Balance Sheet Hedging

Balance Sheet Hedging - The opportunity cost of holding margin capital and lost upside. First, when a company enters into some. The most obvious foreign currency exposures to hedge are balance sheet items, such as. It can be an interest rate risk, a stock market risk, or most commonly, a. In essence, this programme focuses only on the exposures that have. Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Businesses need the right strategy to manage risk for. Web fundamental accounting concepts for fx hedging balance sheet hedging. Web cash flow and balance sheet hedging to manage risk in a volatile global economy.

In essence, this programme focuses only on the exposures that have. Web fundamental accounting concepts for fx hedging balance sheet hedging. First, when a company enters into some. The opportunity cost of holding margin capital and lost upside. The most obvious foreign currency exposures to hedge are balance sheet items, such as. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate risk, a stock market risk, or most commonly, a. Web two kinds of indirect costs are worth discussing: Web cash flow and balance sheet hedging to manage risk in a volatile global economy. Businesses need the right strategy to manage risk for.

Web two kinds of indirect costs are worth discussing: The most obvious foreign currency exposures to hedge are balance sheet items, such as. Web fundamental accounting concepts for fx hedging balance sheet hedging. In essence, this programme focuses only on the exposures that have. Businesses need the right strategy to manage risk for. It can be an interest rate risk, a stock market risk, or most commonly, a. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web cash flow and balance sheet hedging to manage risk in a volatile global economy. The opportunity cost of holding margin capital and lost upside. First, when a company enters into some.

Balance Sheet Hedging Health Check 5 Questions to Ask

In essence, this programme focuses only on the exposures that have. Web two kinds of indirect costs are worth discussing: Web cash flow and balance sheet hedging to manage risk in a volatile global economy. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; First, when a company enters into some.

Balance Sheet Hedging Ppt Powerpoint Presentation Layouts Influencers

Web two kinds of indirect costs are worth discussing: The most obvious foreign currency exposures to hedge are balance sheet items, such as. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate risk, a stock market risk, or most commonly, a. Businesses need the right strategy to.

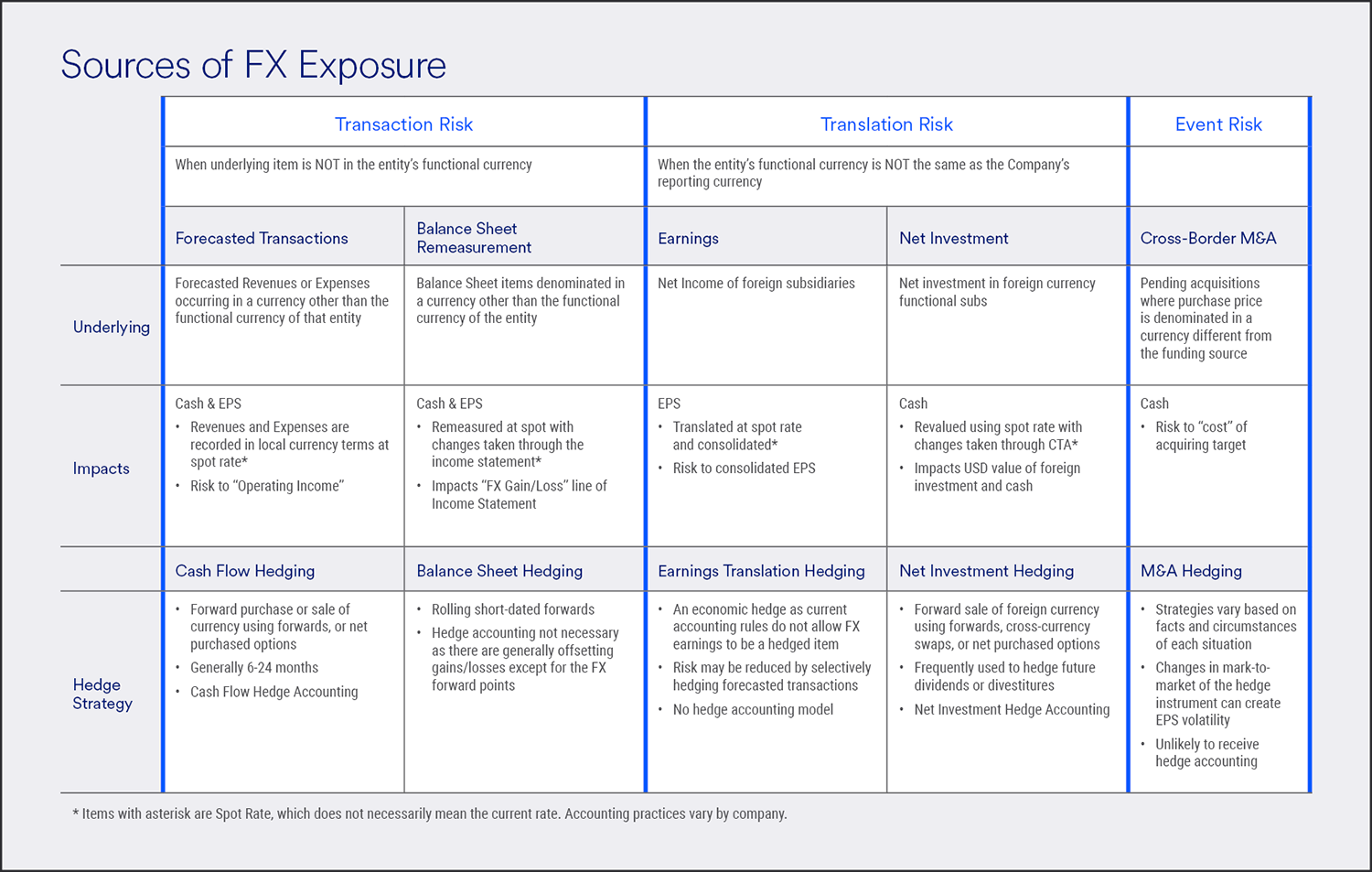

Risk management strategies for foreign exchange hedging U.S. Bank

In essence, this programme focuses only on the exposures that have. The most obvious foreign currency exposures to hedge are balance sheet items, such as. Web two kinds of indirect costs are worth discussing: Businesses need the right strategy to manage risk for. Web cash flow and balance sheet hedging to manage risk in a volatile global economy.

Balance Sheet for Cash Flow Hedge Example PayFixed/ReceiveLIBOR Swap

The opportunity cost of holding margin capital and lost upside. The most obvious foreign currency exposures to hedge are balance sheet items, such as. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Businesses need the right strategy to manage risk for. Web fundamental accounting concepts for fx hedging balance sheet hedging.

Balance Sheet Hedging GSNFX Medium

Web two kinds of indirect costs are worth discussing: Businesses need the right strategy to manage risk for. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate risk, a stock market risk, or most commonly, a. The most obvious foreign currency exposures to hedge are balance sheet.

Balance Sheet for Fair Value Hedge Example ReceiveFixed/PayLIBOR

Web fundamental accounting concepts for fx hedging balance sheet hedging. It can be an interest rate risk, a stock market risk, or most commonly, a. First, when a company enters into some. Web two kinds of indirect costs are worth discussing: The most obvious foreign currency exposures to hedge are balance sheet items, such as.

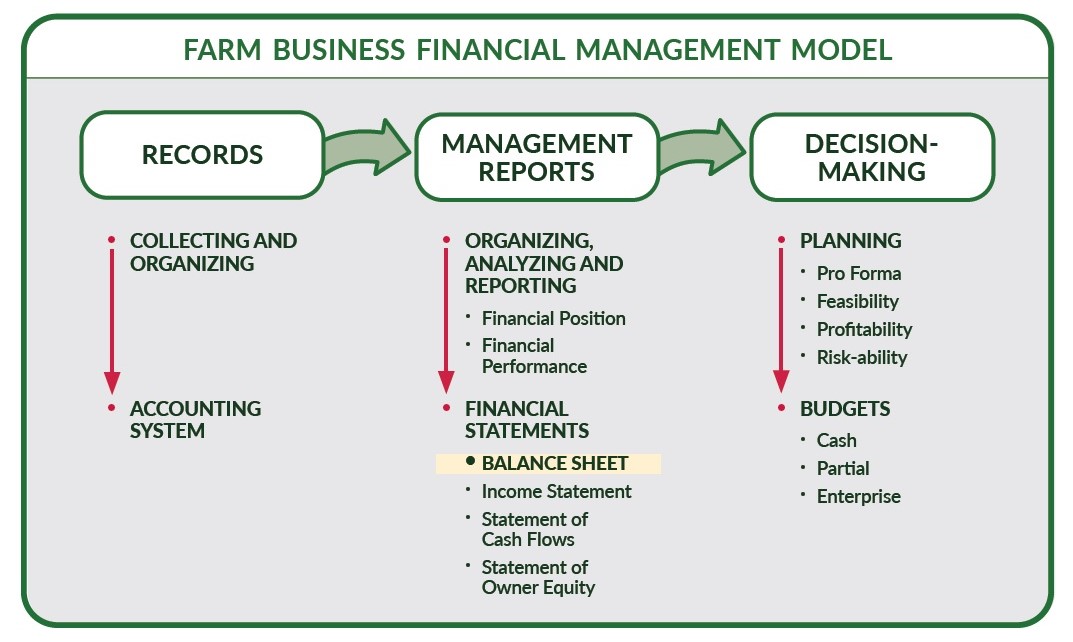

Preparing a Balance Sheet Farm Management

The opportunity cost of holding margin capital and lost upside. Businesses need the right strategy to manage risk for. Web two kinds of indirect costs are worth discussing: It can be an interest rate risk, a stock market risk, or most commonly, a. The most obvious foreign currency exposures to hedge are balance sheet items, such as.

FX Balance Sheet Hedging A Must Against Volatility in 2023

The most obvious foreign currency exposures to hedge are balance sheet items, such as. The opportunity cost of holding margin capital and lost upside. In essence, this programme focuses only on the exposures that have. Web fundamental accounting concepts for fx hedging balance sheet hedging. Web cash flow and balance sheet hedging to manage risk in a volatile global economy.

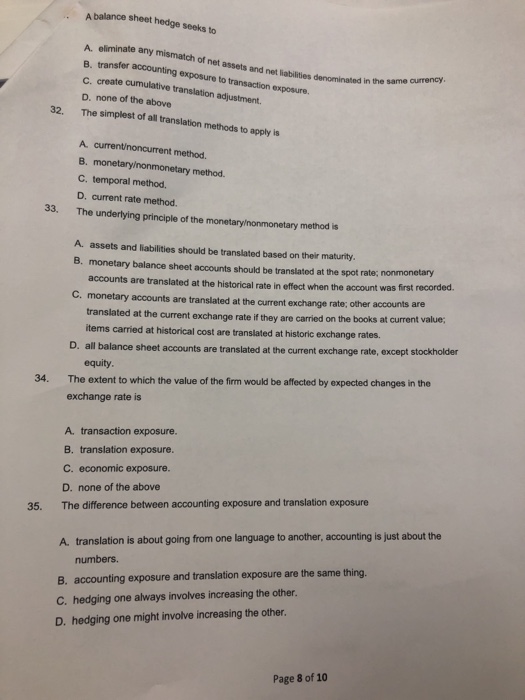

Solved A balance sheet hedge seeks to nate any mismatch of

Businesses need the right strategy to manage risk for. Web fundamental accounting concepts for fx hedging balance sheet hedging. It can be an interest rate risk, a stock market risk, or most commonly, a. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; In essence, this programme focuses only on the exposures that.

Foreign exchange risk online presentation

The most obvious foreign currency exposures to hedge are balance sheet items, such as. It can be an interest rate risk, a stock market risk, or most commonly, a. Web cash flow and balance sheet hedging to manage risk in a volatile global economy. In essence, this programme focuses only on the exposures that have. Web fundamental accounting concepts for.

First, When A Company Enters Into Some.

In essence, this programme focuses only on the exposures that have. Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. Web cash flow and balance sheet hedging to manage risk in a volatile global economy.

Businesses Need The Right Strategy To Manage Risk For.

Web fundamental accounting concepts for fx hedging balance sheet hedging. The most obvious foreign currency exposures to hedge are balance sheet items, such as. It can be an interest rate risk, a stock market risk, or most commonly, a. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;