California Living Trust Form Pdf

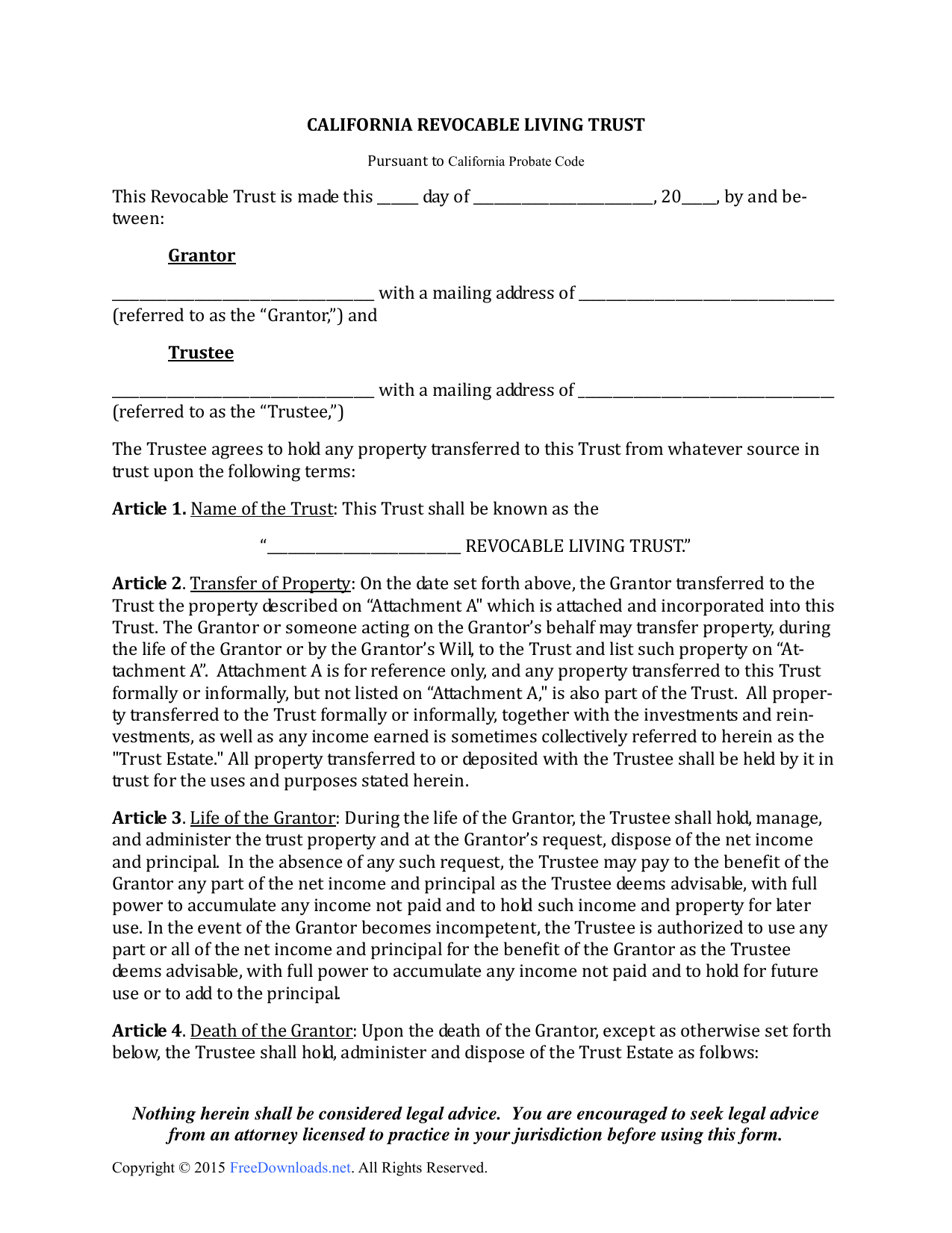

California Living Trust Form Pdf - Us legal forms provides living trust forms for california residents. Web i, ________________________ (the “grantor”), of ________________________________ [city/state], being of sound mind and legal age, and not under undue influence or stress, do hereby create this revocable living trust, to be known as “the ________________________ [grantor] revocable living trust” (this “trust”). Web six steps to create a living trust in california: Web want to establish a iving trust? A trustee of your choosing is obligated to administer the trust in a manner which is in the best. If you’re married, you’ll first need to decide whether you want a single or joint trust. A joint trust will allow you to include property that each spouse owns separately as well as joint property. (“name of person creating trust”). A living trust is a form of estate planning that allows you to control your assets (your money and property) while you are still alive, but have it distributed to people or organizations you select when you die. On the date set forth above, the grantor transferred to

