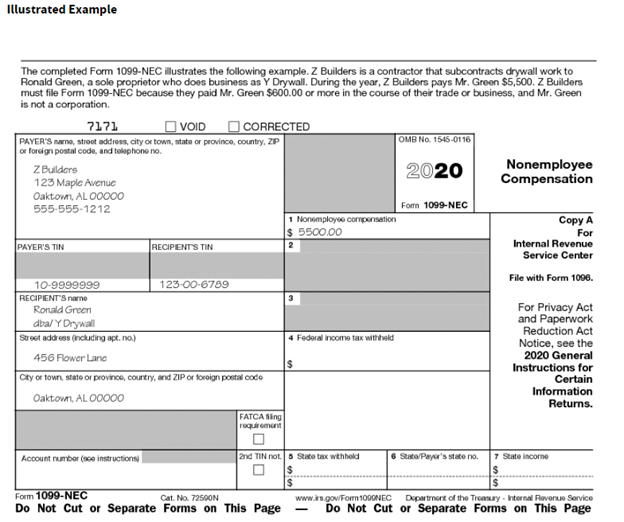

Blank 1099 Nec Form

Blank 1099 Nec Form - Web instructions for recipient recipient’s taxpayer identification number (tin). The payments were made for course that is. You'll be able to obtain the blank form. You will need to fill out this form if: Get ready for tax season deadlines by completing any required tax forms today. There were payments to nonemployees; Persons with a hearing or speech disability with. Ad find deals on 1099 nec forms in office supplies on amazon. Copy a of the form is in red; Do not miss the deadline.

For internal revenue service center. Persons with a hearing or speech disability with. Ad find deals on 1099 nec forms in office supplies on amazon. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Do not miss the deadline. Get ready for tax season deadlines by completing any required tax forms today. For your protection, this form may show only the last four digits of your social security number. You will need to fill out this form if: Fill out the nonemployee compensation online and print it out for free.

Copy a of the form is in red; The payments were made for course that is. You'll be able to obtain the blank form. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. For internal revenue service center. Fill out the nonemployee compensation online and print it out for free. Do not miss the deadline. This is a free filing method. Web you must file the form with the irs by the due date of the return; Persons with a hearing or speech disability with.

W9 vs 1099 IRS Forms, Differences, and When to Use Them

For your protection, this form may show only the last four digits of your social security number. You will need to fill out this form if: Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. This is a free filing method. Copy a of the form is in red;

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Web you must file the form with the irs by the due date of the return; Ad find deals on 1099 nec forms in office supplies on.

Form 1099NEC Nonemployee Compensation, Recipient Copy B

For internal revenue service center. You will need to fill out this form if: Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. For your protection, this form may show only the last four digits of your social security number. Web report payments made of at least $600 in the course of a trade.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Ad find deals on 1099 nec forms in office supplies on amazon. Web instructions for recipient recipient’s taxpayer identification number (tin). Fill out the nonemployee compensation online and print it out for free. Web you must file the form with the irs by the due date of the return; It is for informational purposes and internal.

What the 1099NEC Coming Back Means for your Business Chortek

Persons with a hearing or speech disability with. Ad find deals on 1099 nec forms in office supplies on amazon. Get ready for tax season deadlines by completing any required tax forms today. Fill out the nonemployee compensation online and print it out for free. Web instructions for recipient recipient’s taxpayer identification number (tin).

1099NEC Recipient Copy B Cut Sheet HRdirect

You will need to fill out this form if: You'll be able to obtain the blank form. For your protection, this form may show only the last four digits of your social security number. Web you must file the form with the irs by the due date of the return; Web report payments made of at least $600 in the.

1099 NEC Form 2022

It is for informational purposes and internal. Do not miss the deadline. There were payments to nonemployees; For your protection, this form may show only the last four digits of your social security number. For internal revenue service center.

Blank 1099NEC Tax Forms with Backer

Web instructions for recipient recipient’s taxpayer identification number (tin). You'll be able to obtain the blank form. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. It is for informational purposes and internal. Web blank 3up perforated paper for 1099nec tax forms for recipients.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Persons with a hearing or speech disability with. For more information on these forms, see. You will need to fill out this form if: Do not miss the deadline.

For Internal Revenue Service Center.

You will need to fill out this form if: The payments were made for course that is. Ad find deals on 1099 nec forms in office supplies on amazon. For more information on these forms, see.

Persons With A Hearing Or Speech Disability With.

Copy a of the form is in red; Web you must file the form with the irs by the due date of the return; Fill out the nonemployee compensation online and print it out for free. This is a free filing method.

Ad Register And Subscribe Now To Work On Irs Nonemployee Compensation & More Fillable Forms.

Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Web instructions for recipient recipient’s taxpayer identification number (tin). Do not miss the deadline. Web blank 3up perforated paper for 1099nec tax forms for recipients.

It Is For Informational Purposes And Internal.

For your protection, this form may show only the last four digits of your social security number. You'll be able to obtain the blank form. Get ready for tax season deadlines by completing any required tax forms today. There were payments to nonemployees;

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)