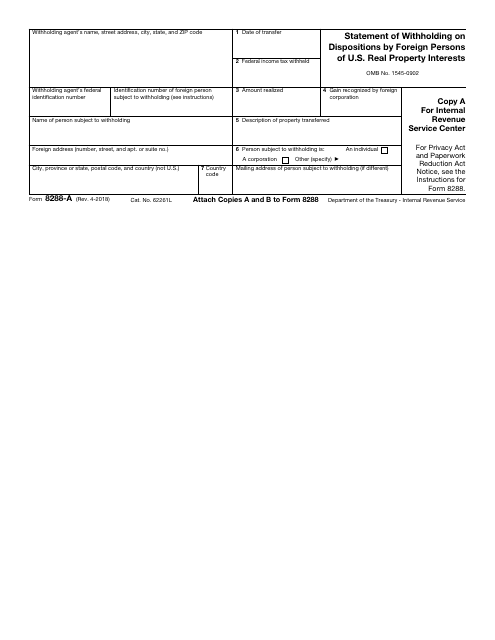

8288 A Form

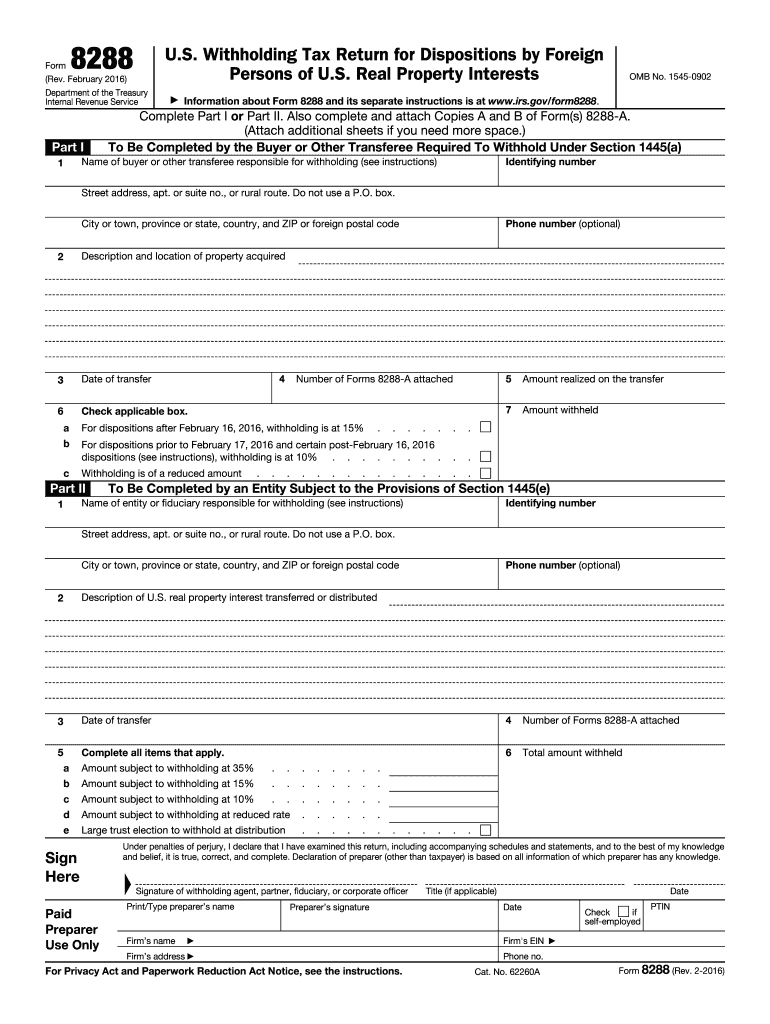

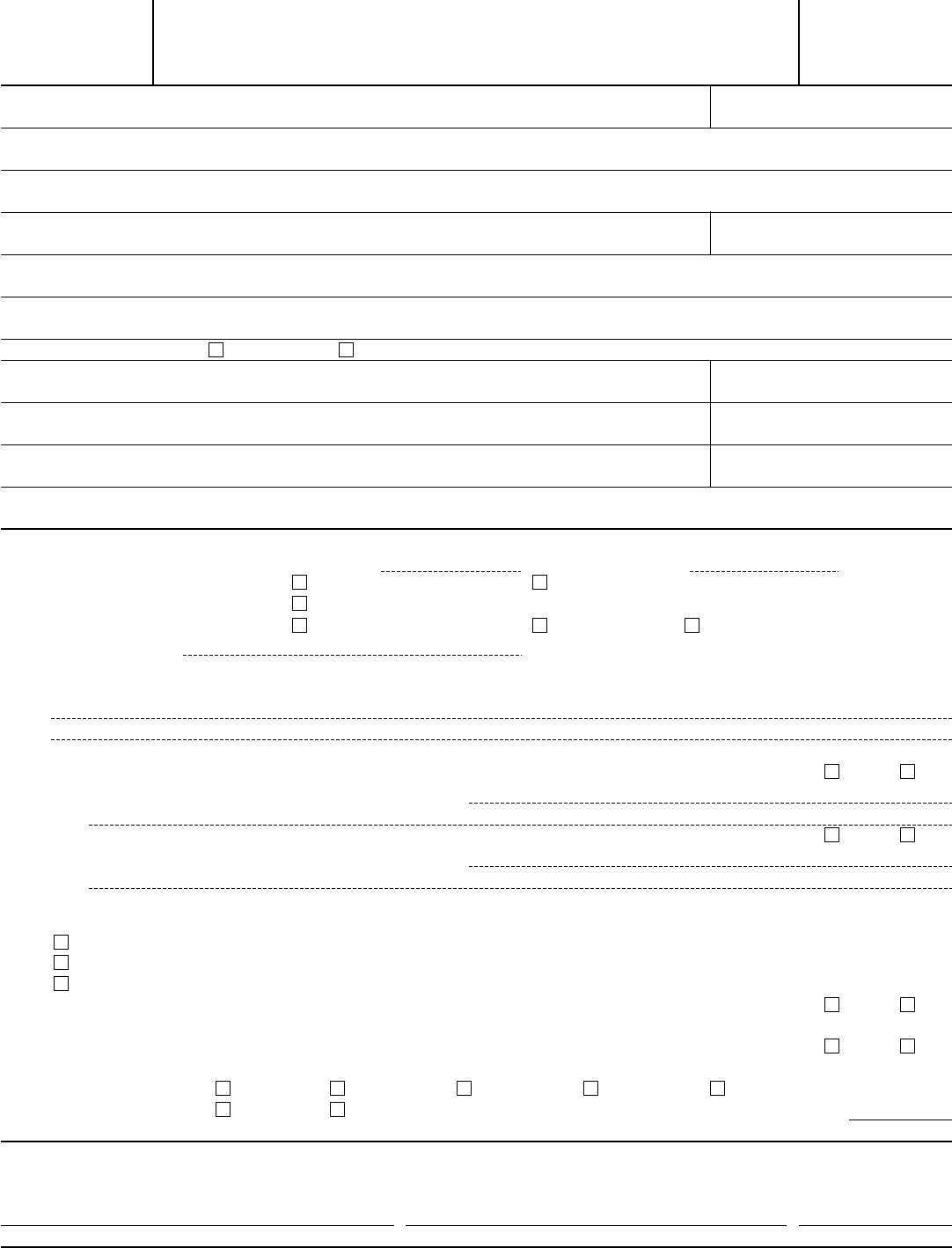

8288 A Form - Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. To report withholding on the amount realized. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Buyers and transferees use this form with form 8288 for each foreign person that disposes of real property located in the u. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Copy c is for your records. Real property interests) for each person subject to withholding. The foreign owner can be a single person, a group of investors, or a corporation. Real property interests | internal revenue service

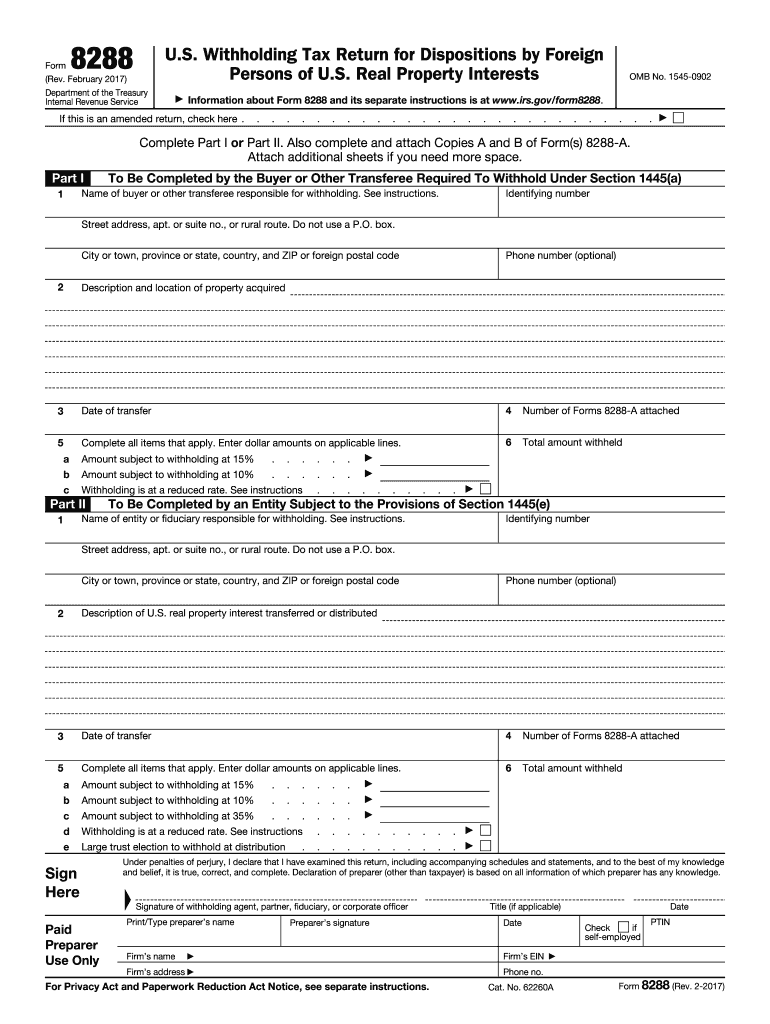

Real property interests by foreign persons to the irs: Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Applying for an early refund. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Copy c is for your records. Copy c is for your records. Real property interests | internal revenue service Buyers and transferees use this form with form 8288 for each foreign person that disposes of real property located in the u. Real property interests) for each person subject to withholding. If this is a corrected return, check here.

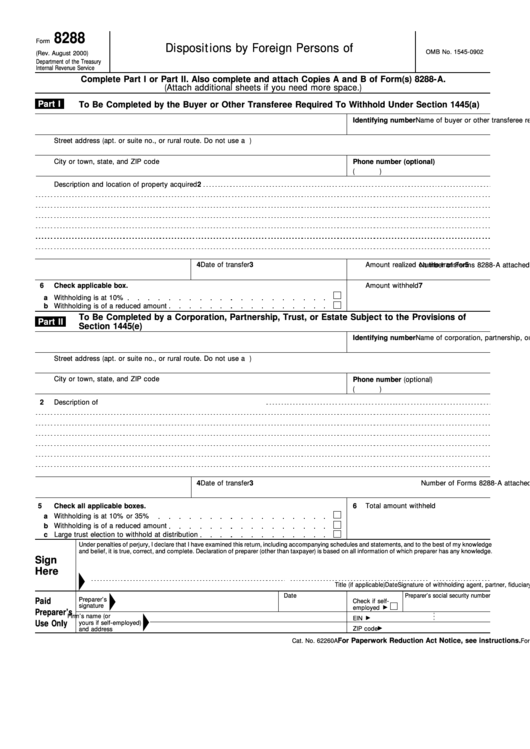

Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Real property interests) for each person subject to withholding. Buyers and transferees use this form with form 8288 for each foreign person that disposes of real property located in the u. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. Withholding tax return for dispositions by foreign persons of. If this is a corrected return, check here. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Copy c is for your records. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. The foreign owner can be a single person, a group of investors, or a corporation.

Fill Free fillable Form 8288 U.S. Withholding Tax Return PDF form

To report withholding on the amount realized. Real property interests by foreign persons to the irs: You must file a u.s. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Withholding tax return for dispositions by foreign persons of.

IRS Form 8288 Withholding Taxes on Purchase of U.S. Real Estate from

Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Withholding tax return for dispositions by foreign persons of. Real property interests by foreign persons to the irs: If this is a corrected return, check here. You must file a u.s.

Form 8288 U.s. Withholding Tax Return For Dispositions By Foreign

Applying for an early refund. Real property interests by foreign persons to the irs: Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes.

2017 Form IRS 8288 Fill Online, Printable, Fillable, Blank pdfFiller

Applying for an early refund. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Web an 8288 tax form is a tax form that tells the irs how much money you are.

IRS Form 8288A Download Fillable PDF or Fill Online Statement of

Withholding tax return for dispositions by foreign persons of. Real property interests by foreign persons to the irs: Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Real property interests) for each person subject to withholding. Real property interests | internal revenue service

Irs Form 8288 Fill Out and Sign Printable PDF Template signNow

Applying for an early refund. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Withholding tax return for dispositions by foreign persons of. Copy c is for your records. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations.

Form 8288B FIRPTA and reduced withholding

Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. Copy c is for your records. Buyers and transferees use this form with form 8288 for each foreign person that disposes of real property located in the.

Form 8288B Edit, Fill, Sign Online Handypdf

Withholding tax return for dispositions by foreign persons of. Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Applying for an early refund. The foreign owner can.

Form 8288B Application for Withholding Certificate for Dispositions

The foreign owner can be a single person, a group of investors, or a corporation. Copy c is for your records. Applying for an early refund. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. If this is a corrected return, check here.

3.21.261 Foreign Investment in Real Property Tax Act (FIRPTA

Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. The foreign owner can be a single person, a group of investors, or a corporation. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy.

Copy C Is For Your Records.

You must file a u.s. Withholding tax return for dispositions by foreign persons of. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Real property interests) for each person subject to withholding.

Buyers And Transferees Use This Form With Form 8288 For Each Foreign Person That Disposes Of Real Property Located In The U.

If this is a corrected return, check here. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. Real property interests | internal revenue service Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations.

Web Foreign Persons Use This Form To Apply For A Withholding Certificate To Reduce Or Eliminate Withholding On Dispositions Of U.s.

To report withholding on the amount realized. Real property interests by foreign persons to the irs: Copy c is for your records. Applying for an early refund.

The Foreign Owner Can Be A Single Person, A Group Of Investors, Or A Corporation.

Web two forms are generally used for reporting and paying the tax required to be withheld on the dispositions of u.s.