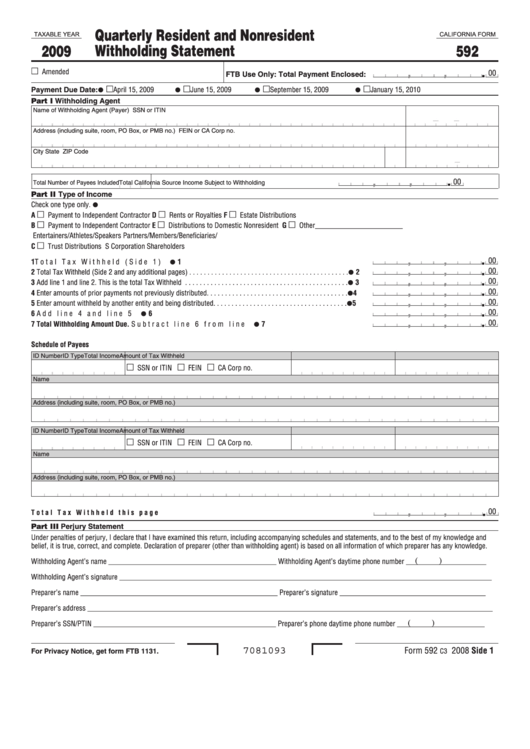

California Withholding Form

California Withholding Form - Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, or distributions to domestic nonresident partners in a partnership, members of an. Use the calculator or worksheet to determine the number of allowances you should claim. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Employee’s withholding allowance certificate (de 4) to determine the appropriate california pit withholding. Web simplified income, payroll, sales and use tax information for you and your business Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax: Form 590 does not apply to payments of backup withholding. See instructions for form 540, line 73. The amount of income subject to tax

The amount of tax withheld is determined by the following. Form 590 does not apply to payments of backup withholding. We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. Web when you file your tax return, you can claim all types of withholding. Form 590 does not apply to payments for wages to employees. For more information, go to ftb.ca.gov and search for backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. See instructions for form 540, line 73. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. The amount of income subject to tax

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. See instructions for form 540, line 73. Wage withholding is the prepayment of income tax. The amount of tax withheld is determined by the following. You must file the state form. Form 590 does not apply to payments for wages to employees. Web simplified income, payroll, sales and use tax information for you and your business The amount of income subject to tax Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed.

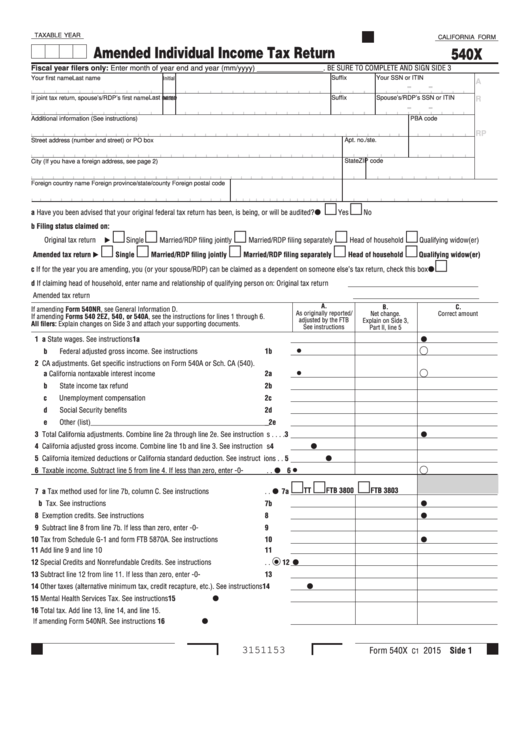

California State Withholding Fillable Form

We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. Form 590 does not apply to payments for wages to employees. You must file the state form. Employee’s withholding allowance certificate (de 4) to determine the appropriate california pit withholding. Web when you file your tax return, you can claim all.

