California Form 593 Instructions

California Form 593 Instructions - Web see the following links for form instructions: Web your california real estate withholding has to be entered on both the state and the federal return. First, complete your state return. The seller is to complete. When california real estate is sold on an. Web 2019593 real estate withholding forms booklet this booklet contains: Ca form 568, limited liability. • provide a copy of form 593. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Enter the amount reported on form 593, box 5 in the amount withheld from seller field.

• provide a copy of form 593. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. When california real estate is sold on an. When you reach take a look at. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: The seller is to complete. Complete ftb form 593 when withholding is done. Web see the following links for form instructions: Ca form 568, limited liability. Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being.

Web instructions for form 593; Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. Ca form 568, limited liability. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. First, complete your state return. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: Complete ftb form 593 when withholding is done. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: • complete form 593, and verify it is accurate. Web your california real estate withholding has to be entered on both the state and the federal return.

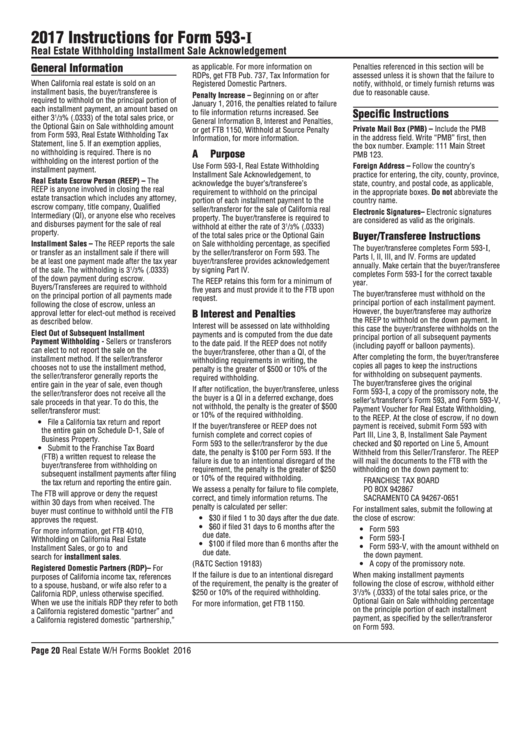

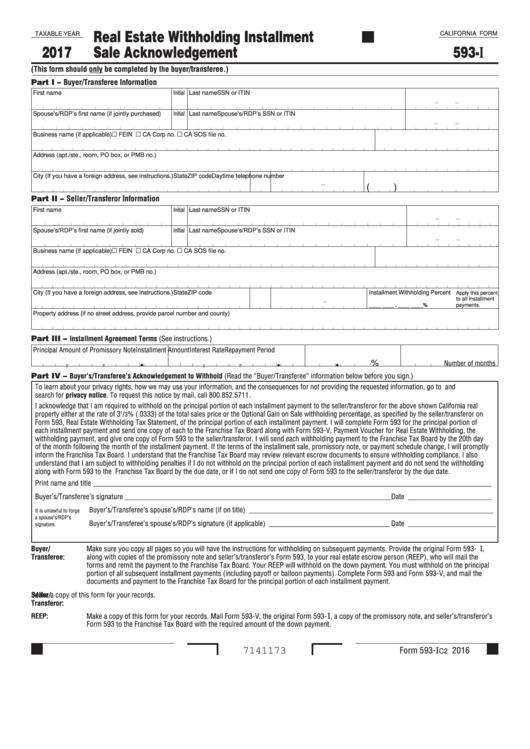

Instructions For Form 593I Real Estate Withholding Installment Sale

Complete ftb form 593 when withholding is done. Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. First, complete your state return. Web instructions for form 593; Web your california real estate withholding has to be entered on both the state and the federal return.

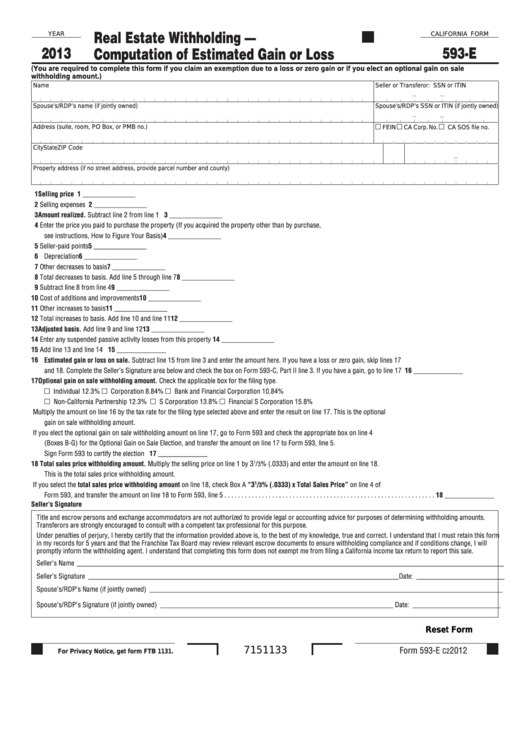

Fillable California Form 593E Real Estate Withholding Computation

• provide a copy of form 593. Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to:.

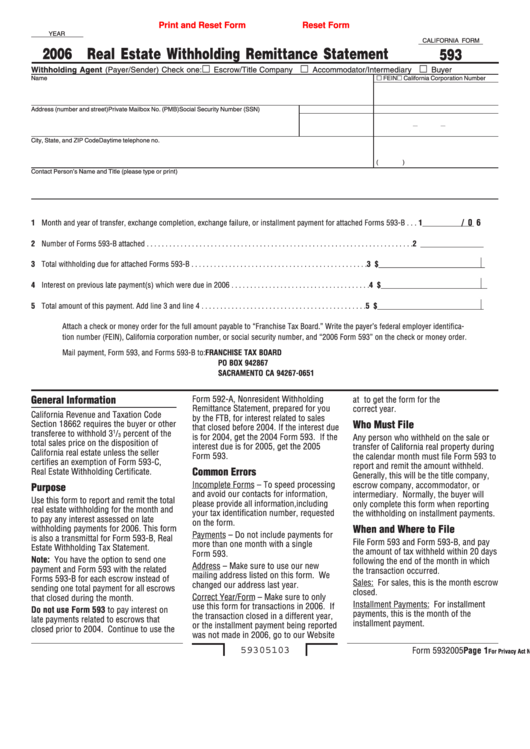

Fillable California Form 593 Real Estate Withholding Remittance

Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web see the following links for form instructions: Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. The seller is to complete. Web a seller/transferor.

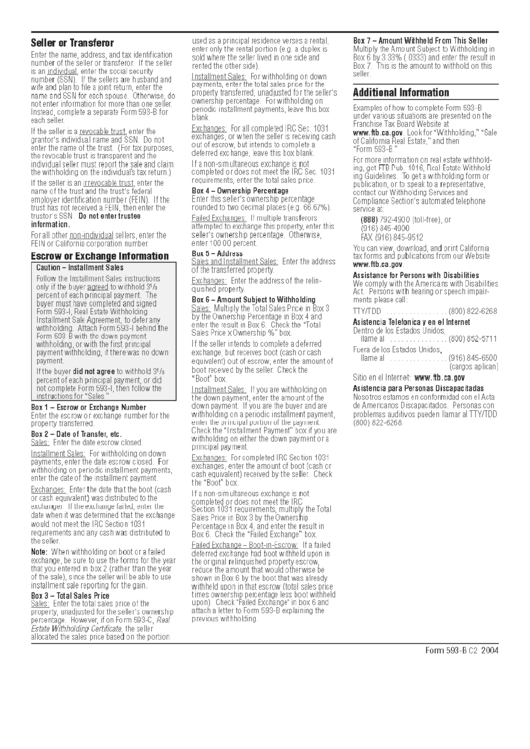

Form 593B Instructions For Real Estate Withholding Tax Statement

Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Complete ftb form 593 when withholding is done. Web see the following links for form instructions: Ca form 568, limited liability. Web your california real estate withholding has to.

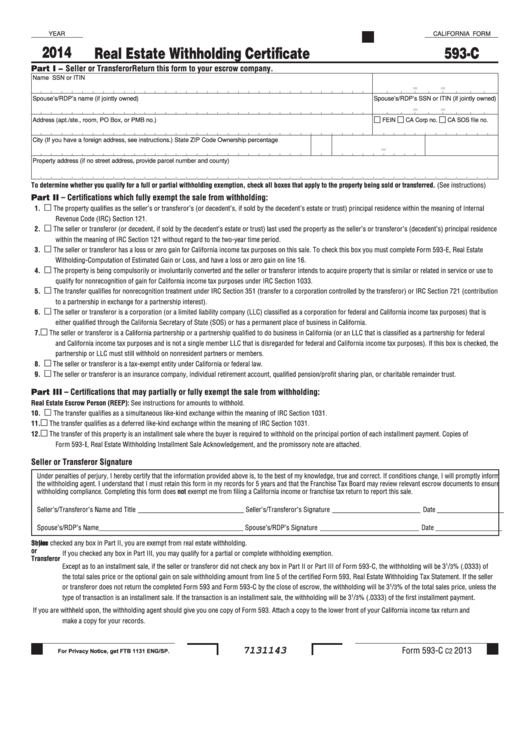

Fillable California Form 593C Real Estate Withholding Certificate

Ca form 568, limited liability. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. • complete form 593, and verify it is accurate. Web instructions for form 593; When you reach take a look at.

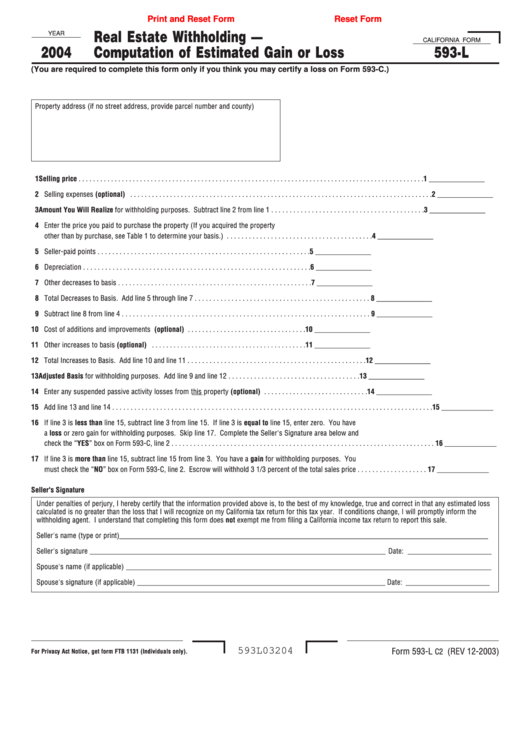

Fillable California Form 593L Real Estate Withholding Computation

Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web see the following links for form instructions: Complete ftb form 593 when withholding is done. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies: Any remitter (individual, business entity, trust, estate, or reep).

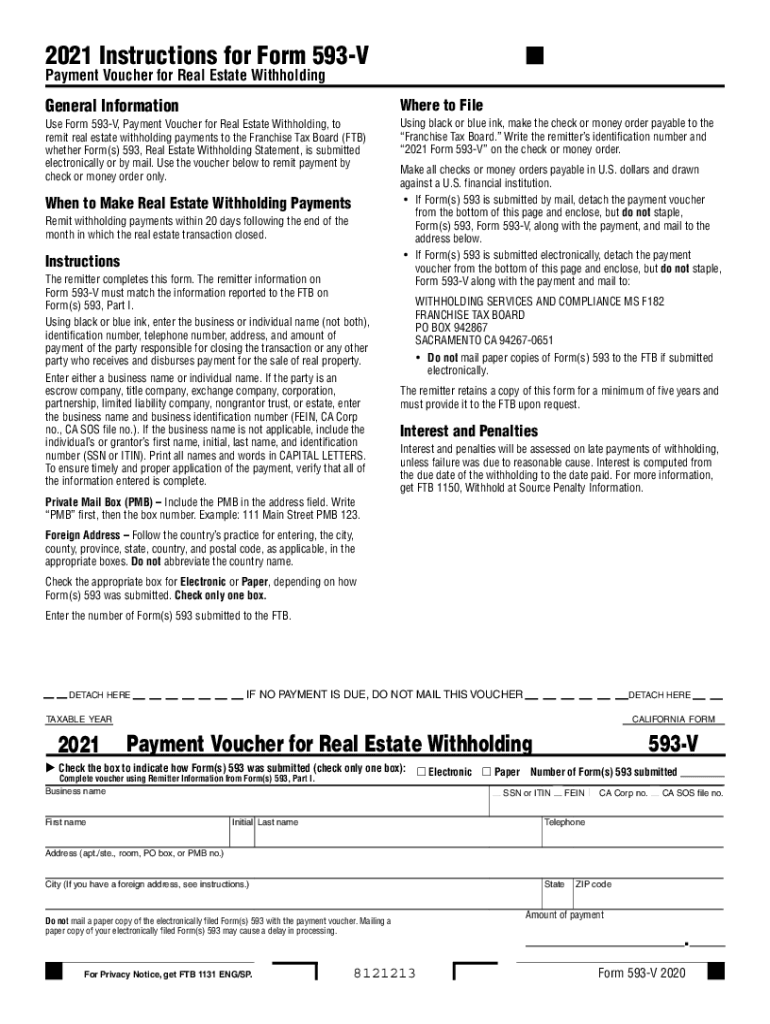

2021 Form 593 Instructions Fill Out and Sign Printable PDF Template

Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Enter the amount reported on form 593, box 5 in the amount withheld from seller field. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web instructions for form 593; Web 2019593 real estate withholding forms booklet this booklet.

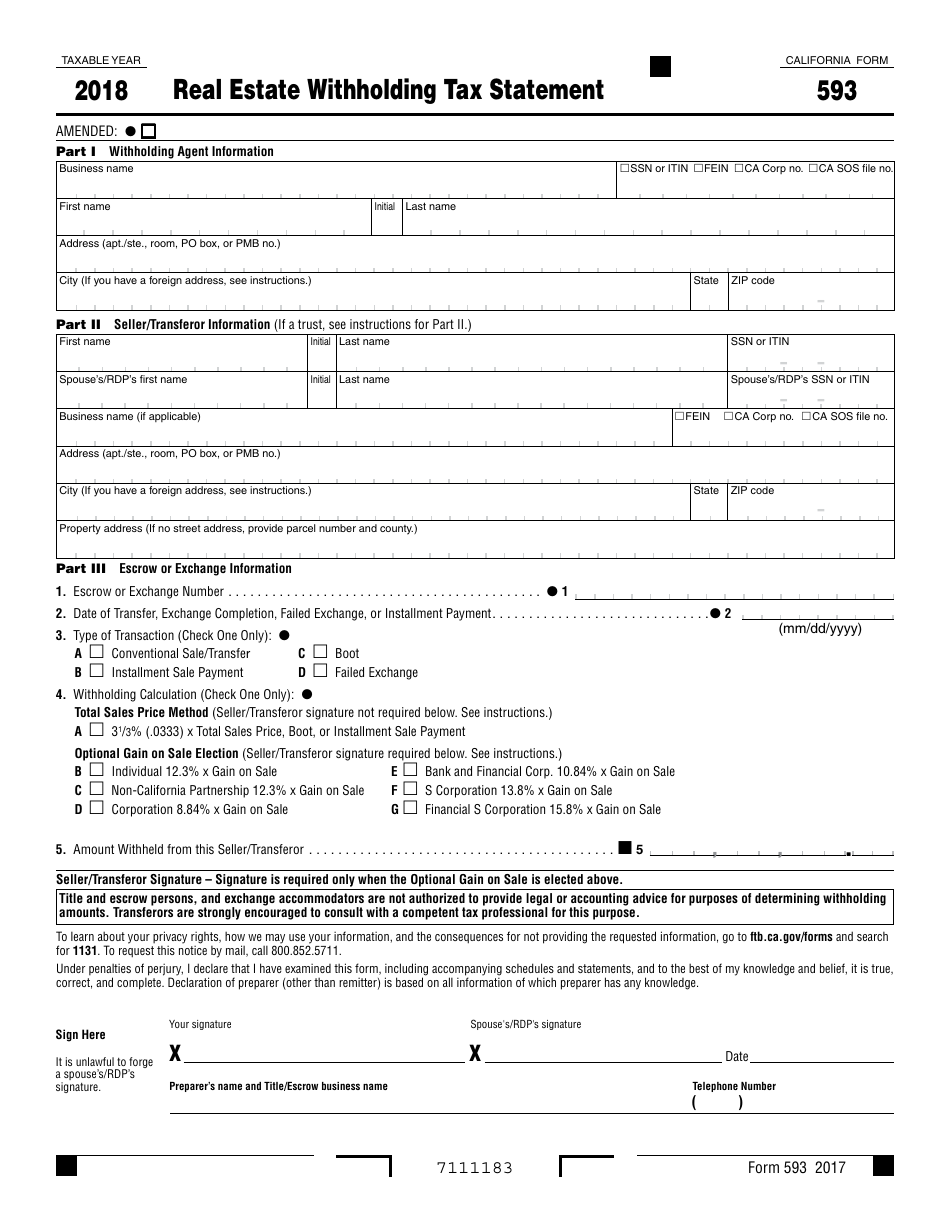

Form 593 Download Fillable PDF or Fill Online Real Estate Withholding

• provide a copy of form 593. Web 3 rows find california form 593 instructions at esmart tax today. When you reach take a look at. The seller is to complete. Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being.

Fillable California Form 593I Real Estate Withholding Installment

Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. • complete form 593, and verify it is accurate. Web 2019593 real estate withholding forms booklet this booklet contains: When you reach take a look at. The seller is.

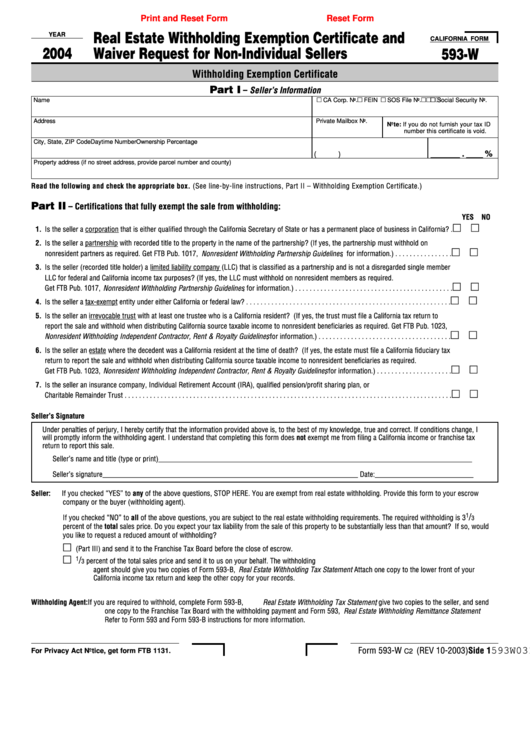

Fillable California Form 593W Real Estate Withholding Exemption

Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. Web 3 rows find california form 593 instructions at esmart tax today. Web your california real estate withholding has to be entered on both the state and the federal return. Web 2019593 real estate withholding forms booklet.

First, Complete Your State Return.

Web 3 rows find california form 593 instructions at esmart tax today. Web the ftb instructions state that the completed form 593 is to be sent to the seller (the transferee at acquisition and the rmc at resale closing) at the time of. Enter the amount reported on form 593, box 5 in the amount withheld from seller field. Complete ftb form 593 when withholding is done.

Ca Form 568, Limited Liability.

When california real estate is sold on an. • provide a copy of form 593. Web for any withholding payments after escrow closes, the buyer becomes the remitter and is required to: When you reach take a look at.

Web Instructions For Form 593;

Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. The seller is to complete. Web your california real estate withholding has to be entered on both the state and the federal return. Web for withholding on a sale, the remitter will need the original completed form 593 and two copies:

• Complete Form 593, And Verify It Is Accurate.

Web 2019593 real estate withholding forms booklet this booklet contains: Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web taxformfinder.org california income tax forms california form 593 california real estate withholding tax statement tax day has passed, and refunds are being. Web see the following links for form instructions: