Can I File Form 2555 Online

Can I File Form 2555 Online - Ad download or email irs 2555 & more fillable forms, try for free now! Form 2555 is part of form 1040. Web irs form 2555 is used to claim the foreign earned income exclusion (feie). File your return using the appropriate address for your. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web you file form 2555 to claim the foreign earned income exclusion and/or the foreign housing exclusion or deduction. These forms, instructions and publication 54,tax. If you meet the requirements, you can. Go to www.irs.gov/form2555 for instructions and the. Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead.

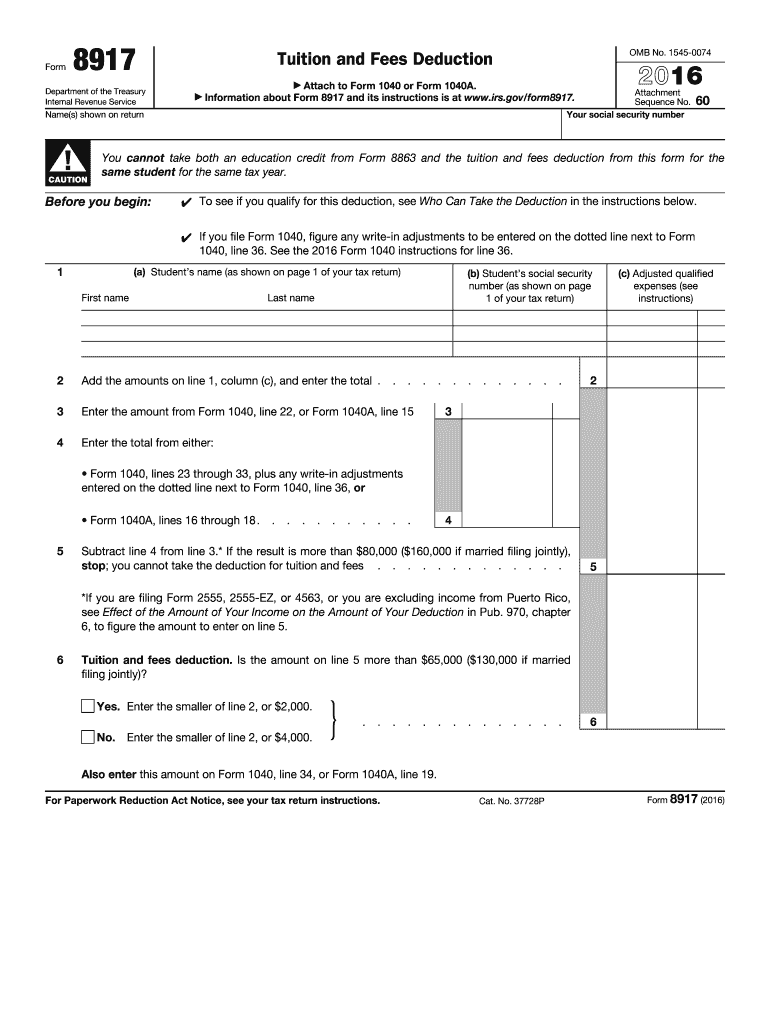

If you meet the requirements, you can. Web you can choose the foreign earned income exclusion and/or the foreign housing exclusion by completing the appropriate parts of form 2555. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Web yes no if “yes,” enter city and country of the separate foreign residence. Web each electronic filer must: Form 2555 is part of form 1040. These forms, instructions and publication 54,tax. Web you can claim foreign tax credits on your 2022 irs income tax return here on efile.com. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. You will file both to report your income and claim the foreign income exclusion.

These forms, instructions and publication 54,tax. You will file both to report your income and claim the foreign income exclusion. You cannot exclude or deduct more than the. (1) comply with any court requirements designed to ensure the integrity of electronic filing and to protect sensitive personal information. You file these forms to exclude. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned. Web yes no if “yes,” enter city and country of the separate foreign residence. If eligible, you can also use form 2555 to request the foreign housing exclusion. Web each electronic filer must: Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion.

