945 Form Instructions

945 Form Instructions - You should use this form to submit a public charge bond. These instructions give you some background information about form 945. Fill out your company information. You the same name and ein in all reporting and depositing of are not required to file form 945 for those years in which. What is irs form 945 and who should file them? How does form 945 work? Web the new owner will file a new form 945 to report nonpayroll withholdings under their ownership. 4 by the internal revenue service. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your. Try it for free now!

The maximum duration to file and. What is irs form 945 and who should file them? It is due till 31st january each year to report the withholding done for the previous year. A quarter of your gambling winnings will be yours to. How does form 945 work? Fill out your company information. Carefully enter your employer identification number (ein) and name at the top of the. You should use this form to submit a public charge bond. You the same name and ein in all reporting and depositing of are not required to file form 945 for those years in which. Federal income tax withheld on line 1, enter the amount.

Federal income tax withheld on line 1, enter the amount. They tell you who must file form 945, how to. Web address as shown on form 945. Web the new owner will file a new form 945 to report nonpayroll withholdings under their ownership. Upload, modify or create forms. How does form 945 work? You the same name and ein in all reporting and depositing of are not required to file form 945 for those years in which. Fill out your company information. It is due till 31st january each year to report the withholding done for the previous year. The maximum duration to file and.

Form 945 Instructions Fill online, Printable, Fillable Blank

They tell you who must file form 945, how to. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you. Web address as shown on form 945. A quarter of your gambling winnings will be yours to. These instructions give you some background information about form 945.

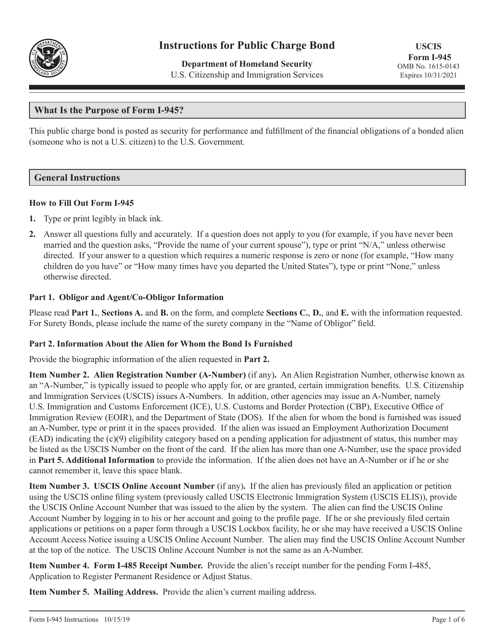

Download Instructions for USCIS Form I945 Public Charge Bond PDF

Upload, modify or create forms. Try it for free now! 4 by the internal revenue service. Irs form 945 is an annual return that summarizes all the federal income taxes you. What is irs form 945 and who should file them?

