Az State Tax Form 140Ez

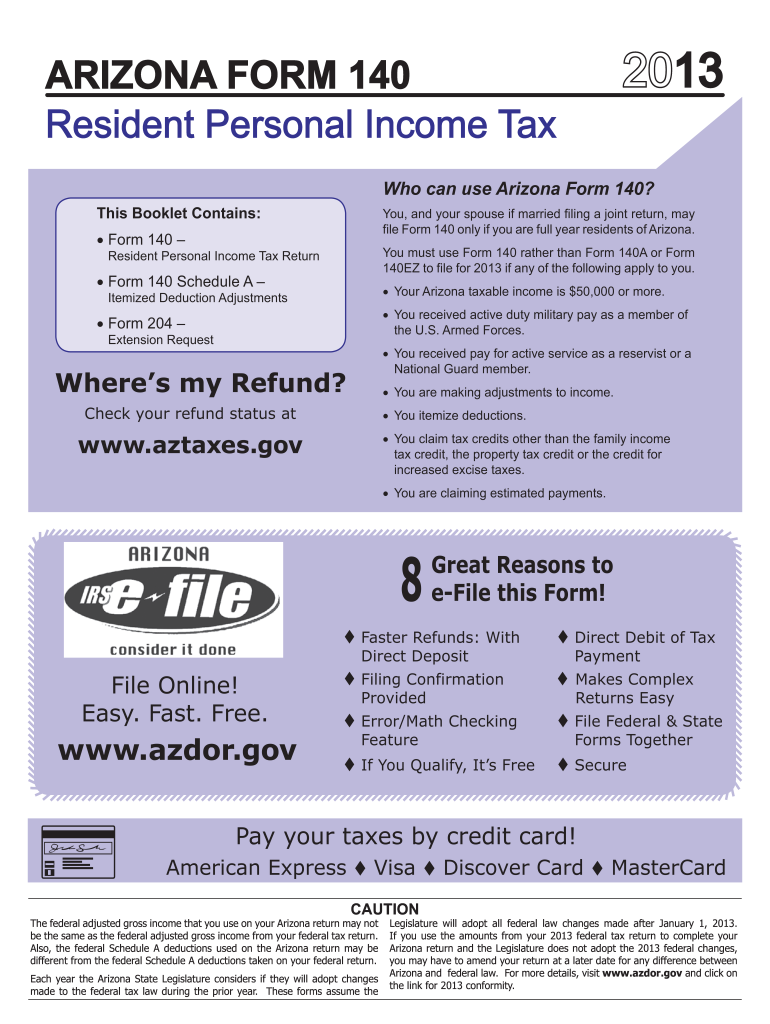

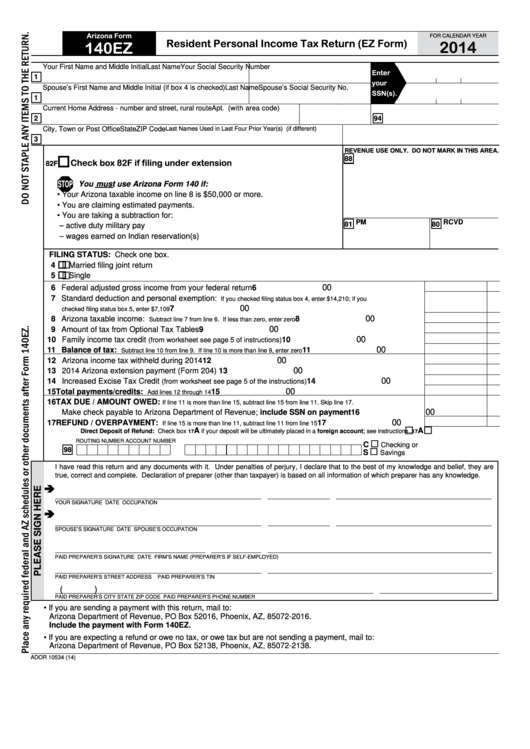

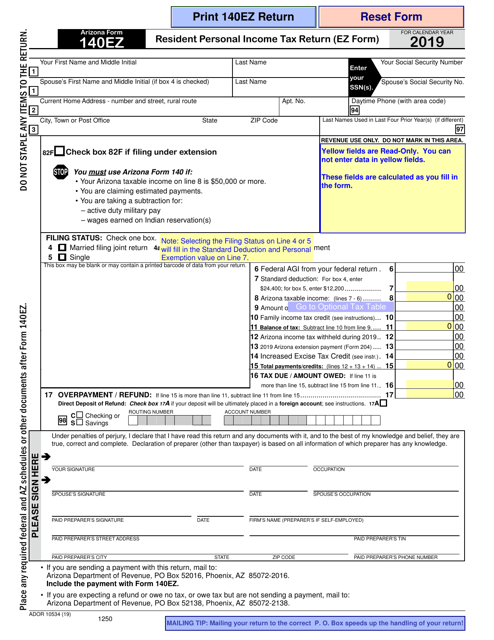

Az State Tax Form 140Ez - If your taxable income is $50,000 or more, you cannot use form 140ez or. Web who can file form 140et? Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax. Complete, edit or print tax forms instantly. Try it for free now! You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web personal income tax return filed by resident taxpayers. This form is for income earned in tax year 2022, with tax returns due in april. Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: Once you receive your confirmation.

Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: Web 26 rows 140ez : Web personal income tax return filed by resident taxpayers. Web personal income tax return filed by resident taxpayers. 2021 arizona resident personal income tax return booklet (easy form) Download or email az 140ez & more fillable forms, register and subscribe now! Web • you are not claiming any tax credits except for the family income tax credit or the credit for increased excise taxes. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. Web arizona form 2020 resident personal income tax return (ez form) for information or help, call one of the numbers listed:

You can use form 140ez to file for 2019 if all of the following apply to you. Web arizona form 2020 resident personal income tax return (ez form) for information or help, call one of the numbers listed: You are single, or if married, you and your spouse are filing a. Web who can use arizona form 140ez? This form is for income earned in tax year 2022, with tax returns due in april. You may use form 140ez if all of the following apply: • you are single, or if married, you and your spouse are filing a. Web personal income tax return filed by resident taxpayers. Web 26 rows 140ez : • your arizona taxable income is less.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in april. Web who can use arizona form 140ez? You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web 26 rows 140ez : Download or email az 140ez & more fillable forms,.

Az 140 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

Web who can use arizona form 140ez? Web use the same names(s) and social security number(s) that were listed on arizona form 140, 140a, 140ez, 140py or 140nr. Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: Web arizona form 2018 resident personal.

Az Ez Tax Form Form Resume Examples

Web • you are not claiming any tax credits except for the family income tax credit or the credit for increased excise taxes. • you are single, or if married, you and your spouse are filing a. Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your.

State Of Michigan Land Contract Form Form Resume Examples

Download or email az 140ez & more fillable forms, register and subscribe now! Upload, modify or create forms. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

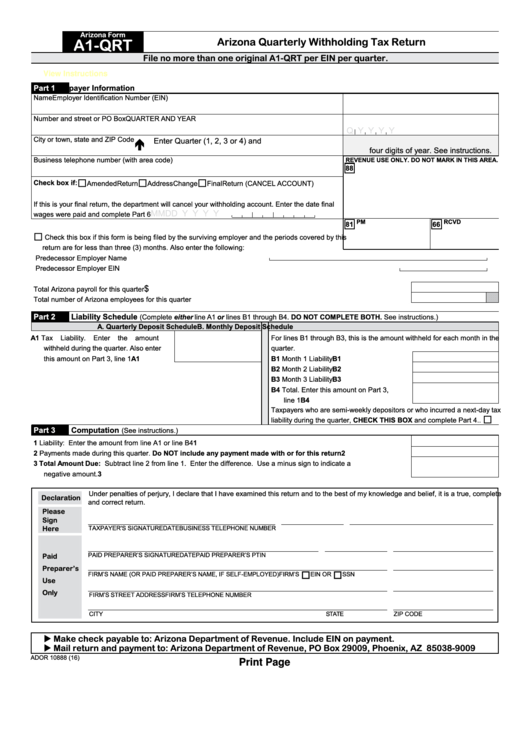

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

Upload, modify or create forms. You may use form 140ez if all of the following apply: Web 26 rows 140ez : You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web the correct amount to enter on line 6c is the total amount of charitable contributions.

AZ DoR JT1/UC001 20192021 Fill out Tax Template Online US Legal

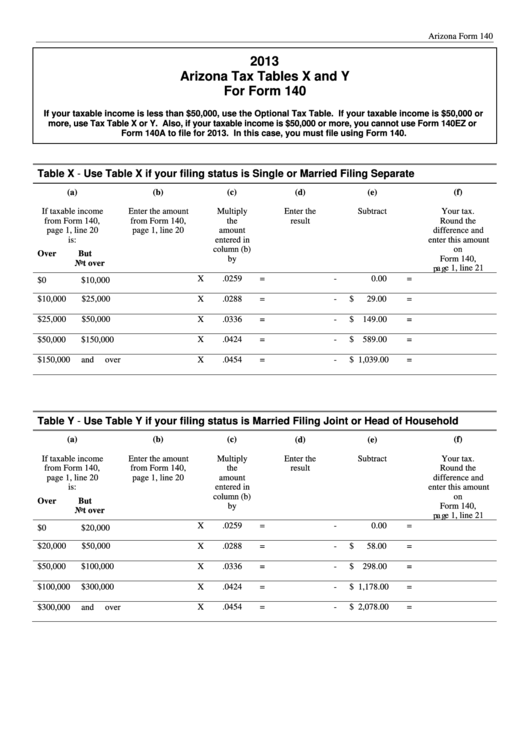

Try it for free now! Web personal income tax return filed by resident taxpayers. Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Upload, modify or create forms.

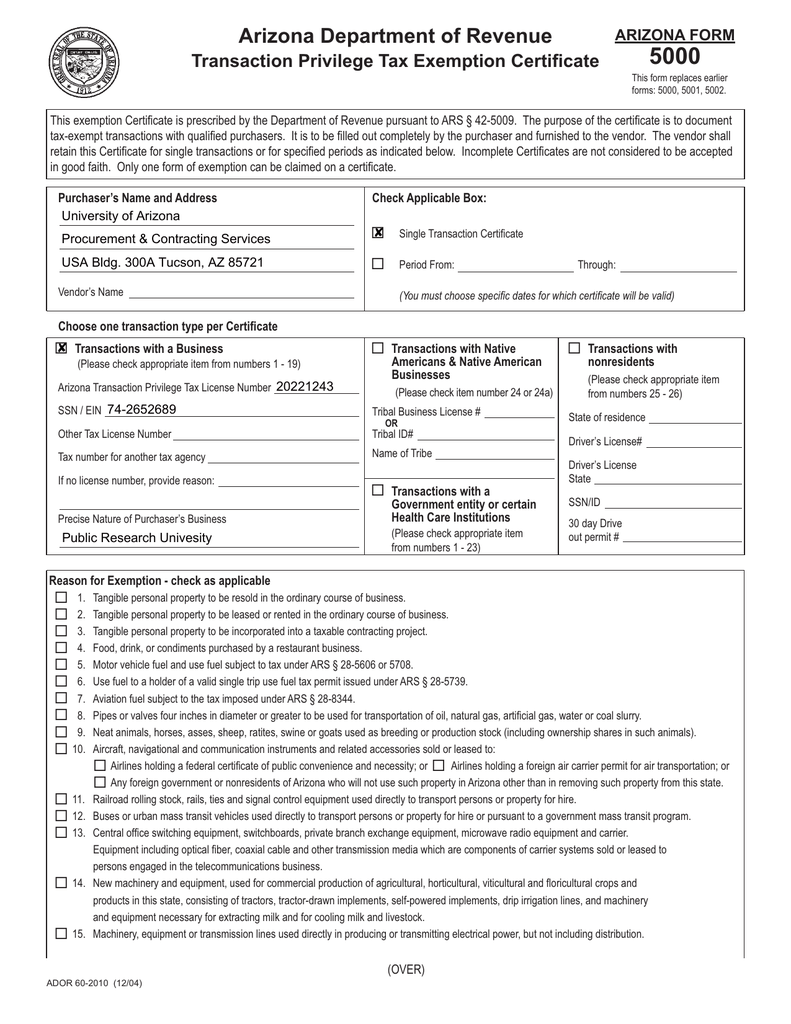

Arizona Department Of Revenue Tax Id Number Tax Walls

Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. • you are not making voluntary gifts through means of a refund. Web personal income tax return filed by resident taxpayers. 2021 arizona resident personal income tax return booklet (easy form) You are single, or if married, you and your spouse are filing a.

Fillable Arizona Form 140ez Resident Personal Tax Return (Ez

This form is for income earned in tax year 2022, with tax returns due in april. 2021 arizona resident personal income tax return booklet (easy form) Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: Az dor 140ez 2020 get az dor 140ez 2020 how it works.

Arizona Form 140EZ (ADOR10534) Download Fillable PDF or Fill Online

• you are not making voluntary gifts through means of a refund. You can use form 140ez to file for 2019 if all of the following apply to you. Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save..

Fillable Arizona Tax Tables X And Y For Form 140 2013 printable pdf

Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save. Complete, edit or print tax forms instantly. Web who can use arizona form.

Complete, Edit Or Print Tax Forms Instantly.

Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. • you are not making voluntary gifts through means of a refund. 2021 arizona resident personal income tax return booklet (easy form) Web use the same names(s) and social security number(s) that were listed on arizona form 140, 140a, 140ez, 140py or 140nr.

You May File Form 140 Only If You (And Your Spouse, If Married Filing A Joint Return) Are Full Year Residents Of Arizona.

Once you receive your confirmation. Complete, edit or print tax forms instantly. You can use form 140ez to file for 2019 if all of the following apply to you. Web 26 rows 140ez :

Try It For Free Now!

Upload, modify or create forms. You may use form 140ez if all of the following apply: You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies:

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web who can use arizona form 140ez? Web who can file form 140et? • you are single, or if married, you and your spouse are filing a. Web the correct amount to enter on line 6c is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax.