Arizona Llc Tax Form

Arizona Llc Tax Form - Typically, the profit llc makes passes through the llc to its members. Every corporation required to file a return shall pay a $50 minimum tax in. Arizona corporation income tax return (short form) corporate tax forms : Drug deaths nationwide hit a record 109,680 in 2022, according to. For information or help, call one of the numbers listed: If you need tax forms, instructions, and other tax information, go Not all llcs are subjected to the same tax filing requirements. Arizona corporate income tax highlights. 16, 2022, president joseph r. Register your llc with the state of arizona and pay applicable fees.

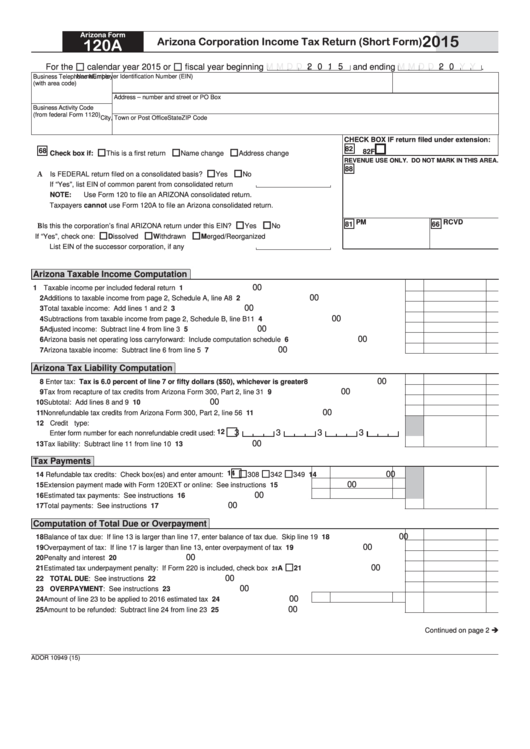

Every corporation required to file a return shall pay a $50 minimum tax in. Web about the home energy rebate programs. Starting with the 2020 taxable year, electronic filing of arizona corporate income tax returns is required. That said, the arizona department of revenue no longer requires that you attach your federal form 1120s with your az form 120s. Web the hearing was particularly timely, because the u.s. Only registered llcs are required to pay taxes. If you need tax forms, instructions, and other tax information, go Web arizona corporate or partnership income tax payment voucher: Typically, the profit llc makes passes through the llc to its members. Biden signed the landmark inflation reduction act (ira) into law.

Arizona corporate income tax highlights. Biden signed the landmark inflation reduction act (ira) into law. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Not all llcs are subjected to the same tax filing requirements. If you need tax forms, instructions, and other tax information, go Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make arizona estimated income tax payments using eft. Register your llc with the state of arizona and pay applicable fees. For information or help, call one of the numbers listed: Only registered llcs are required to pay taxes. Web arizona form 2022 arizona corporation income tax return 120.

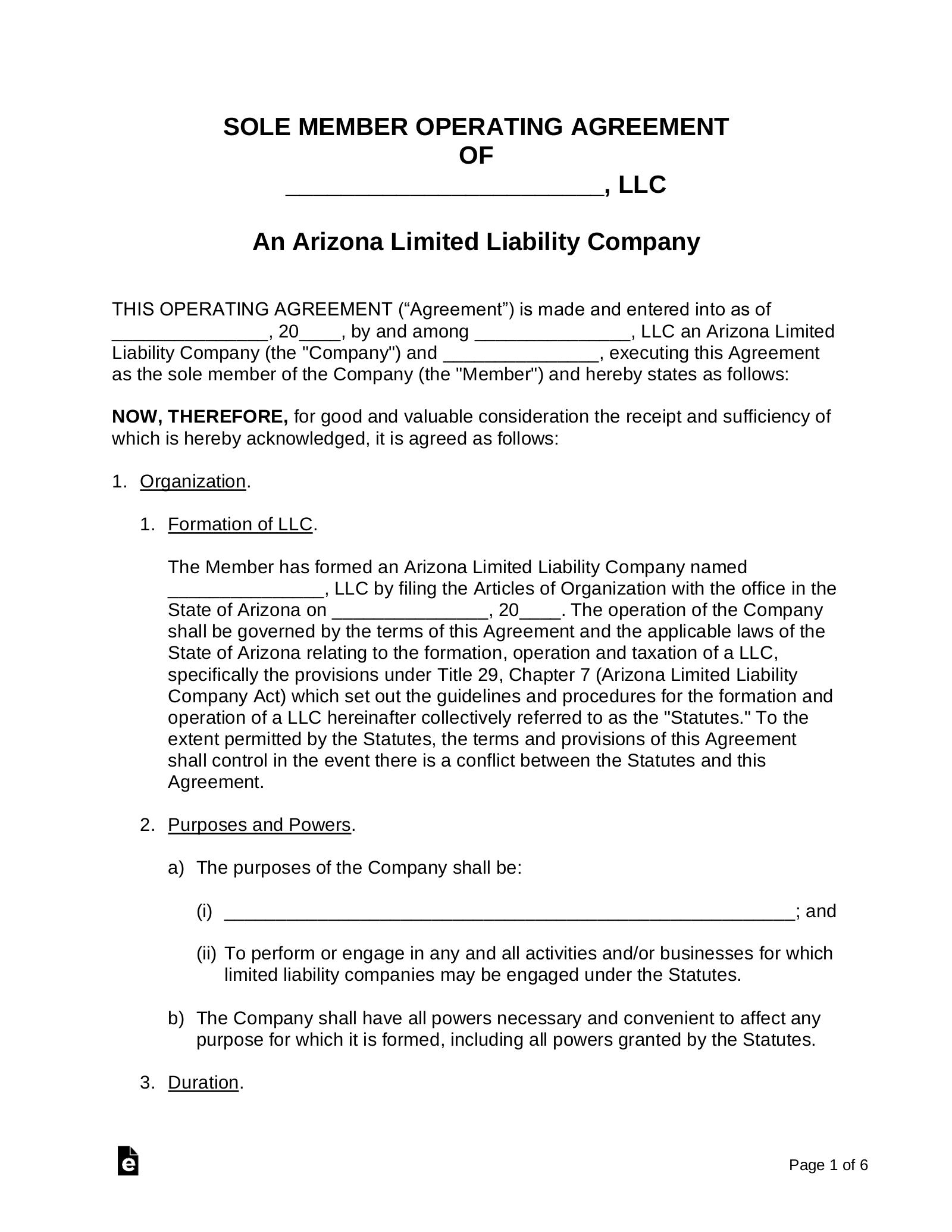

Download Arizona LLC Operating Agreement Form PDF Template Fill

Arizona corporation income tax return (short form) corporate tax forms : Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make arizona estimated income tax payments using eft. Web about the home energy rebate programs. Biden signed the landmark inflation reduction act (ira) into law. Starting with the 2020.

Permanent Guardianship Forms Arizona Form Resume Examples 2A1WbLd8ze

Arizona corporation income tax return (short form) corporate tax forms : Understand what ongoing tax and legal business requirements your llc is subjected to. Arizona corporate income tax highlights. For instance, llcs with employees need to file payroll taxes. Typically, the profit llc makes passes through the llc to its members.

Arizona Guardianship Forms Form Resume Examples w93Z9bJKxl

Is facing intensifying urgency to stop the worsening fentanyl epidemic. Every corporation required to file a return shall pay a $50 minimum tax in. That said, the arizona department of revenue no longer requires that you attach your federal form 1120s with your az form 120s. Web the hearing was particularly timely, because the u.s. Typically, the profit llc makes.

Arizona Llc Tax Forms Form Resume Examples nO9bPZGV4D

Biden signed the landmark inflation reduction act (ira) into law. For instance, llcs with employees need to file payroll taxes. Typically, the profit llc makes passes through the llc to its members. Any taxpayer who files an amended return with the irs must file an arizona amended return on form 120x within. Not all llcs are subjected to the same.

State Of Arizona Llc Forms Form Resume Examples EZVgBXZYJk

That said, the arizona department of revenue no longer requires that you attach your federal form 1120s with your az form 120s. Web corporate tax forms. Web arizona corporate or partnership income tax payment voucher: Understand what ongoing tax and legal business requirements your llc is subjected to. Any taxpayer who files an amended return with the irs must file.

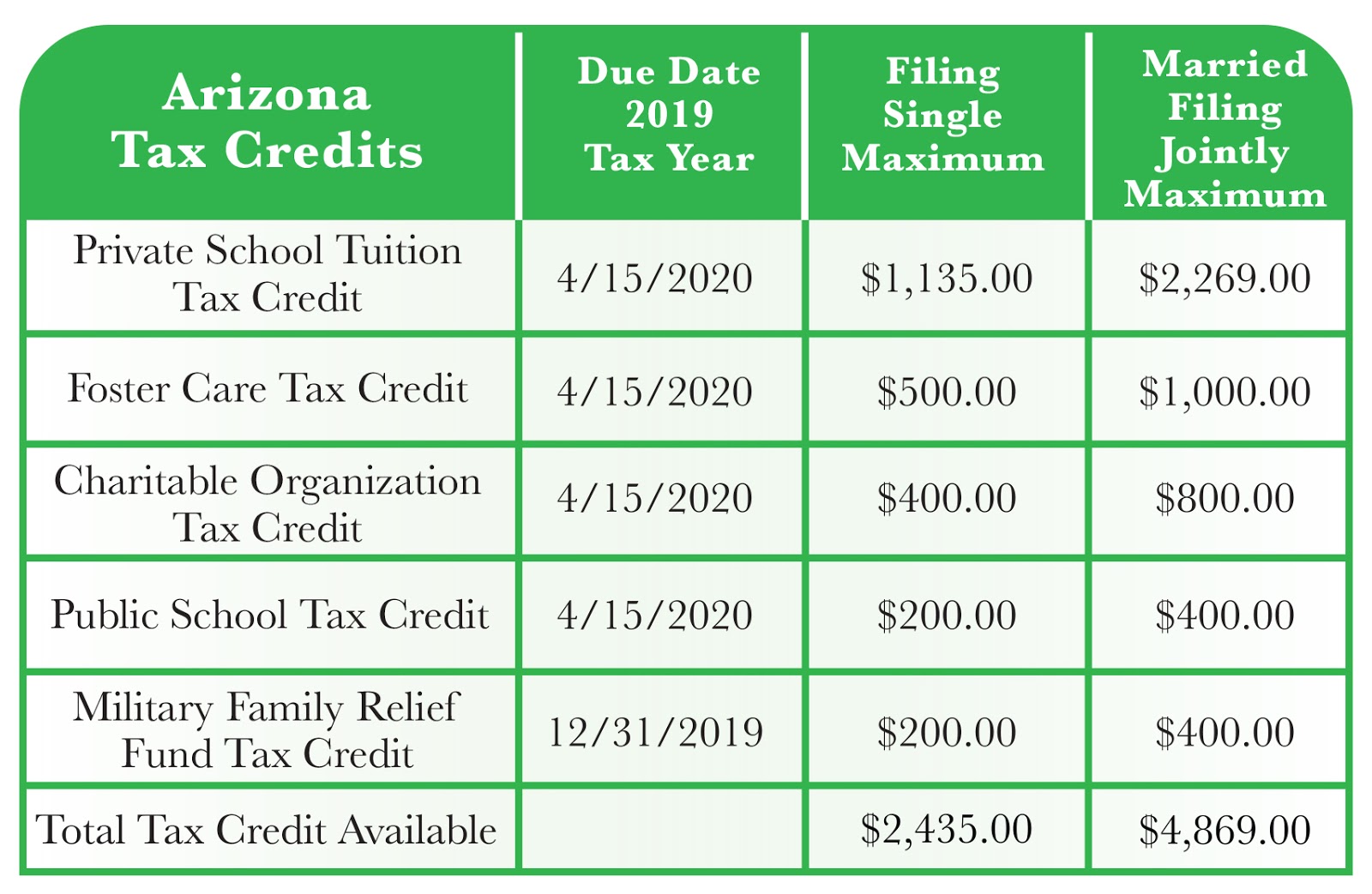

IBE Scholarships Arizona Offers Five Different Tax Credits

For instance, llcs with employees need to file payroll taxes. For information or help, call one of the numbers listed: Any taxpayer who files an amended return with the irs must file an arizona amended return on form 120x within. Arizona s corporation income tax return: Drug deaths nationwide hit a record 109,680 in 2022, according to.

Free Arizona Single Member LLC Operating Agreement Form PDF Word

Every corporation required to file a return shall pay a $50 minimum tax in. Tax forms, instructions, and other tax information. Web corporate tax forms. Electronic filing of arizona corporate income tax returns is required for the 2020 taxable year. Understand what ongoing tax and legal business requirements your llc is subjected to.

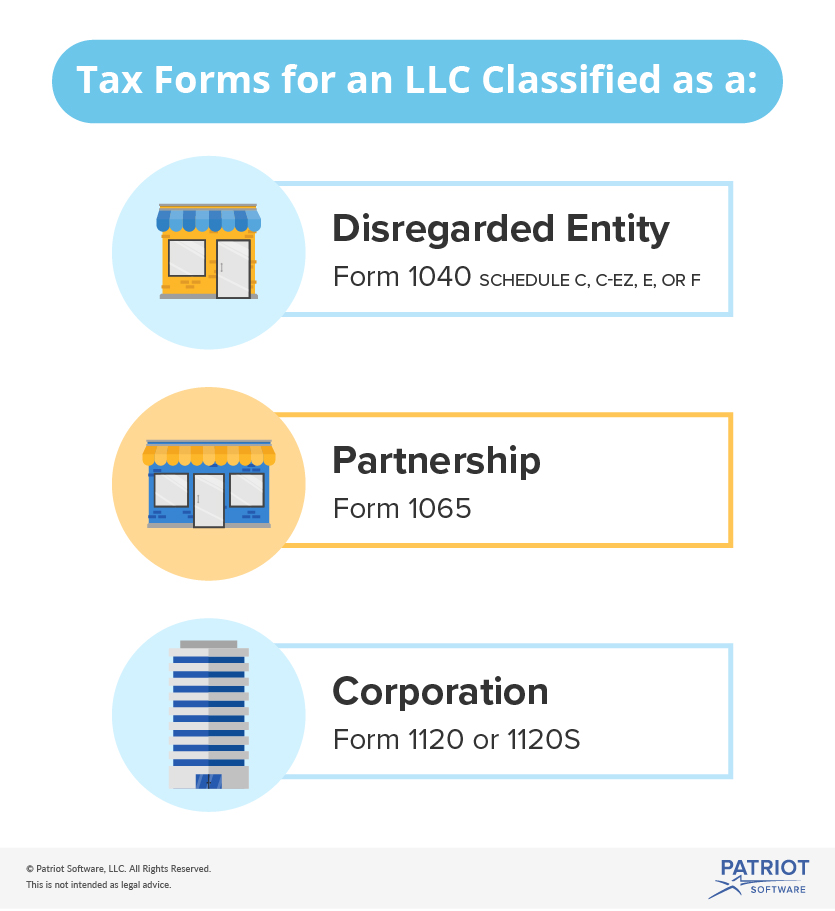

Tax Forms for an LLC Federal Forms LLCs Should Know About

Any taxpayer who files an amended return with the irs must file an arizona amended return on form 120x within. If you need tax forms, instructions, and other tax information, go Corporations may use form 120x to amend corporate returns. Only registered llcs are required to pay taxes. Web about the home energy rebate programs.

Fillable Arizona Form 120a Arizona Corporation Tax Return

Any taxpayer who files an amended return with the irs must file an arizona amended return on form 120x within. Electronic filing of arizona corporate income tax returns is required for the 2020 taxable year. For information or help, call one of the numbers listed: Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability.

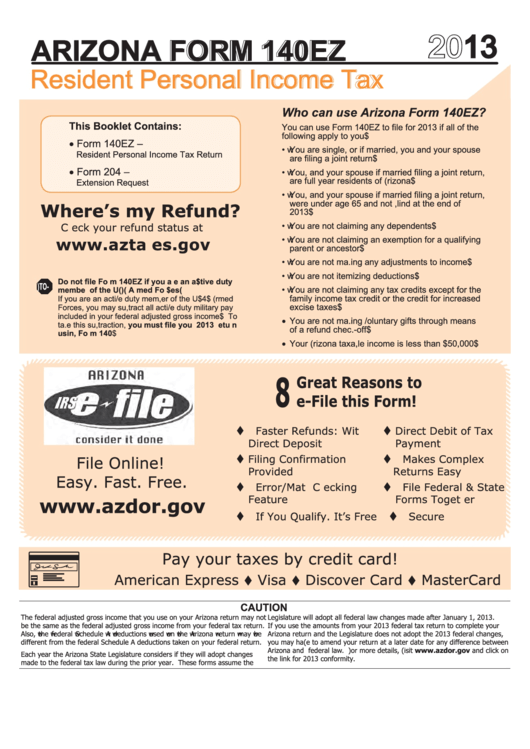

Arizona Form 140ez Resident Personal Tax Return 2013

Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make arizona estimated income tax payments using eft. That said, the arizona department of revenue no longer requires that you attach your federal form 1120s with your az form 120s. Web the hearing was particularly timely, because the u.s. Arizona.

Web Corporate Tax Forms.

Only registered llcs are required to pay taxes. Web the llc itself must file arizona tax return form 120s and pay any income tax owed, regardless of their gross receipts, net income, or activity levels. 16, 2022, president joseph r. Web arizona corporate or partnership income tax payment voucher:

Tax Forms, Instructions, And Other Tax Information.

Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make arizona estimated income tax payments using eft. Register your llc with the state of arizona and pay applicable fees. If you need tax forms, instructions, and other tax information, go Web arizona form 2022 arizona corporation income tax return 120.

The Law Includes $391 Billion To Support Clean Energy And Address Climate Change, Including $8.8 Billion In Rebates For Home Energy Efficiency And Electrification Projects.

Any taxpayer who files an amended return with the irs must file an arizona amended return on form 120x within. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Drug deaths nationwide hit a record 109,680 in 2022, according to. Starting with the 2020 taxable year, electronic filing of arizona corporate income tax returns is required.

Arizona Corporation Income Tax Return (Short Form) Corporate Tax Forms :

Understand what ongoing tax and legal business requirements your llc is subjected to. Electronic filing of arizona corporate income tax returns is required for the 2020 taxable year. Corporations may use form 120x to amend corporate returns. For instance, llcs with employees need to file payroll taxes.