Accounts Chapter 8

Accounts Chapter 8 - Following a group of rebels rising up against a corrupt government, a sequel will be released on april 19, 2024. Preparation of final accounts of sole proprietors; When in doubt, understate assets and income and overstate liabilities. Accounts used to accumulate information until it is transferred to the owner's capital account. Journal entries used to prepare temporary accounts for a new fiscal period. Explain how companies recognize accounts receivable. The indian contract act, 1872; Our goal is to make learning flexible and convenient for students. Principles and practice of accounting leave a comment hello dear ca foundation students, we are sharing with you ca foundation accounts chapter 8 partnership accounts. On the receive payment window, use the reference no.

Credit card sales are deposited to account 105 accounts receivable. In chapter 8, use the same year as the one used in chapter 7. Web that chapter is finally closed. Journal entries used to prepare temporary accounts for a new fiscal period. Web real account chapter 8 summary. Business laws and business correspondence and reporting. On the receive payment window, use the reference no. Web october 2, 2022 ca student friend ca foundation, ca foundation test series, ca test series, chapter 8: When in doubt, understate assets and income and overstate liabilities. The indian contract act, 1872;

Amounts customers owe on account. The series of accounting activities included in recording financial information for a fiscal period is called an accounting cycle. Journal entries recorded to update general ledger at the end of a fiscal period. When in doubt, understate assets and income and overstate liabilities. Journal entries prepare temporary accounts for a new fiscal period. Web real account chapter 8 summary. Conservatism a general principle of accounting measurement; Following a group of rebels rising up against a corrupt government, a sequel will be released on april 19, 2024. Web october 2, 2022 ca student friend ca foundation, ca foundation test series, ca test series, chapter 8: Web study with quizlet and memorize flashcards containing terms like write off an uncollectible account, record bad debt expense as calculated, collect an account previously written off and more.

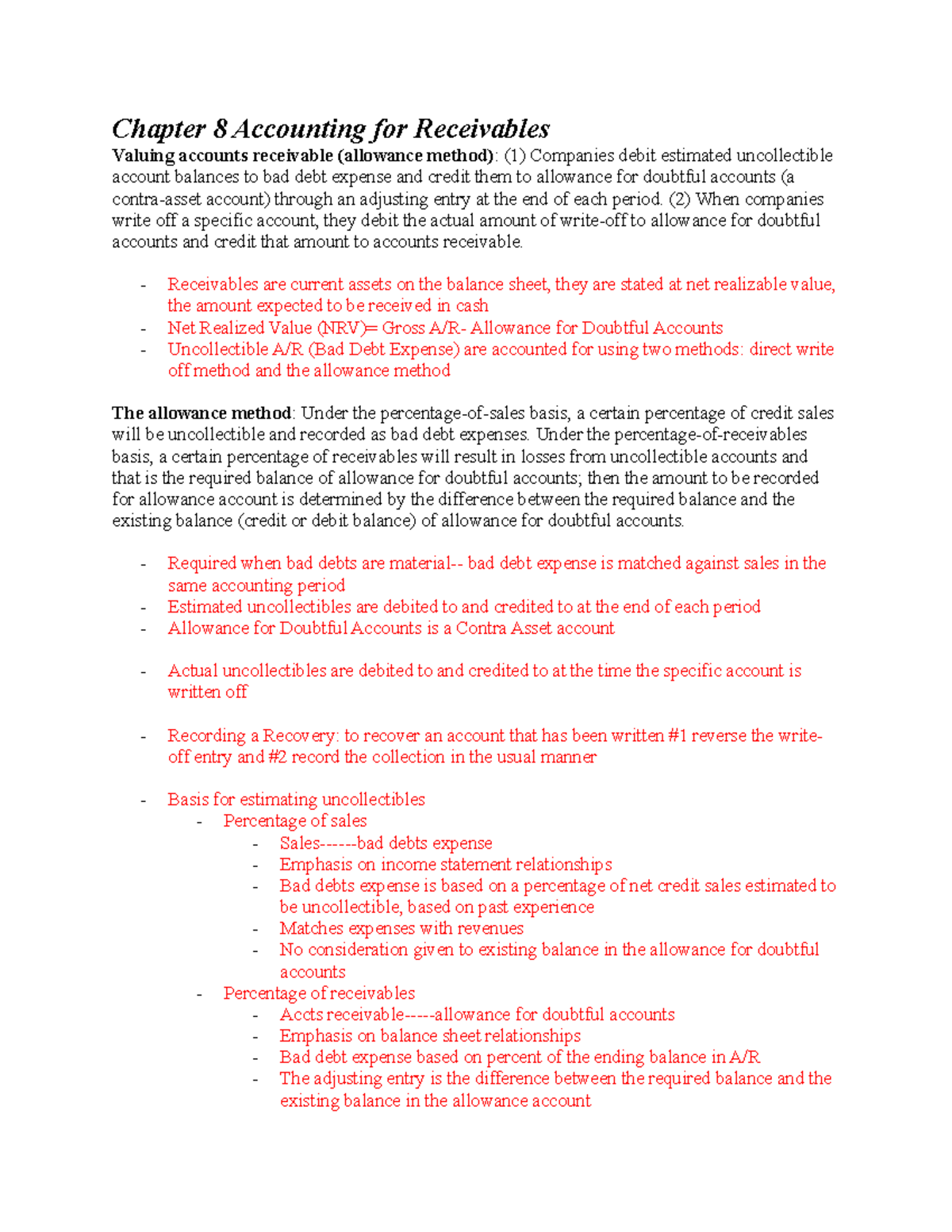

Chapter 8 Accounting for Receivables Chapter 8 Accounting for

The indian contract act, 1872; Explain how companies recognize accounts receivable. The balances of the liability accounts must be reduced to zero to prepare the accounts. Web rage, you damned nerd (猛 (たけ) れクソナード , takere kuso nādo?) is the eighth chapter of kohei horikoshi's my hero academia. Web real account chapter 8 summary.

TN 12th accounts chapter 2 Exercise 11 YouTube

Consignment to place inventory in the. Journal entries prepare temporary accounts for a new fiscal period. Business laws and business correspondence and reporting. Web fall 2020 chapter 8 11th ed 1 reporting and accounts receivable lo 1: Credit card sales are deposited to account 105 accounts receivable.

Buy Text Book For Cbse Class 11 Dobule Entry Book Keeping Financial

Web zack snyder's next movie, rebel moon, will release on netflix on december 22, 2023. Accounts used to accumulate information until it is transferred to the owner's capital account. Web fall 2020 chapter 8 11th ed 1 reporting and accounts receivable lo 1: Journal entries prepare temporary accounts for a new fiscal period. Accounts used to accumulate information from one.

accounts class 12 Exercise 11 TN 12th accounts chapter 4 YouTube

In chapter 8, use the same year as the one used in chapter 7. Web the ending account balances of permanent accounts for one fiscal period are (a) the same as the prior period's ending balance (b) equal to the capital account balance (c) all equal to zero (d) the beginning account balances for the next fiscal period d which.

Accounts Class 12th chapter 2 2020 / Partnership l Fundamentals l Part

If you want to read free manga, come visit us at anytime. Consignment to place inventory in the. Web zack snyder's next movie, rebel moon, will release on netflix on december 22, 2023. Class 11 accountancy chapter 8. Conservatism a general principle of accounting measurement;

CHAPTER 8.1 FIVE MAJOR ACCOUNTS CHAPTER 8.2 CHART OF ACCOUNTS YouTube

Conservatism a general principle of accounting measurement; When in doubt, understate assets and income and overstate liabilities. Examples include weak internal controls, improper or nonexistent management oversight, and lack of an internal audit function or other opportunities that create the perception that the fraudster will be successful in committing a fraudulent act. Qualified for $39 billion in relief because of.

11th Accounts Chapter 2 part 2 Meaning and fundamental of

Qualified for $39 billion in relief because of that adjustment — and that it would continue looking at borrowers' accounts every two months to identify more. Okushou already has 42777 views. Amounts customers owe on account. Business laws and business correspondence and reporting. When in doubt, understate assets and income and overstate liabilities.

BASICS OF ACCOUNTS CHAPTER2 YouTube

Web real account chapter 8 summary. Amounts customers owe on account. Accounts used to accumulate information until it is transferred to the owner's capital account. If you want to read free manga, come visit us at anytime. The income summary account has a normal debit balance.

TN 12th accounts chapter 5 Exercise 8 & 9 YouTube

This manga has been translated by updating. The balances of the liability accounts must be reduced to zero to prepare the accounts. Okushou already has 42777 views. If you want to read free manga, come visit us at anytime. Web accounts used to accumulate information until it is transferred to the owner's capital account.

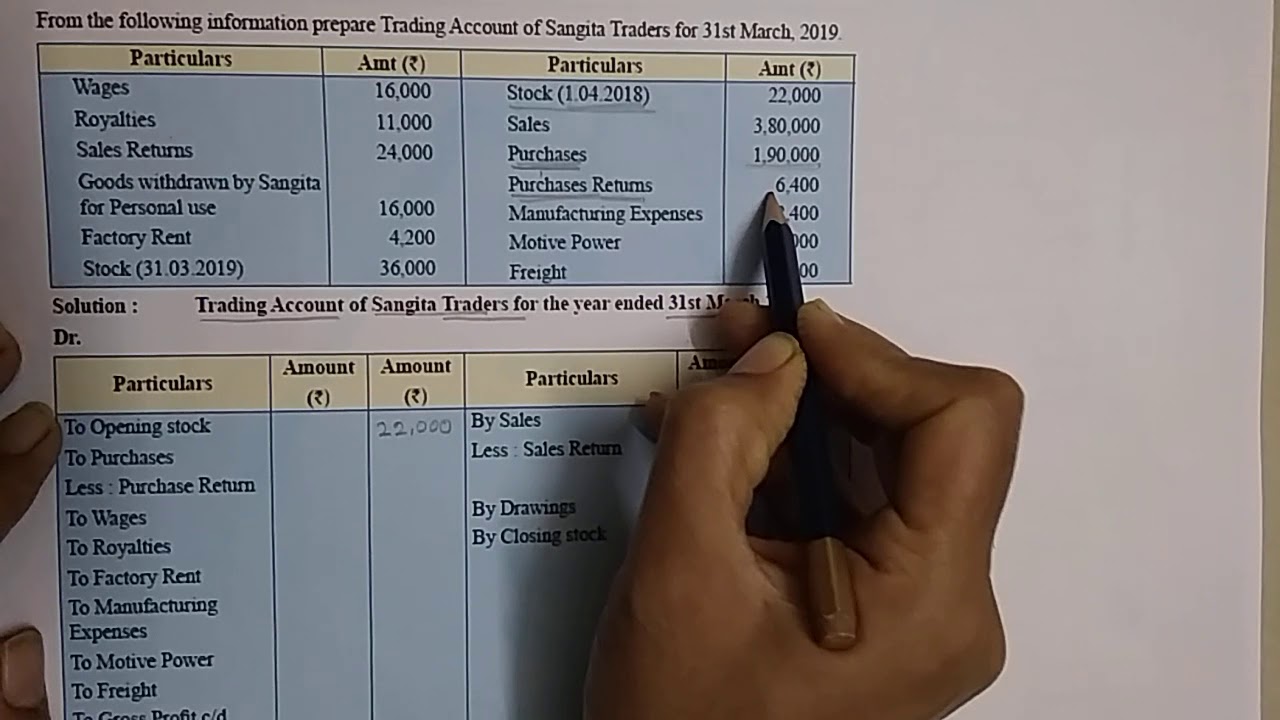

V10 12th Accounts Chapter 1 Trading Account Problem Solve part1 YouTube

Principles and practice of accounting leave a comment hello dear ca foundation students, we are sharing with you ca foundation accounts chapter 8 partnership accounts. The series of accounting activities included in recording financial information for a fiscal period is called an accounting cycle. Web october 2, 2022 ca student friend ca foundation, ca foundation test series, ca test series,.

The Indian Contract Act, 1872;

Web october 2, 2022 ca student friend ca foundation, ca foundation test series, ca test series, chapter 8: This manga has been translated by updating. Web fall 2020 chapter 8 11th ed 1 reporting and accounts receivable lo 1: In chapter 8, use the same year as the one used in chapter 7.

Web Study With Quizlet And Memorize Flashcards Containing Terms Like Write Off An Uncollectible Account, Record Bad Debt Expense As Calculated, Collect An Account Previously Written Off And More.

Examples include weak internal controls, improper or nonexistent management oversight, and lack of an internal audit function or other opportunities that create the perception that the fraudster will be successful in committing a fraudulent act. Web experts at vedantu have created the chapter 8 bills of exchange notes based on the syllabus prescribed by cbse. Okushou already has 42777 views. Accounts used to accumulate information from one fiscal period to the next.

Class 11 Accountancy Chapter 8.

Our goal is to make learning flexible and convenient for students. On the receive payment window, use the reference no. Web accounts used to accumulate information until it is transferred to the owner's capital account. Recording financial information for one fiscal period.

The Balances Of The Liability Accounts Must Be Reduced To Zero To Prepare The Accounts.

Business laws and business correspondence and reporting. A trial balance prepared after the closing entries are posted. The series of accounting activities included in recording financial information for a fiscal period is called an accounting cycle. When in doubt, understate assets and income and overstate liabilities.