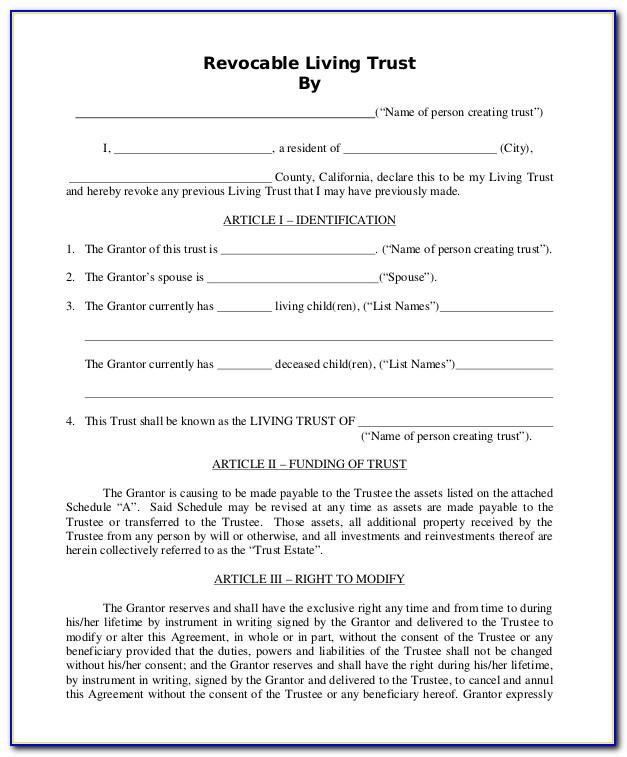

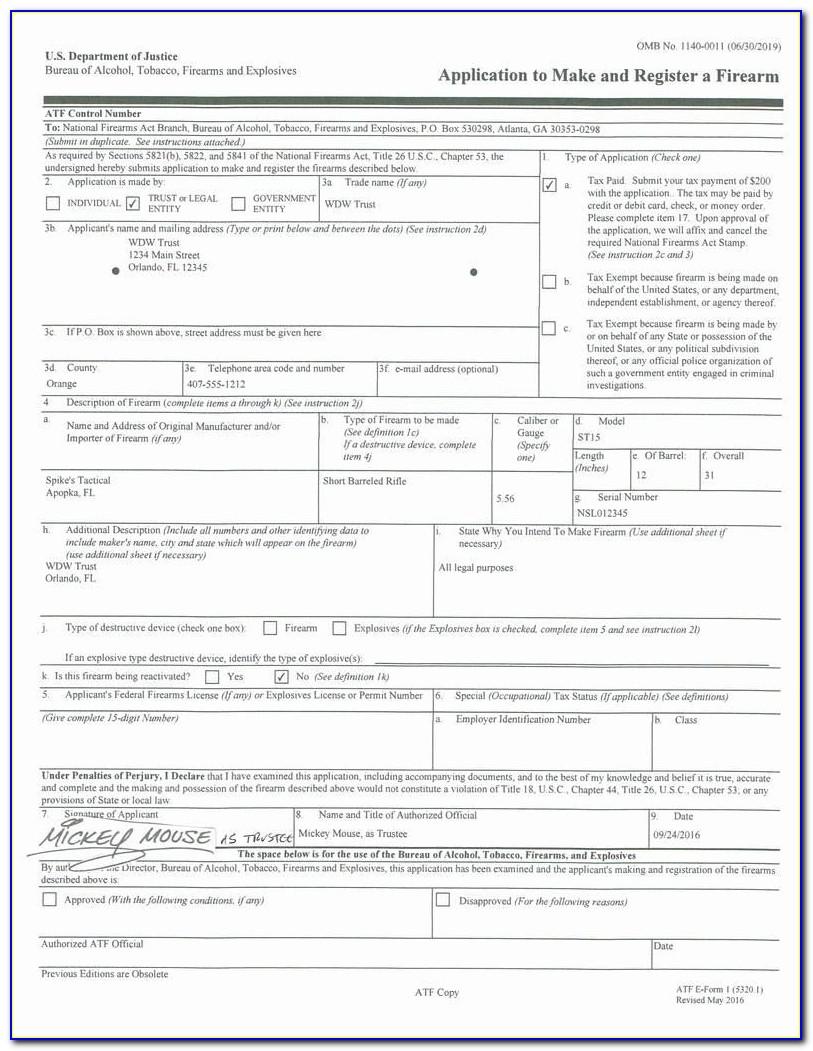

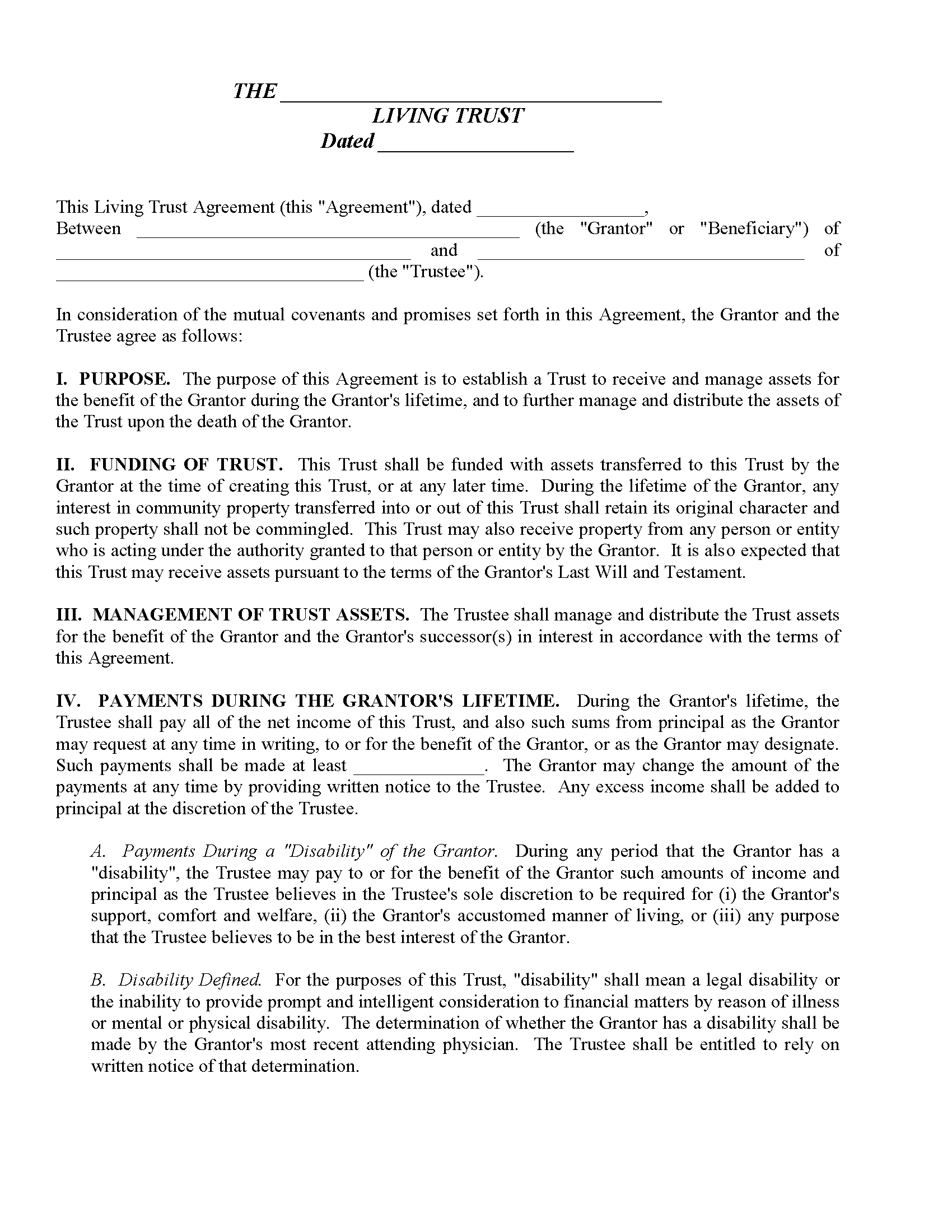

The california revocable living trust is a document that allows a grantor to specify how their assets and property should be managed during their lifetime and after their death. (“name of person creating trust”). A california living trust is a document that enables an individual to manage their assets both during their lifetime and after death while avoiding the probate process. Web we intend to create a valid trust under the laws of california and under the laws of any state in which any trust created under this trust document is administered. Us legal forms provides living trust forms for california residents. This trust shall be known as the “___________________ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is not an amendment to a prior living trust. Web california living trust forms. Take stock of your property Web want to establish a iving trust? A joint trust will allow you to include property that each spouse owns separately as well as joint property.

Us legal forms provides living trust forms for california residents. Pick a type of living trust: The grantor of this trust is. The assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee (person responsible for. A trustee of your choosing is obligated to administer the trust in a manner which is in the best. This trust shall be known as the “___________________ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is not an amendment to a prior living trust. Web we intend to create a valid trust under the laws of california and under the laws of any state in which any trust created under this trust document is administered. If you’re married, you’ll first need to decide whether you want a single or joint trust. Download the california living trust form which allows you to create a separate entity to hold your chosen assets and property which will continue during your life and after your death until the assets are distributed. Web i, ________________________ (the “grantor”), of ________________________________ [city/state], being of sound mind and legal age, and not under undue influence or stress, do hereby create this revocable living trust, to be known as “the ________________________ [grantor] revocable living trust” (this “trust”).

Living Revocable Trust Form California

Web six steps to create a living trust in california: On the date set forth above, the grantor transferred to A joint trust will allow you to include property that each spouse owns separately as well as joint property. A california living trust is a document that enables an individual to manage their assets both during their lifetime and after.

Revocable Living Trust Form Free Printable Legal Forms

Download the california living trust form which allows you to create a separate entity to hold your chosen assets and property which will continue during your life and after your death until the assets are distributed. Take stock of your property Pick a type of living trust: If you’re married, you’ll first need to decide whether you want a single.

Sample Living Trust California Classles Democracy

Web we intend to create a valid trust under the laws of california and under the laws of any state in which any trust created under this trust document is administered. Web six steps to create a living trust in california: Web california living trust forms. On the date set forth above, the grantor transferred to Web updated june 29,.

California Living Trust for Individual as Single Living Trust Form

Web revocable living trust by (“name of person creating trust”) i, , a resident of (city), county, california, declare this to be my living trust and hereby revoke any previous living trust that i may have previously made. Web california living trust forms. On the date set forth above, the grantor transferred to A california living trust is a document.

California Revocable Living Trust Amendment Form Form Resume

A california living trust is a document that enables an individual to manage their assets both during their lifetime and after death while avoiding the probate process. The california revocable living trust is a document that allows a grantor to specify how their assets and property should be managed during their lifetime and after their death. Take stock of your.

Living Trust Sample Form Master of Template Document

This trust shall be known as the “___________________ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is not an amendment to a prior living trust. A california living trust is a document that enables an individual to manage their assets both during their lifetime and after death while avoiding the probate process. A joint trust will.

Free California Revocable Living Trust Form PDF Word eForms

Web updated june 29, 2022. The assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee (person responsible for. Web california living trust forms. Take stock of your property This trust shall be known as the “___________________ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is.

[33+] Sample Notification Letter To Trust Beneficiaries Michigan

Download the california living trust form which allows you to create a separate entity to hold your chosen assets and property which will continue during your life and after your death until the assets are distributed. A living trust is a form of estate planning that allows you to control your assets (your money and property) while you are still.

Download California Revocable Living Trust Form PDF RTF Word

A joint trust will allow you to include property that each spouse owns separately as well as joint property. (“name of person creating trust”). Us legal forms provides living trust forms for california residents. Web want to establish a iving trust? Web i, ________________________ (the “grantor”), of ________________________________ [city/state], being of sound mind and legal age, and not under undue.

Revocable Living Trust Amendment Form California Form Resume

(“name of person creating trust”). The assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee (person responsible for. Web want to establish a iving trust? Web california living trust forms. On the date set forth above, the grantor transferred to

Take Stock Of Your Property

Web we intend to create a valid trust under the laws of california and under the laws of any state in which any trust created under this trust document is administered. Web want to establish a iving trust? (“name of person creating trust”). On the date set forth above, the grantor transferred to

Article Three Trustee Succession Section 3.01 Resignation Of A Trustee

A joint trust will allow you to include property that each spouse owns separately as well as joint property. The assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee (person responsible for. Download the california living trust form which allows you to create a separate entity to hold your chosen assets and property which will continue during your life and after your death until the assets are distributed. A california living trust is a document that enables an individual to manage their assets both during their lifetime and after death while avoiding the probate process.

This Trust Shall Be Known As The “___________________ Revocable Living Trust” Hereinafter Known As The “Trust” And ☐ Is ☐ Is Not An Amendment To A Prior Living Trust.

Web updated june 29, 2022. Web i, ________________________ (the “grantor”), of ________________________________ [city/state], being of sound mind and legal age, and not under undue influence or stress, do hereby create this revocable living trust, to be known as “the ________________________ [grantor] revocable living trust” (this “trust”). Web revocable living trust by (“name of person creating trust”) i, , a resident of (city), county, california, declare this to be my living trust and hereby revoke any previous living trust that i may have previously made. Web california living trust forms.

A Living Trust Is A Form Of Estate Planning That Allows You To Control Your Assets (Your Money And Property) While You Are Still Alive, But Have It Distributed To People Or Organizations You Select When You Die.

Web six steps to create a living trust in california: The california revocable living trust is a document that allows a grantor to specify how their assets and property should be managed during their lifetime and after their death. The grantor of this trust is. If you’re married, you’ll first need to decide whether you want a single or joint trust.

![[33+] Sample Notification Letter To Trust Beneficiaries Michigan](https://www.pdffiller.com/preview/0/20/20744/large.png)