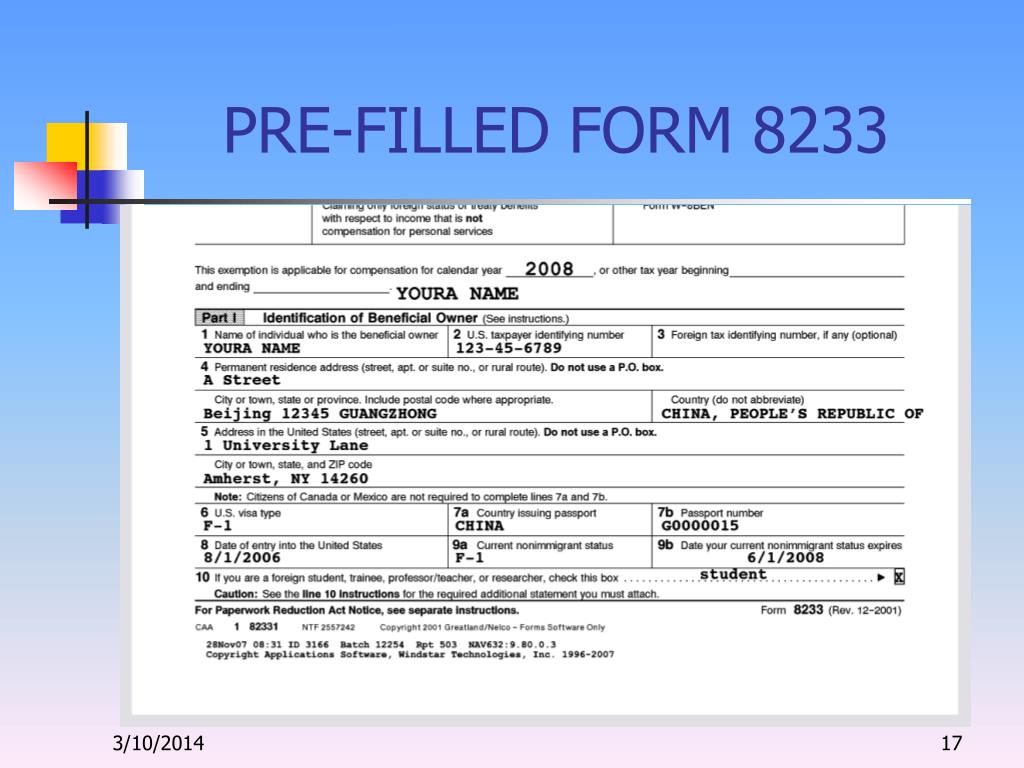

Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for reporting purposes and to document their status for tax reporting purpose. $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another tax year, and payments received with an extension to file, if any. Every year, countless nonresidents ask us what form 8233 is used for. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web what is form 8233 and what is its purpose? The payee has a u.s. Web a tax treaty withholding exemption for part all of that compensation. Form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a. Social security number (ssn) or individual taxpayer identification number (itin), the payee is from a country. Web 314 rows form 8233 is valid for only one (1) year.

Ad access irs tax forms. Form 843, claim for refund and request for abatement. You must complete a form 8233 for each tax year. Do not use form 8233 to claim the daily personal exemption amount. A nonresident alien is primarily present in the united. Before viewing it, please see the important update information below. $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another tax year, and payments received with an extension to file, if any. As a result, you owe. Form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty.

Form 8233 Edit, Fill, Sign Online Handypdf

Web 314 rows form 8233 is valid for only one (1) year. Web you can use form 8233 to claim a tax treaty withholding exemption for noncompensatory scholarship or fellowship income only if you are also claiming a tax treaty withholding exemption for compensation for personal services (including compensatory scholarship. Web what is form 8233 and what is its purpose?.

International Tax Forms When to Use Form 8233 — Video Lorman

Web what is form 8233 and what is its purpose? A nonresident alien is primarily present in the united. Form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a. How does a tax treaty work? Ad access irs tax forms.

IRS Form 8233 (printable .pdf file)

Web changes to your 2017 form 1040a amount due: The payee has a u.s. Web giving form 8233 to the withholding agent.— complete a separate form 8233 for each type of income and give it to each withholding agent for review. Form 843, claim for refund and request for abatement. Taxpayer identification number on the form 8233.

