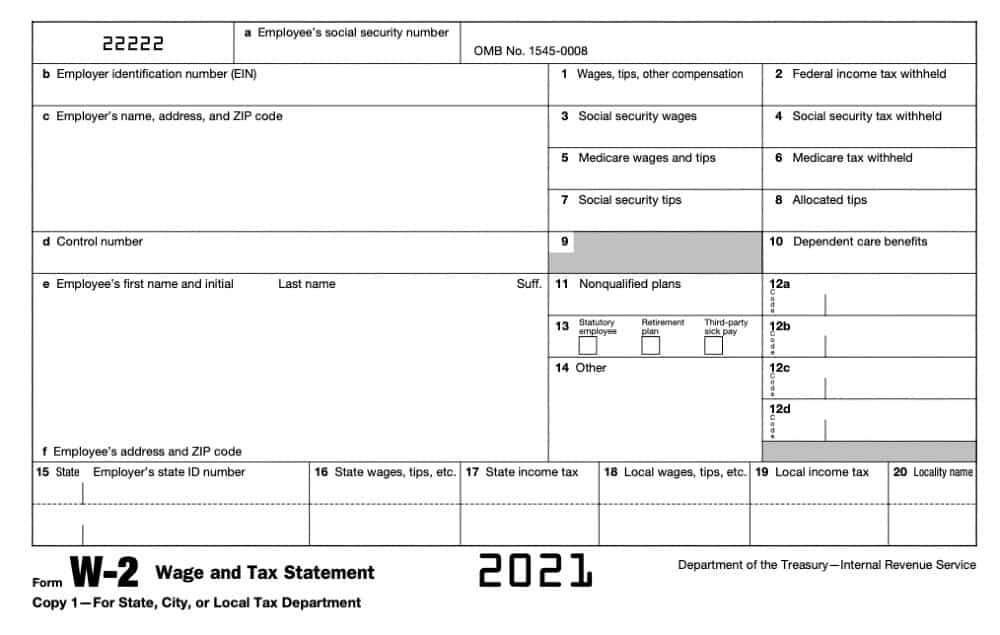

Blank W-2 Form

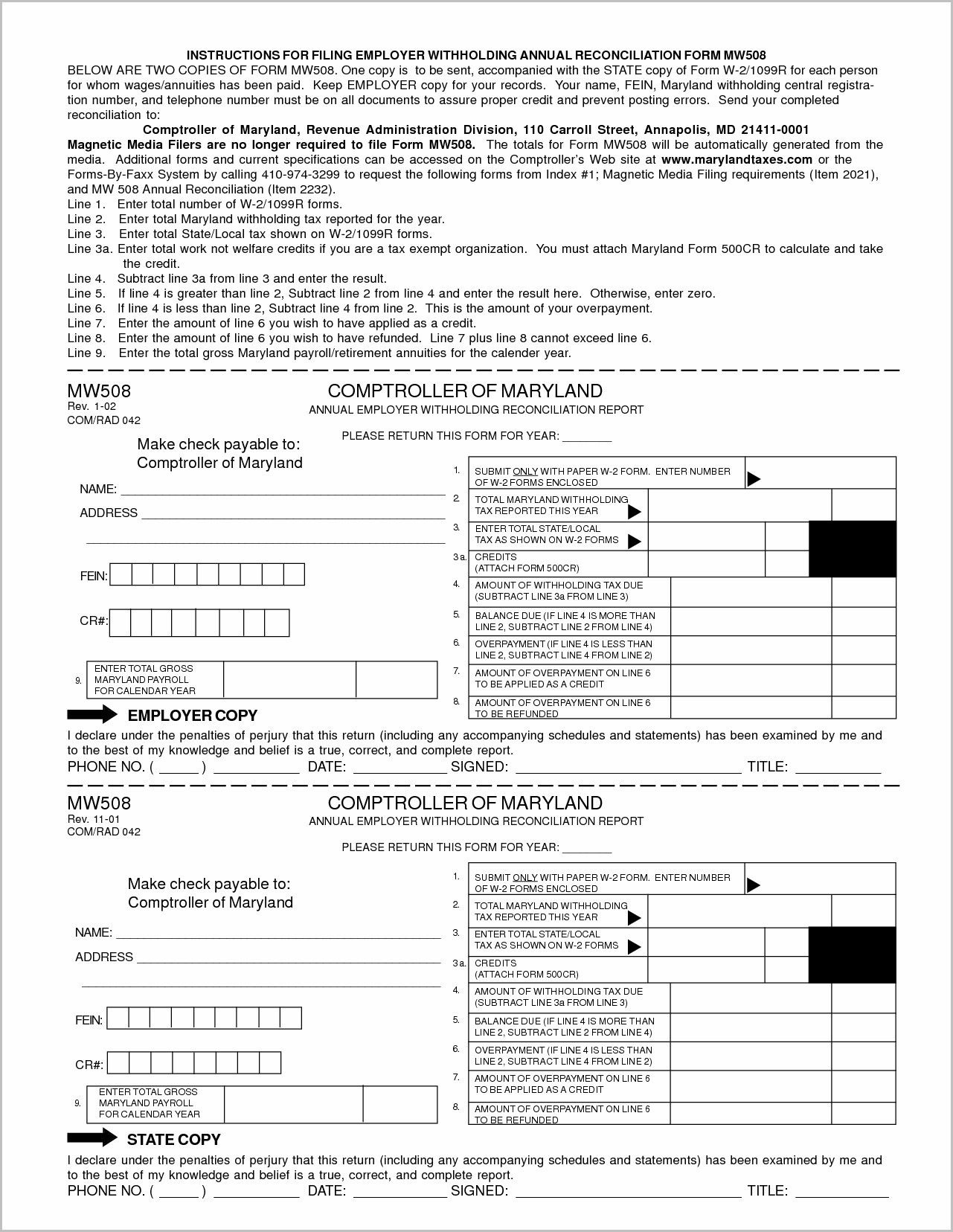

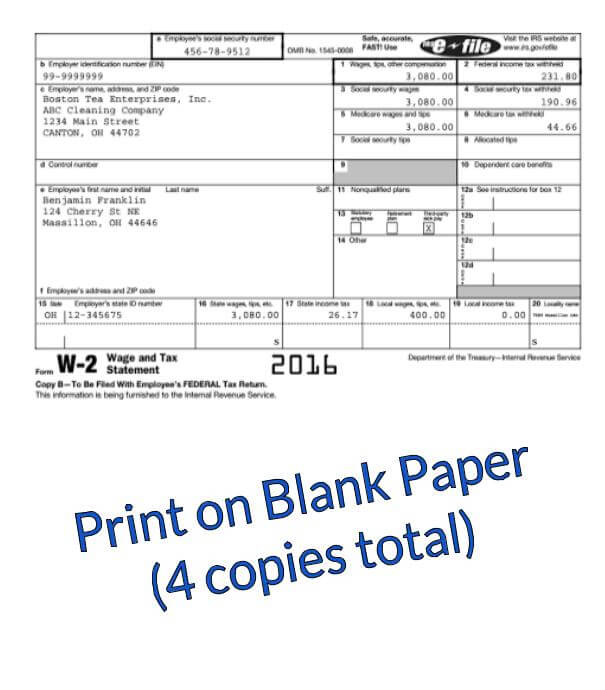

Blank W-2 Form - $ add the amounts above for qualifying children and other dependents. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. Begin by locating the printable w2 form for 2022 (on the page you visit now) to access the newest document for this year. 2020 this information is being furnished to the internal revenue service. You may add to this the amount of any other credits. Web a w2 form is a document that an employer must provide to each employee. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): However, the return is generating the following two critical diagnostics: This shows the income you earned for the previous year and the taxes withheld from those earnings. The w2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks.

Department of the treasury—internal revenue service. Instructions to complete the form. You may add to this the amount of any other credits. $ add the amounts above for qualifying children and other dependents. Copy a—for social security administration. This shows the income you earned for the previous year and the taxes withheld from those earnings. Begin by locating the printable w2 form for 2022 (on the page you visit now) to access the newest document for this year. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s federal tax return. The w2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks.

The w2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks. Copy a—for social security administration. $ add the amounts above for qualifying children and other dependents. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s federal tax return. However, the return is generating the following two critical diagnostics: Department of the treasury—internal revenue service. Begin by locating the printable w2 form for 2022 (on the page you visit now) to access the newest document for this year. You may add to this the amount of any other credits. Instructions to complete the form. For privacy act and paperwork reduction act notice, see the separate instructions.

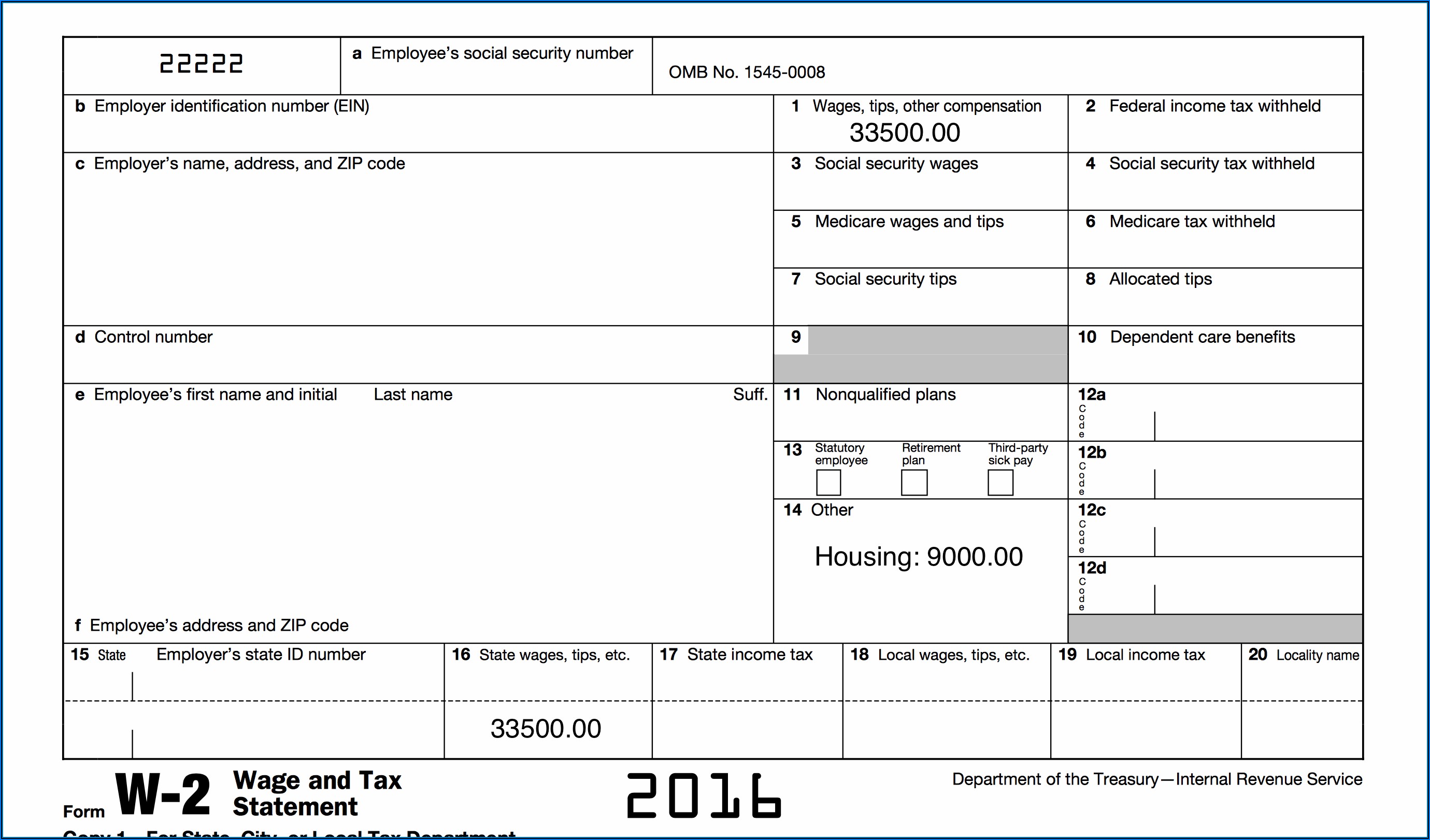

Blank W2 Form 2016 Form Resume Examples DxJKErk3rk

You may add to this the amount of any other credits. The w2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks. 2020 this information is being furnished to the internal revenue service. Web a w2 form is a document that an employer must provide to each employee. Web 22222 employer identification number (ein).

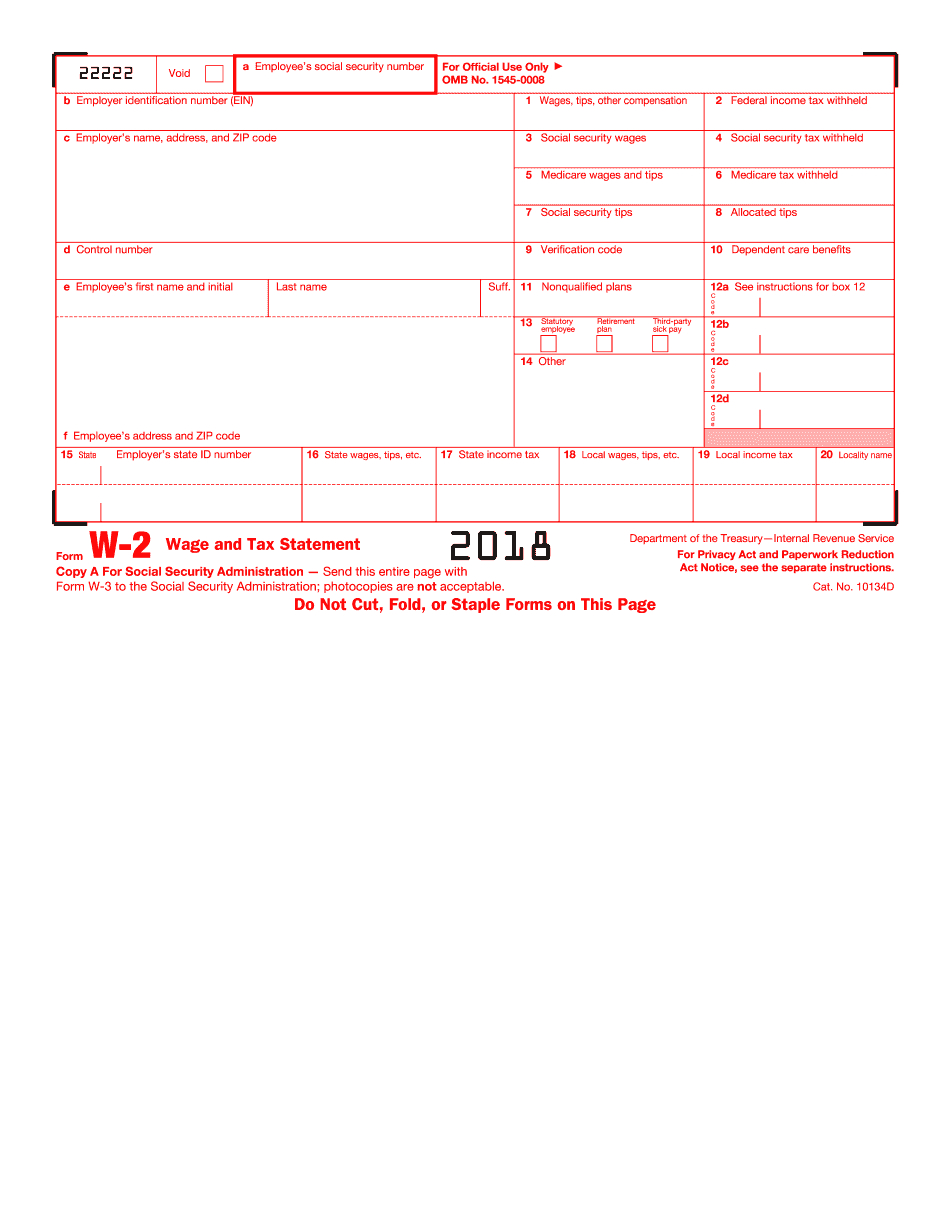

How to Fill Out a W2 Form

Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s federal tax return. Web a w2 form is a document that an employer must provide to each employee. However, the return is generating the following two critical diagnostics: The w2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks..

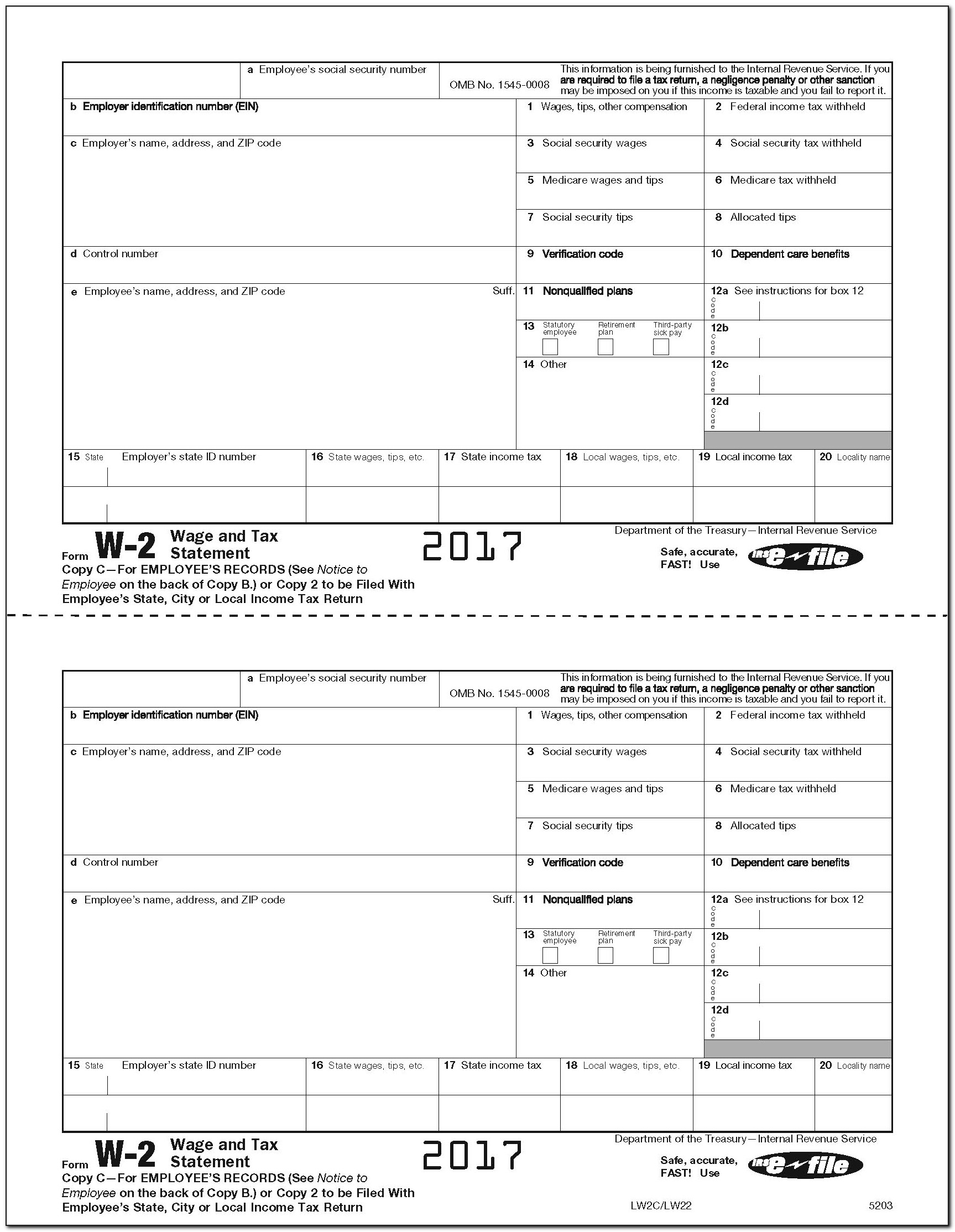

Form W2 2013 Fillable the Tax form Blank W2 form Business letter

However, the return is generating the following two critical diagnostics: This shows the income you earned for the previous year and the taxes withheld from those earnings. Copy a—for social security administration. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s federal tax return. Web if your total income will be $200,000 or less.

Fillable W 2 Form 2019 Free Form Resume Examples WjYD17m6VK

Web a w2 form is a document that an employer must provide to each employee. Department of the treasury—internal revenue service. The w2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks. Web 22222 employer identification number (ein) omb no. $ add the amounts above for qualifying children and other dependents.

Blank Codicil Form Uk Universal Network

Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. Begin by locating the printable w2 form for 2022 (on the page you visit now) to access the newest document for this year. Taxpayer name for the llc #1 reporting entity must not be blank(ref. Get federal tax return forms.

Free W2 Forms Online Printable Free Printable

Employees use the information on the w2 form to file their yearly tax returns. Department of the treasury—internal revenue service. Taxpayer name for the llc #1 reporting entity must not be blank(ref. For privacy act and paperwork reduction act notice, see the separate instructions. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s federal.

Perforated Blank W2 Forms Form Resume Examples B8DVGvX5mb

Web a w2 form is a document that an employer must provide to each employee. For privacy act and paperwork reduction act notice, see the separate instructions. Web 22222 employer identification number (ein) omb no. You may add to this the amount of any other credits. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the.

Empty W2 Form Fill Online, Printable, Fillable, Blank pdfFiller

Department of the treasury—internal revenue service. Web 22222 employer identification number (ein) omb no. Instructions to complete the form. $ add the amounts above for qualifying children and other dependents. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s federal tax return.

W4 Forms Online Printable W2 Forms 2022 W4 Form

The w2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks. Begin by locating the printable w2 form for 2022 (on the page you visit now) to access the newest document for this year. For privacy act and paperwork reduction act notice, see the separate instructions. Web 22222 employer identification number (ein) omb no..

Crush w2 form printable Derrick Website

Copy a—for social security administration. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Begin by locating the printable w2 form for 2022 (on the page you visit now) to access the newest document for this year. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s.

Taxpayer Name For The Llc #1 Reporting Entity Must Not Be Blank(Ref.

Copy a—for social security administration. Copy 1—for state, city, or local tax department 2020 copy b—to be filed with employee’s federal tax return. 2020 this information is being furnished to the internal revenue service. Web a w2 form is a document that an employer must provide to each employee.

You May Add To This The Amount Of Any Other Credits.

Employees use the information on the w2 form to file their yearly tax returns. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Begin by locating the printable w2 form for 2022 (on the page you visit now) to access the newest document for this year. Get federal tax return forms and file by mail get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

The W2 Form Reports An Employee’s Annual Wages And The Amount Of Taxes Withheld From Their Paychecks.

This shows the income you earned for the previous year and the taxes withheld from those earnings. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. However, the return is generating the following two critical diagnostics: $ add the amounts above for qualifying children and other dependents.

Web 22222 Employer Identification Number (Ein) Omb No.

For privacy act and paperwork reduction act notice, see the separate instructions. Department of the treasury—internal revenue service. Instructions to complete the form.