Ca Form 3804

Ca Form 3804 - Web go to california > passthrough entity tax worksheet. Web to pay by voucher, print the ftb 3893 voucher from ftb's website and mail it to the ftb, along with the payment, to “franchise tax board, p.o. (optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet. On form 3804 , check the box for identification number you wish to. Once made, the payments will remain as pte elective tax payments on the entity’s account until the tax return is filed. When will the elective tax expire? Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. Only shareholder types individual, estate, trust, and grantor trust are included on the form 3804. California’s elective pte tax is set to expire after tax year 2025. But, it will be repealed sooner if the $10,000 state and local tax deduction limitation in irc sec.

Web go to california > passthrough entity tax worksheet. Web to pay by voucher, print the ftb 3893 voucher from ftb's website and mail it to the ftb, along with the payment, to “franchise tax board, p.o. Only shareholder types individual, estate, trust, and grantor trust are included on the form 3804. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. But, it will be repealed sooner if the $10,000 state and local tax deduction limitation in irc sec. California’s elective pte tax is set to expire after tax year 2025. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. When will the elective tax expire? (optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet. Once made, the payments will remain as pte elective tax payments on the entity’s account until the tax return is filed.

Only shareholder types individual, estate, trust, and grantor trust are included on the form 3804. (optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. California’s elective pte tax is set to expire after tax year 2025. But, it will be repealed sooner if the $10,000 state and local tax deduction limitation in irc sec. On form 3804 , check the box for identification number you wish to. Web go to california > passthrough entity tax worksheet. Web to pay by voucher, print the ftb 3893 voucher from ftb's website and mail it to the ftb, along with the payment, to “franchise tax board, p.o. When will the elective tax expire? Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue.

Ca Form 3522 amulette

Web go to california > passthrough entity tax worksheet. Once made, the payments will remain as pte elective tax payments on the entity’s account until the tax return is filed. Only shareholder types individual, estate, trust, and grantor trust are included on the form 3804. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see.

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

Web to pay by voucher, print the ftb 3893 voucher from ftb's website and mail it to the ftb, along with the payment, to “franchise tax board, p.o. But, it will be repealed sooner if the $10,000 state and local tax deduction limitation in irc sec. Only shareholder types individual, estate, trust, and grantor trust are included on the form.

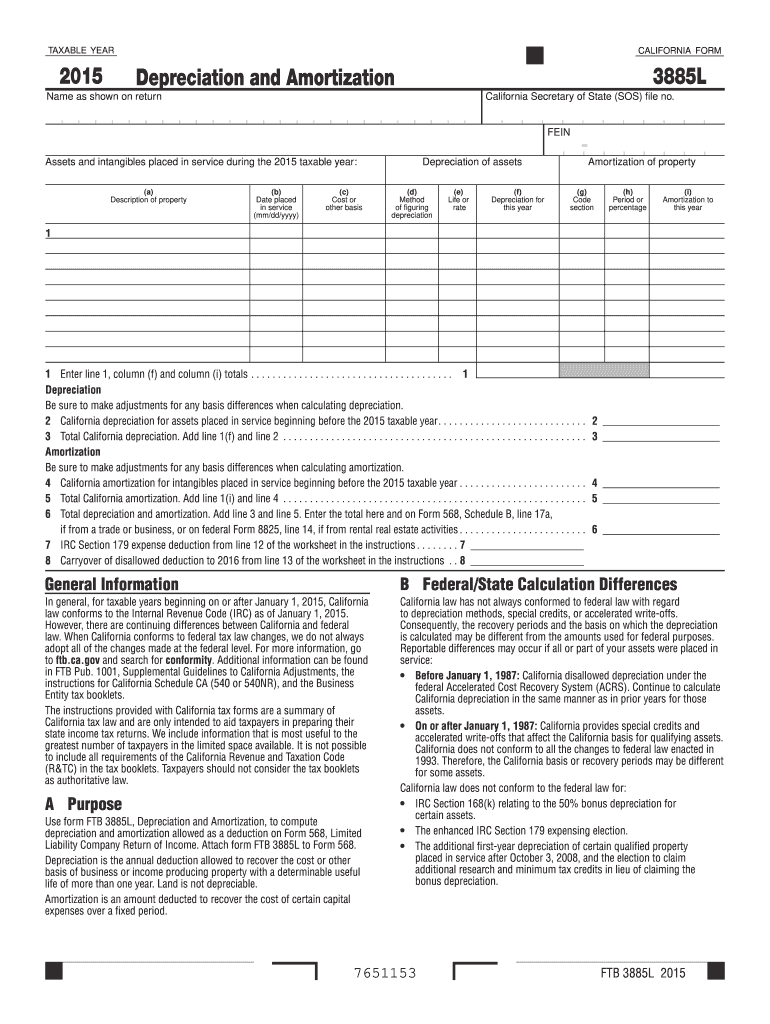

Form 3885L Fill Out and Sign Printable PDF Template signNow

(optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. California’s elective pte tax is set to expire after tax year 2025. But,.

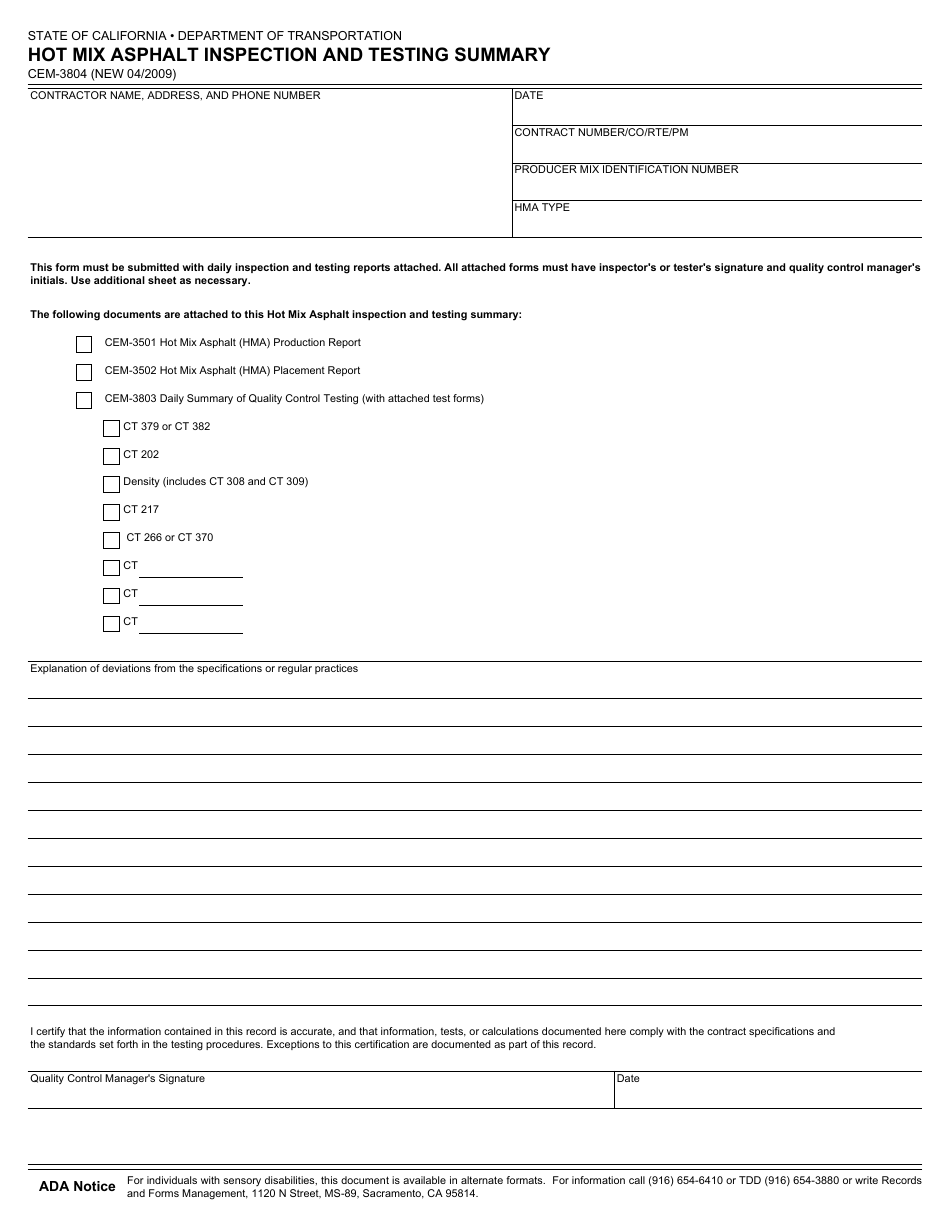

Form CEM3804 Download Fillable PDF or Fill Online Hot Mix Asphalt

California’s elective pte tax is set to expire after tax year 2025. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. But, it will be repealed sooner if the $10,000 state and local tax deduction limitation in irc sec. On.

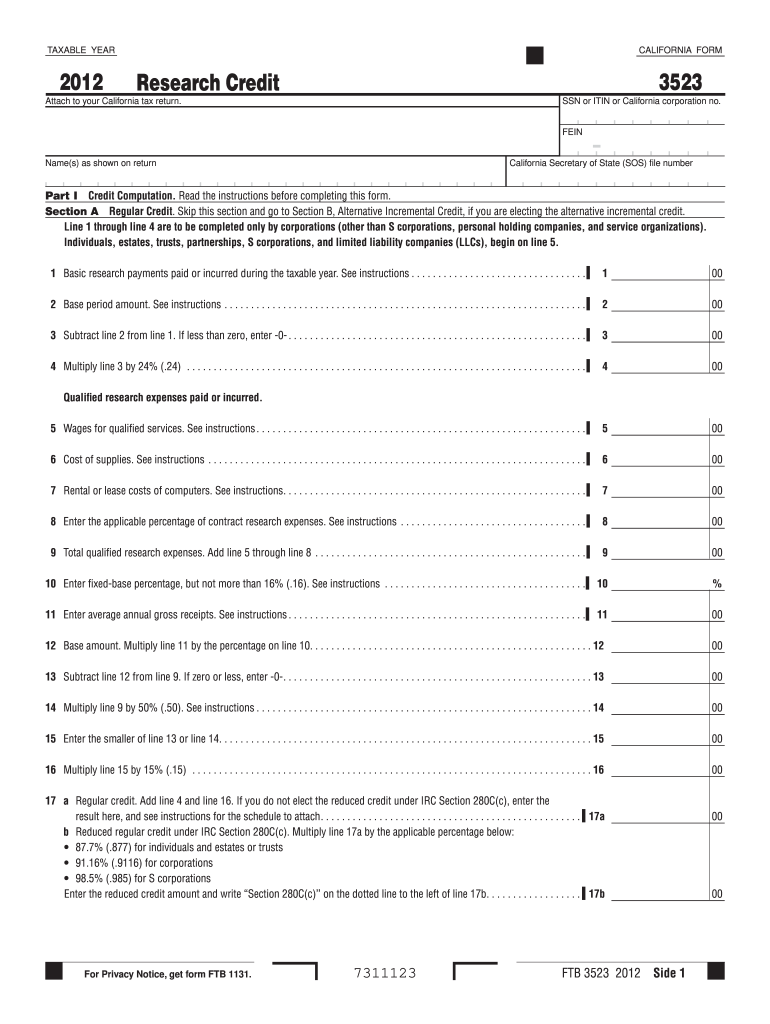

Ca Form 3523 Fill Out and Sign Printable PDF Template signNow

(optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet. California’s elective pte tax is set to expire after tax year 2025. Only shareholder types individual, estate, trust, and grantor trust are included on the form 3804. Once made, the payments will remain as pte elective tax payments on the entity’s account.

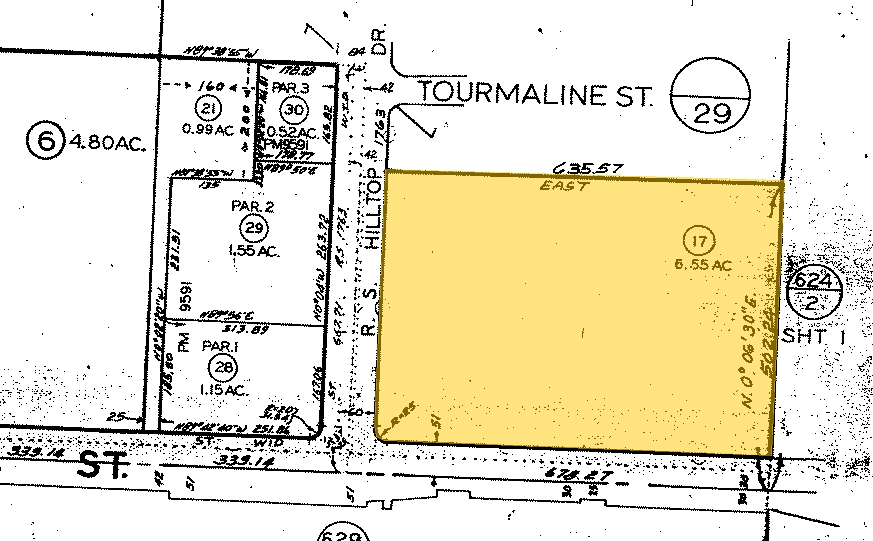

3804 Main St, Chula Vista, CA 91911 Industrial for Lease

On form 3804 , check the box for identification number you wish to. (optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue..

3804 Bixby Dr, La Verne, CA 91750 MLS WS19152657 Redfin

Web to pay by voucher, print the ftb 3893 voucher from ftb's website and mail it to the ftb, along with the payment, to “franchise tax board, p.o. When will the elective tax expire? California’s elective pte tax is set to expire after tax year 2025. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts,.

3804 Surfside Dr, Modesto, CA Studio Mobile / Manufactured 36

Once made, the payments will remain as pte elective tax payments on the entity’s account until the tax return is filed. On form 3804 , check the box for identification number you wish to. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side.

Form 3832 Instructions Fill Out and Sign Printable PDF Template signNow

On form 3804 , check the box for identification number you wish to. (optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet. When will the elective tax expire? Once made, the payments will remain as pte elective tax payments on the entity’s account until the tax return is filed. Web go.

CA Form 414 2016 Fill and Sign Printable Template Online US Legal

Once made, the payments will remain as pte elective tax payments on the entity’s account until the tax return is filed. Only shareholder types individual, estate, trust, and grantor trust are included on the form 3804. When will the elective tax expire? Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there.

Web To Pay By Voucher, Print The Ftb 3893 Voucher From Ftb's Website And Mail It To The Ftb, Along With The Payment, To “Franchise Tax Board, P.o.

On form 3804 , check the box for identification number you wish to. When will the elective tax expire? Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. California’s elective pte tax is set to expire after tax year 2025.

Once Made, The Payments Will Remain As Pte Elective Tax Payments On The Entity’s Account Until The Tax Return Is Filed.

Only shareholder types individual, estate, trust, and grantor trust are included on the form 3804. Web california form 3804 part ii schedule of qualified taxpayers (smllcs, estates, and trusts, see instructions.) (if there are more than seven qualified taxpayers, use side 2 to continue. Web go to california > passthrough entity tax worksheet. (optional) override income and withholding amount of partners on 3804 go to california > passthrough entity tax worksheet.