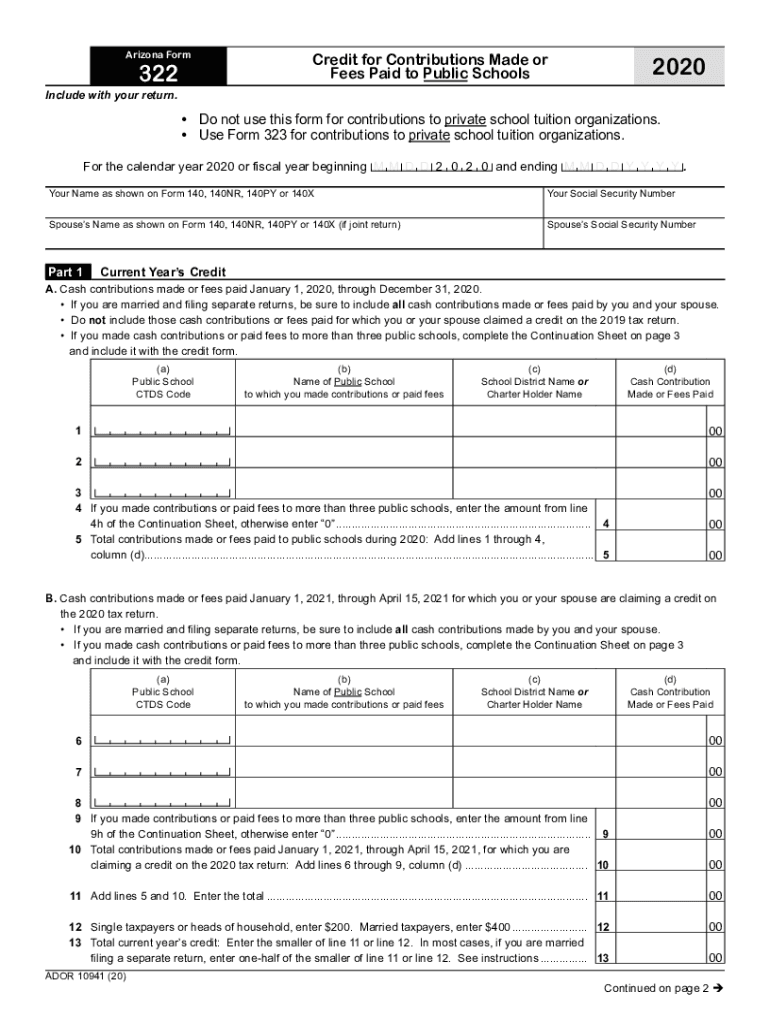

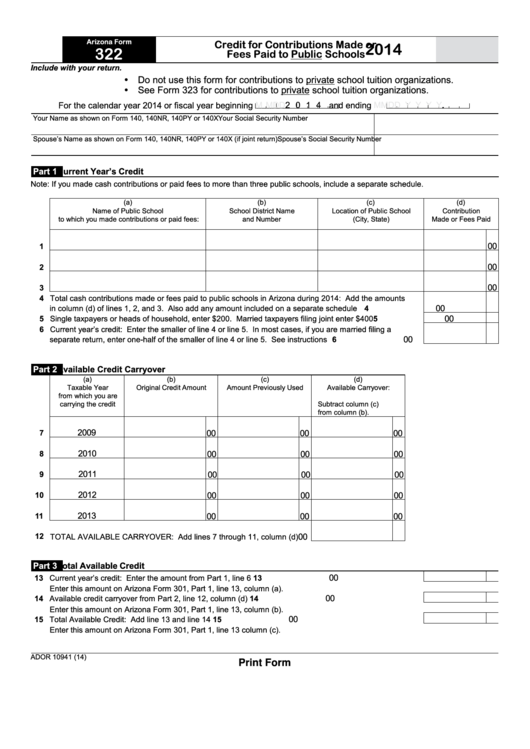

Arizona Form 322

Arizona Form 322 - If a married couple owed $1800 in taxes and donated $800 to a qualifying charitable organization, their tax liability would be reduced. Web include either arizona form 321 or arizona form 352, or both, with this return. The advanced tools of the. • do not use this form for contributions. Do not use this form for cash contributions or fees paid to a. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Get your online template and fill it in using progressive features. Web arizona form 321, credit for contributions to qualifying charitable organizations The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of. Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona.

Web arizona state income tax forms for tax year 2022 (jan. Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. Get your online template and fill it in using progressive features. Web how you can complete the arizona form 323 online: Web we last updated arizona form 322 in february 2023 from the arizona department of revenue. Web the public school tax credit is claimed by the individual taxpayer on form 322. Web arizona form 321, credit for contributions to qualifying charitable organizations Web to enter information for arizona form 322 (credit for contributions made or fees paid to public schools) in turbotax, please take the following steps: For example, if a single individual owes $2,000 in taxes but donates $421 to a qualifying.

Web 26 rows form number title; Web to enter information for arizona form 322 (credit for contributions made or fees paid to public schools) in turbotax, please take the following steps: Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona. Details on how to only prepare and print an. Web include arizona form 321. Get your online template and fill it in using progressive features. Tax credits forms, individual : If a married couple owed $1800 in taxes and donated $800 to a qualifying charitable organization, their tax liability would be reduced. Follow the simple instructions below:. Do not use this form for cash contributions or fees paid to a.

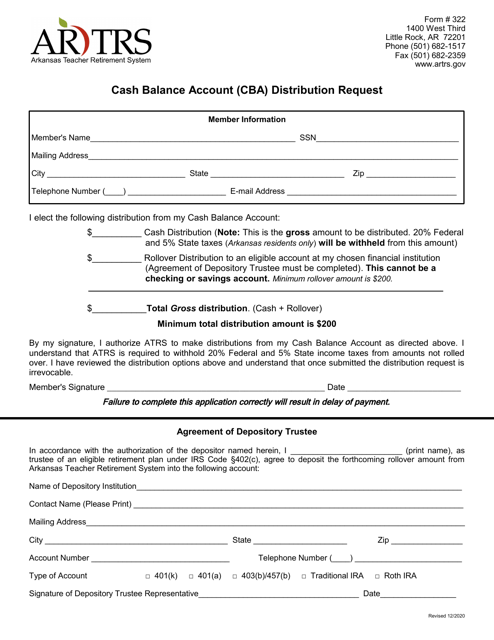

Form 322 Download Printable PDF or Fill Online Cash Balance Account

Web we last updated arizona form 322 in february 2023 from the arizona department of revenue. Application for bingo license packet: Web how to fill out and sign az online? Web arizona form 322 following the close of the taxable year may be applied to either the current or preceding taxable year and is considered to have been made on.

Printable Arizona Form 322 Credit for Contributions Made or Fees Paid

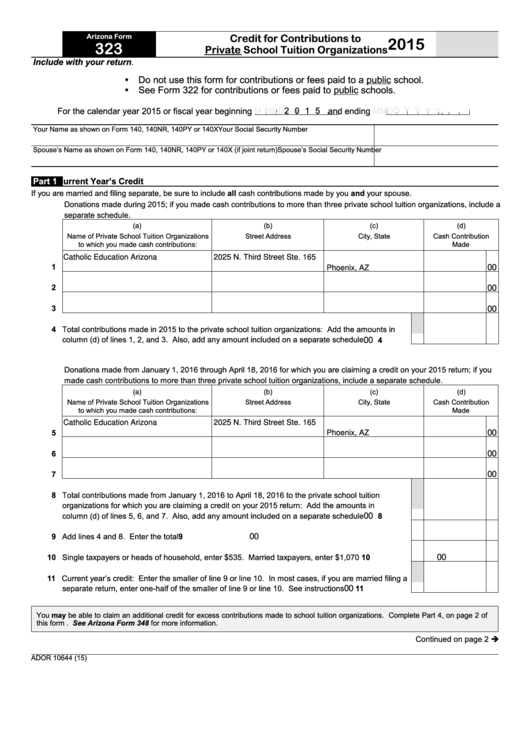

Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Web how to fill out and sign az online? Save or instantly send your ready documents. Tax credits forms, individual : Enjoy smart fillable fields and interactivity.

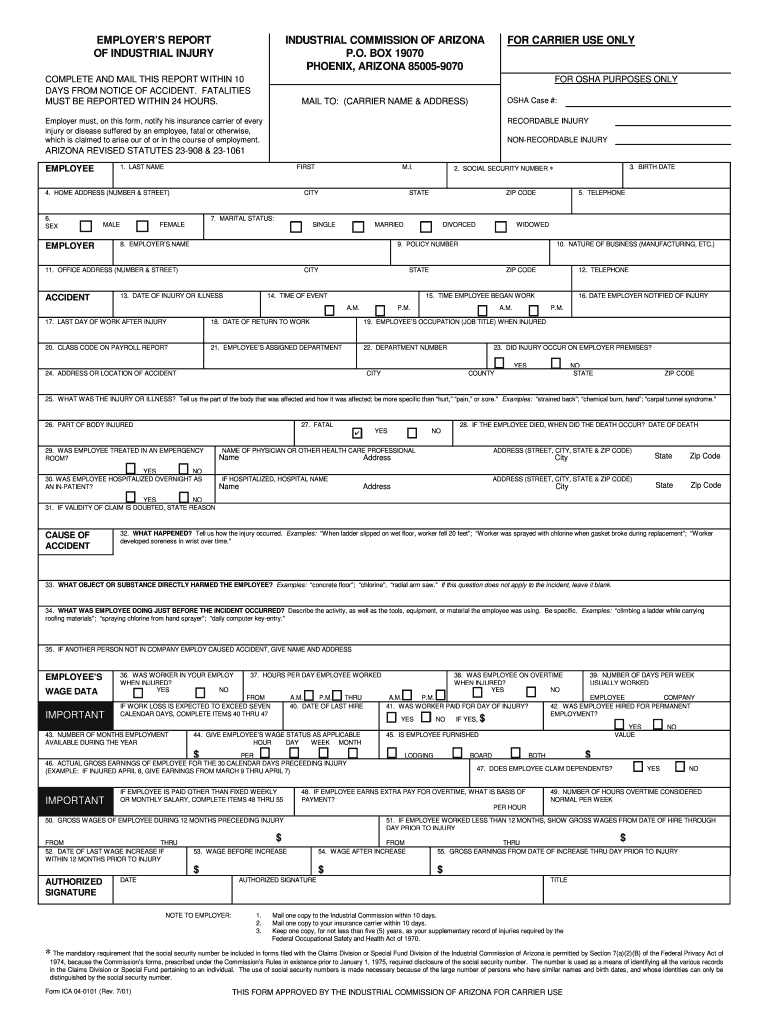

Arizona Report Injury Fill Out and Sign Printable PDF Template signNow

Easily fill out pdf blank, edit, and sign them. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of. For example, if a single individual owes $2,000 in taxes but donates $421 to a qualifying. Web 26 rows form number title; This form is for income earned in tax year 2022, with tax.

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

Web complete az dor form 322 2020 online with us legal forms. Web 26 rows form number title; Easily fill out pdf blank, edit, and sign them. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. The advanced tools of the.

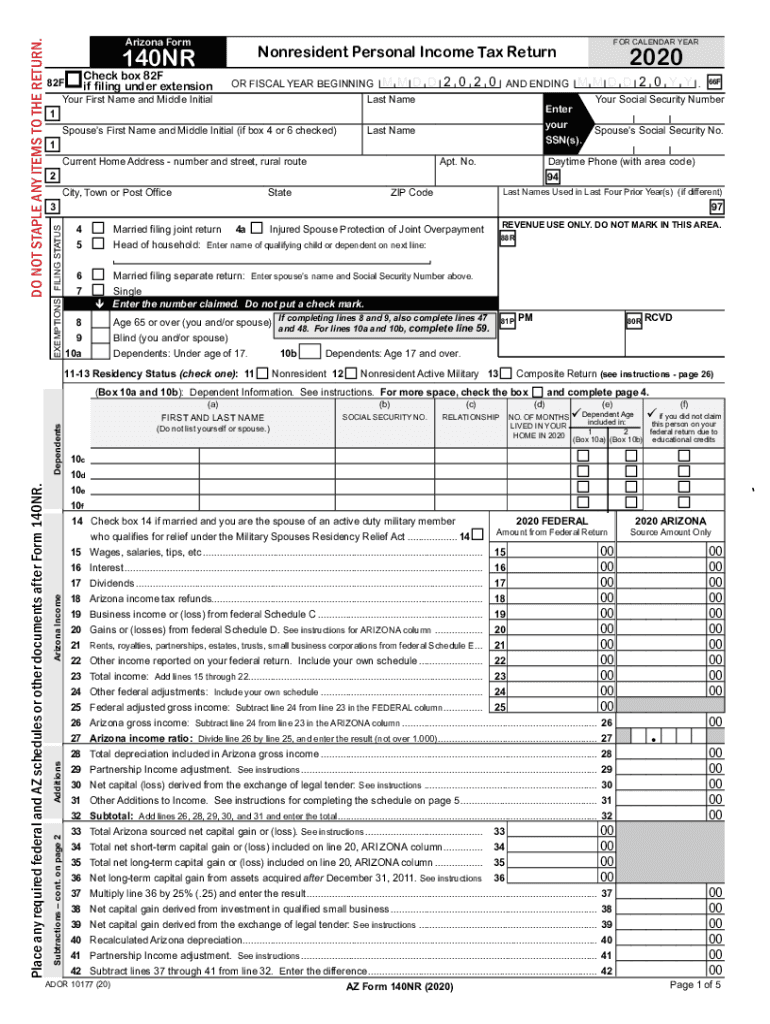

PDF Arizona Form 140NR Arizona Department of Revenue Fill Out and

Tax credits forms, individual : Tax credits forms, individual : Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your return. Details on how to only prepare and print an. Web how you can complete the arizona form 323 online:

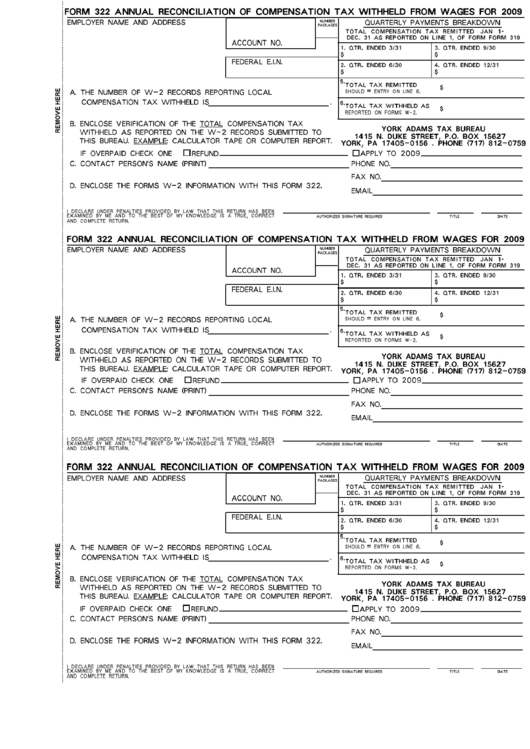

Form 322 Annual Reconciliation Of Compenstaion Tax Withheld From

Web 26 rows form number title; To get started on the form, use the fill & sign online button or tick the preview image of the blank. Enjoy smart fillable fields and interactivity. Easily fill out pdf blank, edit, and sign them. Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your.

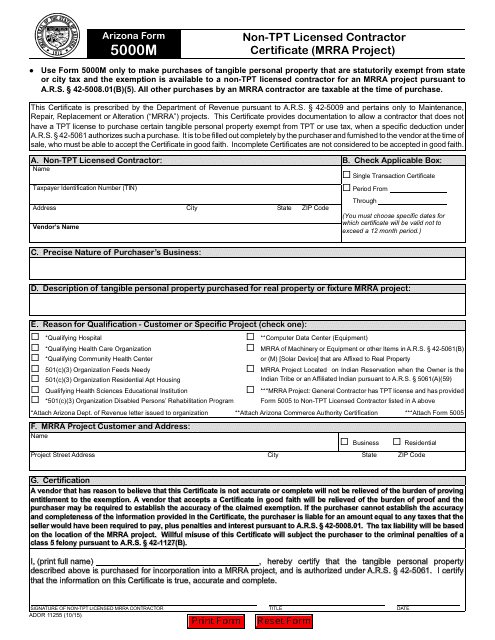

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

Web 26 rows form number title; Save or instantly send your ready documents. Follow the simple instructions below:. Web how to fill out and sign az online? Easily fill out pdf blank, edit, and sign them.

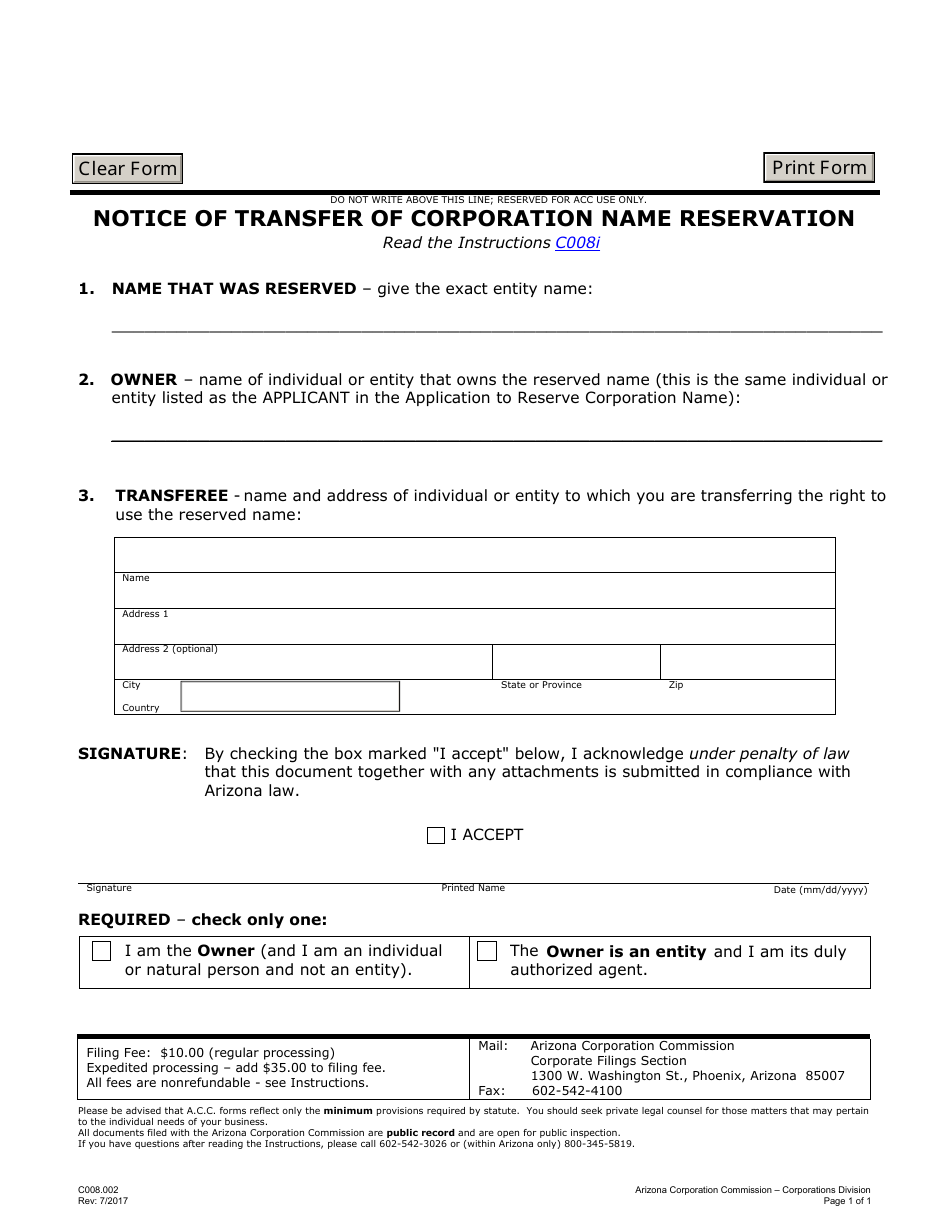

Form C008.002 Download Fillable PDF or Fill Online Notice of Transfer

Web arizona form 322 include with your return. Web state of arizona form 322, also known as form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their arizona. Web 26 rows form number title; Web complete az dor form 322 2020 online with us legal forms. The maximum.

Fillable Arizona Form 322 Credit For Contributions Made Or Fees Paid

Web we last updated arizona form 322 in february 2023 from the arizona department of revenue. Web include arizona form 321. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 322 with your tax. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of..

Fillable Arizona Form 323 Credit For Contributions To Private School

Do not use this form for contributions to private school tuition. Web complete az dor form 322 2020 online with us legal forms. Web the public school tax credit is claimed by the individual taxpayer on form 322. Web to enter information for arizona form 322 (credit for contributions made or fees paid to public schools) in turbotax, please take.

The Advanced Tools Of The.

• do not use this form for contributions. For example, if a single individual owes $2,000 in taxes but donates $421 to a qualifying. Web 26 rows form number title; Get your online template and fill it in using progressive features.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Credit for contributions made or fees paid to public schools 2019 do not use this form for contributions to private school tuition. Web include either arizona form 321 or arizona form 352, or both, with this return. Enjoy smart fillable fields and interactivity.

Do Not Use This Form For Contributions To Private School Tuition.

Web arizona form 322 a 101 21 arizona form credit for contributions made or 322 fees paid to public schools 2021 include with your return. Follow the simple instructions below:. Web arizona form 322 credit for contributions made or fees paid to public schools 2022 include with your return. Tax credits forms, individual :

Web We Last Updated Arizona Form 322 In February 2023 From The Arizona Department Of Revenue.

Tax credits forms, individual : Web to enter information for arizona form 322 (credit for contributions made or fees paid to public schools) in turbotax, please take the following steps: Save or instantly send your ready documents. Web arizona form 321, credit for contributions to qualifying charitable organizations