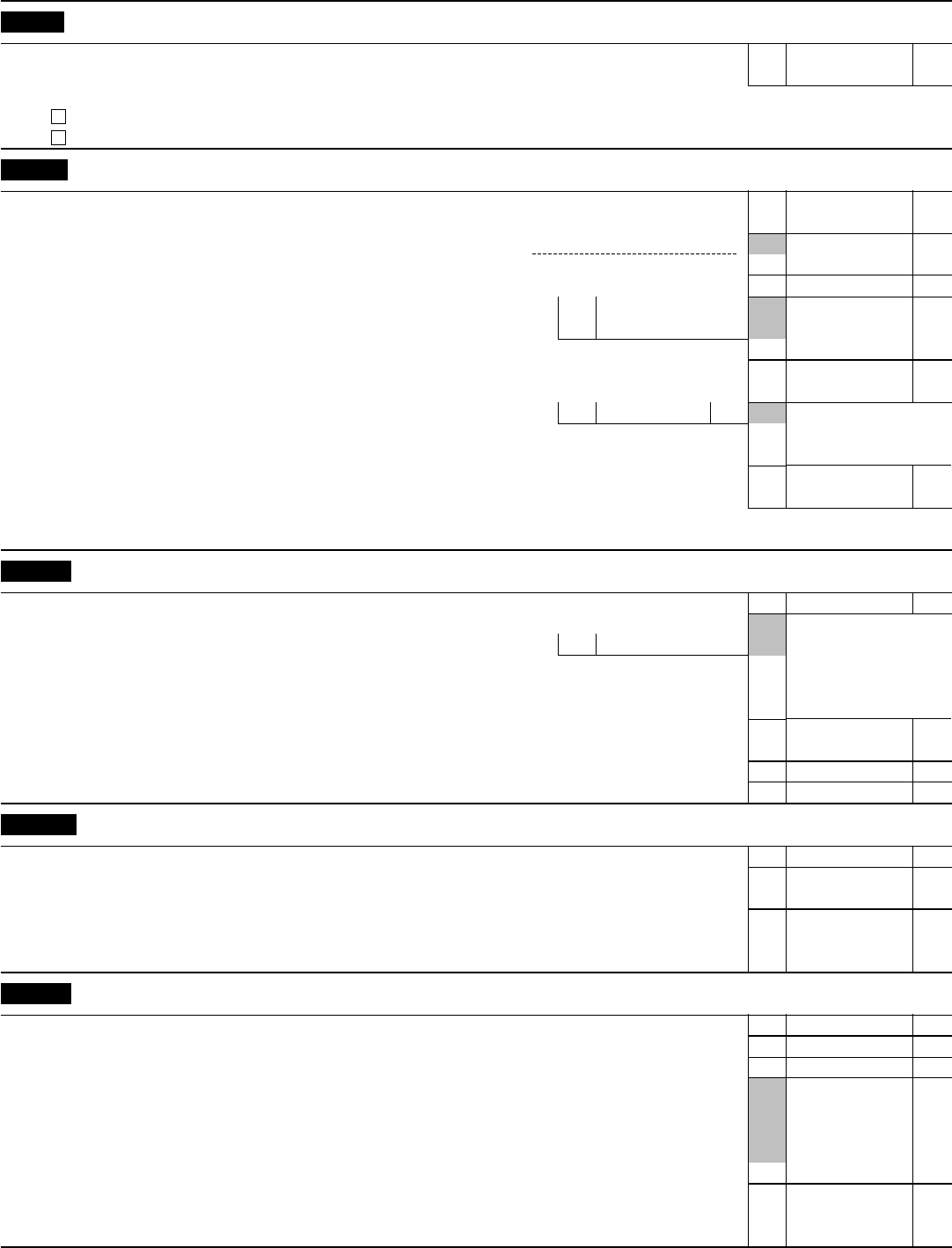

Form 2555Ez Edit, Fill, Sign Online Handypdf

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web each electronic filer must: Go to www.irs.gov/form2555 for instructions and the. Form 2555 is part of form 1040. If you meet the requirements, you can.

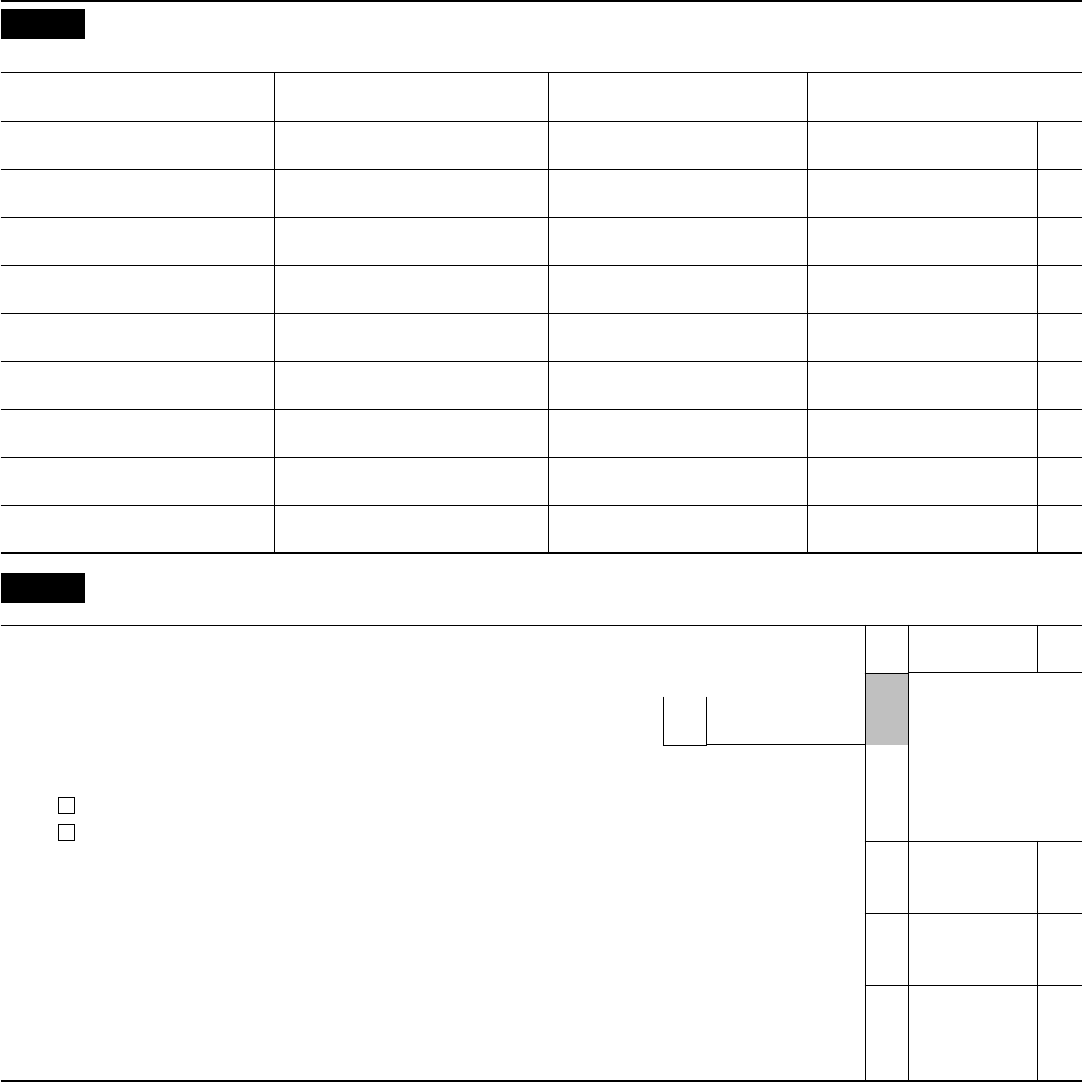

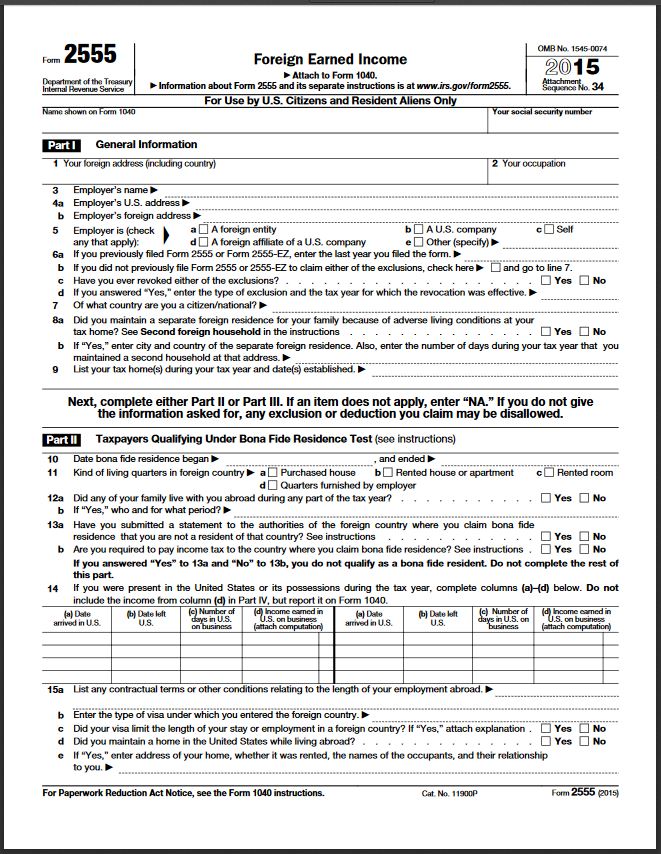

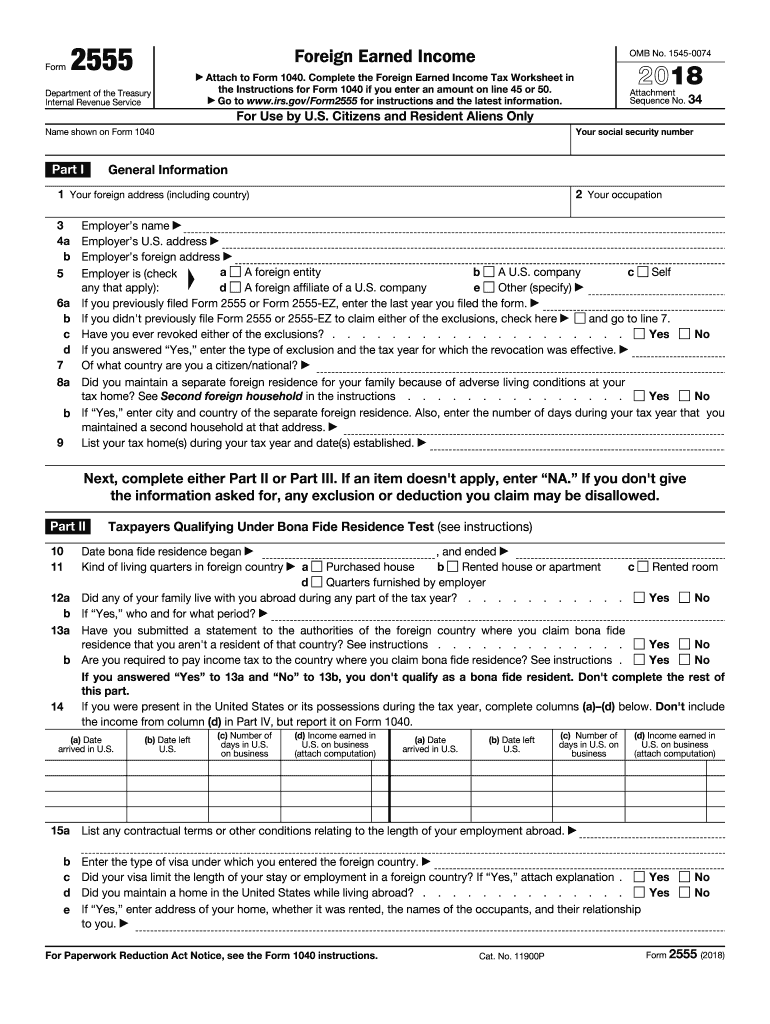

Ssurvivor Form 2555 Instructions 2016

Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. (1) comply with any court requirements designed to ensure the integrity of electronic filing and to protect sensitive personal information. Web eligible taxpayers must file a u.s. If eligible, you can also use form 2555 to request.

Foreign Earned Exclusion Form 2555 Verni Tax Law

Ad download or email irs 2555 & more fillable forms, try for free now! Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. You cannot exclude or deduct more than the. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income.

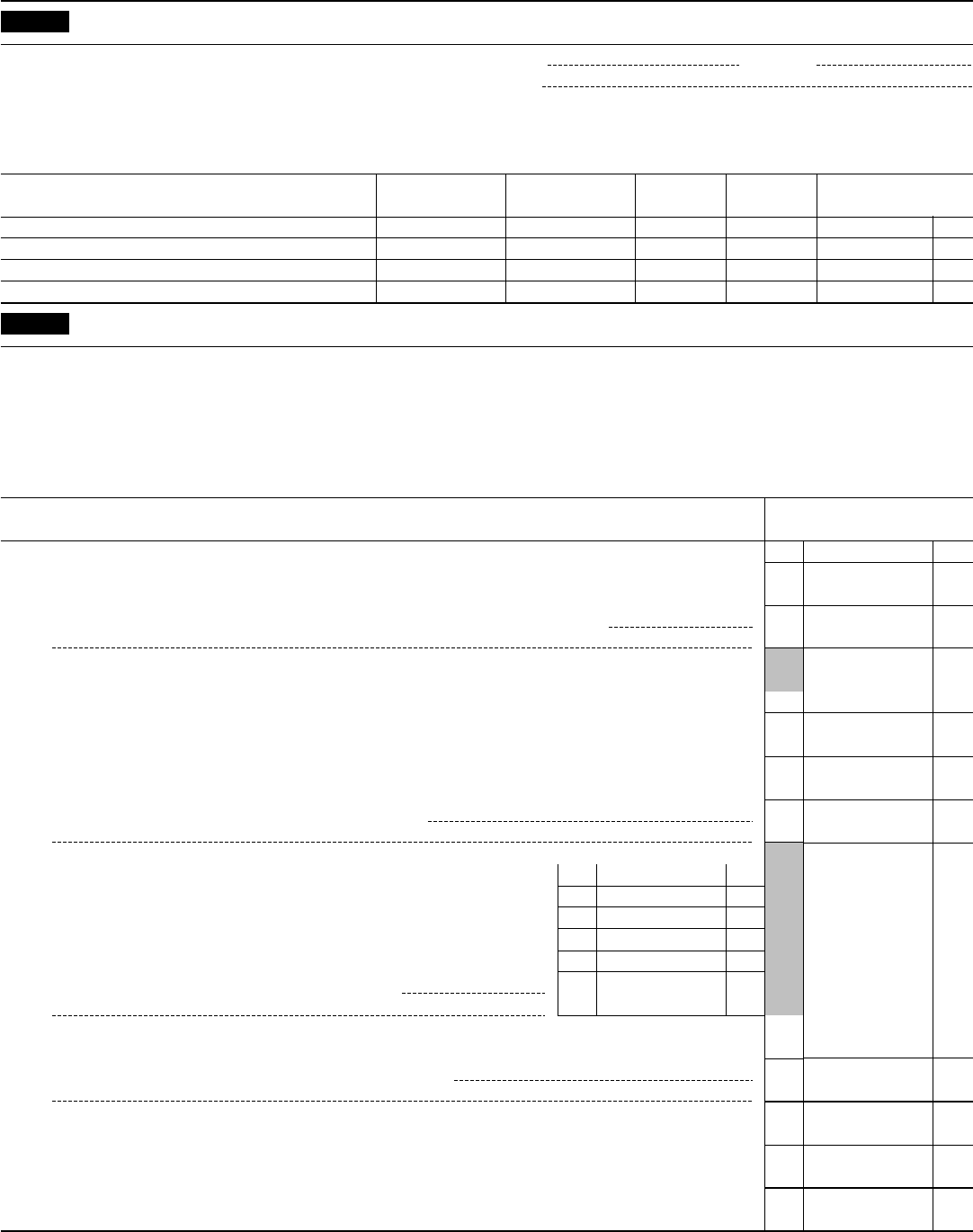

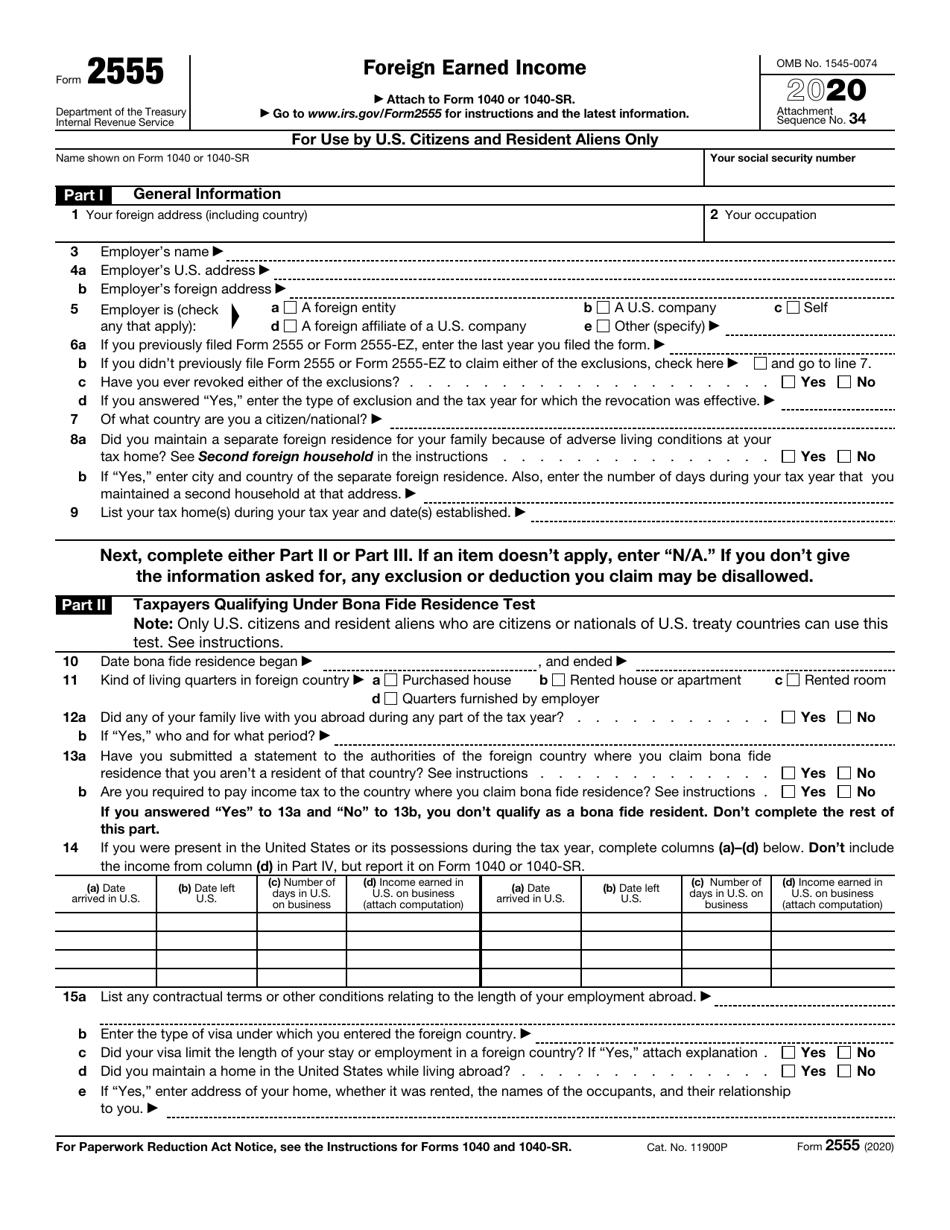

2017 Form 2555 Edit, Fill, Sign Online Handypdf

Ad download or email irs 2555 & more fillable forms, try for free now! Web irs form 2555 is used to claim the foreign earned income exclusion (feie). You’ll need to prepare the following documents to file form 2555: Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. If eligible, you can also.

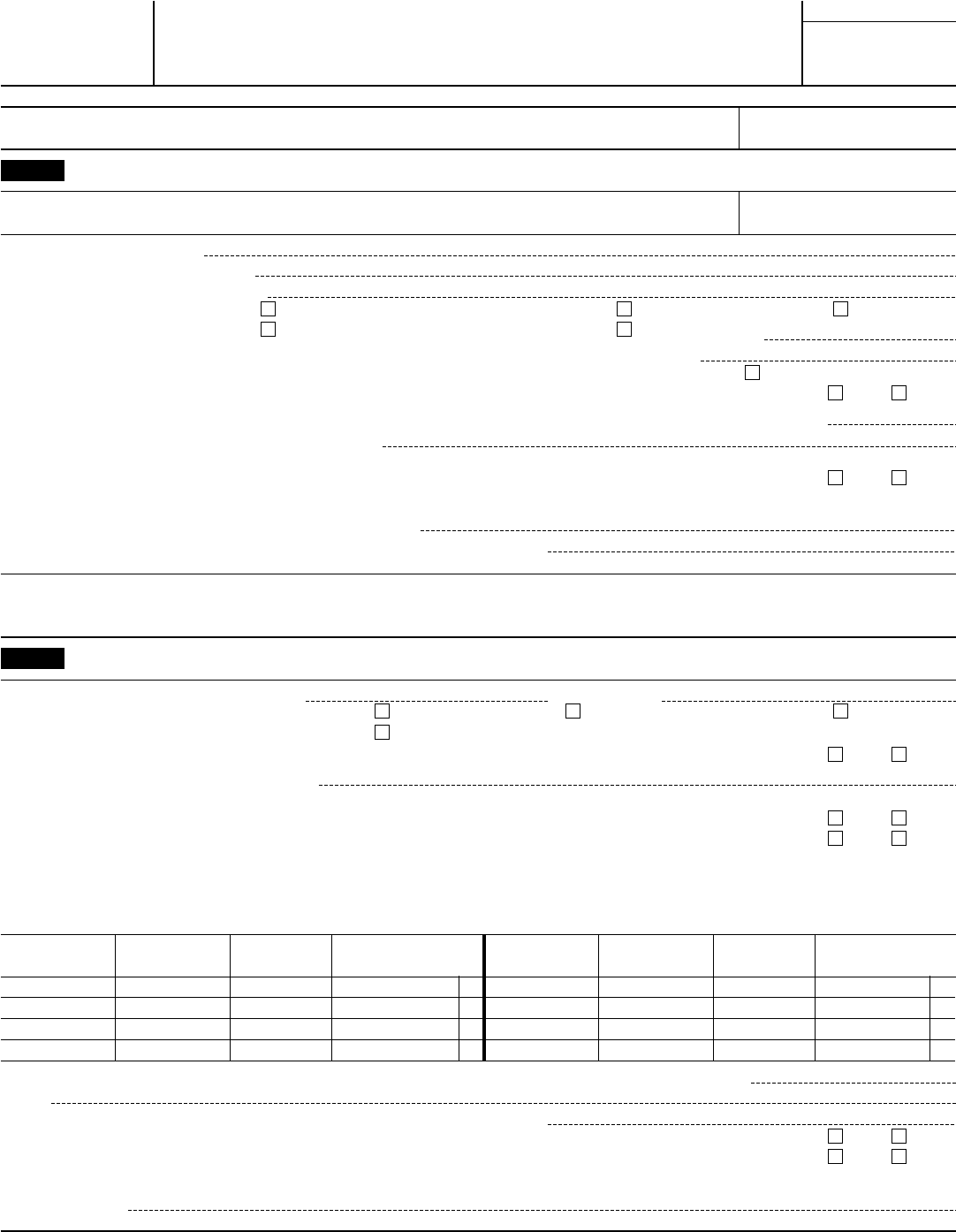

2013 Form 2555 Edit, Fill, Sign Online Handypdf

Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web you can choose the foreign earned income exclusion and/or the foreign housing exclusion by completing the appropriate parts of form 2555. The efile app will.

Form 2555 Fill Out and Sign Printable PDF Template signNow

Web irs form 2555 is used to claim the foreign earned income exclusion (feie). Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. You file these forms to exclude. Web yes no if “yes,” enter city and country of the separate foreign residence. Web if you are working and/or living abroad and meet.

How Much Does It Cost To Get A Copy Of My Naturalization Certificate

Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead. The efile app will do the work for you; Go to www.irs.gov/form2555 for instructions and the. Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms..

IRS Form 2555 Download Fillable PDF or Fill Online Foreign Earned

Web you can claim foreign tax credits on your 2022 irs income tax return here on efile.com. (1) comply with any court requirements designed to ensure the integrity of electronic filing and to protect sensitive personal information. You will file both to report your income and claim the foreign income exclusion. You file these forms to exclude. You’ll need to.

Form 2555 Edit, Fill, Sign Online Handypdf

If you meet the requirements, you can. Form 2555 is part of form 1040. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. File your return using the appropriate address for your. Also, enter the number of days during your tax year that you maintained a second.

TIMELY FILING THE FEIE FORM 2555 Expat Tax Professionals

Ad download or email irs 2555 & more fillable forms, try for free now! Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned. Signnow allows users to edit, sign, fill and share all type of documents online. Web irs form 2555 is used to claim the foreign earned income exclusion (feie). You cannot exclude or deduct more.

Form 2555 (Foreign Earned Income Exclusion) Calculates The Amount Of Foreign Earned.

Ad register and subscribe now to work on your irs instructions 2555 & more fillable forms. You’ll need to prepare the following documents to file form 2555: Web eligible taxpayers must file a u.s. You cannot exclude or deduct more than the.

If Eligible, You Can Also Use Form 2555 To Request The Foreign Housing Exclusion.

Also, enter the number of days during your tax year that you maintained a second household at that. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Go to www.irs.gov/form2555 for instructions and the.

(1) Comply With Any Court Requirements Designed To Ensure The Integrity Of Electronic Filing And To Protect Sensitive Personal Information.

If you meet the requirements, you can. Web you can claim foreign tax credits on your 2022 irs income tax return here on efile.com. Web you file form 2555 to claim the foreign earned income exclusion and/or the foreign housing exclusion or deduction. Web yes no if “yes,” enter city and country of the separate foreign residence.

File Your Return Using The Appropriate Address For Your.

Web you can choose the foreign earned income exclusion and/or the foreign housing exclusion by completing the appropriate parts of form 2555. Web irs form 2555 is used to claim the foreign earned income exclusion (feie). The efile app will do the work for you; These forms, instructions and publication 54,tax.