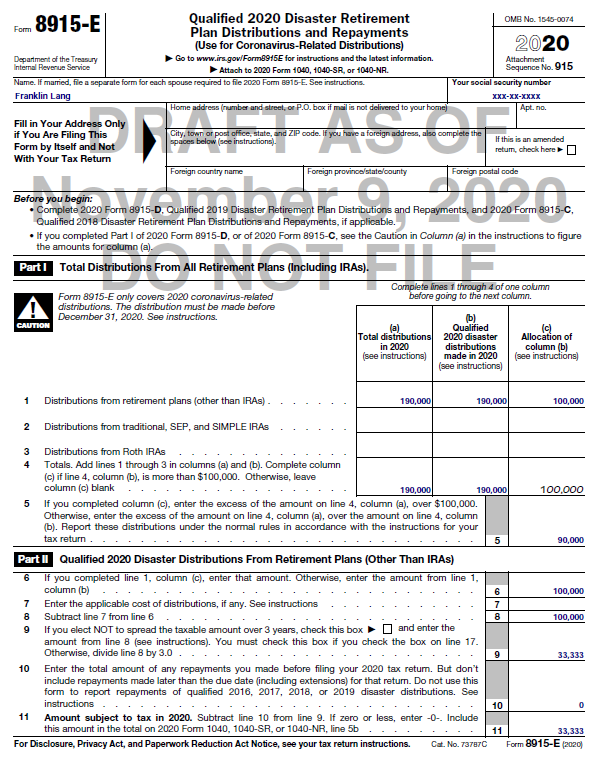

8915-E Form

8915-E Form - Web go to www.irs.gov/form8915e for instructions and the latest information. Try it for free now! This will also include any coronavirus relate. Web if you make a repayment in 2021 after you file your 2020 return, the repayment will reduce the amount of your qualified 2020 disaster distributions included in. Complete, edit or print tax forms instantly. Upload, modify or create forms. From within your taxact return (online or desktop), click federal. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for. Complete, edit or print tax forms instantly. Any distributions you took within the 2021 tax year will be taxable on your federal return.

Web go to www.irs.gov/form8915e for instructions and the latest information. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for. Try it for free now! Complete, edit or print tax forms instantly. Upload, modify or create forms. This will also include any coronavirus relate. From within your taxact return (online or desktop), click federal. Any distributions you took within the 2021 tax year will be taxable on your federal return. Complete, edit or print tax forms instantly. It appears you don't have a pdf plugin for this browser.

It appears you don't have a pdf plugin for this browser. From within your taxact return (online or desktop), click federal. Upload, modify or create forms. Web go to www.irs.gov/form8915e for instructions and the latest information. Complete, edit or print tax forms instantly. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for. Complete, edit or print tax forms instantly. Web if you make a repayment in 2021 after you file your 2020 return, the repayment will reduce the amount of your qualified 2020 disaster distributions included in. Try it for free now! Any distributions you took within the 2021 tax year will be taxable on your federal return.

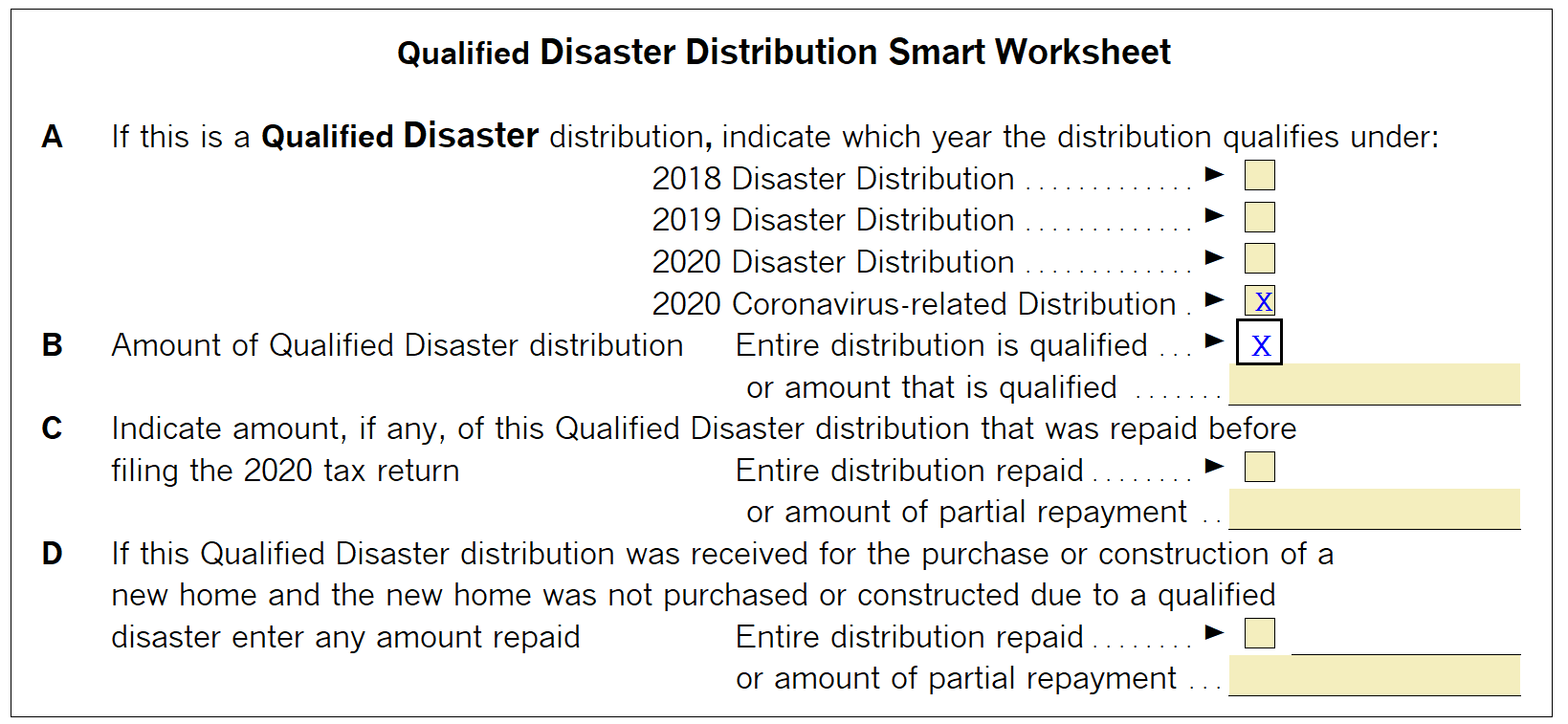

Generating Form 8915E in ProSeries Intuit Accountants Community

Complete, edit or print tax forms instantly. This will also include any coronavirus relate. From within your taxact return (online or desktop), click federal. Complete, edit or print tax forms instantly. Web if you make a repayment in 2021 after you file your 2020 return, the repayment will reduce the amount of your qualified 2020 disaster distributions included in.

Re When will form 8915E 2020 be available in tur... Page 19

From within your taxact return (online or desktop), click federal. Try it for free now! Complete, edit or print tax forms instantly. It appears you don't have a pdf plugin for this browser. Complete, edit or print tax forms instantly.

A Guide to the New 2020 Form 8915E

It appears you don't have a pdf plugin for this browser. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for. Upload, modify or create forms. Web go to www.irs.gov/form8915e for instructions and the latest information. From within your taxact return (online.

Kandy Snell

This will also include any coronavirus relate. Try it for free now! Complete, edit or print tax forms instantly. From within your taxact return (online or desktop), click federal. Upload, modify or create forms.

Tax Newsletter December 2020 Basics & Beyond

Upload, modify or create forms. From within your taxact return (online or desktop), click federal. This will also include any coronavirus relate. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for. Complete, edit or print tax forms instantly.

Wordly Account Gallery Of Photos

Complete, edit or print tax forms instantly. It appears you don't have a pdf plugin for this browser. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on march 27, 2020, provides for special distribution options and rollover rules for. Try it for free now! Web if you make a repayment in 2021 after.

How To Report 2021 COVID Distribution On Taxes Update! Form 8915F

Upload, modify or create forms. Complete, edit or print tax forms instantly. Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any coronavirus relate. From within your taxact return (online or desktop), click federal.

Fill Free fillable Form 8915E Plan Distributions and Repayments

Web go to www.irs.gov/form8915e for instructions and the latest information. It appears you don't have a pdf plugin for this browser. Upload, modify or create forms. Complete, edit or print tax forms instantly. This will also include any coronavirus relate.

Fill Free fillable Form 8915E Plan Distributions and Repayments

Try it for free now! Web if you make a repayment in 2021 after you file your 2020 return, the repayment will reduce the amount of your qualified 2020 disaster distributions included in. It appears you don't have a pdf plugin for this browser. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on.

8915e tax form release date Chaffin

This will also include any coronavirus relate. From within your taxact return (online or desktop), click federal. Any distributions you took within the 2021 tax year will be taxable on your federal return. It appears you don't have a pdf plugin for this browser. Web section 2202 of the coronavirus aid, relief, and economic security act (cares act), enacted on.

Try It For Free Now!

Web if you make a repayment in 2021 after you file your 2020 return, the repayment will reduce the amount of your qualified 2020 disaster distributions included in. This will also include any coronavirus relate. Complete, edit or print tax forms instantly. Web go to www.irs.gov/form8915e for instructions and the latest information.

Complete, Edit Or Print Tax Forms Instantly.

It appears you don't have a pdf plugin for this browser. Upload, modify or create forms. From within your taxact return (online or desktop), click federal. Any distributions you took within the 2021 tax year will be taxable on your federal return.