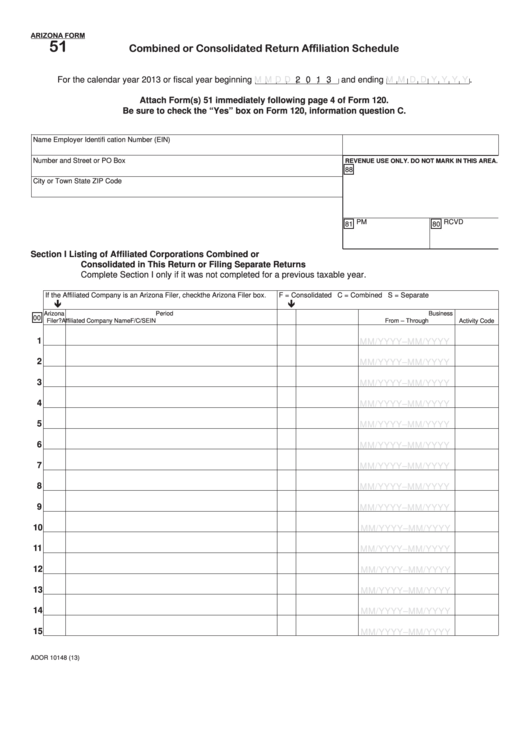

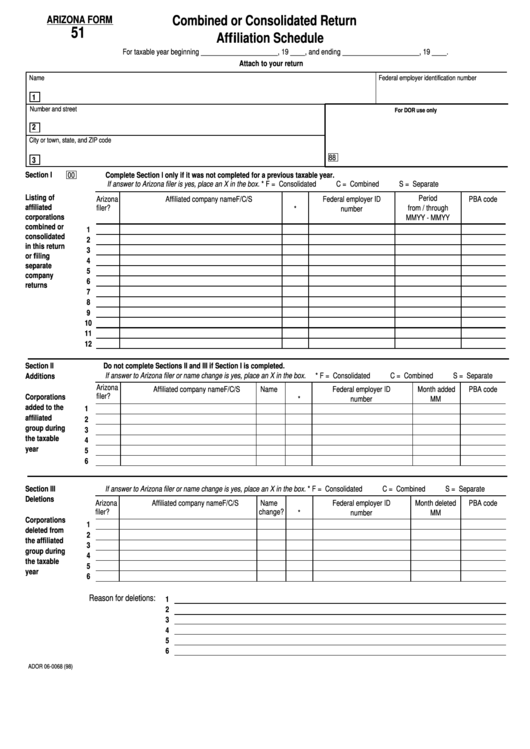

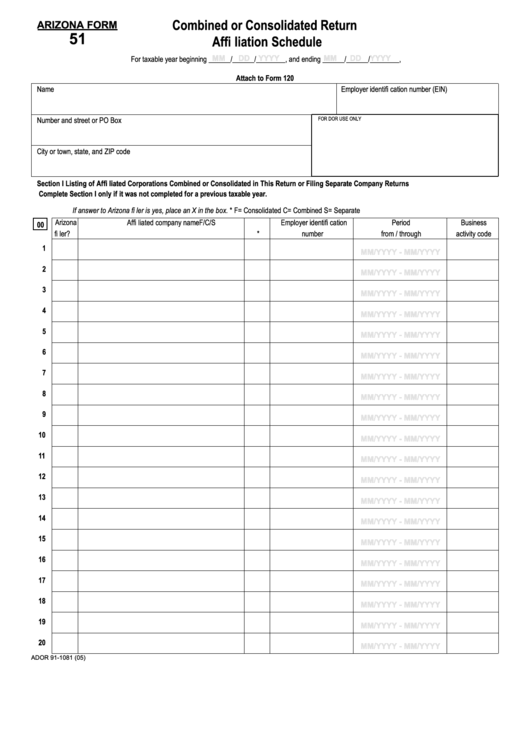

Arizona Form 51 Instructions

Arizona Form 51 Instructions - Supplier electronic monthly report instructions 5.1. You can print other arizona tax forms here. Yes no e arizona apportionment for multistate corporations. If the affiliated company is an arizona filer, check the arizona filer box. 19 nonrefundable tax credits claimed on line 20 from arizona form 300, part 2, line 47. Web we last updated the combined or consolidated return affiliation schedule in february 2023, so this is the latest version of form 51, fully updated for tax year 2022. List the affiliated corporations that file a separate combined return to arizona. Web general instructions use of the form form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups and affiliated corporations that file on a separate company basis, or file a separate combined return to arizona. Name of reporting entity enter the effective date of the change: Web 20 rows arizona s corporation income tax return.

Yes no e arizona apportionment for multistate corporations. Web az form 51 (2020) page 2 of 2 section 2 corporations added to the affiliated group during the taxable year do not complete section 2 if section 1 is completed. Name employer identification number (ein) number and street or po box city or town 19 00 20 enter form number for each. Web 51 consolidated or combined return affiliation schedule 2022 include form(s) 51 immediately following form 120. Web general instructions use of the form form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups and affiliated corporations that file on a separate company basis, or file a separate combined return to arizona. 8age 65 or over (you and/or spouse) Or fiscal year beginning m m d d 2 0 2 1and ending m m d d 2 0 y y. Check box 82f if filing under extension. Web az form 51 (2021) page 2 of 2 section 2 corporations added to the affiliated group during the taxable year do not complete section 2 if section 1 is completed.

Web 51 consolidated or combined return affiliation schedule 2022 include form(s) 51 immediately following form 120. Web general instructions use of the form form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups and affiliated corporations that file on a separate company basis, or file a separate combined return to arizona. If the affiliated company is an arizona filer, check the arizona filer box. Be sure to check the “yes” box on form 120, line d. These changes include name changes, additions to the group filing the return, or deletions from the group filing the return. Web nonrefundable credits from arizona form 301 , part 2, line 61 balance of tax: Web form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups and affiliated corporations that file on a separate company basis or file a separate combined return to arizona. Subtract lines 49 50 and 51 from line 48. Web general instructions use of the form arizona form 120 filers complete form 51 to: 1269 arizona tax forms and templates are collected for any of your needs.

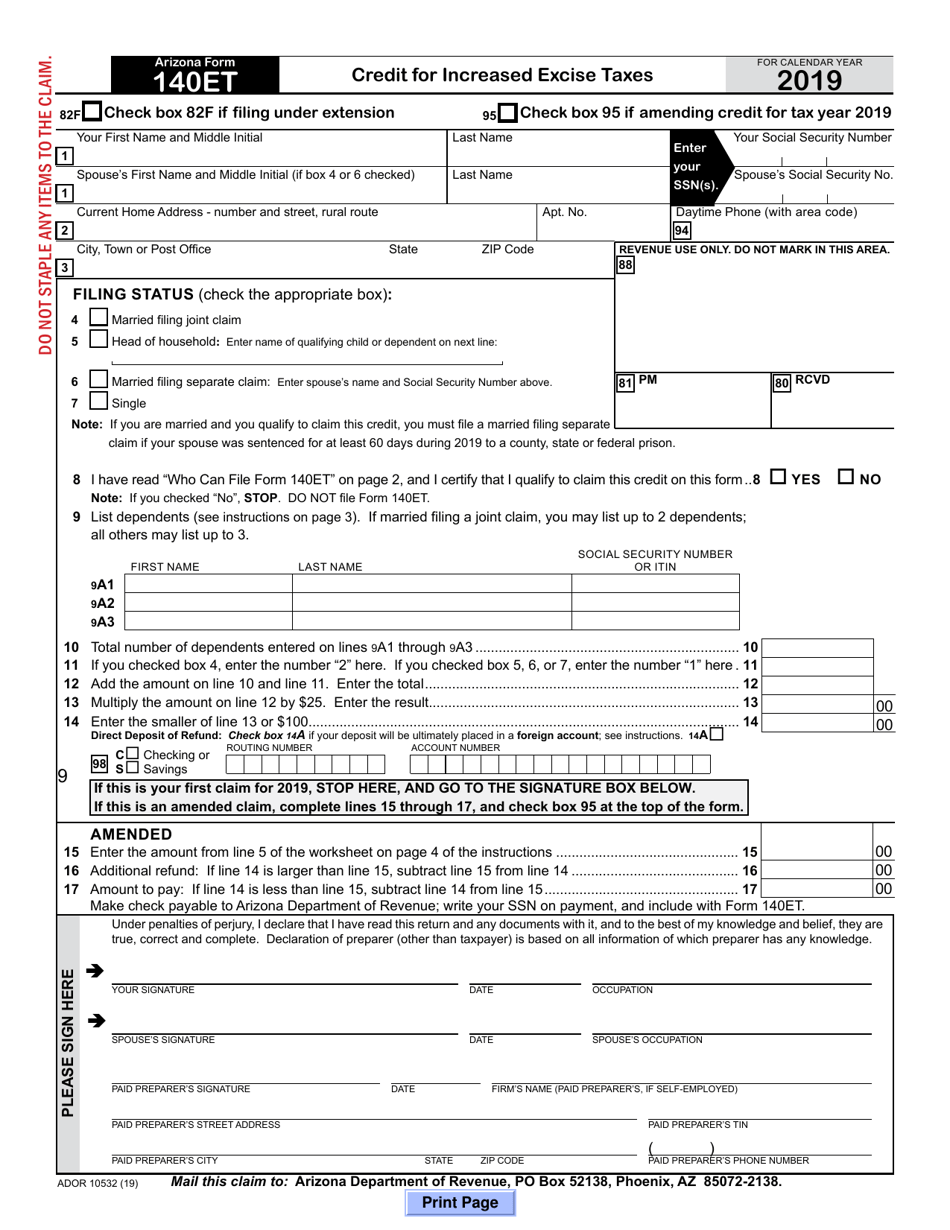

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

List the affiliated corporations that file a separate combined return to arizona. Name employer identification number (ein) number and street or po box city or town Web 51t transaction privilege tax election 2020to allocate credit for accounting and reporting expenses if this is a change of your credit allocation, check the box. 2021 az income tax withheld. 8age 65 or.

Fillable Arizona Form 51 Combined Or Consolidated Return Affiliation

Web d if arizona filing method is combined or consolidated, see form 51 instructions. Web form 51 identifies changes to the federal consolidated group and related companies during the taxable year. Both documents can be obtained from the website of the arizona department of revenue. If the sum of lines 49 50 and 51 is reater than line 48 enter.

Download Instructions for Arizona Form 120 Arizona Corporation

Be sure to check the “yes” box on form 120, line d. Web 12 rows home forms corporate tax forms combined or consolidated return affiliation schedules combined or consolidated return affiliation schedules corporations complete this form to identify changes to the federal consolidated group and related companies during the taxable year. Check box 82f if filing under extension. Web we.

Arizona Form A4 Instructions Best Product Reviews

Web this document contains official instructions for arizona form 51, and form ador10148. You can print other arizona tax forms here. Web resident shareholder's information schedule form with instructions: Yes no e arizona apportionment for multistate corporations. 19 00 20 enter form number for each.

Fillable Arizona Form 51 Combined Or Consolidated Return Affiliation

If you are attaching form 51 to your return, be sure to check the yes box to information question c on form 120. List the affiliated corporations that file a separate combined return to arizona. Web az form 51 (2021) page 2 of 2 section 2 corporations added to the affiliated group during the taxable year do not complete section.

Arizona Form 51 Combined Or Consolidated Return Affiliation Schedule

Both documents can be obtained from the website of the arizona department of revenue. Web this document contains official instructions for arizona form 51, and form ador10148. 2021 az estimated tax payments 54a 00 claim of right 54b add 546 and 54b. 2021 az income tax withheld. Arizona combined or consolidated return affiliation schedule (form 51) corporations operating in arizona.

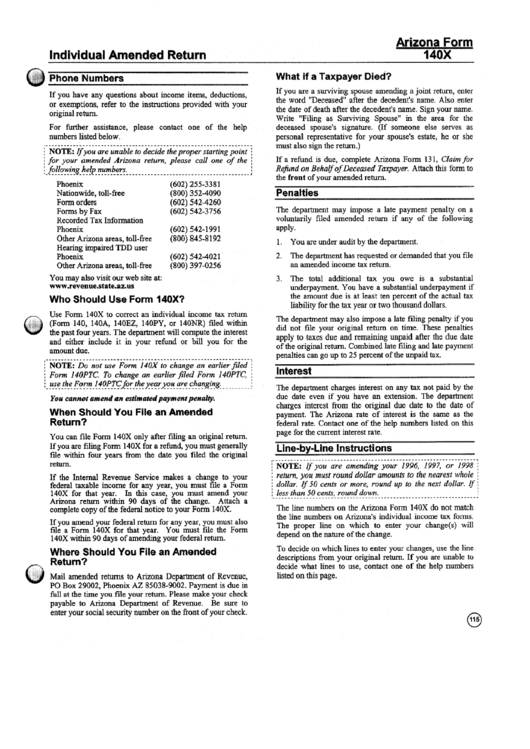

Instructions For Arizona Form 140x Individual Amended Return

Web az form 51 (2020) page 2 of 2 section 2 corporations added to the affiliated group during the taxable year do not complete section 2 if section 1 is completed. Web 12 rows $5,000 or more for any taxable year beginning from and after december 31, 2019 through december 31, 2020 or, $500 or more for any taxable year.

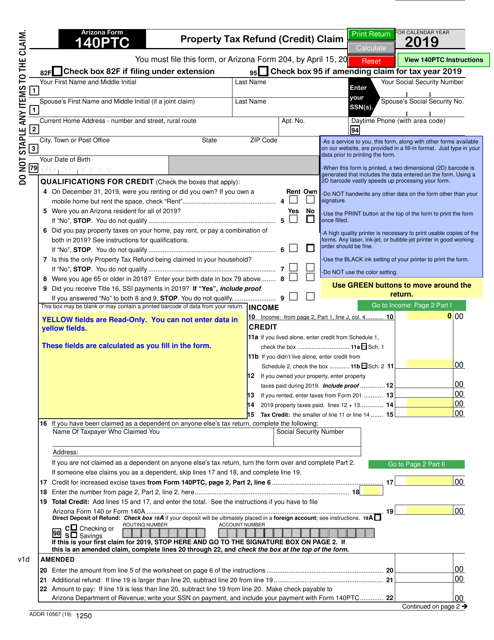

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Web this document contains official instructions for arizona form 51, and form ador10148. Be sure to check the “yes” box on form 120, line d. If the affiliated company changed its name during the taxable year, check the name change box. 19 nonrefundable tax credits claimed on line 20 from arizona form 300, part 2, line 47. Or fiscal year.

Download Arizona Form A4 (2013) for Free FormTemplate

8age 65 or over (you and/or spouse) Supplier electronic monthly report instructions 5.1. List the affiliated corporations that file a separate combined return to arizona. Web az form 51 (2021) page 2 of 2 section 2 corporations added to the affiliated group during the taxable year do not complete section 2 if section 1 is completed. Web az form 51.

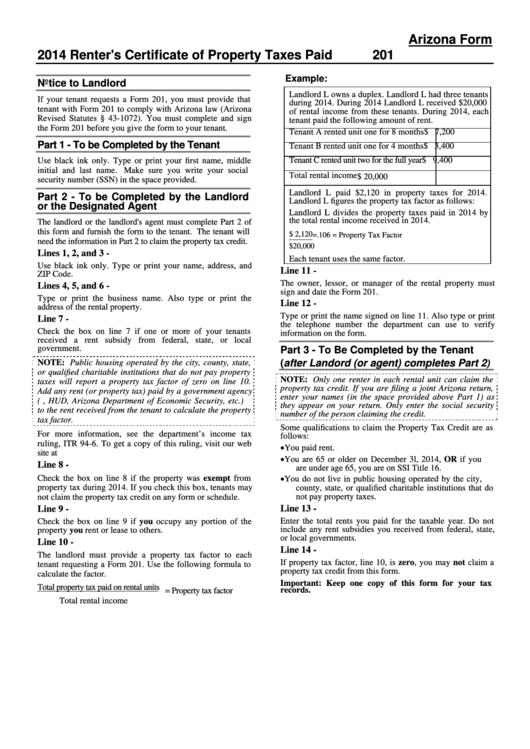

Instructions For Arizona Form 201 Renter'S Certificate Of Property

If you are attaching form 51 to your return, be sure to check the yes box to information question c on form 120. 1269 arizona tax forms and templates are collected for any of your needs. Yes no e arizona apportionment for multistate corporations. Name of reporting entity enter the effective date of the change: Subtract lines 49 50 and.

If The Affiliated Company Changed Its Name During The Taxable Year, Check The Name Change Box.

Web 20 rows arizona s corporation income tax return. Or fiscal year beginning m m d d 2 0 2 1and ending m m d d 2 0 y y. Web 12 rows $5,000 or more for any taxable year beginning from and after december 31, 2019 through december 31, 2020 or, $500 or more for any taxable year beginning from and after december 31, 2020. Web resident shareholder's information schedule form with instructions:

Both Forms Are Released And Collected By The Arizona Department Of Revenue.

2021 az income tax withheld. 8age 65 or over (you and/or spouse) Web nonrefundable credits from arizona form 301 , part 2, line 61 balance of tax: If the sum of lines 49 50 and 51 is reater than line 48 enter 0.

List The Affiliated Corporations That File To Arizona On A Separate Company Basis.

List the members of combined or consolidated groups. Web this document contains official instructions for arizona form 51, and form ador10148. 19 00 20 enter form number for each. Web az form 51 (2020) page 2 of 2 section 2 corporations added to the affiliated group during the taxable year do not complete section 2 if section 1 is completed.

Name Employer Identification Number (Ein) Number And Street Or Po Box City Or Town

Name of reporting entity enter the effective date of the change: Web we last updated the combined or consolidated return affiliation schedule in february 2023, so this is the latest version of form 51, fully updated for tax year 2022. Web form 51 identifies changes to the federal consolidated group and related companies during the taxable year. These changes include name changes, additions to the group filing the return, or deletions from the group filing the return.