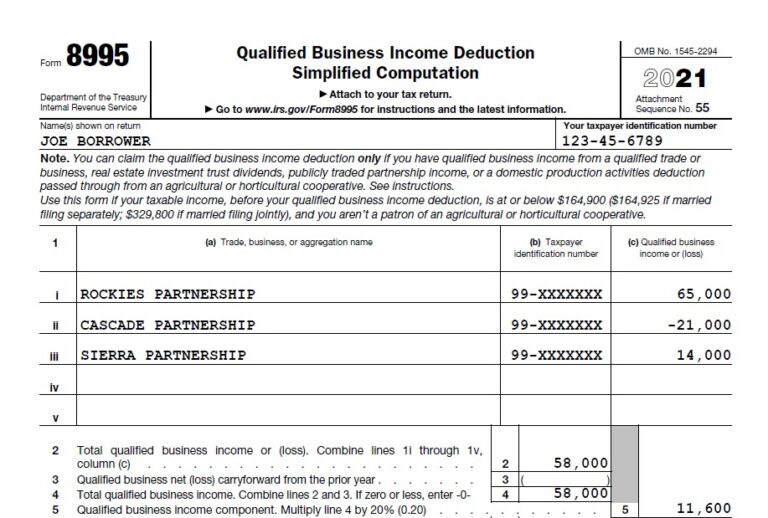

8995 Form 2021

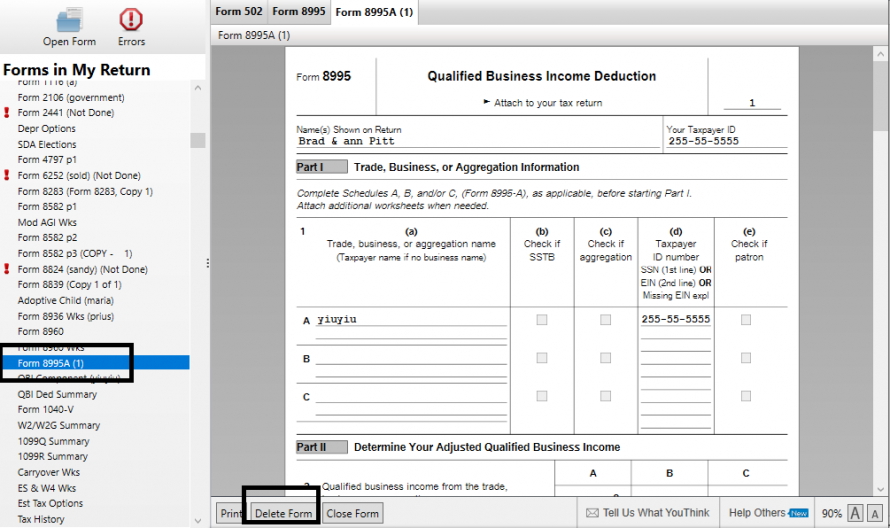

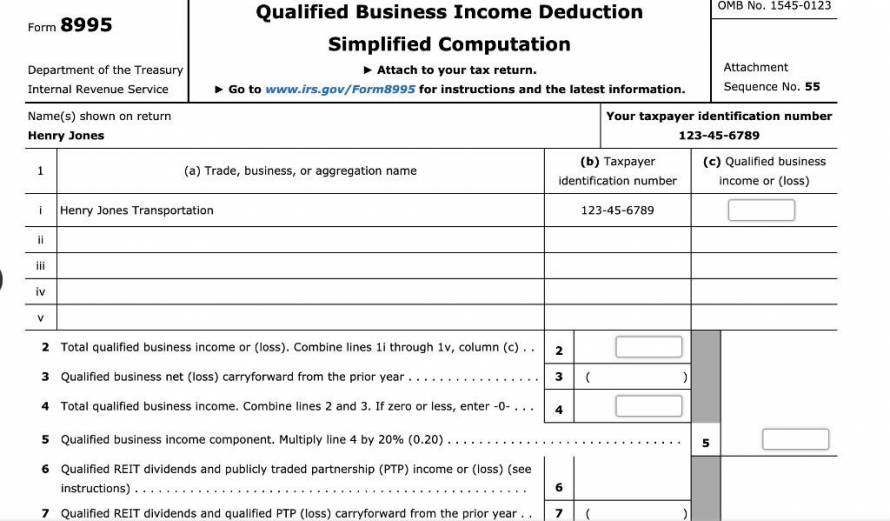

8995 Form 2021 - Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Complete, edit or print tax forms instantly. Web federal tax addition and deduction. Ad register and subscribe now to work on your irs form 8995 & more fillable forms. Web what is form 8995? Upload, modify or create forms. Web great news for small business owners: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Form 8995 and form 8995a.

Web federal tax addition and deduction. Your 20% tax savings is just one form away. Use separate schedules a, b, c, and/or d, as. By completing irs tax form 8995, eligible small business owners can claim. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. You have qbi, qualified reit dividends, or qualified ptp income or loss;. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web great news for small business owners: Complete, edit or print tax forms instantly.

Ad register and subscribe now to work on your irs form 8995 & more fillable forms. Use this form to figure your qualified business income deduction. You have qbi, qualified reit dividends, or qualified ptp income or loss;. Web federal tax addition and deduction. Web great news for small business owners: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Your 20% tax savings is just one form away. Use separate schedules a, b, c, and/or d, as. Form 8995 and form 8995a. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Upload, modify or create forms. Ad register and.

2021 Entry Forms[5299].pdf DocDroid

Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web form 8995 is the simplified form and is used.

Using Form 8995 to Identify Your Borrower's K1s? Think Again! Bukers

Upload, modify or create forms. Enter 50% (.50) of the qualified business income (qbi) deduction claimed on your 2021 federal form 8995, line 15, or. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Form 8995 and form 8995a. Web we last updated the qualified business income deduction.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Web what is form 8995? Use this form to figure your qualified business income deduction. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed.

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Web federal tax addition and deduction. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Try it for free now! Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995,.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

You have qbi, section 199a dividends, or ptp income (defined below), b. By completing irs tax form 8995, eligible small business owners can claim. Written by a turbotax expert •. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Ad register and subscribe now to work on your irs form 8995.

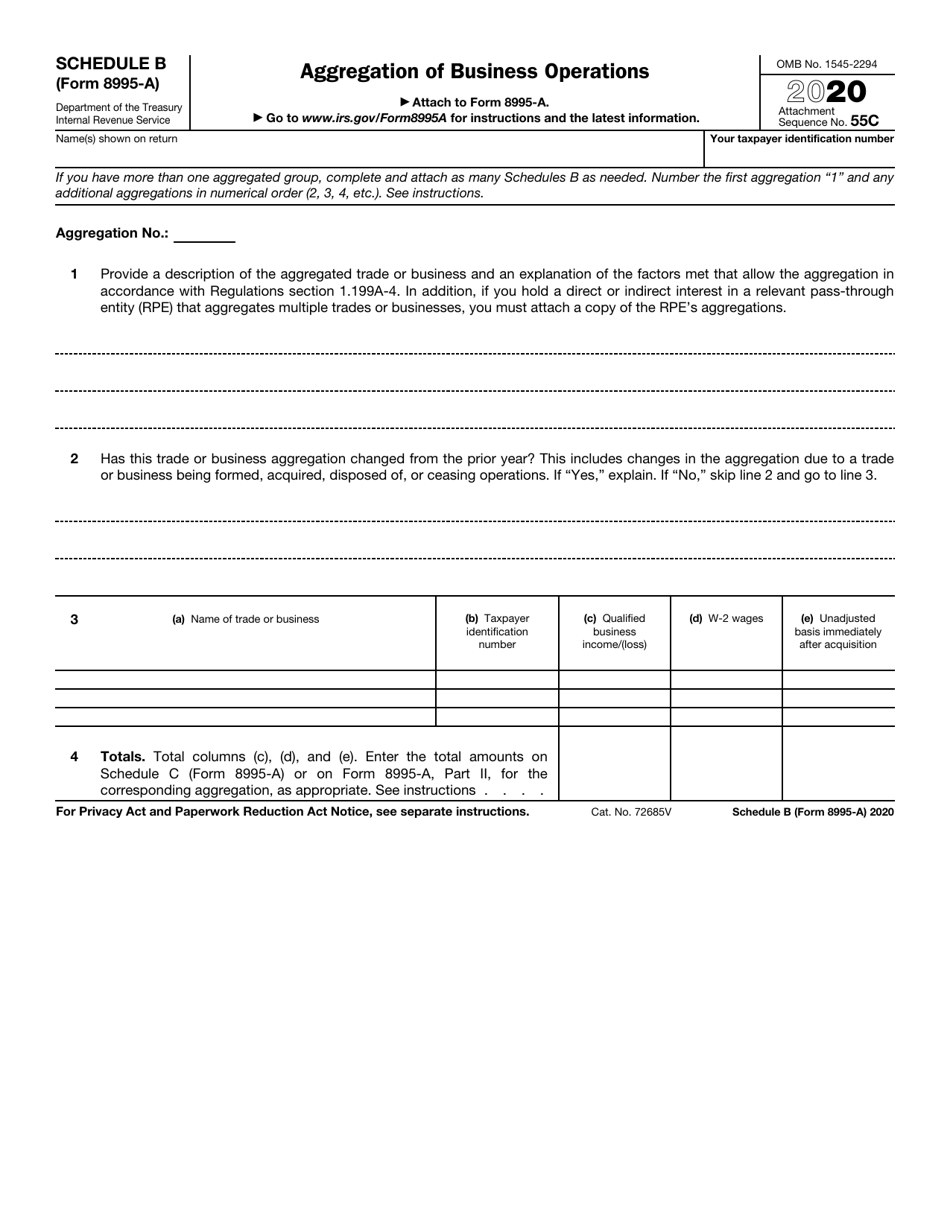

Irs Form 8995a Schedule B Download Fillable Pdf Or Fill Online

Web form 8995 is the simplified form and is used if all of the following are true: Your 20% tax savings is just one form away. You have qbi, qualified reit dividends, or qualified ptp income or loss;. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. You.

8995 Form News Fresh Guides fo 8995 Form Product Blog

Ad register and subscribe now to work on your irs form 8995 & more fillable forms. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Your 20% tax savings is just one form away. You have qbi, section 199a dividends, or ptp income (defined below), b. Web information about form 8995, qualified business income.

Printable Form 8995 Blog 8995 Form Website

Ad register and subscribe now to work on your irs form 8995 & more fillable forms. Web federal tax addition and deduction. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. You have qbi, section 199a dividends, or ptp income (defined below),.

Online Form 8995 Blog 8995 Form Website

Use this form to figure your qualified business income deduction. Your 20% tax savings is just one form away. Form 8995 and form 8995a. Complete, edit or print tax forms instantly. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file.

Web Form 8995 Is A Newly Created Tax Form Used To Calculate The Qualified Business Income Deduction (Qbid).

Who can use form 8995? Upload, modify or create forms. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Ad register and subscribe now to work on your irs form 8995 & more fillable forms.

Web Information About Form 8995, Qualified Business Income Deduction Simplified Computation, Including Recent Updates, Related Forms And Instructions On How To File.

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Use separate schedules a, b, c, and/or d, as. Web what is form 8995?

Your 20% Tax Savings Is Just One Form Away.

By completing irs tax form 8995, eligible small business owners can claim. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web great news for small business owners: Enter 50% (.50) of the qualified business income (qbi) deduction claimed on your 2021 federal form 8995, line 15, or.

Web Use Form 8995, Qualified Business Income Deduction Simplified Computation, If:

Written by a turbotax expert •. Web form 8995 is the simplified form and is used if all of the following are true: Web federal tax addition and deduction. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return.

![2021 Entry Forms[5299].pdf DocDroid](https://www.docdroid.net/file/view/wwCf8sl/2021-entry-forms5299-pdf.jpg)