8825 Form Irs

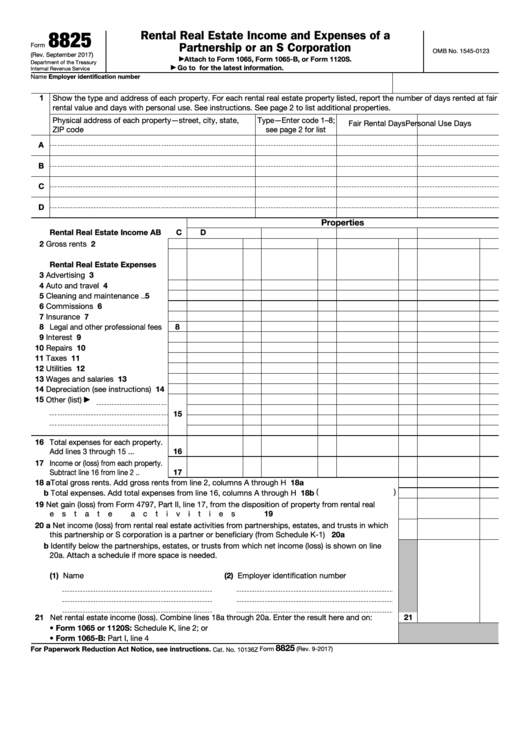

8825 Form Irs - Web entering guaranteed payments for form 8825, schedule f, or other rental. Rental real estate income and expenses of a partnership or an s corporation. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Web the irs form 8825 is an important tax document that partnerships and s corporations can file. December 2010) department of the treasury internal revenue service. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located. This article covers the purpose of form 8825 and the instructions for form 8825. Ad download or email irs 8825 & more fillable forms, register and subscribe now! The form allows you to record. Get ready for tax season deadlines by completing any required tax forms today.

Web form 8825 is used by partnerships and s corps to report income and deductible expenses from rental real estate activities. Complete, edit or print tax forms instantly. You can enter guaranteed payments on. Web entering guaranteed payments for form 8825, schedule f, or other rental. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Ad download or email irs 8825 & more fillable forms, register and subscribe now! Web the irs form 8825 is an important tax document that partnerships and s corporations can file. Download or email irs 8825 & more fillable forms, register and subscribe now! When using irs form 8825, determine the number of months the property was in service by dividing the fair rental days by 30. Complete, edit or print tax forms instantly.

This article covers the purpose of form 8825 and the instructions for form 8825. Download or email irs 8825 & more fillable forms, register and subscribe now! It is also used to report net income. When using irs form 8825, determine the number of months the property was in service by dividing the fair rental days by 30. Evaluate each property listed on form 8825, as shown below: Sign in to the editor with your credentials or click create free account to. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web entering guaranteed payments for form 8825, schedule f, or other rental. Web form 8825 is used by partnerships and s corps to report income and deductible expenses from rental real estate activities. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located.

Form 8825 Rental Real Estate and Expenses of a Partnership or

You can enter guaranteed payments on. Web make these fast steps to edit the pdf irs form 8825 online for free: Evaluate each property listed on form 8825, as shown below: The form allows you to record. Web follow this guideline to correctly and quickly fill in irs 8825.

2020 Form IRS Instruction 1040 Schedule E Fill Online, Printable

Fill in all required lines. Sign up and log in to your account. Rental real estate income and expenses of a partnership or an s corporation. Complete, edit or print tax forms instantly. Web follow this guideline to correctly and quickly fill in irs 8825.

Form 8825 ≡ Fill Out Printable PDF Forms Online

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Click on the button get form to open it and begin editing. Get ready for tax season deadlines by completing any required tax forms today. Web form 8825 is used by partnerships and.

3.11.15 Return of Partnership Internal Revenue Service

Fill in all required lines. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web the irs form 8825 is an important tax document that partnerships and s corporations can file. Solved • by intuit • 31 • updated july 13, 2022.

IRS Form 8825 Fill out & sign online DocHub

Ad access irs tax forms. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Sign up and log in to your account. Web the irs form 8825 is an important tax document that partnerships and s corporations can file. The form allows you to record.

IRS Form 8825 Rental Real Estate and Expenses of a Partnership

Sign in to the editor with your credentials or click create free account to. When using irs form 8825, determine the number of months the property was in service by dividing the fair rental days by 30. Ad download or email irs 8825 & more fillable forms, register and subscribe now! This article covers the purpose of form 8825 and.

Fillable Form 8825 Rental Real Estate And Expenses Of A

Web entering guaranteed payments for form 8825, schedule f, or other rental. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located. You can enter guaranteed payments on. Web make these fast steps to edit the pdf irs.

How to fill out an LLC 1065 IRS Tax form

Sign up and log in to your account. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. Books or records relating to a form or its. Fill.

Fill Free fillable Form 8825 Rental Real Estate and Expenses

The form allows you to record. Ad download or email irs 8825 & more fillable forms, register and subscribe now! Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web follow this guideline to correctly and quickly fill in irs 8825. Web partnerships and s corporations.

Form 8821 Fillable Fill Out and Sign Printable PDF Template signNow

Evaluate each property listed on form 8825, as shown below: Ad access irs tax forms. Solved • by intuit • 31 • updated july 13, 2022. Rental real estate income and expenses of a partnership or an s corporation. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or.

Click On The Button Get Form To Open It And Begin Editing.

Rental real estate income and expenses of a partnership or an s corporation. Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Web form 8825 is used by partnerships and s corps to report income and deductible expenses from rental real estate activities.

Ad Download Or Email Irs 8825 & More Fillable Forms, Register And Subscribe Now!

You can enter guaranteed payments on. Web make these fast steps to edit the pdf irs form 8825 online for free: Download or email irs 8825 & more fillable forms, register and subscribe now! It is also used to report net income.

Fill In All Required Lines.

Evaluate each property listed on form 8825, as shown below: Sign in to the editor with your credentials or click create free account to. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Web the irs form 8825 is an important tax document that partnerships and s corporations can file.

Complete, Edit Or Print Tax Forms Instantly.

Books or records relating to a form or its. December 2010) department of the treasury internal revenue service. Web form 8825 will generate as blank if a number is entered in the if disposition applies to rental, enter rental number (enter as a negative if not real estate) field located. Solved • by intuit • 31 • updated july 13, 2022.