IRS Form 8233 "Exemption From Withholding on Compensation" MAY be

Web the form you are looking for begins on the next page of this file. How does a tax treaty work? Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Ad access irs tax forms. This form is used if an employee.

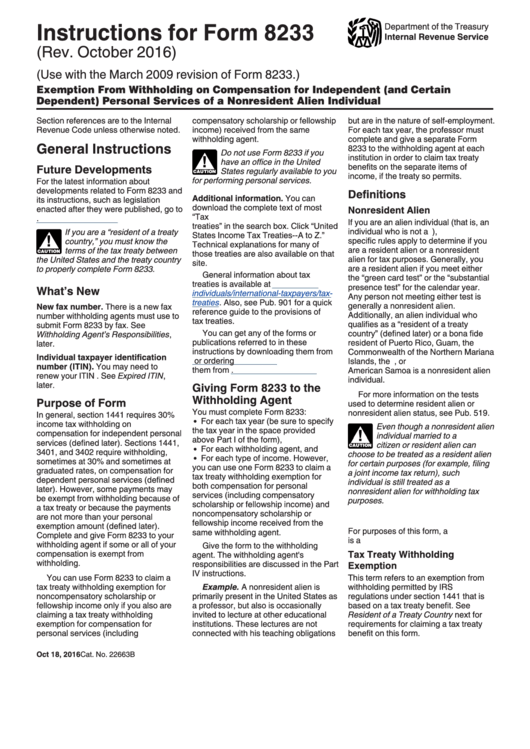

Instructions For Form 8233 2016 printable pdf download

Who should use this form? Web please note that you are required to furnish a u.s. Web form 8233 is a federal individual income tax form. Do not use form 8233 to claim the daily personal exemption amount. You must complete a form 8233 for each tax year.

IRS 8233 2001 Fill out Tax Template Online US Legal Forms

A nonresident alien is primarily present in the united. Web giving form 8233 to the withholding agent.— complete a separate form 8233 for each type of income and give it to each withholding agent for review. As a result, you owe. The payee has a u.s. Complete irs tax forms online or print government tax documents.

5 US Tax Documents Every International Student Should Know

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web please note that you are required to furnish a u.s. By filing form 8233, they are looking to claim an exemption from federal income tax withholding (fitw) based on a tax treaty..

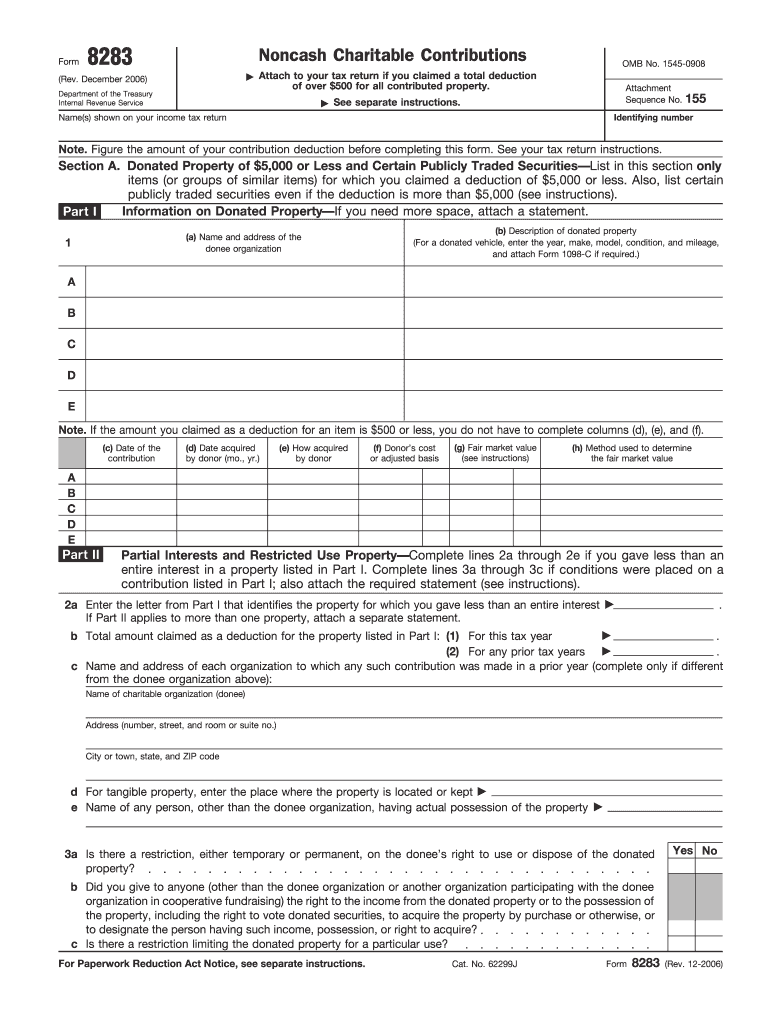

2006 Form IRS 8283 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a. How does a tax treaty work? Taxpayer identification number on the form 8233. Complete, edit or print tax forms instantly. Web 314 rows form 8233 is valid for only one (1) year.

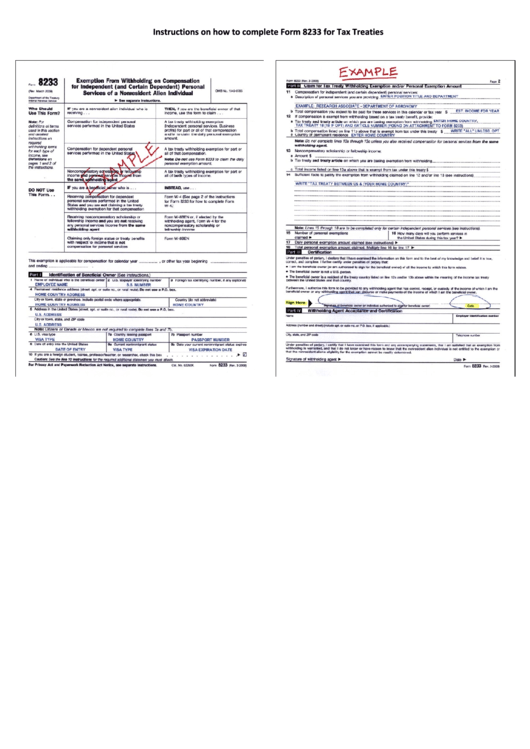

Instructions On How To Complete Form 8233 For Tax Treaties printable

Web what is form 8233 and what is its purpose? Taxpayer identification number on the form 8233. ( for a copy of a form, instruction, or publication) address to mail form to irs: Form 8233 ( exemption from withholding on compensation for independent and certain dependent personal services of a. Ad access irs tax forms.

PPT Taxes & Treaties for International Student Employees PowerPoint

Social security number (ssn) or individual taxpayer identification number (itin), the payee is from a country. As a result, you owe. Web giving form 8233 to the withholding agent.— complete a separate form 8233 for each type of income and give it to each withholding agent for review. Web please note that you are required to furnish a u.s. You.

Web You Can Use Form 8233 To Claim A Tax Treaty Withholding Exemption For Noncompensatory Scholarship Or Fellowship Income Only If You Are Also Claiming A Tax Treaty Withholding Exemption For Compensation For Personal Services (Including Compensatory Scholarship.

This form is used if an employee is a resident of another country that has a tax treaty with the us that exempts the employee from some or all. Web what is form 8233 and what is its purpose? Web giving form 8233 to the withholding agent.— complete a separate form 8233 for each type of income and give it to each withholding agent for review. Web please note that you are required to furnish a u.s.

Ad Access Irs Tax Forms.

Every year, countless nonresidents ask us what form 8233 is used for. $500.73 we changed your 2017 form 1040a to match our record of your estimated tax payments, credits applied from another tax year, and payments received with an extension to file, if any. (if you have applied for, or will apply for, an itin through the payroll office leave blank) line 3. Addresses for mailing certain forms have changed since the forms were last published.

Web The Corporate Payroll Services Is Required To File A Completed Irs Form 8233 And Attachment With The Internal Revenue Service Each Year For All Foreign Nationals Claiming A Tax Treaty Exemption.

For definitions of terms used in this section and detailed instructions on required withholding. Web the form you are looking for begins on the next page of this file. Social security number (ssn) or individual taxpayer identification number (itin), the payee is from a country. Form 843, claim for refund and request for abatement.

Web Employer's Quarterly Federal Tax Return.

Web a tax treaty withholding exemption for part all of that compensation. You must complete a form 8233 for each tax year. The payee has a u.s. Therefore, we must obtain irs form 8233 and attachment for.