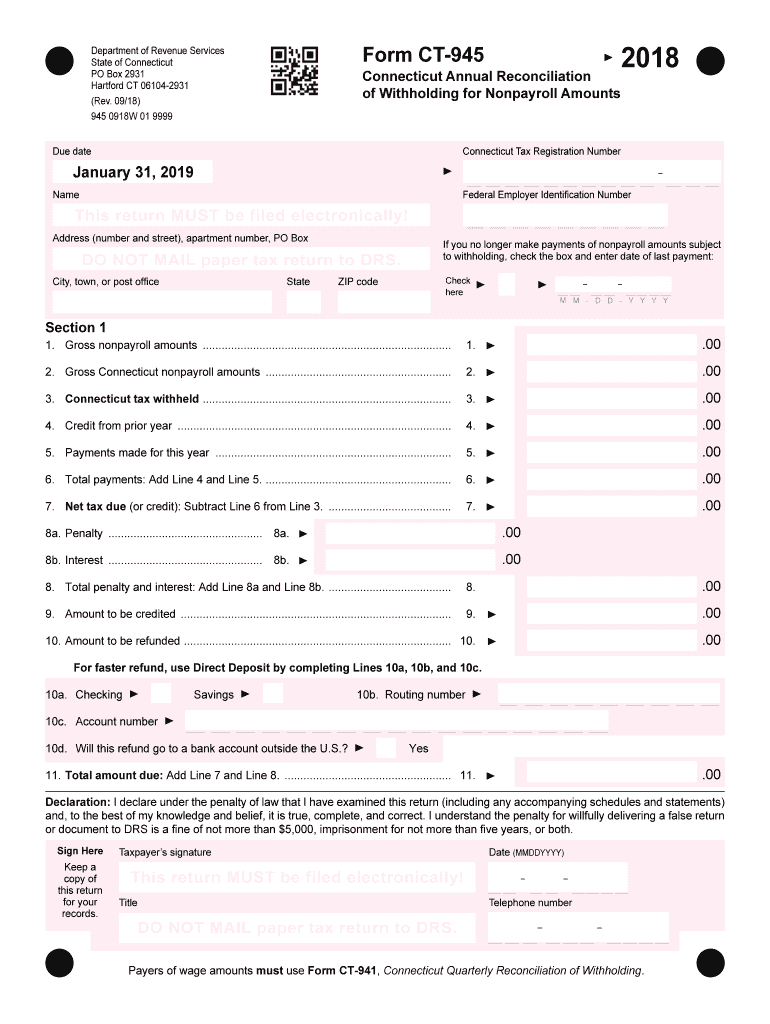

Ct 945 Fill Out and Sign Printable PDF Template signNow

Federal income tax withheld on line 1, enter the amount. Try it for free now! What is irs form 945 and who should file them? A quarter of your gambling winnings will be yours to. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you.

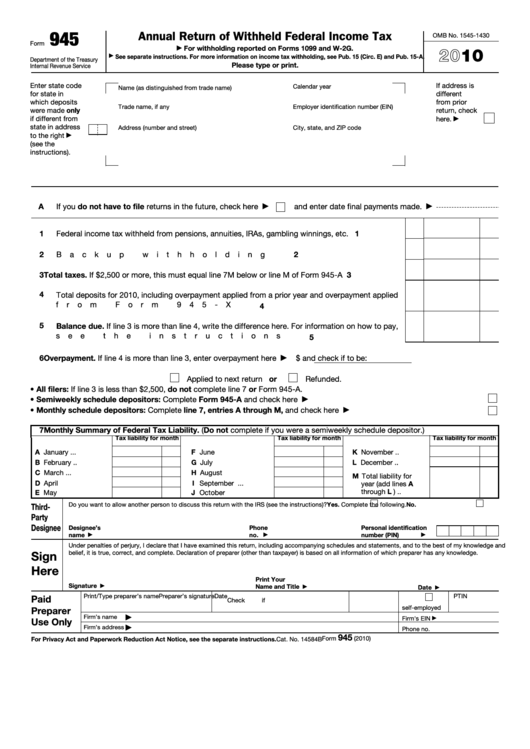

Fillable Form 945 Annual Return Of Withheld Federal Tax 2010

Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you. 4 by the internal revenue service. These instructions give you some background information about form 945. Fill out your company information. It is due till 31st january each year to report the withholding done for the previous year.

Form 945 Annual Return of Withheld Federal Tax Form (2015

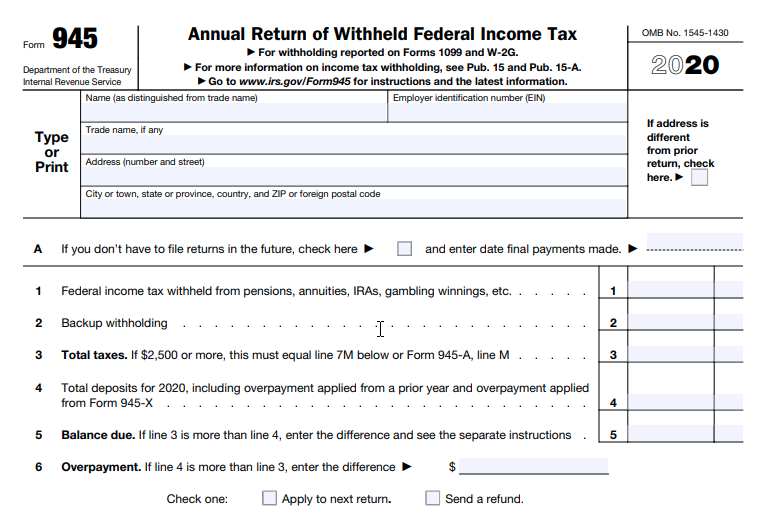

It is due till 31st january each year to report the withholding done for the previous year. Fill out your company information. You the same name and ein in all reporting and depositing of are not required to file form 945 for those years in which. Web the finalized 2020 form 945, annual return of withheld federal income tax, and.

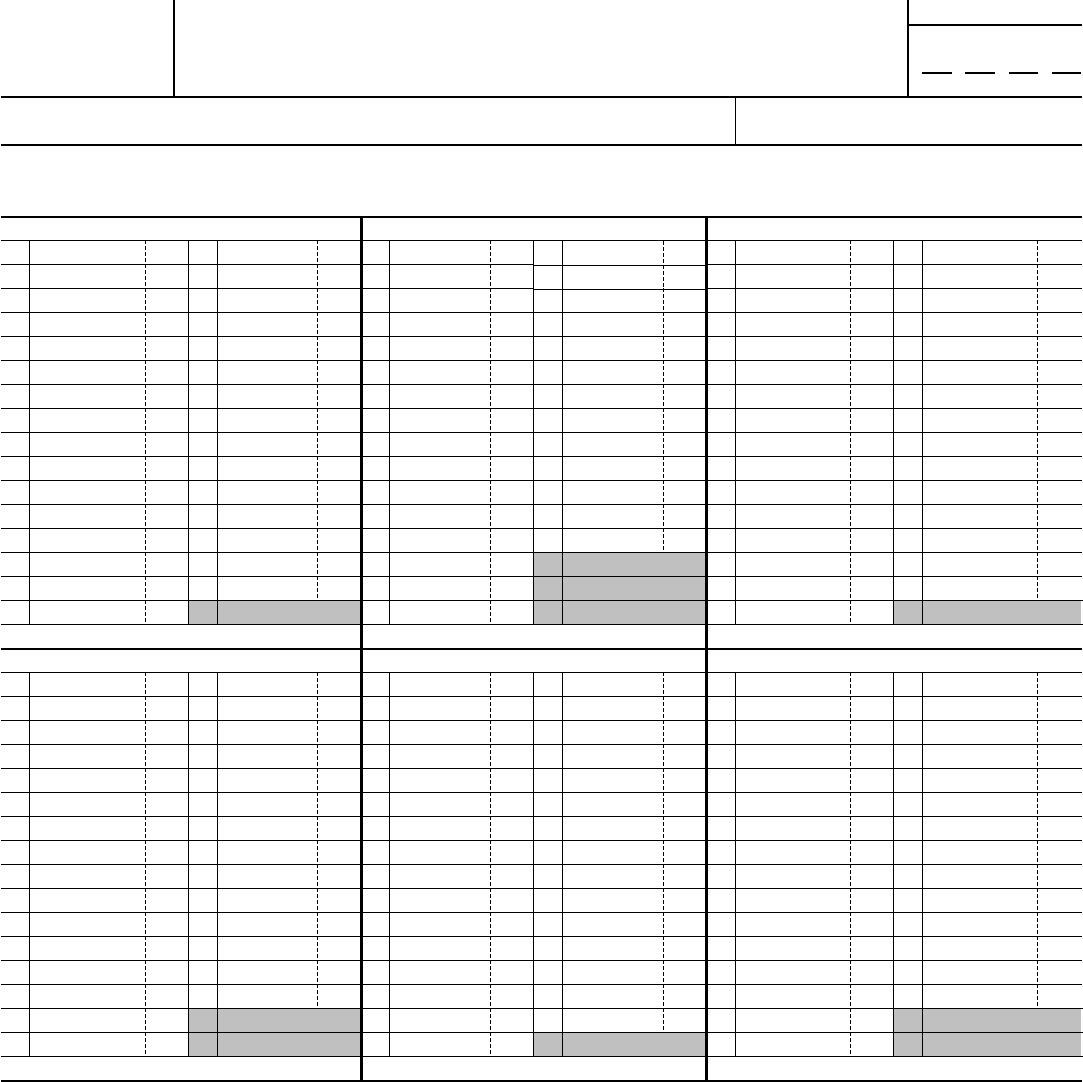

Form 945A Edit, Fill, Sign Online Handypdf

These instructions give you some background information about form 945. The maximum duration to file and. Web if your business awards gambling wins, you must file form 945 to report federal income tax withholding. You the same name and ein in all reporting and depositing of are not required to file form 945 for those years in which. Web address.

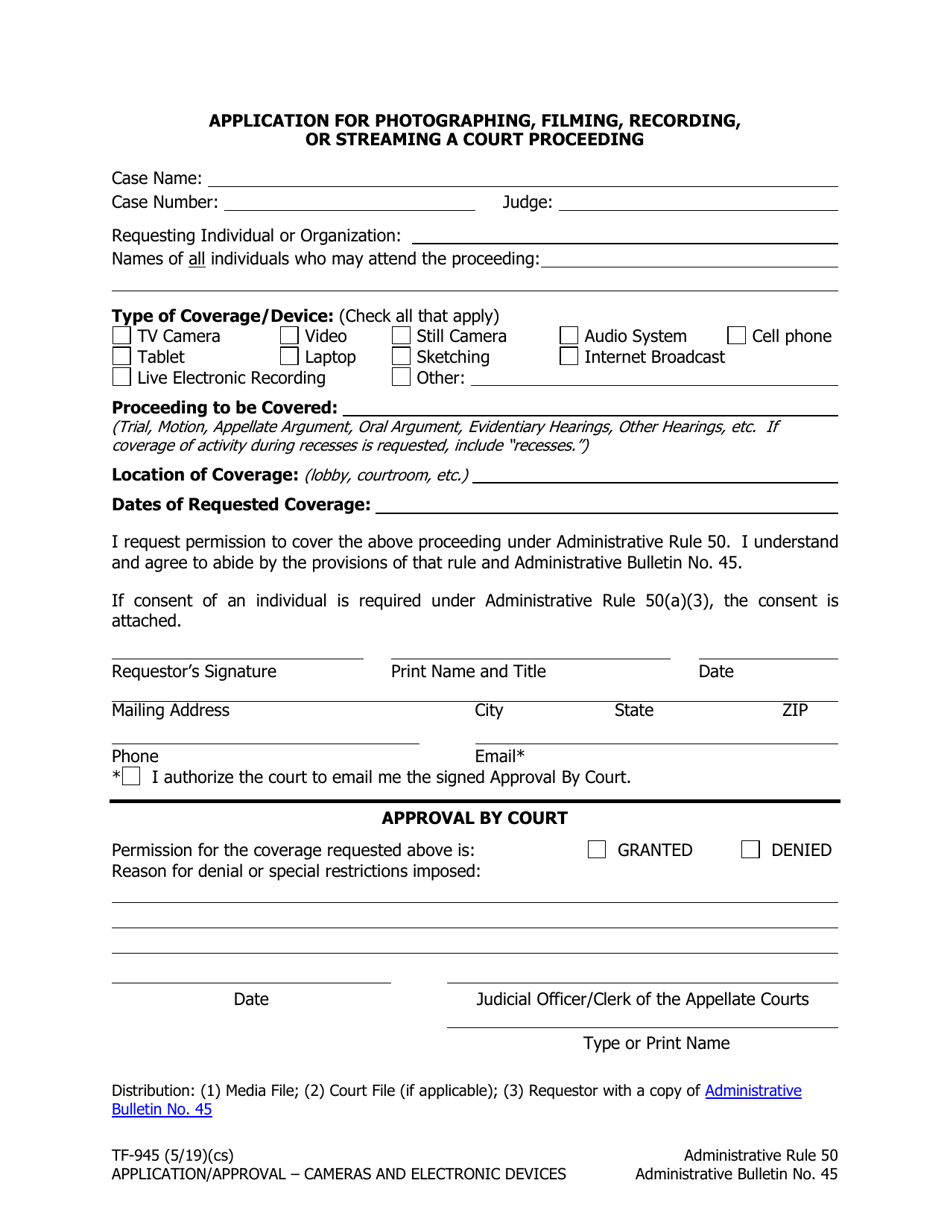

Form TF945 Download Fillable PDF or Fill Online Application for

A quarter of your gambling winnings will be yours to. The maximum duration to file and. Fill out your company information. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you. Specific instructions if you are required to report your tax liabilities on form.

IRS Form 945 instructions How to fill out 945 for 2021

It is due till 31st january each year to report the withholding done for the previous year. Try it for free now! How does form 945 work? Irs form 945 is an annual return that summarizes all the federal income taxes you. Web address as shown on form 945.

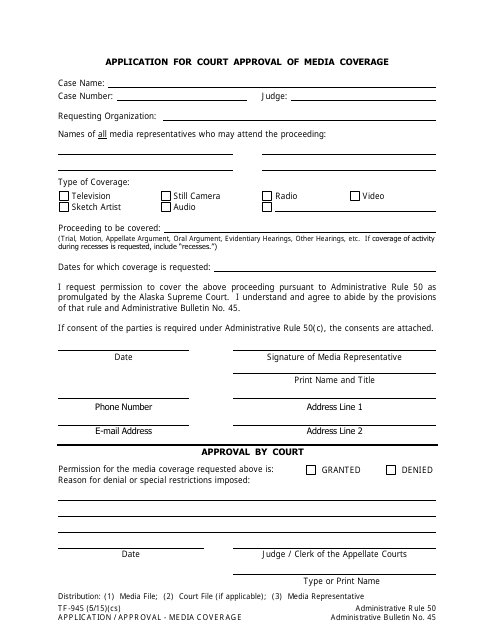

Form TF945 Download Fillable PDF or Fill Online Application for Court

Try it for free now! 4 by the internal revenue service. The maximum duration to file and. Fill out your company information. Web address as shown on form 945.

Form 8879EMP IRS efile Signature Authorization for Forms 940945

Web address as shown on form 945. Web the new owner will file a new form 945 to report nonpayroll withholdings under their ownership. These instructions give you some background information about form 945. If you did not file. You the same name and ein in all reporting and depositing of are not required to file form 945 for those.

A Quarter Of Your Gambling Winnings Will Be Yours To.

Irs form 945 is an annual return that summarizes all the federal income taxes you. Fill out your company information. Carefully enter your employer identification number (ein) and name at the top of the. Web you must file form 945.

Try It For Free Now!

You should use this form to submit a public charge bond. 4 by the internal revenue service. Federal income tax withheld on line 1, enter the amount. The maximum duration to file and.

Web The Finalized 2020 Form 945, Annual Return Of Withheld Federal Income Tax, And Accompanying Instructions Were Released Nov.

Specific instructions if you are required to report your tax liabilities on form. These instructions give you some background information about form 945. It is due till 31st january each year to report the withholding done for the previous year. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you.

If You Did Not File.

What is irs form 945 and who should file them? • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your. How does form 945 work? You the same name and ein in all reporting and depositing of are not required to file form 945 for those years in which.