Can I File Form 3520 Electronically

Can I File Form 3520 Electronically - The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 & instructions: Web friday, april 23, 2021 the list of internal revenue service (irs) forms that can be digitally signed continues to grow. The form provides information about the foreign trust, its u.s. The form provides information about the foreign trust, its u.s. Web this form must be submitted to the u.s. It does not have to be a “foreign gift.” rather, if a. Web updated september 10, 2020: Ad talk to our skilled attorneys by scheduling a free consultation today. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically.

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Web updated september 10, 2020: 35% of contributions to a foreign trust (form 3520); 35% of distributions received from a foreign. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Customs and border protection to import passenger vehicles, highway motorcycles and the corresponding engines into the. The form provides information about the foreign trust, its u.s. It does not have to be a “foreign gift.” rather, if a.

Web form 3520 filing requirements form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain foreign gifts. Get ready for tax season deadlines by completing any required tax forms today. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. The form provides information about the foreign trust, its u.s. Web friday, april 23, 2021 the list of internal revenue service (irs) forms that can be digitally signed continues to grow. Web can i file income tax return electronically and mail form 3520? Web this form must be submitted to the u.s. Web form 3520 & instructions: The form provides information about the foreign trust, its u.s. Ad download or email irs 3520 & more fillable forms, register and subscribe now!

Buy tickets for Form 3520/3520A Preparation on GoToWebinar, Tue Sep 8

Web updated september 10, 2020: The form provides information about the foreign trust, its u.s. The form provides information about the foreign trust, its u.s. Complete, edit or print tax forms instantly. On august 28, 2020, the irs issued a.

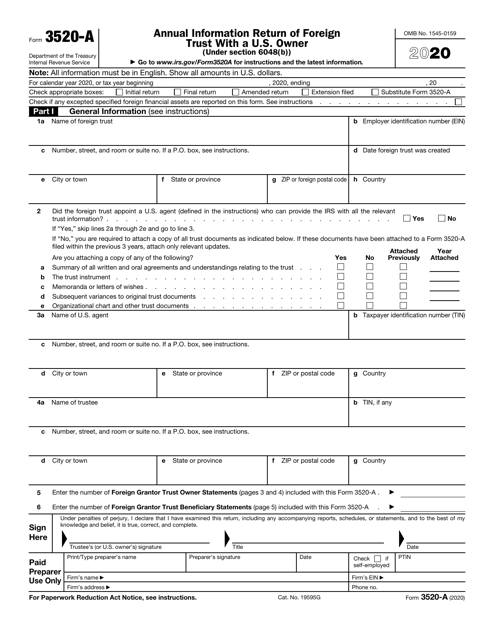

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Get ready for tax season deadlines by completing any required tax forms today. Web friday, april 23, 2021 the list of internal revenue service (irs) forms that can be digitally signed continues to grow. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Web this form must be submitted to the u.s. Download or email.

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

The form provides information about the foreign trust, its u.s. Web updated september 10, 2020: Web friday, april 23, 2021 the list of internal revenue service (irs) forms that can be digitally signed continues to grow. 35% of distributions received from a foreign. Ad talk to our skilled attorneys by scheduling a free consultation today.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Does it cause any issues with reconciling form 3520 with one's income tax return? It does not have to be a “foreign gift.” rather, if a. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain.

The Tax Times Foreign Trust Form 3520A Filing Date Reminder & Tips To

Web this form must be submitted to the u.s. 35% of distributions received from a foreign. The form provides information about the foreign trust, its u.s. Ad download or email irs 3520 & more fillable forms, register and subscribe now! The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 & instructions: Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. The form.

Form 3520 Reporting Foreign Gifts and Distributions From a Foreign Trust

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. 35% of distributions received from a foreign. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on.

Can File Form 8379 Electronically hqfilecloud

Customs and border protection to import passenger vehicles, highway motorcycles and the corresponding engines into the. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Does it cause any issues with reconciling form 3520 with one's income tax return? Web form 3520 & instructions: The form provides information about.

Form 3520 Edit, Fill, Sign Online Handypdf

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Complete, edit or print tax forms instantly..

Form 3520 Blank Sample to Fill out Online in PDF

Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. The form provides information about the foreign trust, its u.s. 35% of distributions received from a foreign. Download or email irs 3520 & more fillable forms, register and subscribe now! Customs and border.

Web Form 3520 & Instructions:

Complete, edit or print tax forms instantly. Does it cause any issues with reconciling form 3520 with one's income tax return? Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. The form provides information about the foreign trust, its u.s.

Web Friday, April 23, 2021 The List Of Internal Revenue Service (Irs) Forms That Can Be Digitally Signed Continues To Grow.

Customs and border protection to import passenger vehicles, highway motorcycles and the corresponding engines into the. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Download or email irs 3520 & more fillable forms, register and subscribe now! 35% of contributions to a foreign trust (form 3520);

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. The form provides information about the foreign trust, its u.s. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Ad talk to our skilled attorneys by scheduling a free consultation today.

Ad Download Or Email Irs 3520 & More Fillable Forms, Register And Subscribe Now!

It does not have to be a “foreign gift.” rather, if a. Web this form must be submitted to the u.s. 35% of distributions received from a foreign. Web updated september 10, 2020: