Az Withholding Form 2023

Az Withholding Form 2023 - I certify that i have made the election marked above. Check either box 1 or box 2: 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. State employees on the hris. Phoenix, az— the arizona department of revenue and the arizona association of. Web 20 rows arizona withholding reconciliation tax return: The withholding formula helps you. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Web form to elect arizona income tax withholding. Previously (and for the 2022 tax year), arizonans had to pay one of two tax.

Previously (and for the 2022 tax year), arizonans had to pay one of two tax. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web 20 rows arizona withholding reconciliation tax return: All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. 1 i am an arizona. Submitted by anonymous (not verified) on fri,. Check either box 1 or box 2: State employees on the hris. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue.

1 i am an arizona. State employees on the hris. Check either box 1 or box 2: All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web july 26, 2023. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Phoenix, az— the arizona department of revenue and the arizona association of. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Submitted by anonymous (not verified) on fri,.

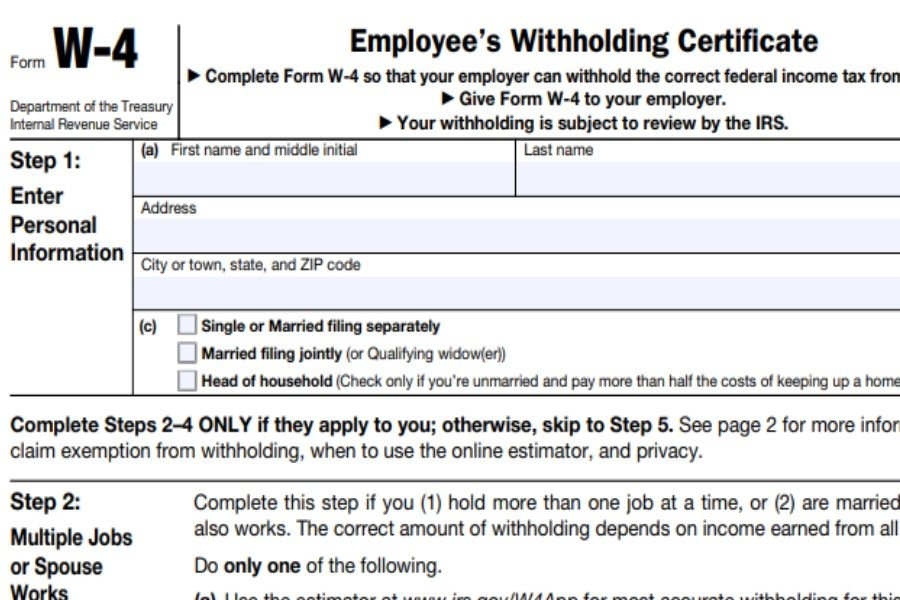

Irs New Tax Employee Forms 2023

Web form to elect arizona income tax withholding. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Previously (and.

Arizona State Tax withholding form 2018 Fresh 3 21 111 Chapter Three

Previously (and for the 2022 tax year), arizonans had to pay one of two tax. The withholding formula helps you. Here’s what that means for employers and employees. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. 1 i elect to have arizona income taxes.

W4 Form 2023 Printable Form IMAGESEE

Here’s what that means for employers and employees. Previously (and for the 2022 tax year), arizonans had to pay one of two tax. The withholding formula helps you. Web july 26, 2023. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax.

Irs Form W4V Printable 2020 Irs W9 Form 2020 Printable Pdf

I certify that i have made the election marked above. State employees on the hris. Web july 26, 2023. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state.

Employee Withholding Form 2021 W4 Form 2021

Phoenix, az— the arizona department of revenue and the arizona association of. I certify that i have made the election marked above. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. All wages, salaries, bonuses or other compensation paid for services performed in arizona are.

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Web form to elect arizona income tax withholding. I certify that i have made the election marked above. Check either.

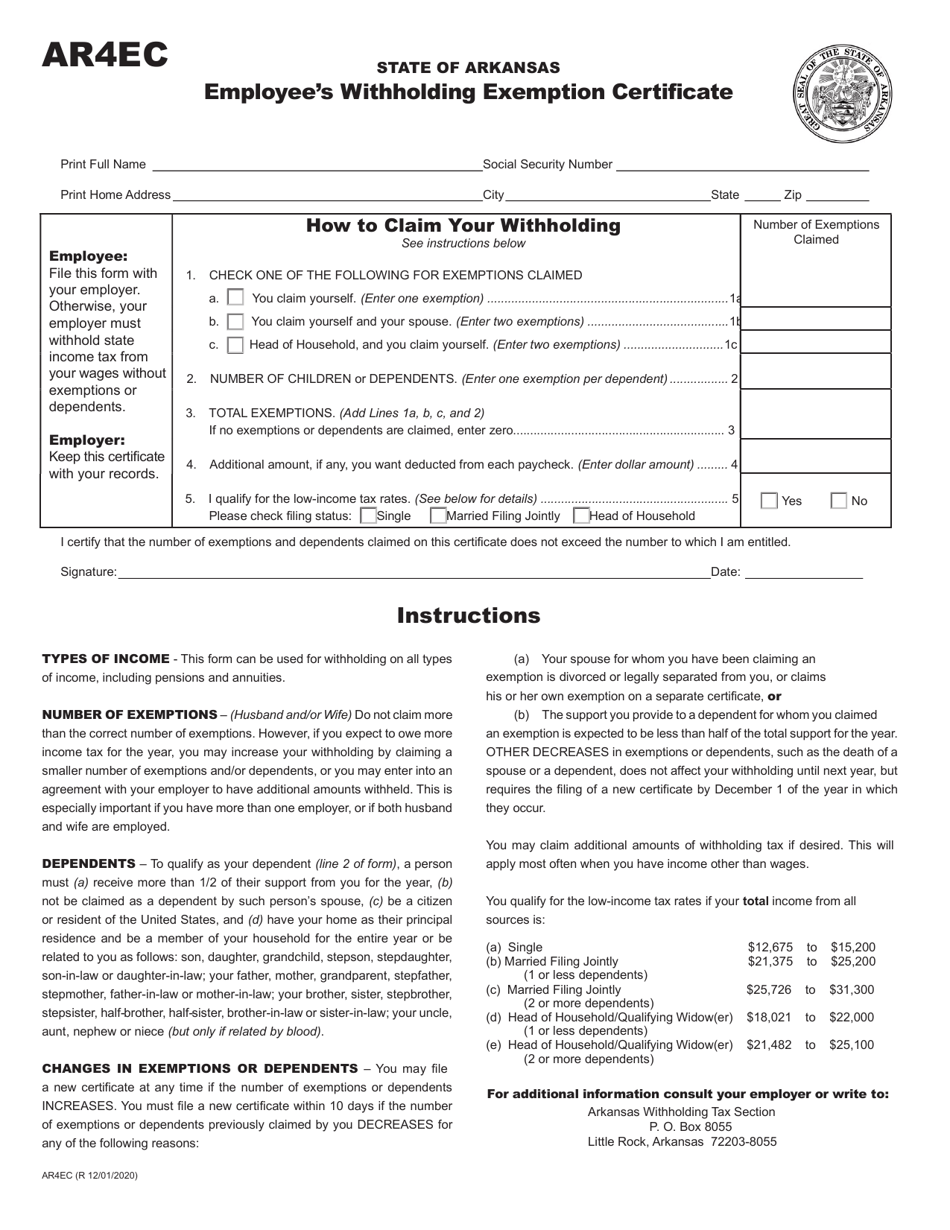

Form AR4EC Download Fillable PDF or Fill Online Employee's Withholding

The withholding formula helps you. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web 20 rows arizona withholding reconciliation tax return: Here’s what that means.

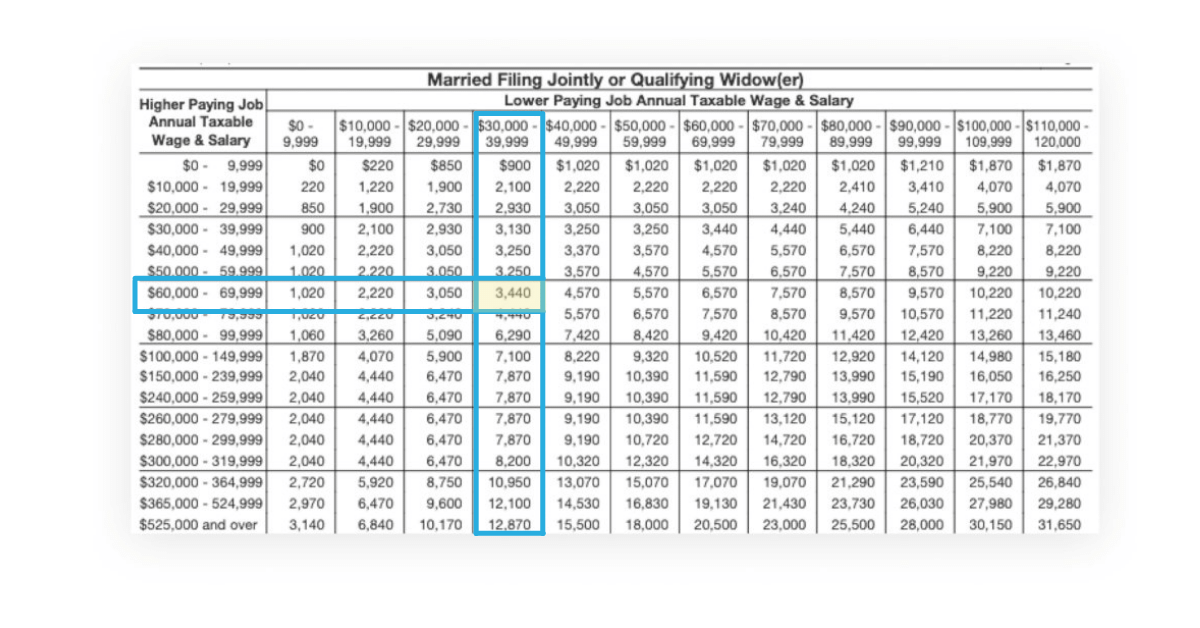

Payroll withholding calculator 2023 MonaDeimante

Web july 26, 2023. The withholding formula helps you. State employees on the hris. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web 20 rows arizona withholding reconciliation tax return:

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. I certify that i have made the election marked above. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Check either.

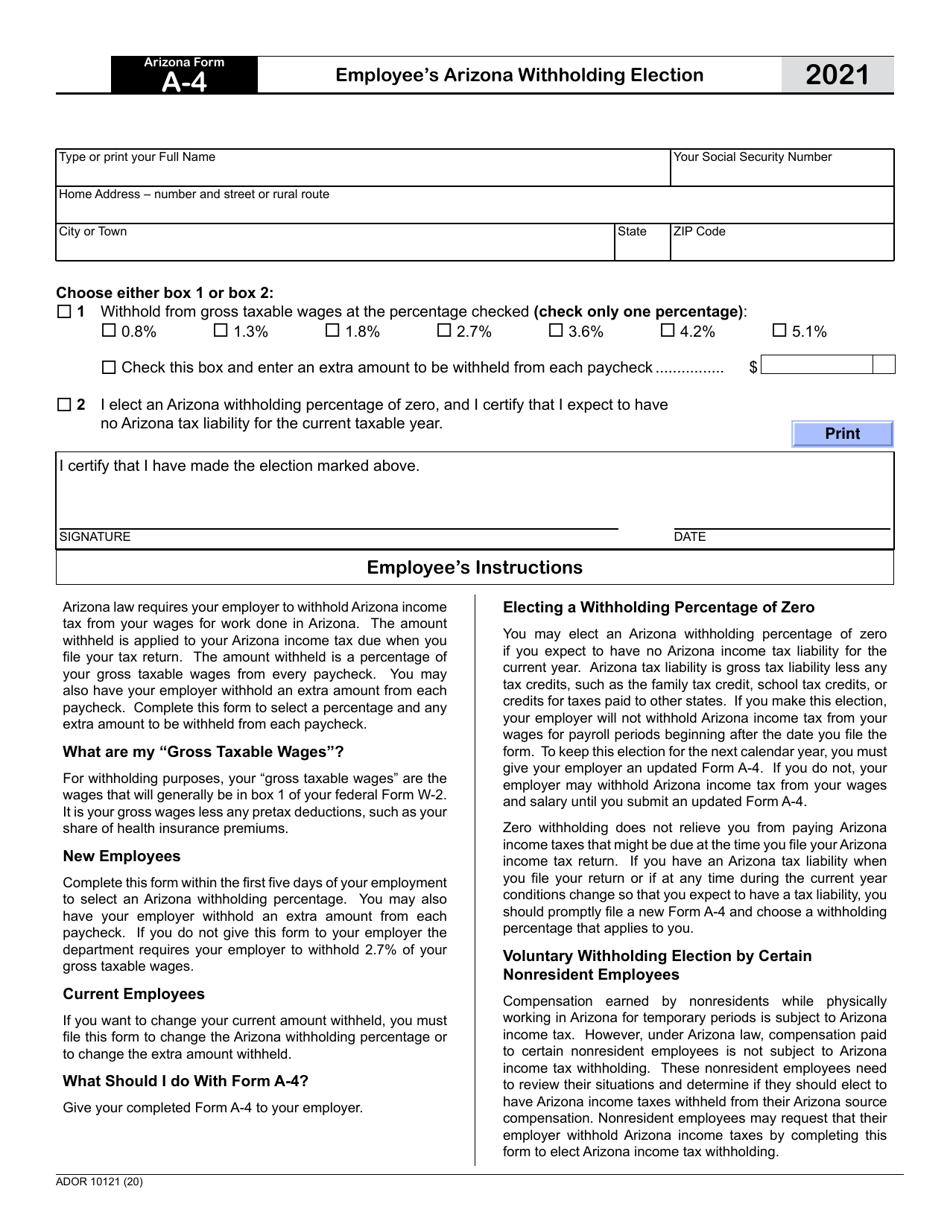

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Web form to elect arizona income tax withholding. Here’s what that means for employers and employees. Web 20 rows arizona withholding reconciliation tax return: Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and.

I Certify That I Have Made The Election Marked Above.

Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Previously (and for the 2022 tax year), arizonans had to pay one of two tax. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web form to elect arizona income tax withholding.

The Withholding Formula Helps You.

Web 20 rows arizona withholding reconciliation tax return: Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web july 26, 2023. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as.

State Employees On The Hris.

Phoenix, az— the arizona department of revenue and the arizona association of. Here’s what that means for employers and employees. Submitted by anonymous (not verified) on fri,. Check either box 1 or box 2:

1 I Am An Arizona.

Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents.