A Major Advantage Of The Corporate Form Of Ownership Is

A Major Advantage Of The Corporate Form Of Ownership Is - A company organized in the form of a company has an unlimited life. Web answered • expert verified. D) that corporate earnings aren't taxed. A major advantage of the corporate form of ownership is: Which of the following is not a characteristic of a corporation? Web a major advantage of the corporate form of ownership is: A partnership is a corporation with fewer than 100 owners. The major advantage of the corporate form of ownership is limited legal liability which means that the owner is limited to liability up to the tune of the. Major advantage of the corporate form of business. Web transferable ownership rights are a major advantage, not a disadvantage of corporations.

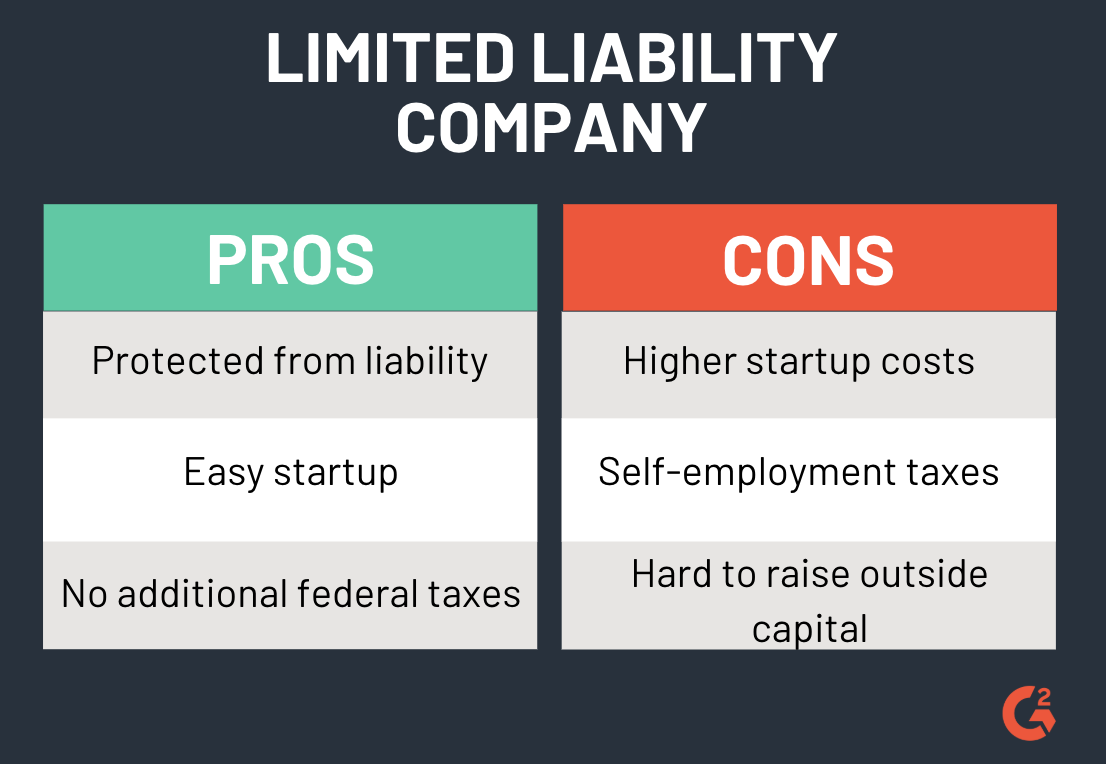

Web the major advantage of the corporate form of ownership is limited legal liability. Web compared to partnerships and sole proprietorships, a major advantage of the c (conventional) corporation as a form of business ownership is that it: D) that corporate earnings aren't taxed. 5 which of the following statements about partnerships is most accurate? A major advantage of the corporate form of ownership is: Web when there is limited liability and a company fails, creditors cannot touch the personal assets of the owners under limited liability. The ease of raising capital as both large and small investors can participate in. Web a major advantage of the corporate form of ownership is legal liability. Ow instructions question 17 a major advantage of the corporate form of ownership is: A partnership is a corporation with fewer than 100 owners.

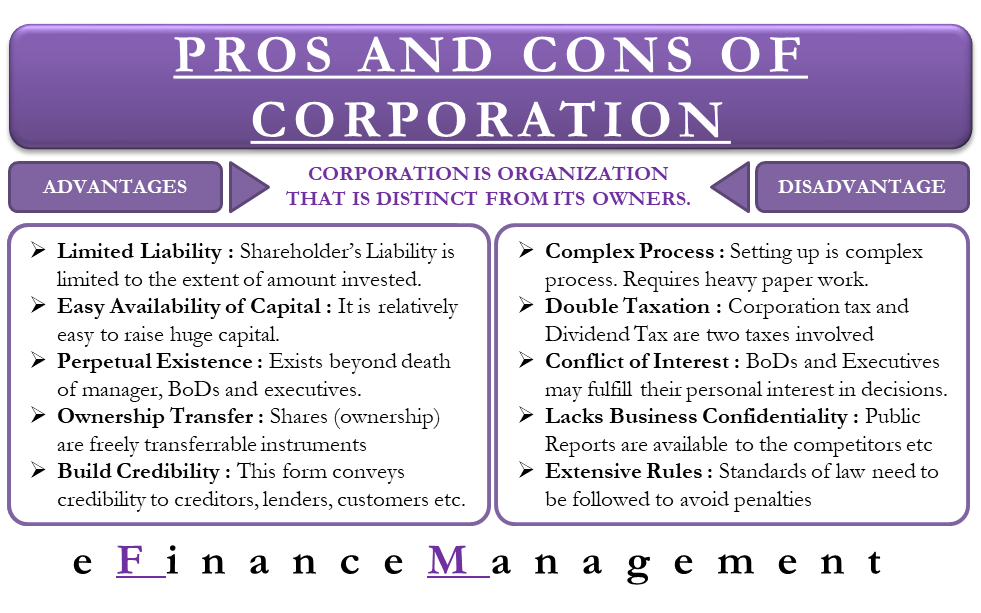

Web accounting questions and answers. The major advantage of the corporate form of ownership is limited legal liability which means that the owner is limited to liability up to the tune of the. Which of the following is not a characteristic of a corporation? Web discuss the advantages and disadvantages of the corporate form of ownership. That corporate eamings aren't taxed until they are. A major advantage of the corporate form of ownership is limited legal liability. 5 which of the following statements about partnerships is most accurate? A company organized in the form of a company has an unlimited life. A major advantage of the corporate form of ownership is: Web incorporation benefits include:

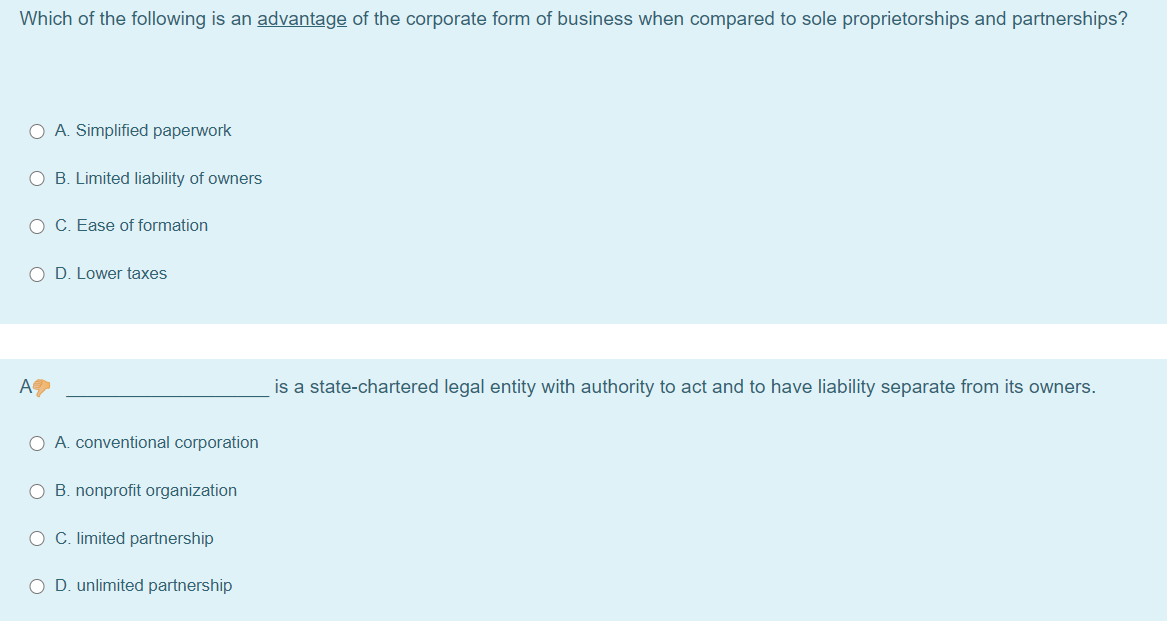

Solved Which of the following is an advantage of the

That corporate earnings aren't taxed until they are distributed to owners as dividends. Establishing a corporation makes the business a separate and self. Ow instructions question 17 a major advantage of the corporate form of ownership is: Which of the following is not a characteristic of a corporation? Web all businesses must have some form of legal ownership, such as.

Advantages and Disadvantages of Corporations

Which of the following is not a characteristic of a corporation? A major advantage of the corporate form of ownership is limited legal liability. D) that corporate earnings aren't taxed. A major advantage of the corporate form of ownership is: A company organized in the form of a company has an unlimited life.

5 Types of Business Ownership (+ Pros and Cons of Each)

A partnership is a corporation with fewer than 100 owners. A major advantage of the corporate form of ownership is: D) that corporate earnings aren't taxed. A major advantage of the corporate form of ownership is limited legal liability. Click the card to flip 👆.

FREE 11+ Legal Ownership Forms in PDF

Web accounting questions and answers. Web all businesses must have some form of legal ownership, such as a sole proprietorship and a corporation. Web when there is limited liability and a company fails, creditors cannot touch the personal assets of the owners under limited liability. A major advantage of the corporate form of ownership is: That corporate eamings aren't taxed.

Forms of business ownership and organization Tuko.co.ke

Which of the following is not a characteristic of a corporation? Web a major advantage of the corporate form of ownership is: That corporate eamings aren't taxed until they are. That corporate earnings aren't taxed until they are distributed to owners as dividends. A partnership is a corporation with fewer than 100 owners.

(PDF) What Is The Corporate Form and Why Does It Matter?

A major advantage of the corporate form of ownership is: Click the card to flip 👆. Establishing a corporation makes the business a separate and self. Which of the following is not a characteristic of a corporation? Web a major advantage of the corporate form of ownership is:

Identify which of the following statements are true for the corporate

Web one advantage of the corporate form of organization is that it permits otherwise unaffiliated persons to join together in mutual ownership of a business entity. A major advantage of the corporate form of ownership is limited legal liability. Web a major advantage of the corporate form of ownership is: Establishing a corporation makes the business a separate and self..

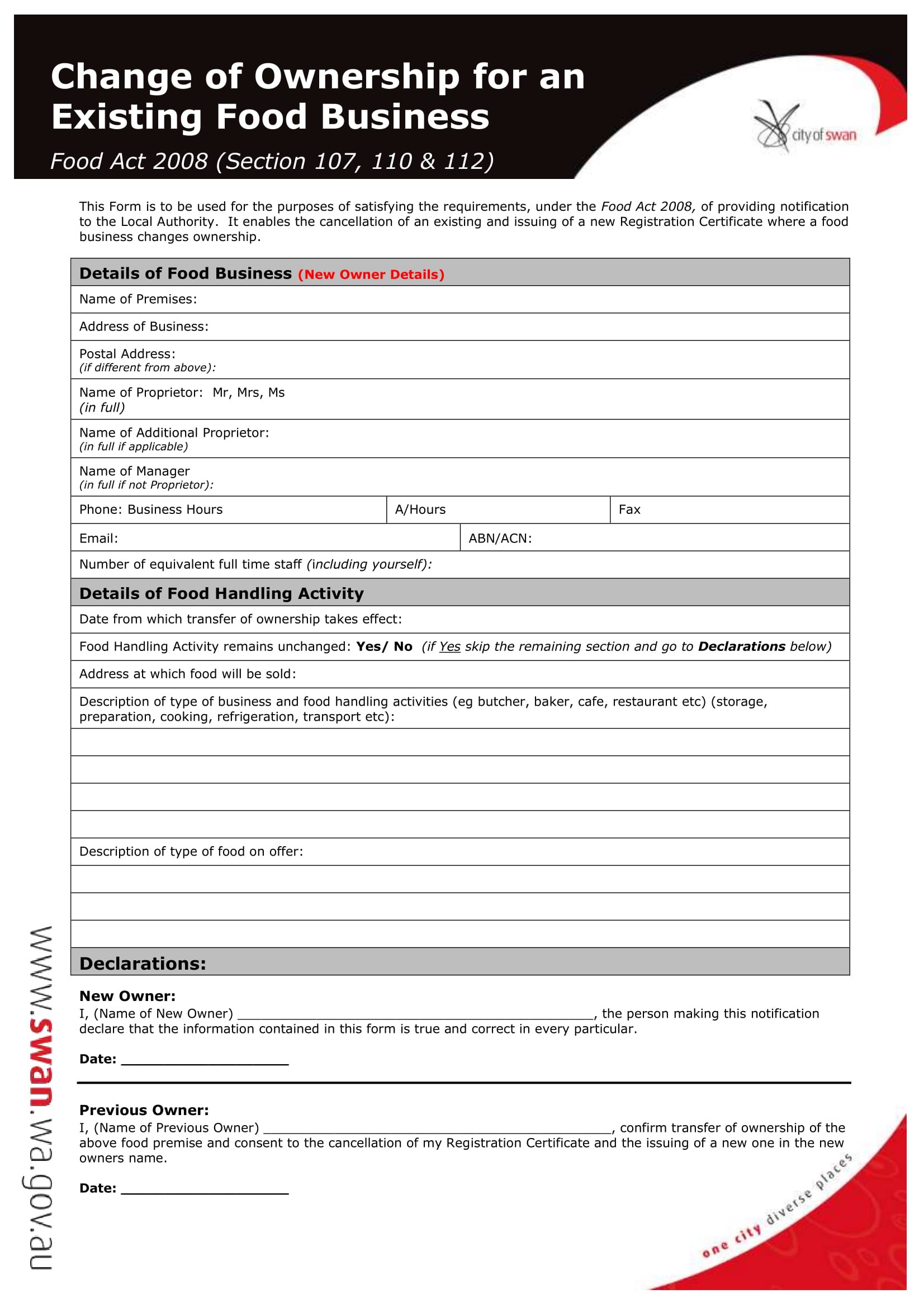

FREE 4+ Restaurant Transfer of Ownership Forms in PDF MS Word

A major advantage of the corporate form of ownership is: A major advantage of the corporate form of ownership is limited legal liability. Web incorporation benefits include: A major advantage of the corporate form of ownership is: The ease of raising capital as both large and small investors can participate in.

Corporate Org Chart Diagram Structure Ownership Stock Illustration

Click the card to flip 👆. Establishing a corporation makes the business a separate and self. D) that corporate earnings aren't taxed. A major advantage of the corporate form of ownership is limited legal liability. Web accounting questions and answers.

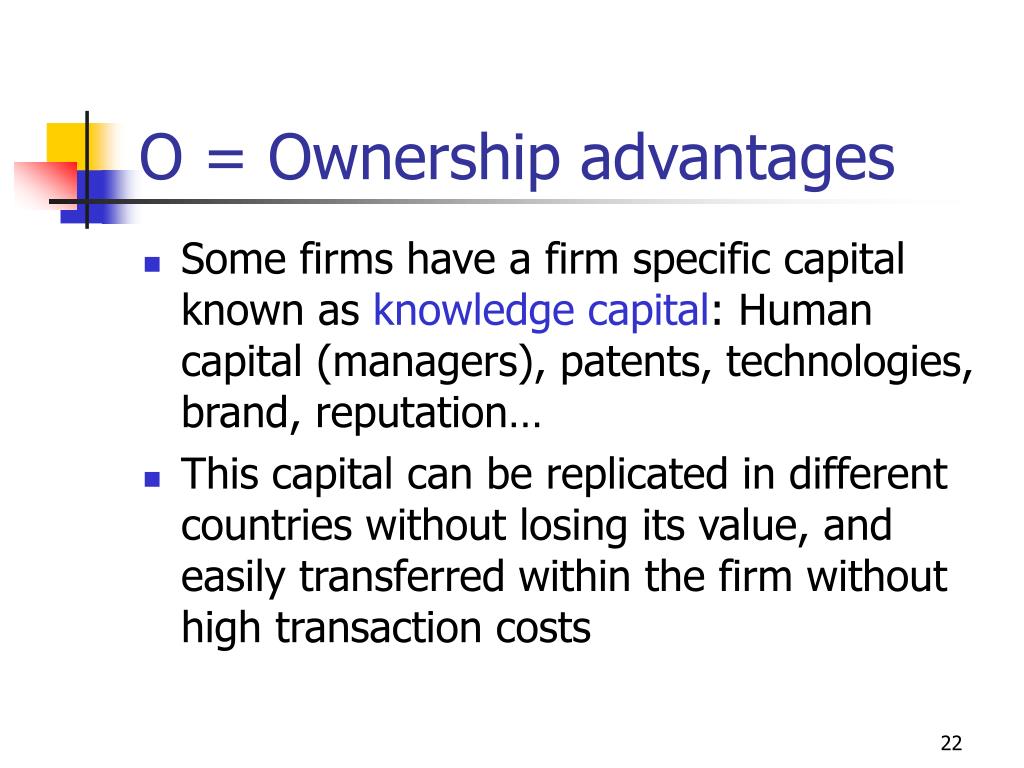

PPT Foreign Direct Investment Theory PowerPoint Presentation

Web all businesses must have some form of legal ownership, such as a sole proprietorship and a corporation. One of the main advantages of the corporate form of ownership. Major advantage of the corporate form of business. A company organized in the form of a company has an unlimited life. Web a major advantage of the corporate form of ownership.

Click The Card To Flip 👆.

Which of the following is not a characteristic of a corporation? The ease of raising capital as both large and small investors can participate in. Web discuss the advantages and disadvantages of the corporate form of ownership. D) that corporate earnings aren't taxed.

A Major Advantage Of The Corporate Form Of Ownership Is:

Ow instructions question 17 a major advantage of the corporate form of ownership is: Establishing a corporation makes the business a separate and self. One of the main advantages of the corporate form of ownership. That corporate earnings aren't taxed until they are distributed to owners as dividends.

A Company Organized In The Form Of A Company Has An Unlimited Life.

Which of the following is not a major advantage of the corporate form of organization? D) that corporate earnings aren't taxed. A major advantage of the corporate form of ownership is: Web transferable ownership rights are a major advantage, not a disadvantage of corporations.

Web All Businesses Must Have Some Form Of Legal Ownership, Such As A Sole Proprietorship And A Corporation.

Web accounting questions and answers. 5 which of the following statements about partnerships is most accurate? Web when there is limited liability and a company fails, creditors cannot touch the personal assets of the owners under limited liability. That corporate eamings aren't taxed until they are.