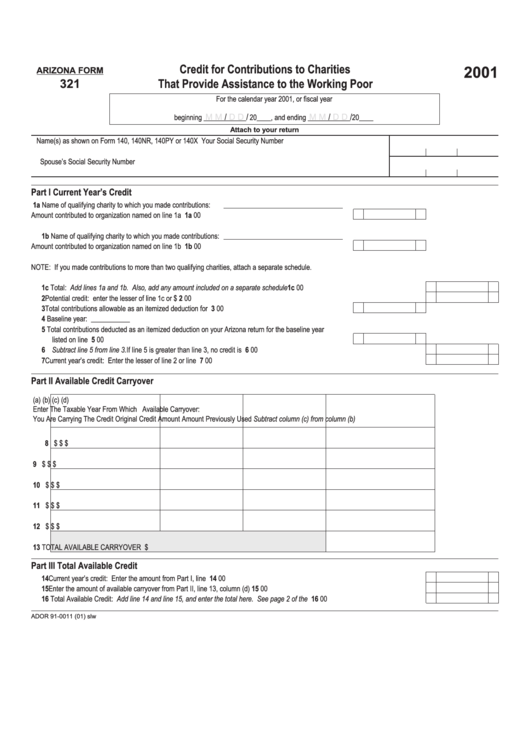

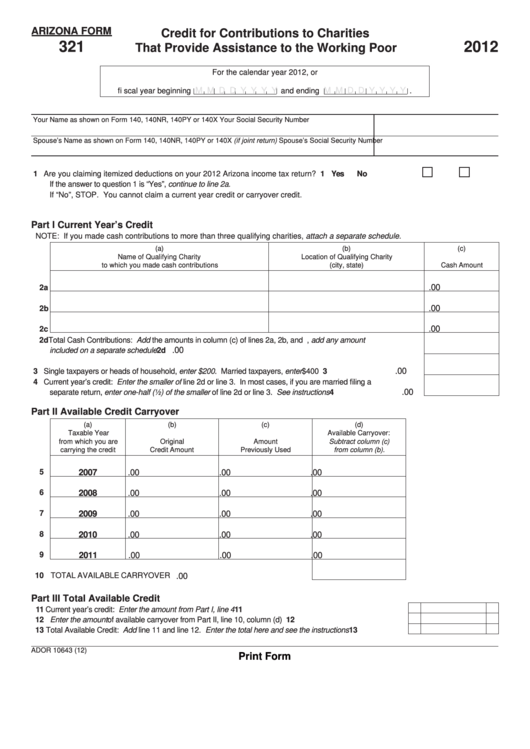

Arizona Tax Form 321

Arizona Tax Form 321 - Web arizona's credits under form 321 and 352 are 100% refundable so contributions may only be claimed if as federal itemized deduction if they are taken as a state tax payment on. For information or help, call one of the numbers listed: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Cash contributions made january 1, 2021 through december 31, 2021. For contributions made to non. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 321with your tax return to claim this credit. Web 26 rows form number title; Easily fill out pdf blank, edit, and sign them. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web the tax credit is claimed on form 321.

Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Easily fill out pdf blank, edit, and sign them. Web we last updated arizona form 321 in february 2023 from the arizona department of revenue. Web arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. The deadline for making a. Claim for refund on behalf of deceased taxpayer: Web arizona tax form 321. Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim your tax credit. Web 26 rows arizona corporate or partnership income tax payment voucher: Web more about the arizona form 131.

Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim your tax credit. Web separately on arizona form 321. Web 26 rows form number title; Claim for refund on behalf of deceased taxpayer: Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Web arizona tax form 321. Ad register and subscribe now to work on your az dor form 321 & more fillable forms. When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on. Get everything done in minutes. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

Arizona Tax Credit Homicide Survivors Inc

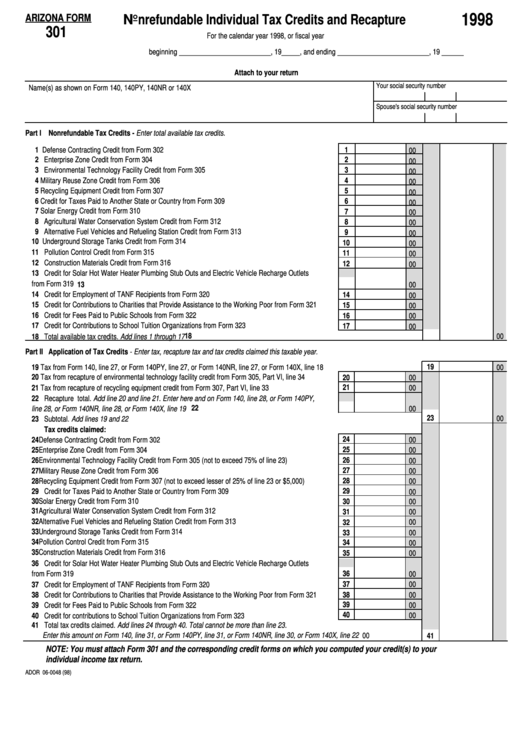

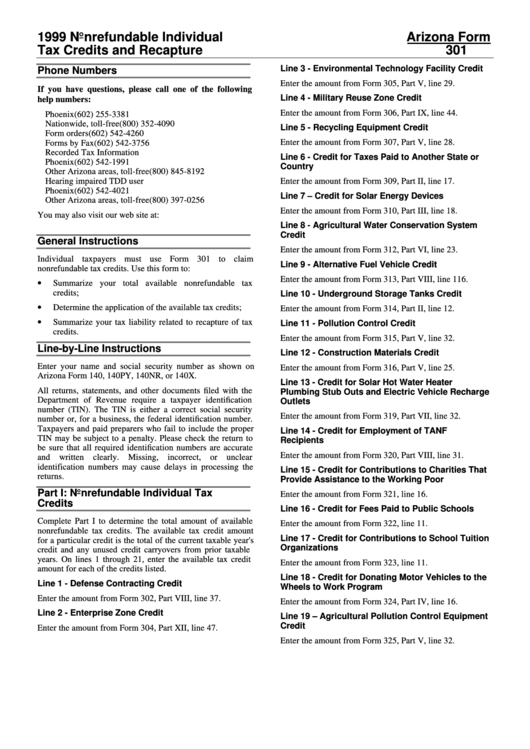

You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 321with your tax return to claim this credit. Part 1 current year’s credit a. Web a nonrefundable individual tax credit for voluntary cash contributions to a qualifying foster care charitable organization (qfco). Save or instantly send your ready documents. Web separately on.

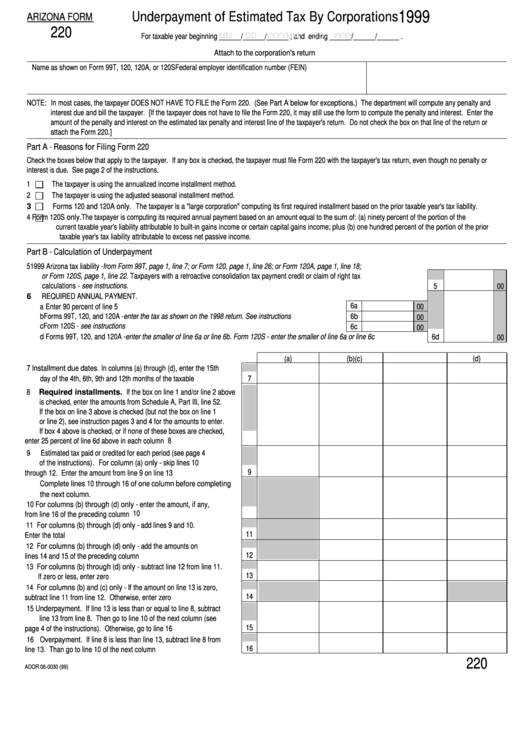

Arizona Form 220 Underpayment Of Estimated Tax By Corporations 1999

For contributions made to non. Web more about the arizona form 131. Part 1 current year’s credit a. The deadline for making a. This form is for income earned in tax year.

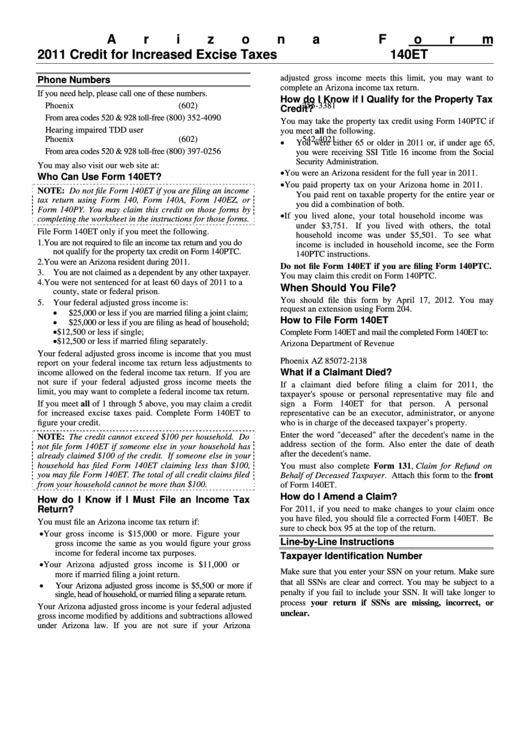

Instructions For Arizona Form 140et Credit For Increased Excise Taxes

Easily fill out pdf blank, edit, and sign them. Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: This form is for income earned in tax year. Web 26 rows form number title; Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim.

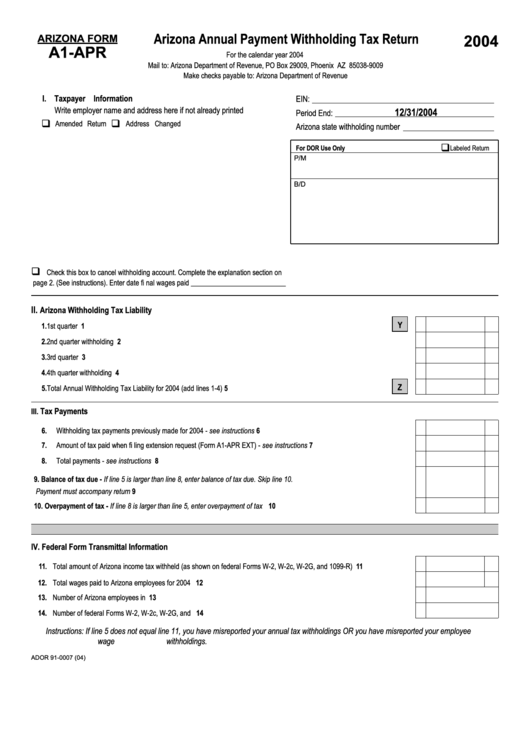

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Web to qualifying charitable organizations 321. Web a nonrefundable individual tax credit for voluntary cash contributions to a qualifying foster care charitable organization (qfco). Ad register and subscribe now to work on your az dor form 321 & more fillable forms. The maximum qco credit donation amount for 2022: Check out how easy it is to complete and esign documents.

Arizona Form 321 Credit For Contributions To Charities That Provide

Web the tax credit is claimed on form 321. We last updated arizona form 131 in february 2023 from the arizona department of revenue. For contributions made to non. Cash contributions made january 1, 2021 through december 31, 2021. Web to qualifying charitable organizations 321.

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Ad register and subscribe now to work on your az dor form 321 & more fillable forms. We last updated arizona form 131 in february 2023 from the arizona department of revenue. For contributions made to non. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them.

Fillable Arizona Form 321 Credit For Contributions To Charities That

Complete, edit or print tax forms instantly. This form is for income earned in tax year. Web the tax credit is claimed on form 321. We last updated arizona form 131 in february 2023 from the arizona department of revenue. For contributions made to non.

Noor Women's Association “Bringing Light into the Lives of Refugees”

Get everything done in minutes. This form is for income earned in tax year. Complete, edit or print tax forms instantly. Web use arizona form 321, “credit for contributions to qualifying charitable organizations” to claim your tax credit. Complete, edit or print tax forms instantly.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web 26 rows form number title; When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on. Get everything done in minutes. Web to qualifying charitable organizations 321. Web we last updated arizona form 321 in february 2023 from the arizona department of revenue.

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

Complete, edit or print tax forms instantly. Web arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web a nonrefundable individual tax credit for voluntary.

This Form Is For Income Earned In Tax Year.

Web 26 rows arizona corporate or partnership income tax payment voucher: For contributions made to non. Web separately on arizona form 321. Web arizona's credits under form 321 and 352 are 100% refundable so contributions may only be claimed if as federal itemized deduction if they are taken as a state tax payment on.

When Filing Your Taxes In 2022, Charitable Tax Credit Gifts Made Between January 1, 2021, And December 31, 2021, Are Required To Be Listed On.

Web the tax credit is claimed on form 321. Web arizona form 321 1 (1) include with your return. Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Complete, edit or print tax forms instantly.

What Is The Deadline For Contributing?

For information or help, call one of the numbers listed: This form is for income earned in tax year 2022, with tax returns due in. Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed:

Cash Contributions Made January 1, 2021 Through December 31, 2021.

You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 321with your tax return to claim this credit. Easily fill out pdf blank, edit, and sign them. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web a nonrefundable individual tax credit for voluntary cash contributions to a qualifying foster care charitable organization (qfco).