California Form 199

California Form 199 - Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. From side 2, part ii, line 8. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction b, who. 1gross sales or receipts from other sources. Type text, add images, blackout confidential details, add comments, highlights and more. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web we last updated california form 199 in january 2023 from the california franchise tax board. • religious or apostolic organizations described in r&tc section 23701k must attach a. Round your gross receipts value to the.

Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction. Web they are required to file form 199, not form 541, california fiduciary income tax return. Sign it in a few clicks. What is ca form 199? Round your gross receipts value to the. You have 20 minutes to complete. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses. Type text, add images, blackout confidential details, add comments, highlights and more.

Signnow allows users to edit, sign, fill and share all type of documents online. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Round your gross receipts value to the. Basic information about your organization. Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Web they are required to file form 199, not form 541, california fiduciary income tax return. You have 20 minutes to complete. This form is for income earned in tax year 2022, with tax returns due in april. Ad download or email ftb 199 & more fillable forms, register and subscribe now!

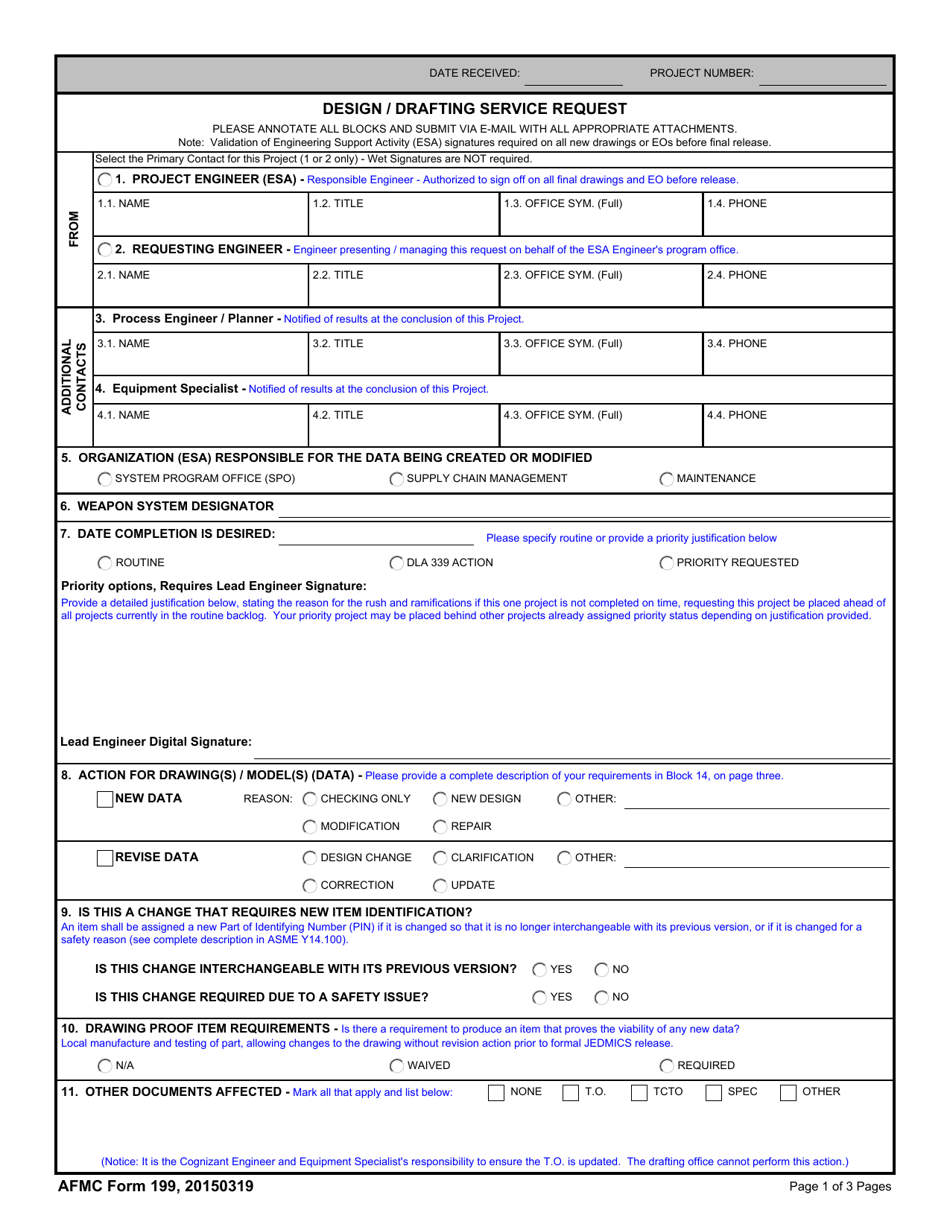

AFMC Form 199 Download Fillable PDF or Fill Online Design/Drafting

Ad download or email ftb 199 & more fillable forms, register and subscribe now! An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. From side 2, part ii, line 8. What is ca form 199? 2gross dues and assessments from members and affiliates.

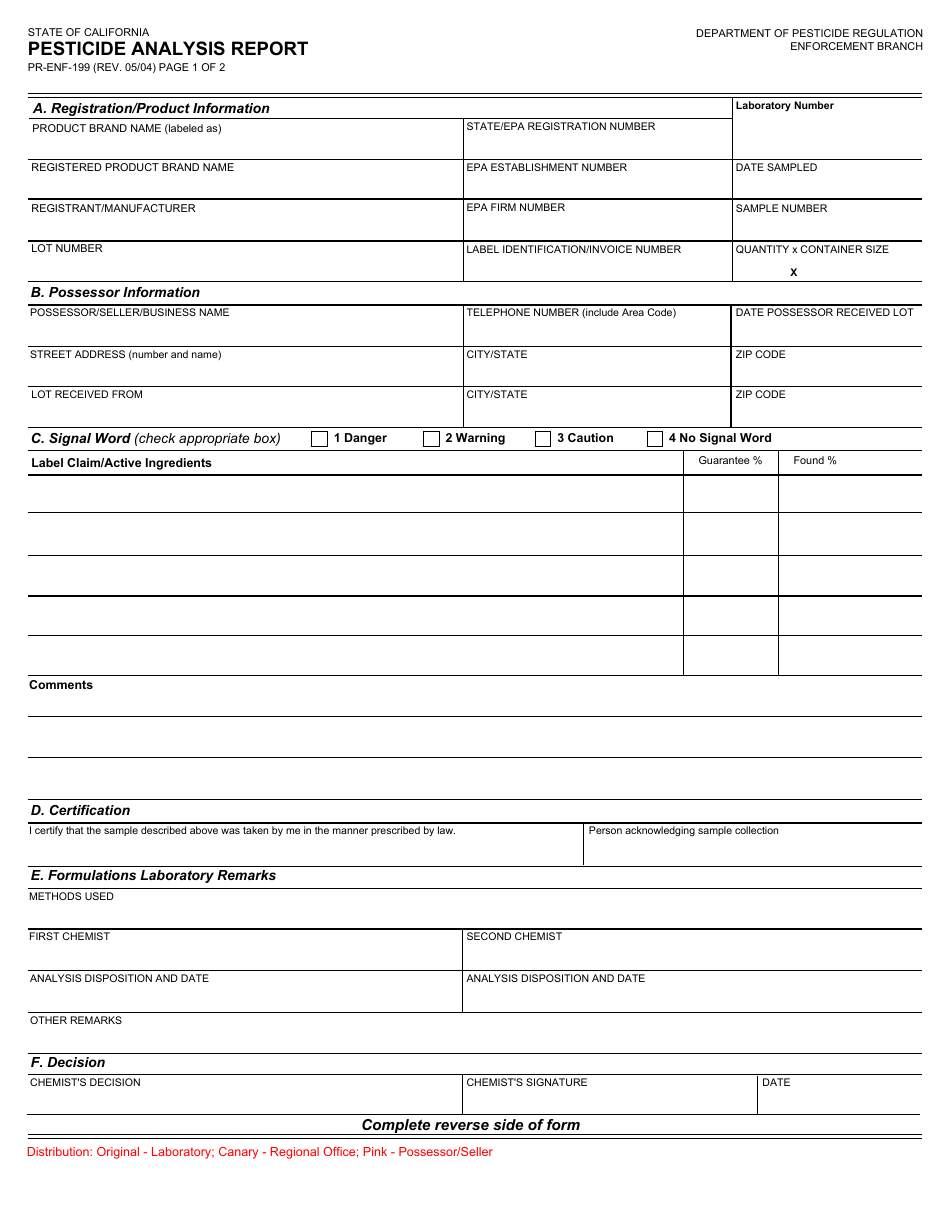

Form PRENF199 Download Fillable PDF or Fill Online Pesticide Analysis

Type text, add images, blackout confidential details, add comments, highlights and more. Web we last updated california form 199 in january 2023 from the california franchise tax board. Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction b, who. An extension allows you more time to file the.

California HOA & Condo Tax Returns Tips to Stay Compliant [Template]

Basic information about your organization. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. California exempt organization annual information return is used by the following organizations: Web california form 199 has two versions, ftb 199n and form 199. Form 199 is.

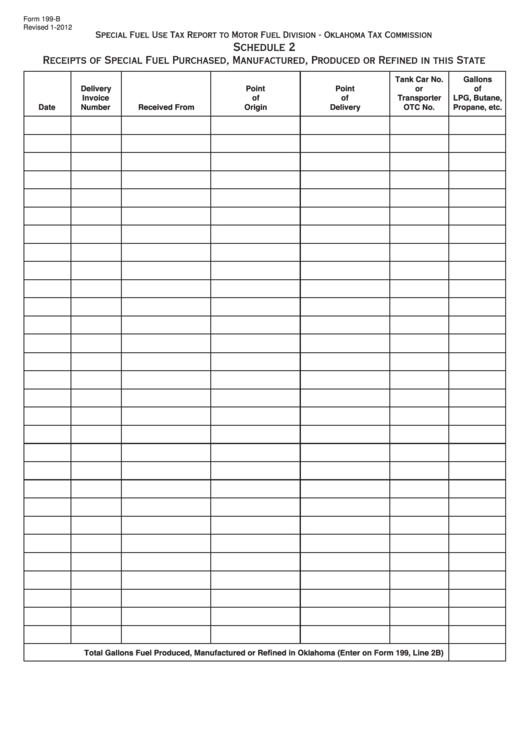

Fillable Form 199B Schedule 2 Receipts Of Special Fuel Purchased

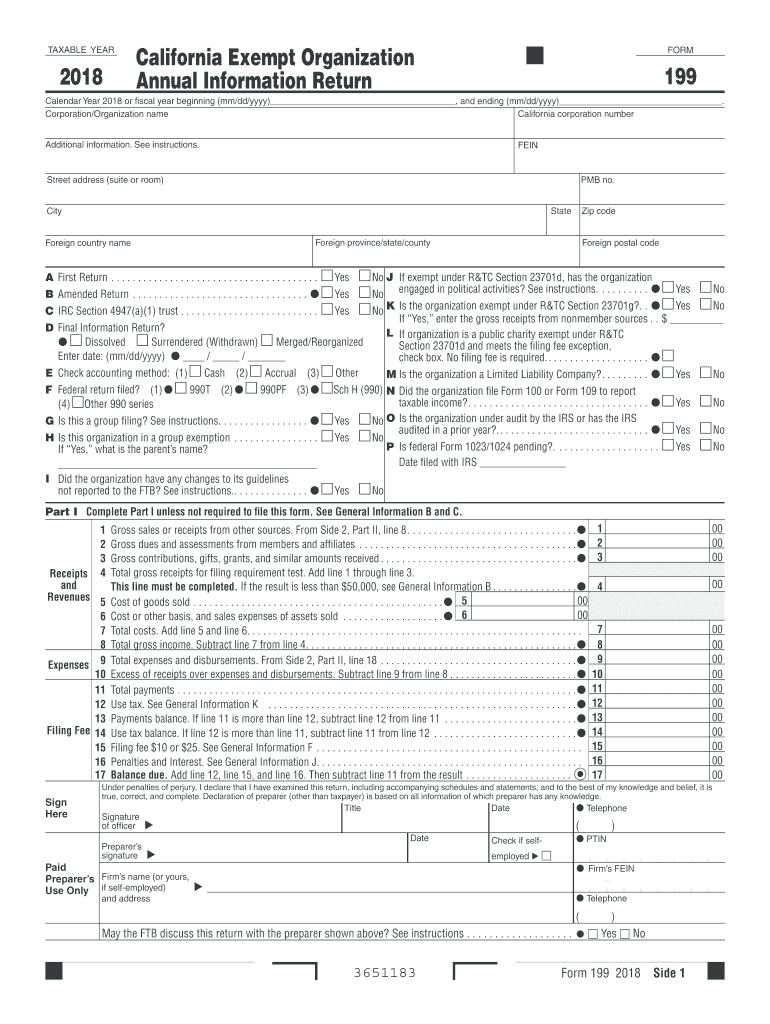

Web form 199 2018 side 1. Edit your form 199 online. Signnow allows users to edit, sign, fill and share all type of documents online. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Sign it in a few clicks.

CA FTB 199 2018 Fill out Tax Template Online US Legal Forms

• religious or apostolic organizations described in r&tc section 23701k must attach a. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described.

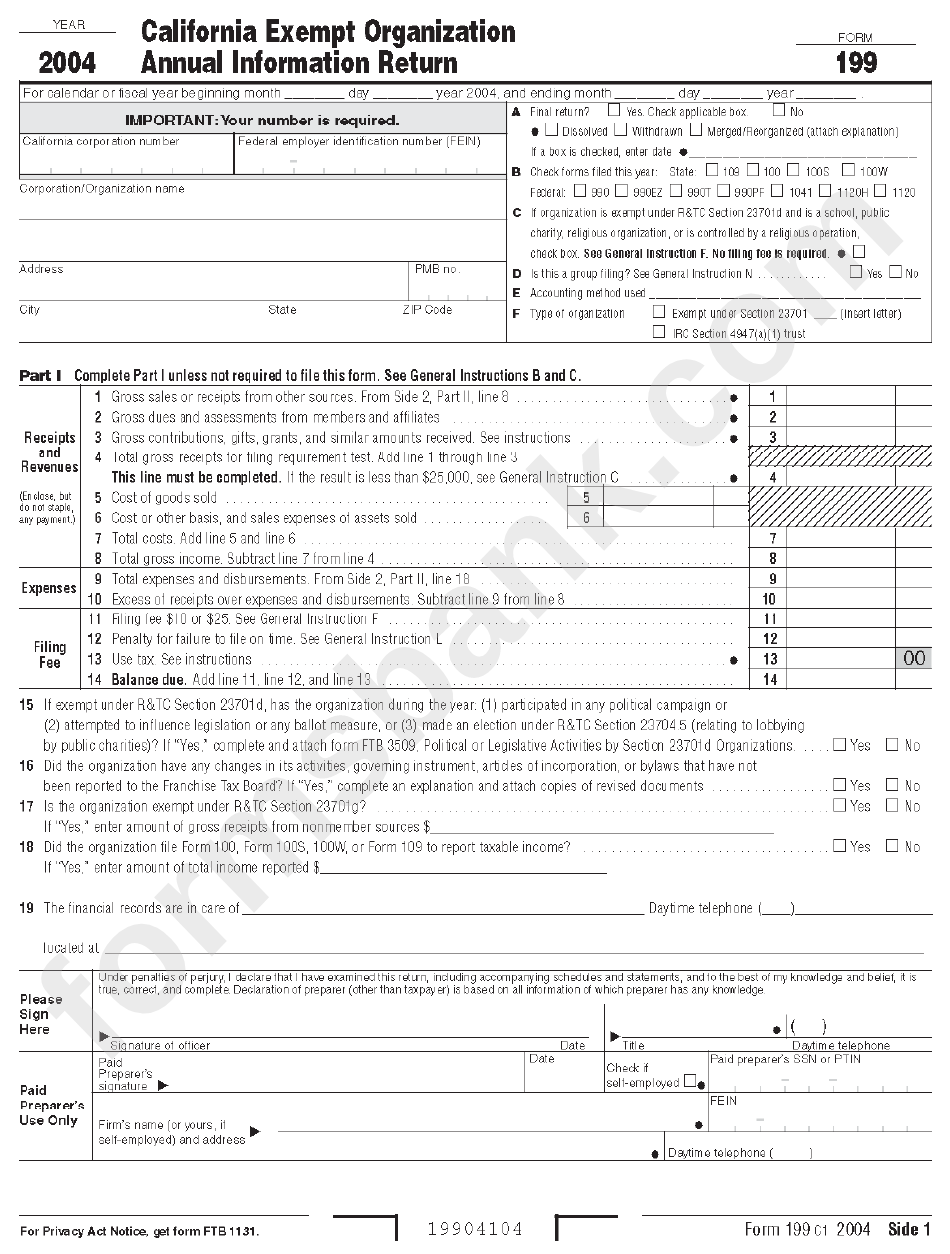

Form 199 California Exempt Organization Annual Information Return

Form 199 is the california exempt. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses. 1gross sales or receipts from other sources. Web form 199.

California Form 199 2019 CA Form 199, 199N Instructions

Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. What is ca form 199? You have 20 minutes to complete. Part ii organizations with gross.

California Form 199 2019 CA Form 199, 199N Instructions

Your entity id number or california corporation number. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. Web form 199 2018 side 1. Edit your form 199 online. Web we last updated california form 199 in january 2023 from the california franchise tax board.

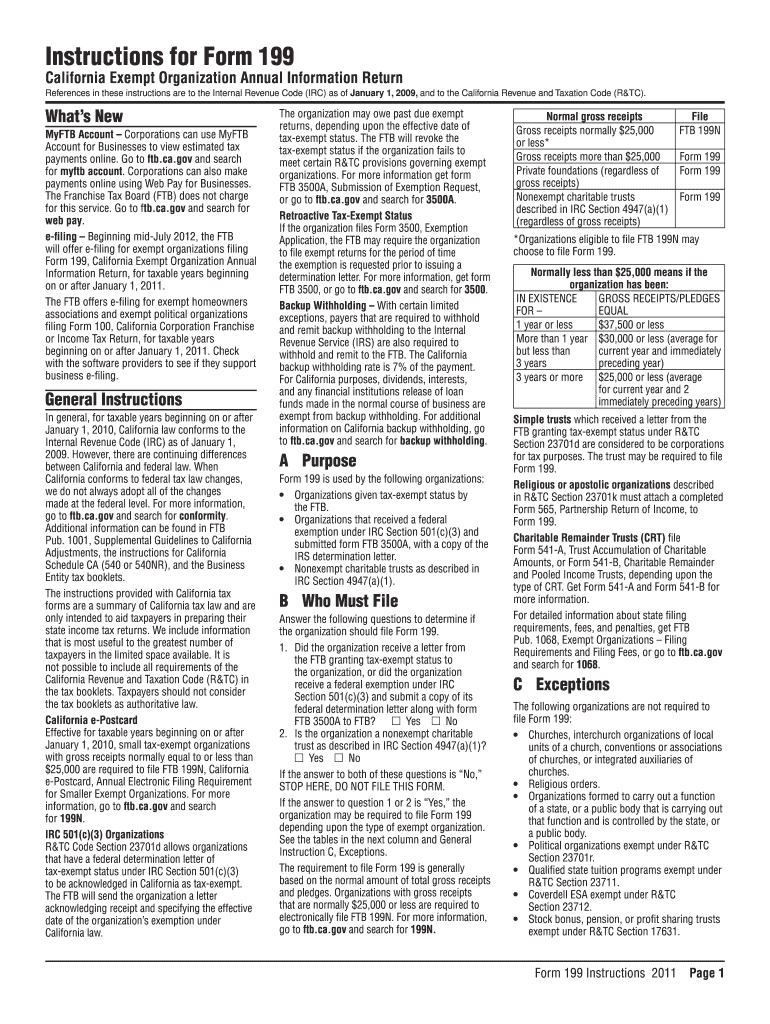

Instructions for Form 199 California Franchise Tax Board Fill out

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web we last updated california form 199 in january 2023 from the california franchise tax board. Web form 199 2018 side 1. Signnow allows users to edit, sign, fill and share all.

2015 Form CA FTB 199 Instructions Fill Online, Printable, Fillable

• religious or apostolic organizations described in r&tc section 23701k must attach a. 1gross sales or receipts from other sources. Signnow allows users to edit, sign, fill and share all type of documents online. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or furnish. Type.

Web California Form 199 Has Two Versions, Ftb 199N And Form 199.

Type text, add images, blackout confidential details, add comments, highlights and more. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web we last updated california form 199 in january 2023 from the california franchise tax board.

California Exempt Organization Annual Information Return Is Used By The Following Organizations:

The new 990 and its relationship to california law. You have 20 minutes to complete. Ad download or email ftb 199 & more fillable forms, register and subscribe now! Web form 199, california exempt organization annual information return, unless the organization is a nonexempt charitable trust described under general instruction b, who.

Your Entity Id Number Or California Corporation Number.

2gross dues and assessments from members and affiliates. 1gross sales or receipts from other sources. Signnow allows users to edit, sign, fill and share all type of documents online. Round your gross receipts value to the.

Part Ii Organizations With Gross Receipts Of More Than $50,000 And Private Foundations Regardless Of Amount Of Gross Receipts — Complete Part Ii Or Furnish.

What is ca form 199? This form is for income earned in tax year 2022, with tax returns due in april. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. • religious or apostolic organizations described in r&tc section 23701k must attach a.

![California HOA & Condo Tax Returns Tips to Stay Compliant [Template]](https://hoatax.com/wp-content/uploads/2017/08/CA-filing-fee-1024x786.png)