State Tax Withholding Form California

Employee’s withholding allowance certificate (de 4) to determine the appropriate california pit withholding. The amount of tax withheld is determined by the following. We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. Form 590 does not apply to payments for wages to employees. Use the calculator or worksheet to determine.

ca earnings taxes Doc Template pdfFiller

The amount of income subject to tax Wage withholding is the prepayment of income tax. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web simplified income, payroll, sales and use tax information for you and your business Web california withholding schedules for 2023 california provides two methods for.

California Tax Withholding Form (DE 4 Form) Ultimate Guide

You must file the state form. Wage withholding is the prepayment of income tax. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Form 590 does not apply to payments for wages to employees. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement.

1+ California State Tax Withholding Forms Free Download

See instructions for form 540, line 73. For more information, go to ftb.ca.gov and search for backup withholding. Wage withholding is the prepayment of income tax. Employee’s withholding allowance certificate (de 4) to determine the appropriate california pit withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

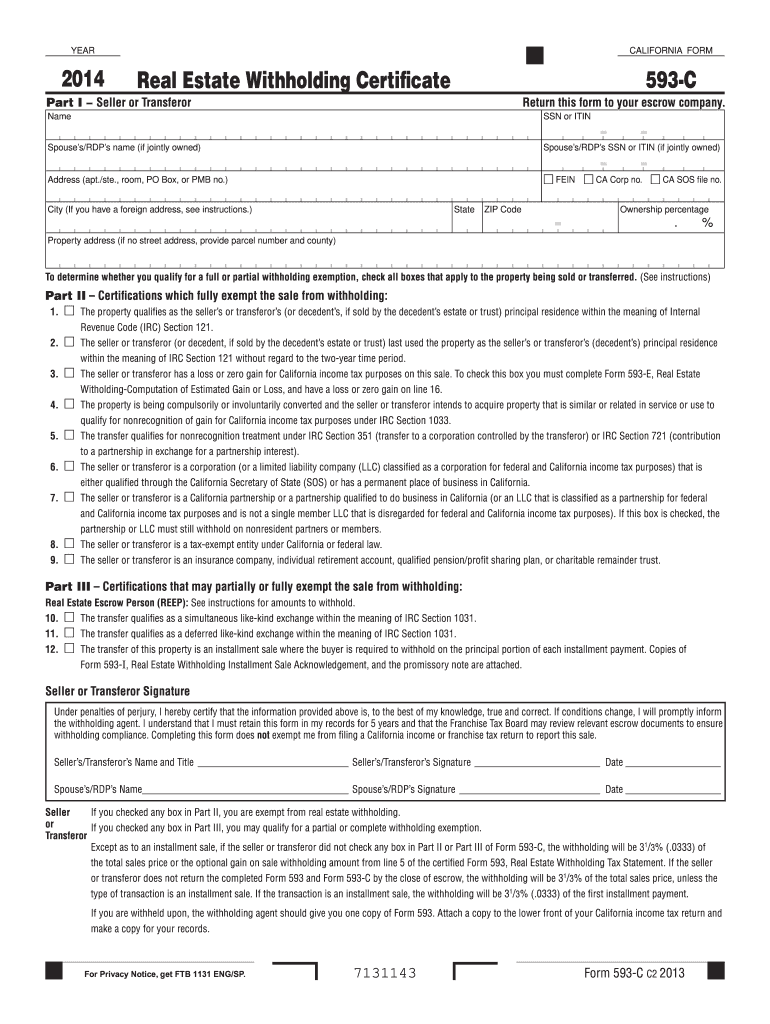

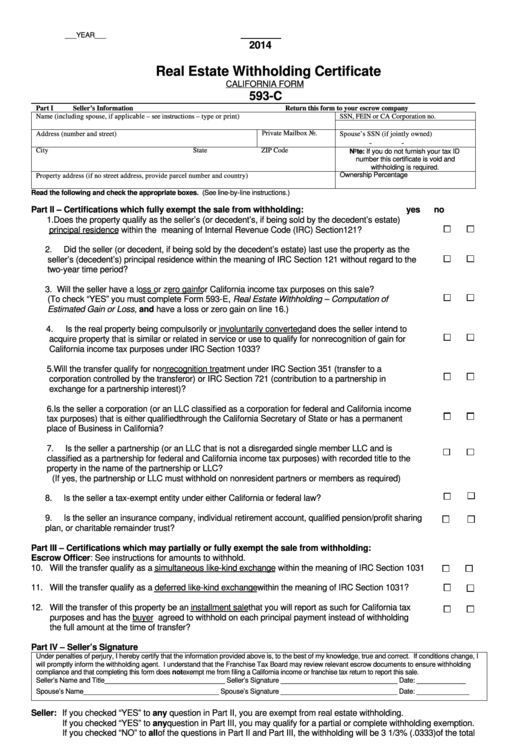

Form 593 C Real Estate Withholding Certificate California Fill Out

Form 590 does not apply to payments of backup withholding. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, or distributions to domestic nonresident partners in a partnership, members of an. Form 590 does not apply to payments for wages to employees. Web use form 592 to report the total.

California Form 593C Real Estate Withholding Certificate 2014

Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. For more information, go to ftb.ca.gov and search for backup withholding. The amount of tax withheld is determined by the following. Form 590 does.

CA FTB 589 2019 Fill out Tax Template Online US Legal Forms

The amount of income subject to tax See instructions for form 540, line 73. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Web simplified income, payroll, sales and use tax information for you and your business Form 590 does not apply to payments for wages to employees.

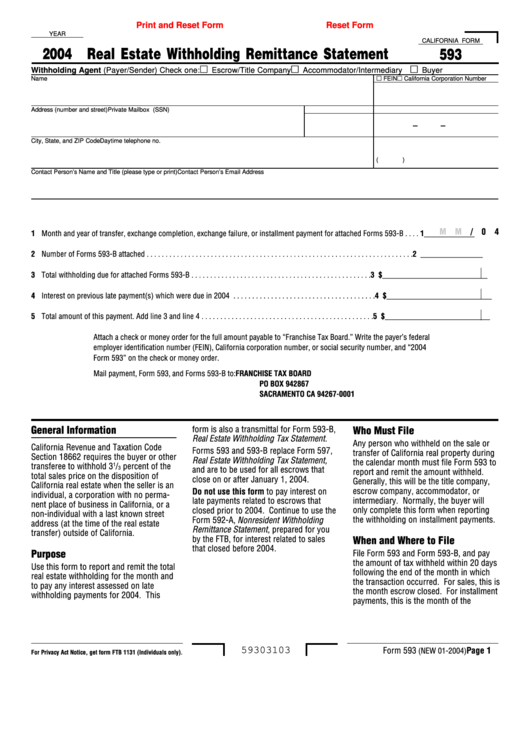

Fillable California Form 593 Real Estate Withholding Remittance

Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. For more information, go to ftb.ca.gov and search for backup withholding. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. We refer to the amount of wages taken from your paycheck.

California DE4 App

You must file the state form. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. For more information, go to ftb.ca.gov and search for backup withholding. The amount of income subject to tax Form 590 does not apply to payments of backup withholding.

You Must File The State Form.

Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, or distributions to domestic nonresident partners in a partnership, members of an. Employee’s withholding allowance certificate (de 4) to determine the appropriate california pit withholding. Wage withholding is the prepayment of income tax. The amount of tax withheld is determined by the following.

Form 590 Does Not Apply To Payments For Wages To Employees.

See instructions for form 540, line 73. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web when you file your tax return, you can claim all types of withholding.

Form 590 Does Not Apply To Payments Of Backup Withholding.

Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. The amount of income subject to tax Web simplified income, payroll, sales and use tax information for you and your business We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding.

Web Of California Withholding Allowances Used In 2020 And Prior, Then A New De 4 Is Not Needed.

Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax: For more information, go to ftb.ca.gov and search for backup withholding. Use the calculator or worksheet to determine the number of allowances you should claim.