Calendar Call Spread

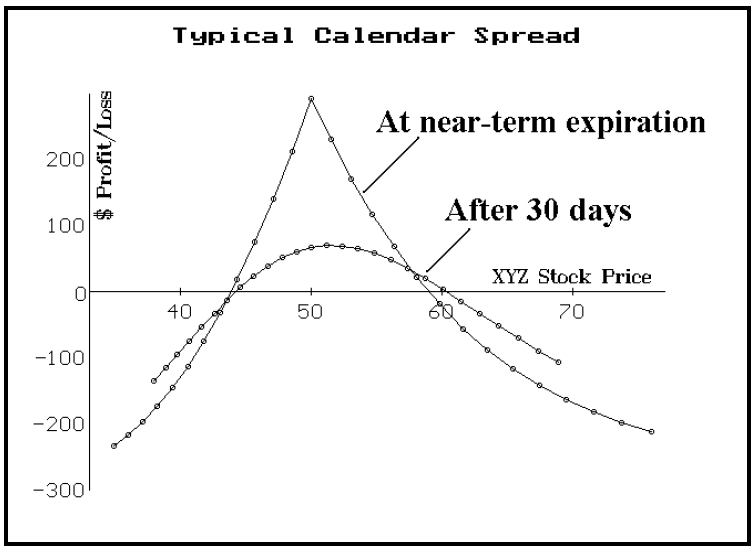

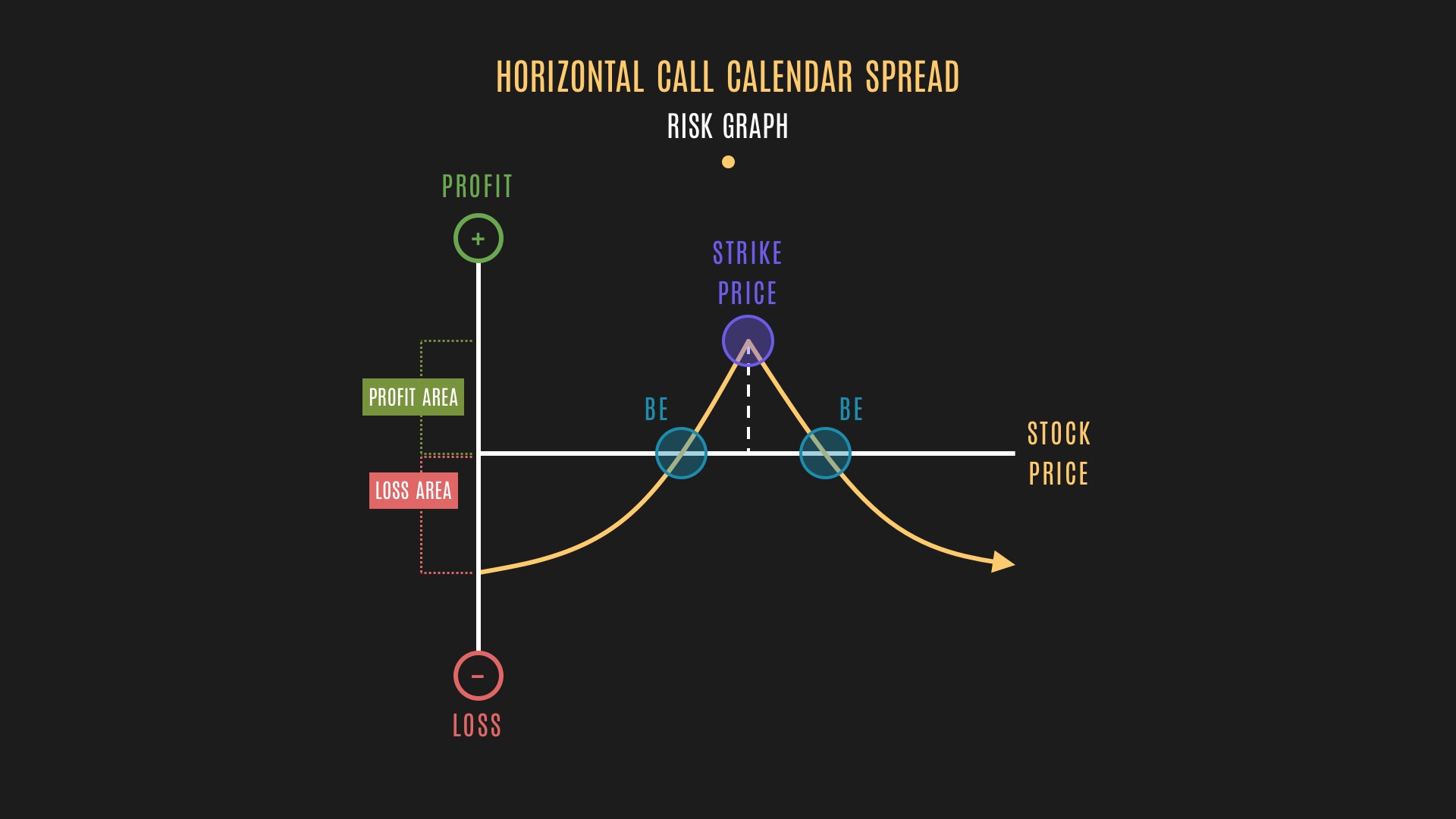

Calendar Call Spread - Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web learn how to profit from different levels of volatility in the underlying stock at different expiration dates with a.

Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web learn how to profit from different levels of volatility in the underlying stock at different expiration dates with a.

Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web learn how to profit from different levels of volatility in the underlying stock at different expiration dates with a. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of.

Calendar Call Spread Options Edge

Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web learn how to profit from different levels of volatility in the underlying stock at.

Calendar Call Option Spread [SPX] YouTube

Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web a long calendar spread with calls is a strategy to profit from neutral or.

What is a Horizontal Call Calendar Spread YouTube

Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web learn how to profit from different levels of volatility in the.

Trading Guide on Calendar Call Spread AALAP

Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web learn how to profit from different levels of volatility in the underlying stock at.

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web learn how to profit from different levels of volatility in the underlying stock at.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web learn how to profit from different levels of volatility in the underlying stock at.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web the calendar call spread is a strategy that involves buying and.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web learn how to profit from different levels of volatility in the.

Calendar Spreads YouTube

Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web a long calendar spread with calls is a strategy to profit from neutral or directional stock price action near the strike price of. Web learn how to profit from different levels of volatility in the underlying stock at.

Long Calendar Spreads Unofficed

Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web a long calendar spread with calls is a strategy to profit from neutral or.

Web A Long Calendar Spread With Calls Is A Strategy To Profit From Neutral Or Directional Stock Price Action Near The Strike Price Of.

Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration. Web a long call calendar spread is a strategy that involves buying and selling the same type of option (calls or puts) for the. Web learn how to profit from different levels of volatility in the underlying stock at different expiration dates with a.

![Calendar Call Option Spread [SPX] YouTube](https://i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29a07be7965ab577d88_Call-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)