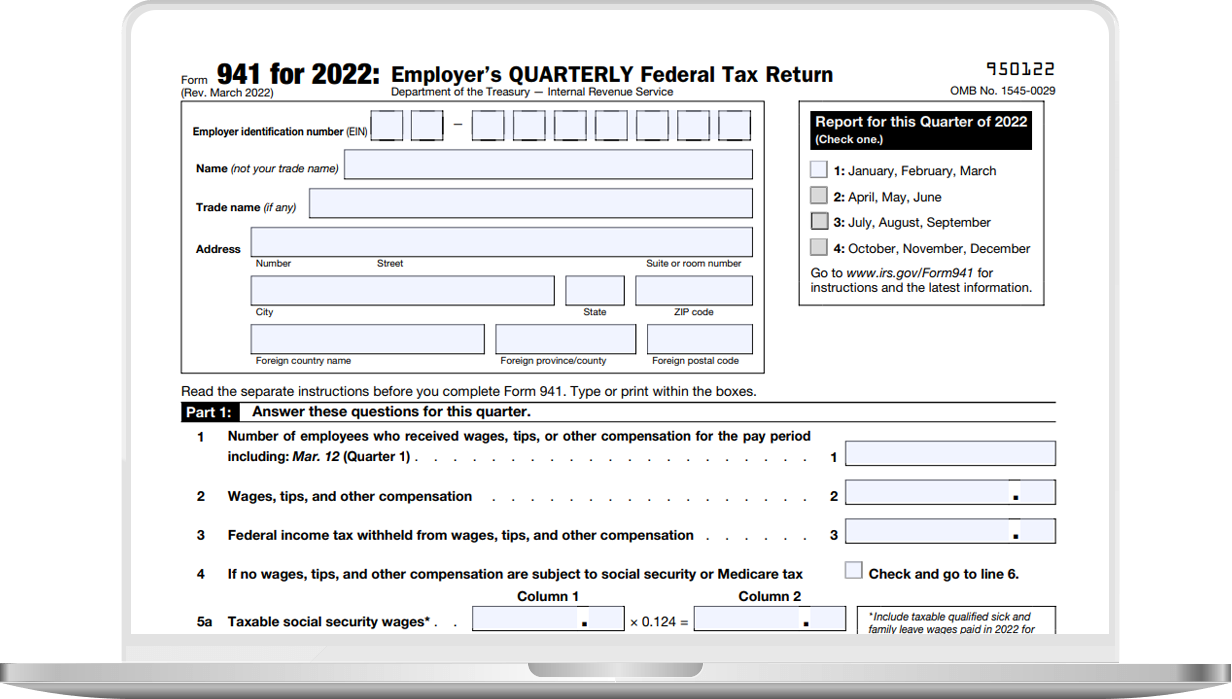

941 For 2020 Fillable Form

941 For 2020 Fillable Form - Enter the irs form 941 2020 in the. Type text, add images, blackout confidential details, add comments, highlights and more. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Edit your 941 tax forms printable online. You should simply follow the instructions: 30 by the internal revenue. It is used to report the total wages paid to employees, total taxes. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Try it for free now! Web form 941 employer's quarterly federal tax return.

We need it to figure and collect the right amount of tax. You should simply follow the instructions: Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. For employers who withhold taxes from employee's paychecks or who must pay. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. April 2020) department of the treasury — internal revenue service employer identification number (ein) name (not your trade name) trade name. Sign it in a few clicks. Choose the income tax form you need. Www.irs.gov/form941 for instructions and the latest information.

Web up to $40 cash back the 941 form is an irs form used to report quarterly payroll tax information for employers. Edit your 941 tax forms printable online. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Ad download or email irs 941 & more fillable forms, register and subscribe now! Enter the irs form 941 2020 in the. It is used to report the total wages paid to employees, total taxes. Sign it in a few clicks. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. We need it to figure and collect the right amount of tax. Web form 941 employer's quarterly federal tax return.

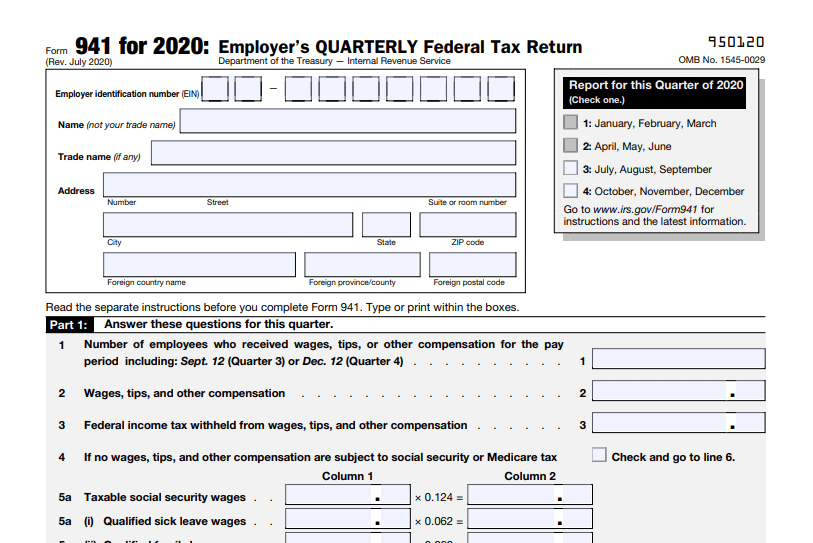

941 Form 2020 941 Forms

Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Www.irs.gov/form941 for instructions and the latest information. Upload, modify or create forms. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Type text, add images, blackout confidential details, add comments, highlights and more.

Form 941 for 20 Employer's Quarterly Federal Tax Return

It is used to report the total wages paid to employees, total taxes. You should simply follow the instructions: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Form 941 is used by employers. Type text, add images, blackout confidential details, add comments, highlights and more.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

It is used to report the total wages paid to employees, total taxes. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Ad download or email irs 941 & more fillable forms, register and subscribe.

EFile Form 941 for 2023 File 941 Electronically at 5.95

30 by the internal revenue. Type text, add images, blackout confidential details, add comments, highlights and more. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Enter the irs form 941 2020 in the. Www.irs.gov/form941 for instructions and the latest information.

Printable 941 Form 2021 Printable Form 2022

Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Try it for free now! Web how to complete a fillable 941 form 2020? July 2020) employer’s quarterly federal tax return 950120 omb no. Web form 940 (2020) employer's annual federal unemployment (futa) tax.

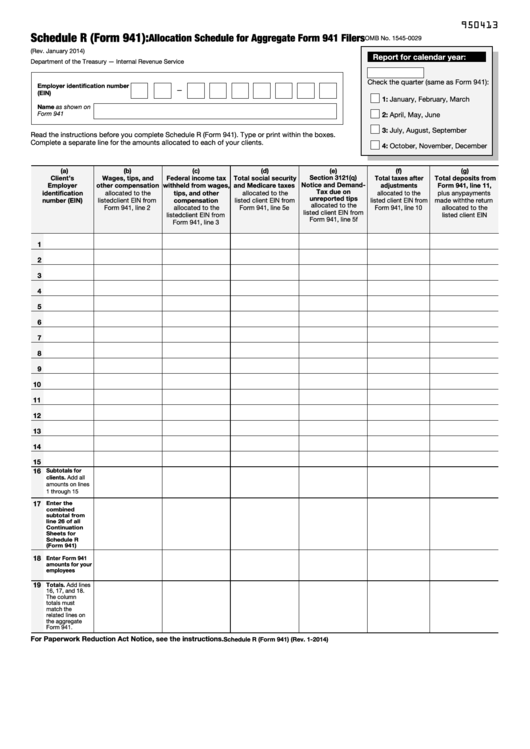

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

Ad most dependable payroll solution for small businesses in 2023 by techradar editors. It is used to report the total wages paid to employees, total taxes. Sign it in a few clicks. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Upload, modify or create forms.

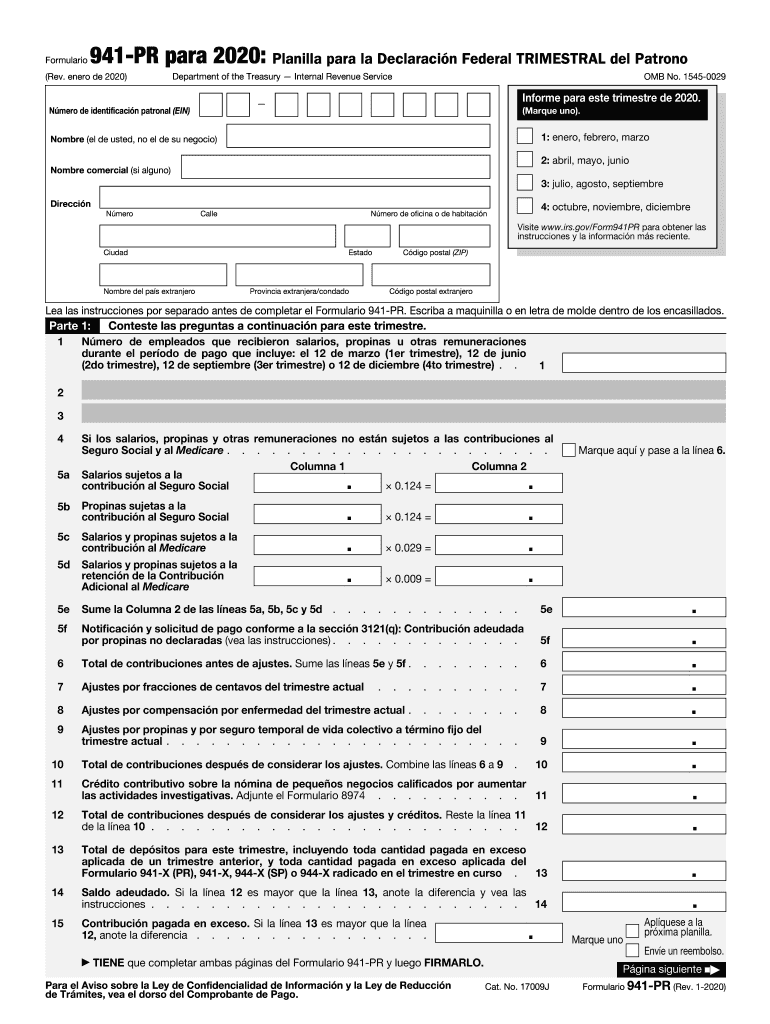

IRS 941PR 20202022 Fill and Sign Printable Template Online US

Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020, to. Www.irs.gov/form941 for instructions and the latest information. April 2020) department of the treasury — internal revenue service employer identification number (ein) name (not your trade name) trade.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Ad download or email irs 941 & more fillable forms, register and subscribe now! Try it for free now! You should simply follow the instructions: Edit your 941 tax forms printable online. Choose the income tax form you need.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Ad download or email irs 941 & more fillable forms, register and subscribe now! Choose the income tax form you need. You should simply follow the instructions: Ad download or email irs 941 & more fillable forms, register and subscribe now!

IRS Fillable Forms 2290, 941, 941X, W2 & 1099 Download & Print

Ad download or email irs 941 & more fillable forms, register and subscribe now! Web form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1, 2020, to. Choose the income tax form you need. Web form 941 for 2020: Web.

Sign It In A Few Clicks.

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. It is used to report the total wages paid to employees, total taxes. Free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept.

Www.irs.gov/Form941 For Instructions And The Latest Information.

Web up to $40 cash back the 941 form is an irs form used to report quarterly payroll tax information for employers. Enter the irs form 941 2020 in the. You should simply follow the instructions: 30 by the internal revenue.

April 2020) Department Of The Treasury — Internal Revenue Service Employer Identification Number (Ein) Name (Not Your Trade Name) Trade Name.

Upload, modify or create forms. July 2020) employer’s quarterly federal tax return 950120 omb no. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Ad download or email irs 941 & more fillable forms, register and subscribe now!

Web About Free File Fillable Forms.

For employers who withhold taxes from employee's paychecks or who must pay. We need it to figure and collect the right amount of tax. Web form 941 employer's quarterly federal tax return. October, november, december go to www.irs.gov/form941 for instructions and the latest.