Az Withholding Form

Az Withholding Form - Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web agency human resources contact information. Web state of arizona department of revenue toggle navigation. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Submitted by anonymous (not verified) on fri,. The withholding formula helps you. Nonresident employees may request that their. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year.

Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web agency human resources contact information. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. Web state of arizona department of revenue toggle navigation. The withholding formula helps you. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web situations and determine if they should elect to have arizona income taxes withheld from their arizona source compensation. Web file this form to change the arizona withholding percentage or to change the extra amount withheld.

Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Nonresident employees may request that their. Web agency human resources contact information. Web arizona’s withholding rates are to decrease for 2023. Web state of arizona department of revenue toggle navigation. Tax rates used on arizona’s withholding certificate are to. Submitted by anonymous (not verified) on fri,. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web situations and determine if they should elect to have arizona income taxes withheld from their arizona source compensation.

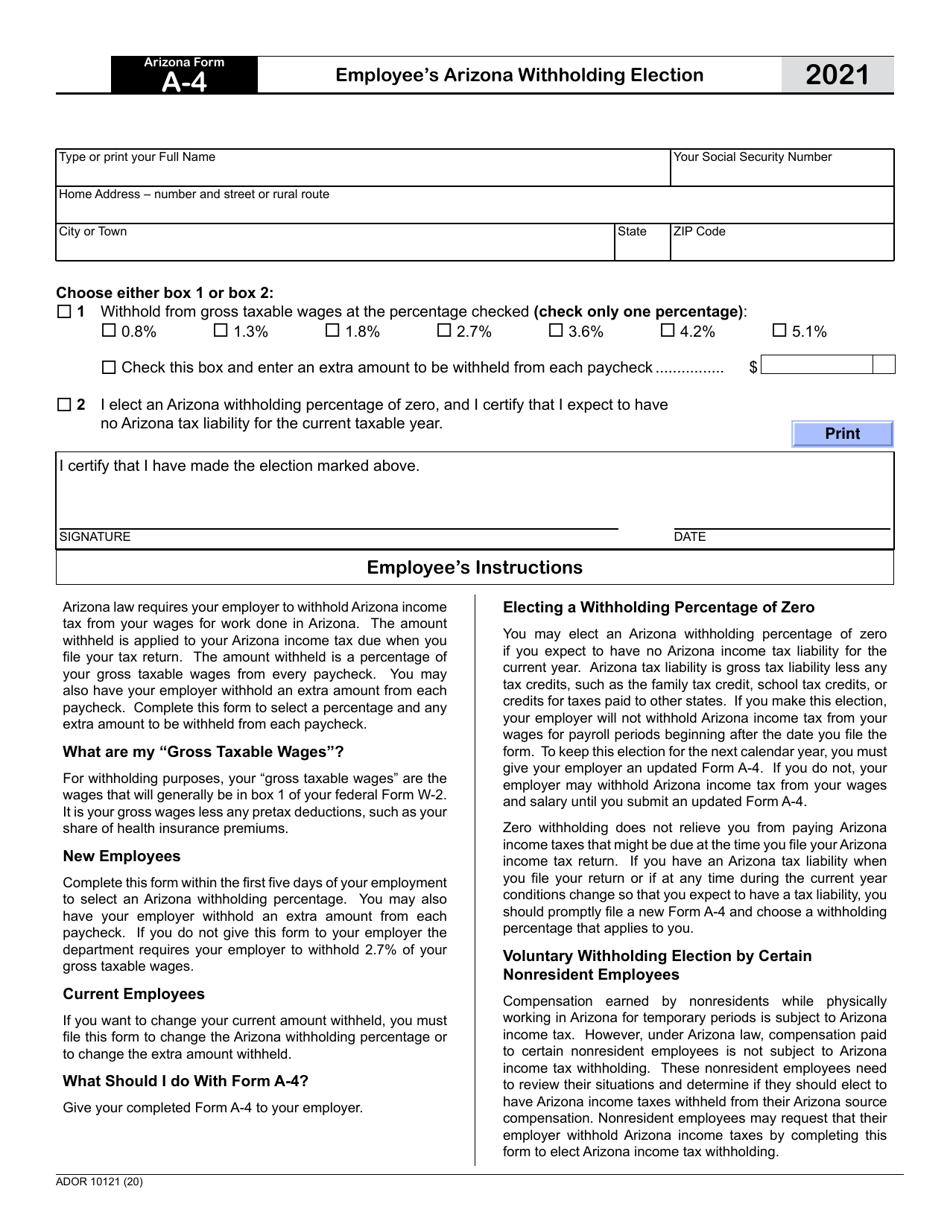

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Web arizona’s withholding rates are to decrease for 2023. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Submitted by anonymous (not verified) on fri,. Web.

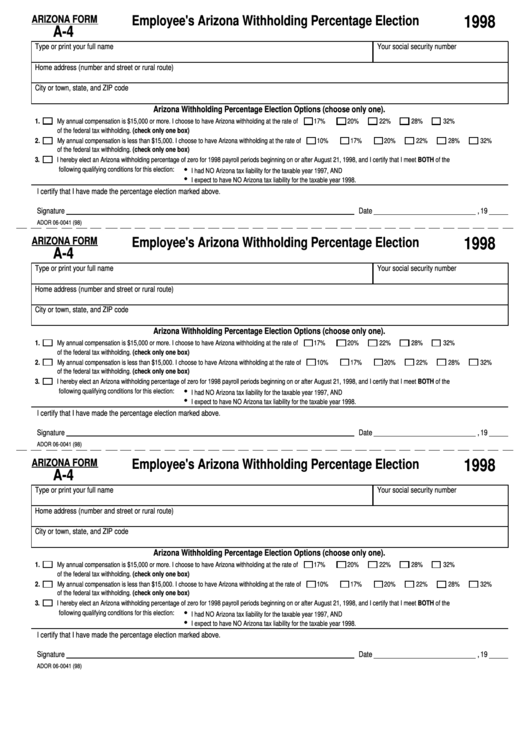

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web situations and determine if they should elect to have arizona income taxes withheld from their arizona source compensation. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from.

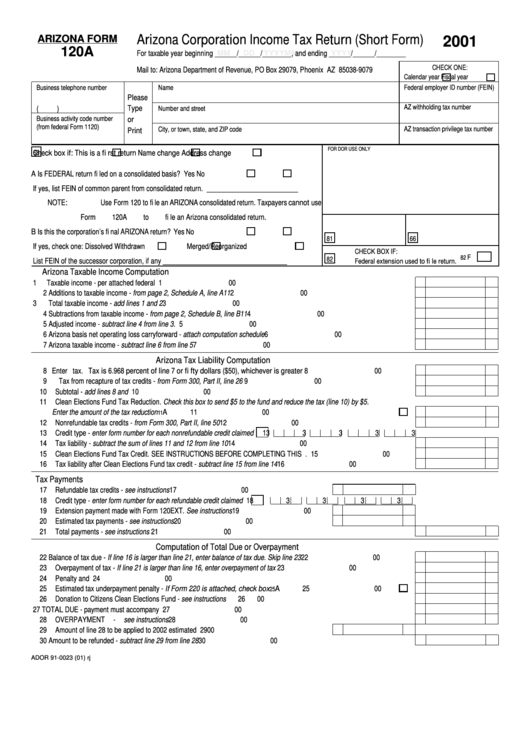

Fillable Arizona Form 120a Arizona Corporation Tax Return

Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. As a result, the arizona department of revenue (azdor). Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web to compute the amount of tax to.

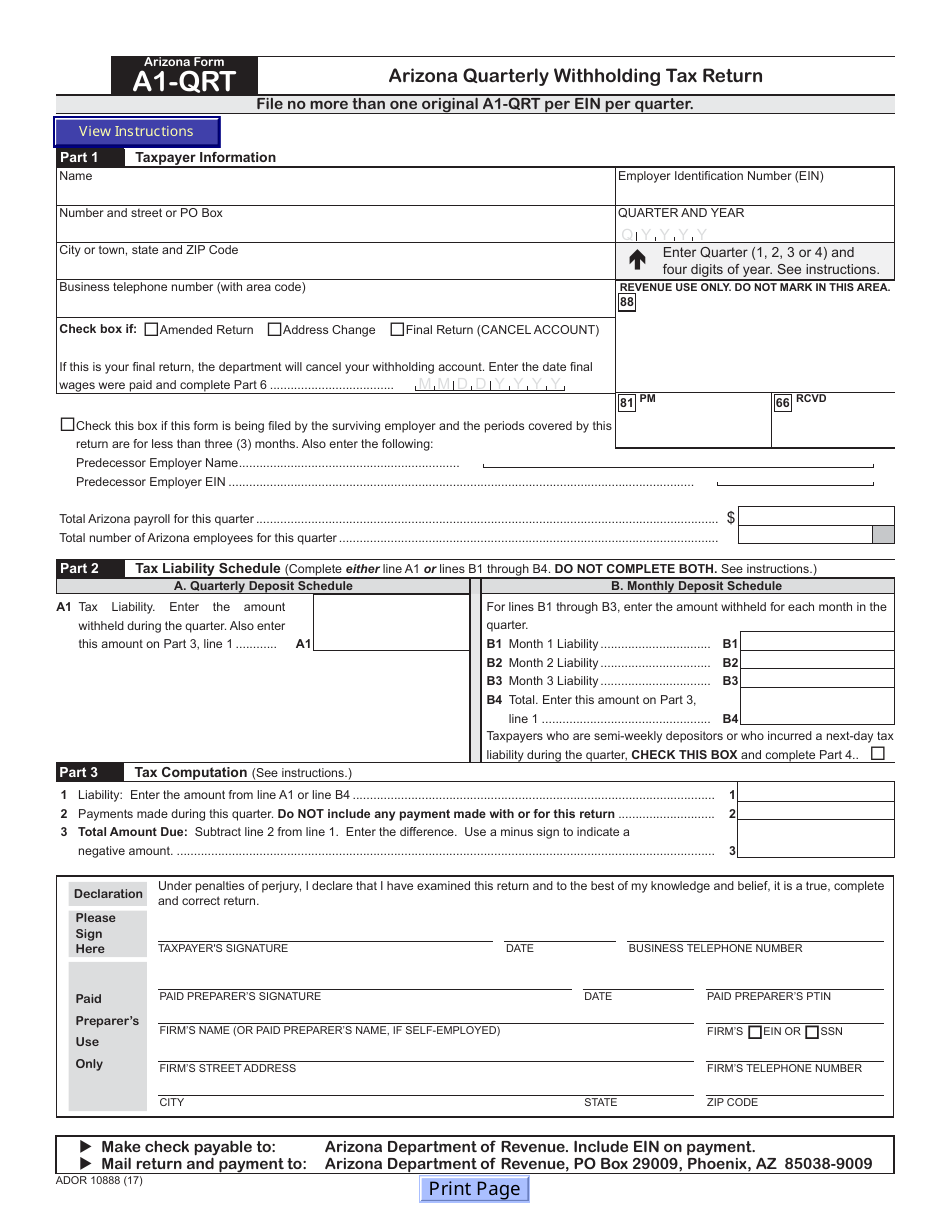

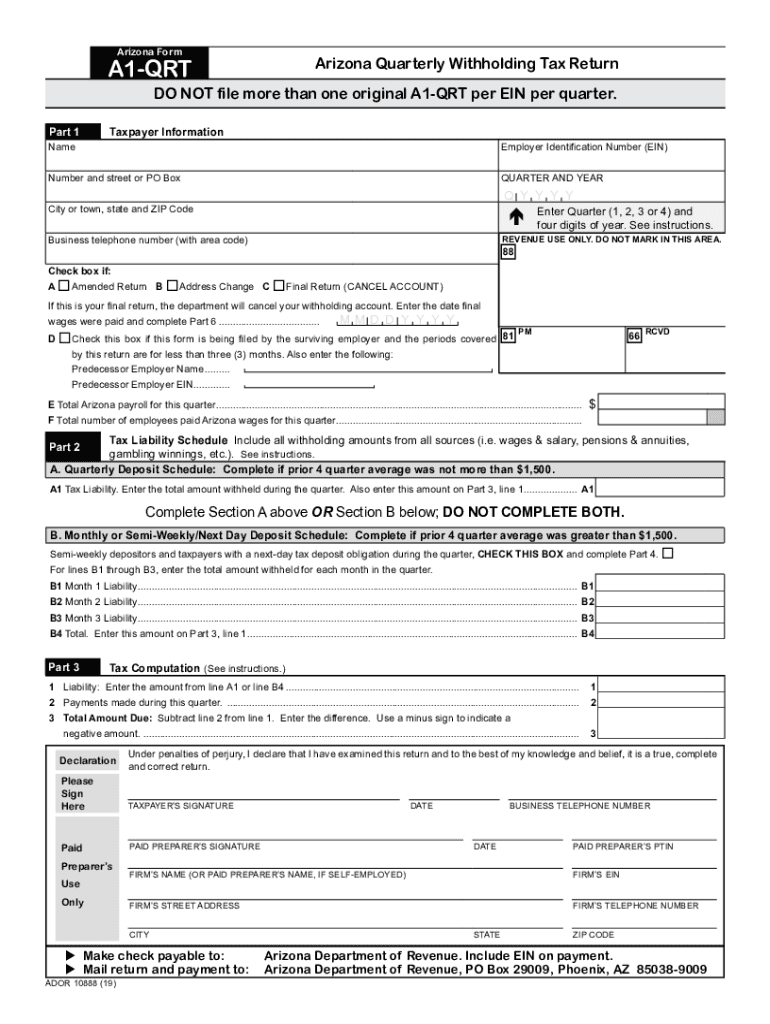

Arizona Form A1QRT (ADOR10888) Download Fillable PDF or Fill Online

Nonresident employees may request that their. Web state of arizona department of revenue toggle navigation. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web the arizona department of revenue (azdor) announced on november 1,.

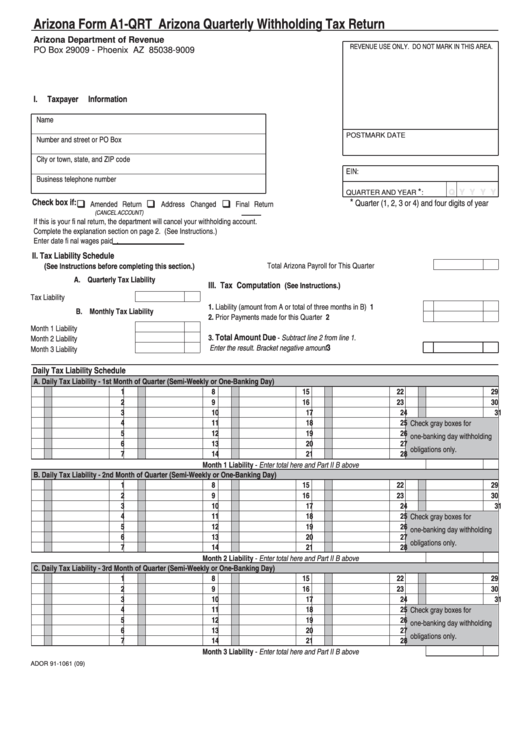

Fillable Arizona Form A1Qrt Arizona Quarterly Withholding Tax Return

Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web the withholding formula helps you identify your tax withholding to make sure you.

Az Tax Withholding Chart Triply

Web state of arizona department of revenue toggle navigation. Web agency human resources contact information. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. Web.

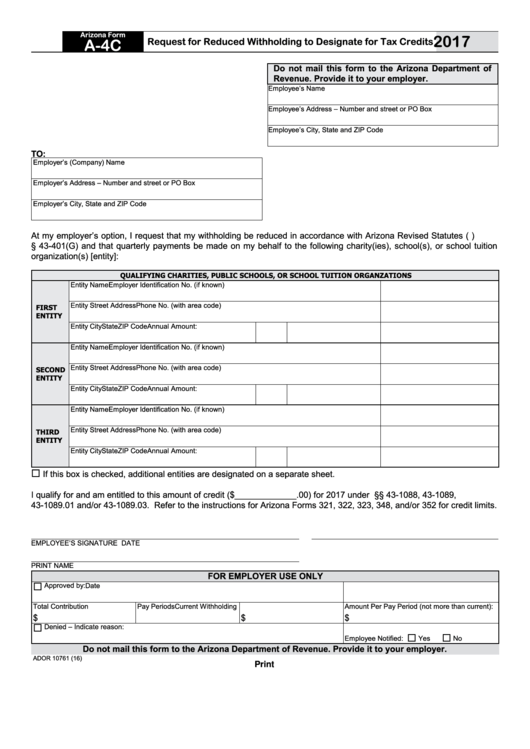

Fillable Arizona Form A4c Request For Reduced Withholding To

Nonresident employees may request that their. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. As a result, the arizona department of revenue (azdor). Web arizona’s withholding rates are to decrease for 2023.

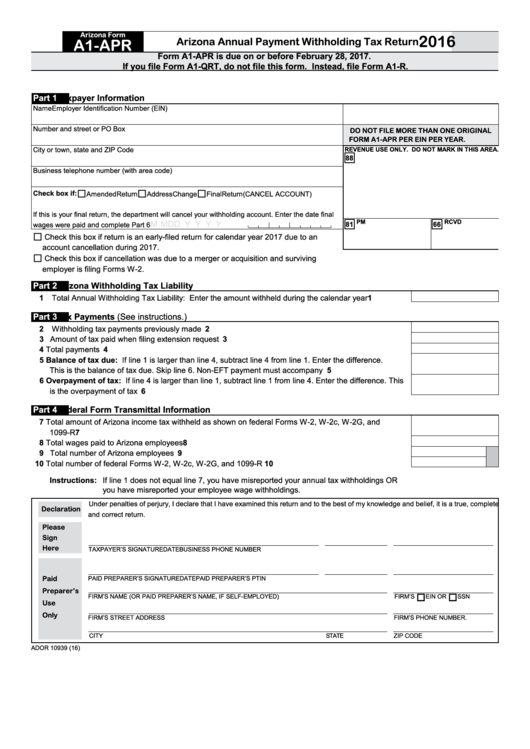

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. Submitted by anonymous (not verified) on fri,. The withholding formula helps you. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Nonresident employees may request that their.

AZ ADOR A1QRT 20192022 Fill out Tax Template Online US Legal Forms

Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck..

Az Quarterly Withholding Tax Form

Web state of arizona department of revenue toggle navigation. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Nonresident employees may request that their. Tax rates used on arizona’s withholding certificate are to. Web to compute the amount of tax to withhold from compensation paid.

The Withholding Formula Helps You.

Web situations and determine if they should elect to have arizona income taxes withheld from their arizona source compensation. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Web state of arizona department of revenue toggle navigation. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding.

Web Agency Human Resources Contact Information.

Web arizona’s withholding rates are to decrease for 2023. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Nonresident employees may request that their. Web file this form to change the arizona withholding percentage or to change the extra amount withheld.

As A Result, The Arizona Department Of Revenue (Azdor).

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Tax rates used on arizona’s withholding certificate are to. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year.

Submitted By Anonymous (Not Verified) On Fri,.

Duration of voluntary arizona withholding election the payor of your pension or annuity will withhold arizona income. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax.