8862 Form 2022

8862 Form 2022 - Web on the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no, none of these apply and i need to. Earned income credit (eic), child tax credit (ctc), refundable child. Web add the form 8862 (rev. Go to www.irs.gov/form8962 for instructions and the. Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Web solved•by intuit•8•updated january 10, 2023. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Married filing jointly vs separately. Get ready for tax season deadlines by completing any required tax forms today.

Web on the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no, none of these apply and i need to. Web solved•by intuit•8•updated january 10, 2023. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Guide to head of household. Information to claim earned income credit after disallowance to your return. Web how do i enter form 8862? Web tax tips & video homepage. Web to resolve this rejection, you'll need to add form 8862: Please see the faq link. Web filing tax form 8862:

Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for. Go to www.irs.gov/form8962 for instructions and the. Married filing jointly vs separately. Web solved•by intuit•8•updated january 10, 2023. Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies. Complete, edit or print tax forms instantly. Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed.

Top 14 Form 8862 Templates free to download in PDF format

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Information to claim earned income credit after disallowance to your return. You can generate form 8862, information to claim certain credits after disallowance, in the individual module. Information to.

20192022 Form IRS 886HDEP Fill Online, Printable, Fillable, Blank

Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Click the new document option above, then drag and drop. Web follow the simple.

Top 14 Form 8862 Templates free to download in PDF format

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web solved•by intuit•8•updated january 10, 2023. Web follow the simple instructions below: Go to screen 77.1, eic/ctc/aoc after disallowances (8862). You can generate form 8862, information to claim certain credits after disallowance, in the individual.

8862

Web tax tips & video homepage. Go to www.irs.gov/form8962 for instructions and the. Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Ad download or email irs 8862 & more fillable forms, try for free now! Ad download or email irs 8862 & more fillable forms, register and subscribe now!

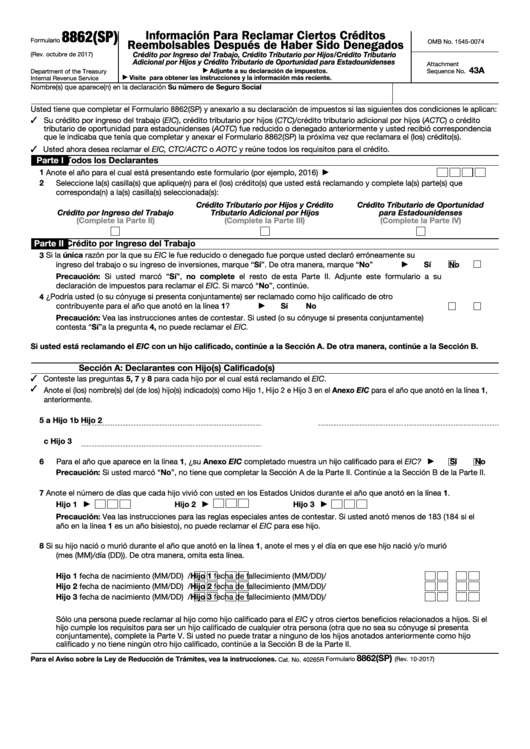

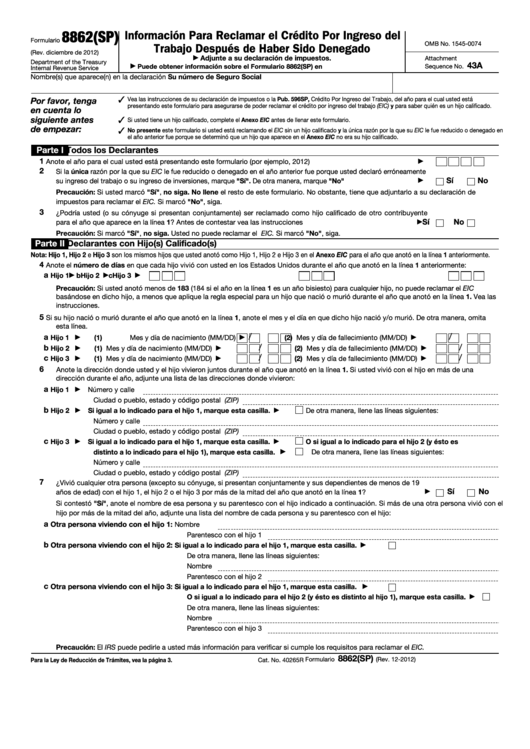

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for. If the irs rejected one or more of these credits: Web add the form 8862 (rev. Web solved•by intuit•8•updated january 10, 2023. Ad download or email irs 8862 & more fillable forms, register and subscribe now!

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Enter the appropriate number in qualifying children: Get ready for tax season deadlines by completing any required tax forms today. Information to claim certain credits after disallowance for redacting. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web more from h&r block.

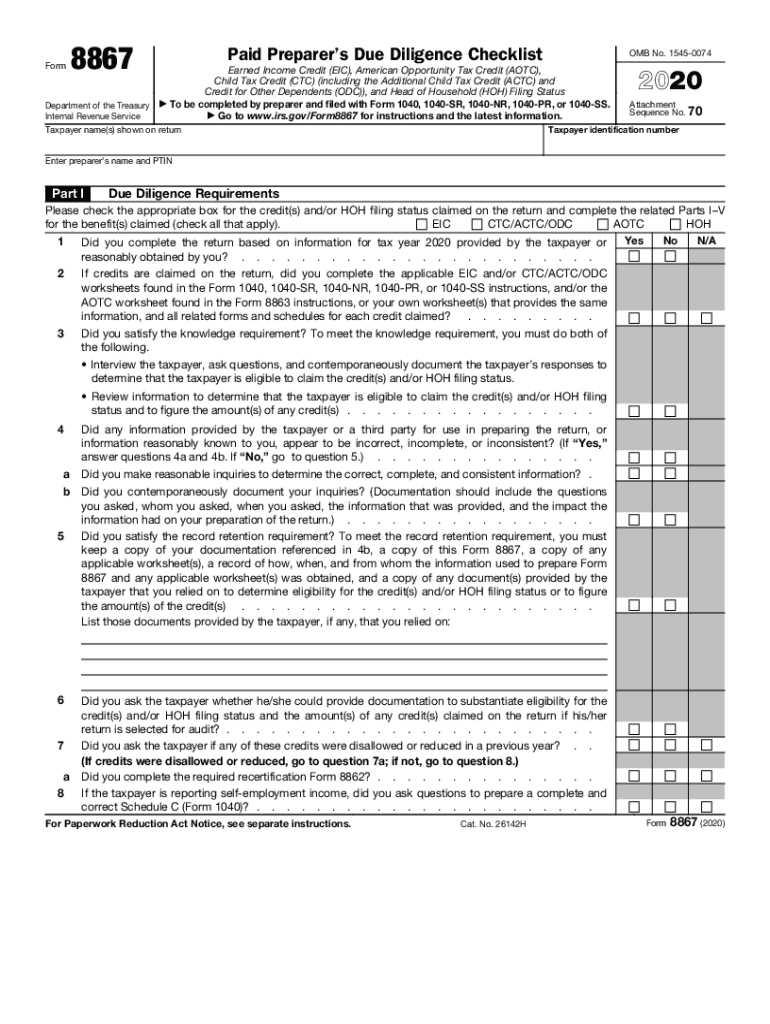

IRS 8867 2020 Fill out Tax Template Online US Legal Forms

Web form 8862 federal — information to claim earned income credit after disallowance download this form print this form it appears you don't have a pdf plugin for this. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Ad download or email irs 8862 & more fillable forms, register and subscribe now!.

How to claim an earned credit by electronically filing IRS Form 8862

Web filing tax form 8862: Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Go to www.irs.gov/form8962 for instructions and the. Web to resolve this rejection, you'll need to add form 8862: Information to claim earned income credit after disallowance.

2022 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Go to www.irs.gov/form8962 for instructions and the..

Fill Free fillable F8862 Form 8862 (Rev. November 2018) PDF form

Information to claim certain credits after disallowance for redacting. Married filing jointly vs separately. Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/form8962 for instructions and the. Web to resolve this rejection, you'll need to add form 8862:

Web On The Since You Got An Irs Notice, We Need To Check If Any Of These Apply To Your Situation Screen, Click The Radio Button Next To No, None Of These Apply And I Need To.

Web solved•by intuit•8•updated january 10, 2023. Web follow the simple instructions below: You can generate form 8862, information to claim certain credits after disallowance, in the individual module. If the irs rejected one or more of these credits:

Ad Download Or Email Irs 8862 & More Fillable Forms, Try For Free Now!

Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Web form 8862 federal — information to claim earned income credit after disallowance download this form print this form it appears you don't have a pdf plugin for this. Click the new document option above, then drag and drop. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for. Information to claim certain credits after disallowance for redacting. Guide to head of household.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Enter the appropriate number in qualifying children: