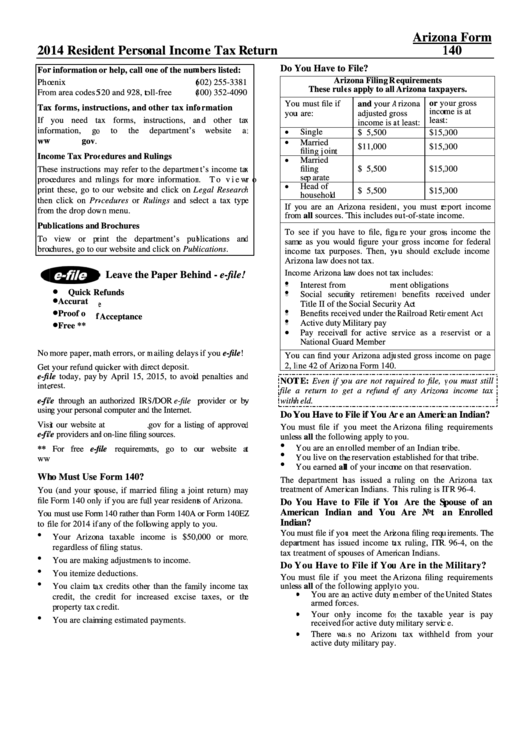

Arizona Income Tax Form 140

Arizona Income Tax Form 140 - You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web in this case, you must file using form 140. You can download or print. File a form 140py if you were an arizona resident for less than 12 months during 2021. Your arizona taxable income is $50,000 or. We last updated arizona form 140 in february 2023 from the arizona. • you received pay for active service as a. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. Web who can use arizona form 140? Web arizona form 140 resident personal income tax return for calendar year 2019 or fiscal year beginning m m d d 2 0 1 9 and ending m m d d 2 0 y y.

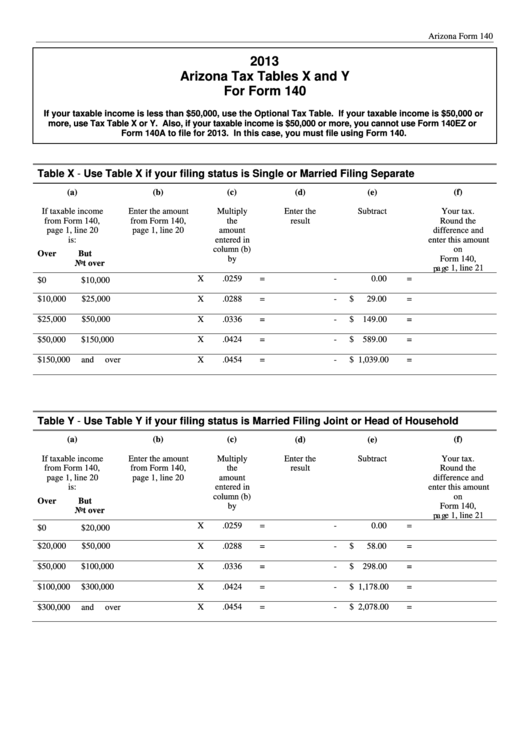

Tax tables x and y have been. Web who can use arizona form 140? You must use tax tables x and y to figure your tax. Web arizona income tax forms. Web all arizona taxpayers must file a form 140 with the arizona department of revenue. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. Web in this case, you must file using form 140. • you received active duty military pay as a member of the u.s. Web personal income tax return filed by resident taxpayers. Arizona state income tax forms for tax year 2022 (jan.

Web make an individual or small business income payment. • you received active duty military pay as a member of the u.s. You (and your spouse, if married filing a joint return) may file form 140 only if you are full year residents of arizona. Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. File a form 140py if you were an arizona resident for less than 12 months during 2021. Get ready for tax season deadlines by completing any required tax forms today. Web report error it appears you don't have a pdf plugin for this browser. Web in this case, you must file using form 140. Your arizona taxable income is $50,000 or. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

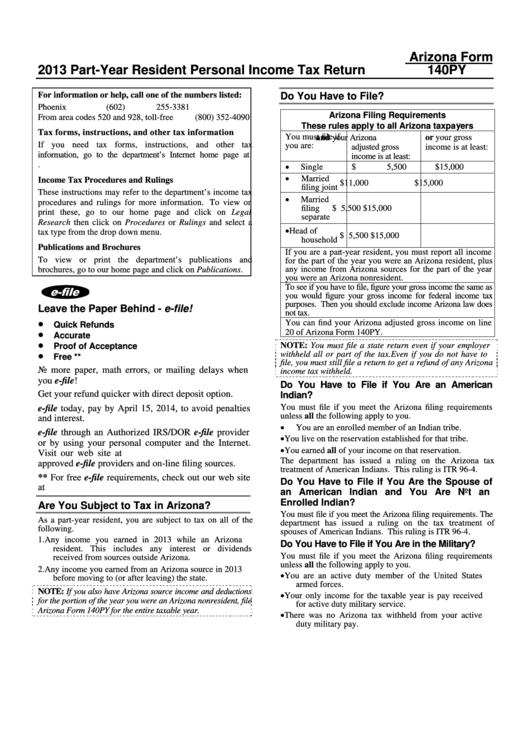

Arizona Form 140py PartYear Resident Personal Tax Return

Your arizona taxable income is $50,000 or. Form 140a arizona resident personal income tax booklet. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. Web who must use form 140? Web who can use arizona form 140?

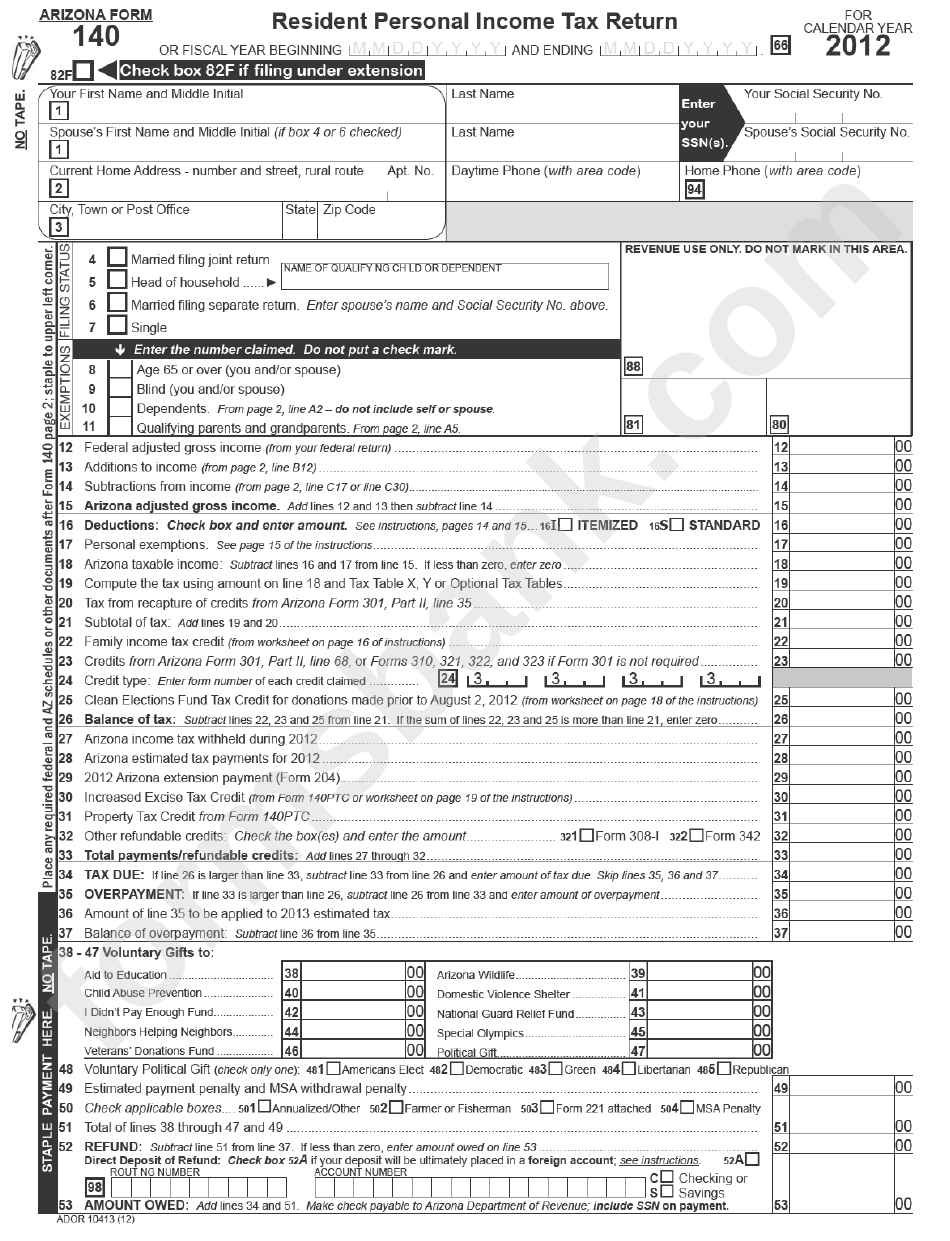

Arizona Printable Tax Forms 2012 Form 140 Fill In or Print Only

Web who can use arizona form 140? Ad register and subscribe now to work on your az form 140 & more fillable forms. Form 140a arizona resident personal income tax booklet. You can download or print. File a form 140py if you were an arizona resident for less than 12 months during 2021.

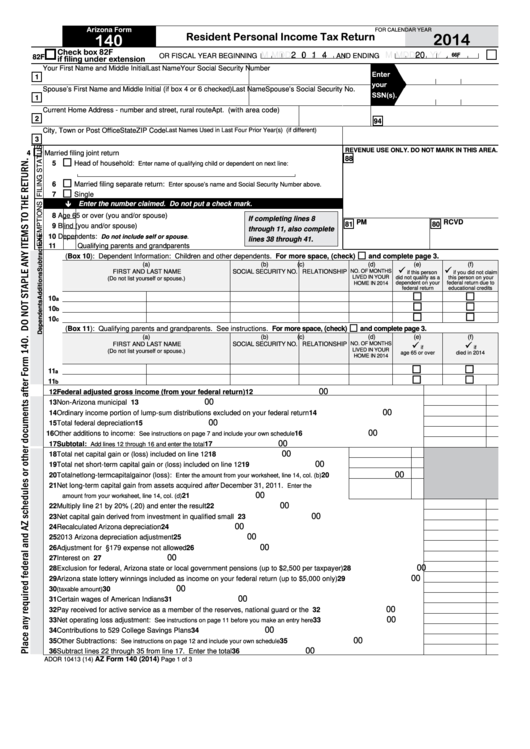

Arizona Form 140 Resident Personal Tax Return printable pdf

Web who can use arizona form 140? Ad register and subscribe now to work on your az form 140 & more fillable forms. You must use form 140. You can download or print. Web arizona form 140resident personal income tax return for calendar year 2021 or fiscal year beginning m m d d 2 0 2 1and ending m m.

Fillable Arizona Form 140 Resident Personal Tax Return 2014

Ad register and subscribe now to work on your az form 140 & more fillable forms. Web who must usepersonal income tax return arizona form 140py? Web in this case, you must file using form 140. Web make an individual or small business income payment. File a form 140py if you were an arizona resident for less than 12 months.

Fillable Arizona Tax Tables X And Y For Form 140 2013 printable pdf

You may need to use use form 140 instead if all of the following apply: Web report error it appears you don't have a pdf plugin for this browser. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Your arizona taxable income is $50,000 or. Web.

Instructions For Arizona Form 140 Resident Personal Tax Return

Get ready for tax season deadlines by completing any required tax forms today. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. • you received pay for active service as a. Web all arizona taxpayers must file a form 140 with the arizona department of revenue..

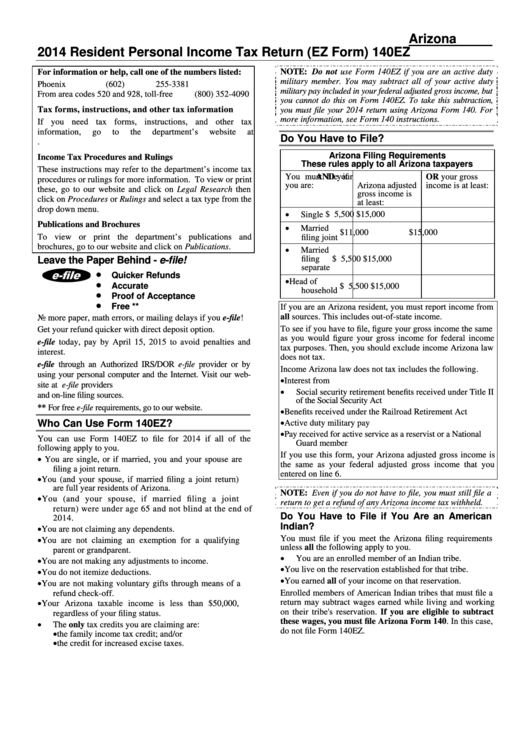

Instructions For Arizona Form 140ez Resident Personal Tax

Web who must use form 140? Web who can use arizona form 140? Web all arizona taxpayers must file a form 140 with the arizona department of revenue. Your arizona taxable income is $50,000 or. Web arizona form 140 resident personal income tax return for calendar year 2019 or fiscal year beginning m m d d 2 0 1 9.

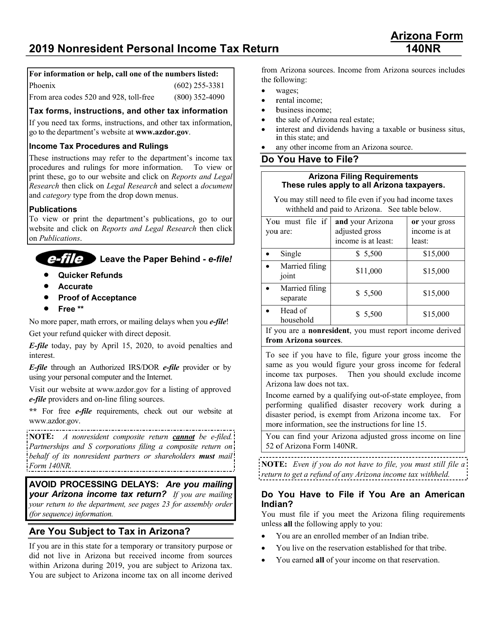

Download Instructions for Arizona Form 140, ADOR10413 Nonresident

Web all arizona taxpayers must file a form 140 with the arizona department of revenue. Form 140a arizona resident personal income tax booklet. Web who can use arizona form 140? Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. Web arizona.

Arizona Entity Profile Form Download Fillable Pdf Templateroller Gambaran

Web who can use arizona form 140? Arizona state income tax forms for tax year 2022 (jan. Individual payment type options include: For more information about the arizona income tax, see the arizona income tax page. Ad download or email az form 140 & more fillable forms, register and subscribe now!

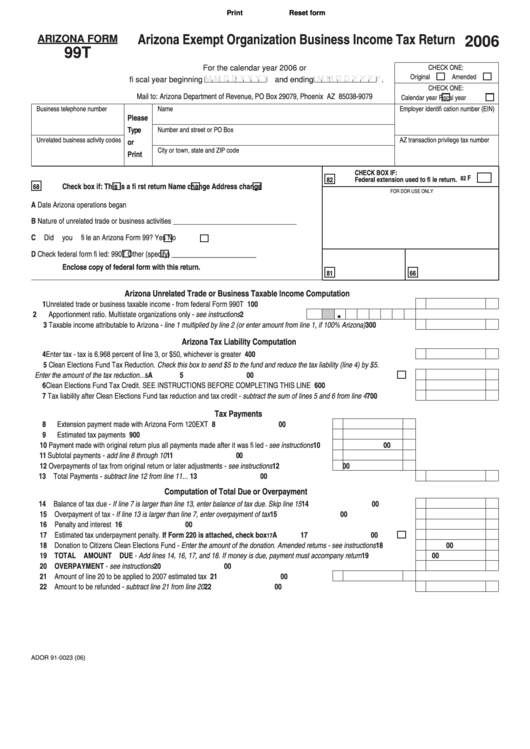

Fillable Arizona Form 99t Arizona Exempt Organization Business

You must use form 140. Ad download or email az form 140 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. We last updated arizona form 140 in february 2023 from the arizona. Web arizona income tax forms.

Web Who Must Usepersonal Income Tax Return Arizona Form 140Py?

Web personal income tax return filed by resident taxpayers. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. You (and your spouse, if married filing a joint return) may file form 140 only if you are full year residents of arizona. Web who can use arizona form 140?

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Arizona state income tax forms for tax year 2022 (jan. For more information about the arizona income tax, see the arizona income tax page. Ad download or email az form 140 & more fillable forms, register and subscribe now! You may need to use use form 140 instead if all of the following apply:

File A Form 140Py If You Were An Arizona Resident For Less Than 12 Months During 2021.

• you received pay for active service as a. Your arizona taxable income is $50,000 or. Individual payment type options include: Web in this case, you must file using form 140.

Web Who Must Use Form 140?

Form 140a arizona resident personal income tax booklet. We last updated arizona form 140 in february 2023 from the arizona. You must use form 140. Web make an individual or small business income payment.